Neptune Digital Closes Cdn$40 Million Institutional Capital Raise to Accelerate Growth

16 Abril 2021 - 4:04PM

Neptune Digital Assets Corp. (TSX-V:NDA) (OTC:NPPTF) (FSE:1NW) (the

“Company”) is pleased to announce that it has closed its previously

announced sale to U.S. and foreign institutional investors of its

common shares (“Common Shares”) and warrants to purchase Common

Shares (“Warrants”) for aggregate gross proceeds to the Company of

approximately Cdn$40 million (the “Private Placement”). Pursuant

to the Private Placement, the Company issued 29,630,002 Common

Shares and Warrants to purchase up to 14,815,001 Common Shares at

a purchase price of Cdn$1.35 per Common Share and associated half

Warrant. Each whole Warrant entitles the holder thereof to purchase

one Common Share at an exercise price of Cdn$1.75 per Common Share

at any time on or before April 16, 2024 (totaling another

approximately Cdn$26 million once exercised).

“We are very

pleased to complete this equity financing well above our 20-day

volume weighted average price. We have held back from doing any

major financing since 2018 in order to minimize dilution to our

shareholders. This equity financing marks an important milestone in

the growth trajectory for Neptune and this capital will enable

Neptune to rapidly advance its business plan, substantially grow

our earnings and pursue a variety of new and exciting projects in

both proof-of-stake and proof-of-work mining. We are also very

pleased to expand our institutional shareholder presence in the

United States and abroad”, commented Cale Moodie,

President and CEO, who managed this process for Neptune.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the Private Placement.

H.C. Wainwright & Co. received (i) a cash

commission of approximately Cdn$2.8 million (equal to 7.0% of the

gross proceeds of the Private Placement) and (ii) 2,222,250

non-transferable compensation warrants (the “Agent Warrants”).

Each Agent Warrant entitles the holder thereof to purchase one

Common Share at an exercise price of Cdn$1.6875 per Common Share at

any time on or before April 16, 2024.

The Company intends to use the net proceeds of

the Private Placement to fund the development of a 5MW clean tech

Bitcoin mining facility (i.e., negotiate property leases, purchase

mining hardware, purchase containers for mining equipment,

negotiate power purchase agreements with renewable energy providers

and build out facilities and power infrastructure), to complete one

or more purchases of Bitcoin mining servers over the course of

2021, to invest in proof-of-stake mining (such as blockchain

infrastructure and their associated token ecosystems) and for

working capital and general corporate purposes. Details as to the

intended specific allocation of the proceeds are disclosed in the

Prospectus Supplement referred to below and further business

development announcements will be made by Neptune in due course as

they arise.

The Common Shares and Warrants issued under the

Private Placement were qualified by way of a prospectus supplement

dated April 14, 2021 under the Company’s base shelf prospectus

dated April 12, 2021 (collectively, the “Prospectus Supplement”)

which was filed in the province of British Columbia, copies of

which are available under the Company’s profile at

www.sedar.com.

The Common Shares and Warrants were offered and

sold in the United States on a private placement basis pursuant to

exemptions from the registration requirements of the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”) and

all applicable state securities laws, and in certain other

jurisdictions in accordance with applicable securities laws. No

securities were offered or sold to Canadian purchasers. The

Private Placement remains subject to the final acceptance of the

TSX Venture Exchange.

The securities issued under the Private

Placement are subject to resale restrictions in the United States

under applicable U.S. federal and state securities laws with no

resale restrictions in Canada.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

This news release shall not constitute an offer of securities for

sale in the United States. The securities being offered have not

been, nor will they be, registered under the U.S. Securities Act

and such securities may not be offered or sold within the United

States absent registration under U.S. federal and state securities

laws or an applicable exemption from such U.S. registration

requirements.

About Neptune Digital Assets Corp.

Neptune Digital Assets is a cryptocurrency and

digital finance leader with a diversified portfolio of investments

and cryptocurrency operations across the digital asset ecosystem

including Bitcoin mining, tokens, proof-of-stake cryptocurrencies,

decentralized finance (DeFi), and associated blockchain

technologies.

ON BEHALF OF THE BOARDCale Moodie, President and

CEONeptune Digital Assets

Corp.1-800-545-0941www.neptunedigitalassets.com

Neither the TSX Venture Exchange nor its

Regulation Service Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Forward-Looking Statements

This release contains certain “forward looking

statements” and certain “forward-looking information” as defined

under applicable Canadian securities laws. Forward-looking

statements and information can generally be identified by the use

of forward-looking terminology such as “may”, “will”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”,

“proposes” or similar terminology. Forward-looking statements and

information include, but are not limited to, the future exercise of

the Warrants and Agent Warrants; the rapid advancement of the

Company’s business plan; the future growth of the Company’s

earnings; the use of the net proceeds of the Private Placement

including the future development of a 5MW clean tech Bitcoin mining

facility,, the purchase of one or more Bitcoin mining servers,

Proof-of-Stake investments and general and administrative expenses;

the completion of one or more purchases of Bitcoin mining servers

over the course of 2021; the anticipated timing for the Company

receiving ASIC Bitcoin mining machines; the Company’s agreement

with third-parties with respect to developing a 5MW clean tech

Bitcoin mining facility, including with respect to the anticipated

power supply therefor; the final acceptance of the Private

Placement by the TSX Venture Exchange; and the potential for

Neptune becoming a cryptocurrency leader. Forward-looking

statements and information are based on forecasts of future

results, estimates of amounts not yet determinable and assumptions

that, while believed by management to be reasonable, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. Forward-looking statements and

information are subject to various known and unknown risks and

uncertainties, many of which are beyond the ability of the Company

to control or predict, that may cause the Company’s actual results,

performance or achievements to be materially different from those

expressed or implied thereby, and are developed based on

assumptions about such risks, uncertainties and other factors set

out herein, including but not limited to: the inherent risks

involved in the cryptocurrency and general securities markets; the

Company’s ability to successfully mine digital currency; revenue of

the Company may not increase as currently anticipated, or at all;

the Company may not be able to profitably liquidate its current

digital currency inventory, or at all; a decline in digital

currency prices may have a significant negative impact on the

Company’s operations; the volatility of digital currency prices;

uncertainties relating to the availability and costs of financing

needed in the future; the inherent uncertainty of production and

cost estimates and the potential for unexpected costs and expenses,

currency fluctuations; regulatory restrictions, liability,

competition, loss of key employees and other related risks and

uncertainties. The Company does not undertake any obligation to

update forward-looking information except as required by applicable

law. Such forward-looking information represents management’s best

judgment based on information currently available. No

forward-looking statement can be guaranteed and actual future

results may vary materially. Accordingly, readers are advised not

to place undue reliance on forward-looking statements or

information.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

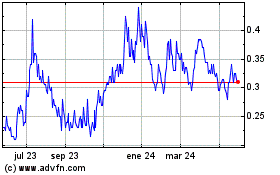

Neptune Digital Assets (TSXV:NDA)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

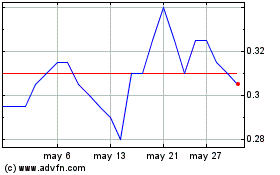

Neptune Digital Assets (TSXV:NDA)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025