Bitcoin Well Announces Annual General Meeting Results

17 Junio 2022 - 1:08PM

Bitcoin Well Inc. (the “Company” or “Bitcoin

Well”) (TSXV: BTCW), announced that at its 2022 annual general

meeting of shareholders held yesterday (the “Meeting”), four

nominees were elected as directors of Bitcoin Well.

The elected directors are: Mitchell Demeter,

David Bradley, Adam O’Brien and Terry Rhode.

“I wish to extend my heartfelt thanks to our

outgoing directors for their expert guidance and support as we took

Bitcoin Well public and over the last year,” said Adam O’Brien,

Founder & CEO of Bitcoin Well. “As we move into the next stage

of our strategic plan, I look forward to working with the Board to

identify how to best facilitate sustainable shareholder value

creation as we continue to future-proof money.”

Mitchell Demeter and Terry Rhode are newly

appointed to the Bitcoin Well Board of Directors.

Mitchell Demeter is the Founder, President, and

Chief Executive Officer of Madali Ventures. Previously, he was the

President of Netcoins Inc., a Canadian online cryptocurrency

brokerage wholly owned by BIGG Digital Assets (CSE: BIGG) in which

he also sat on the Board of Directors. He is a serial entrepreneur

with a range of experience in blockchain, exchanges, and currency

trading. He brought the world its first Bitcoin ATM in 2013 to

Vancouver, BC. He currently sits on the Board of Neptune Digital

Assets (TSXV: NDA) and advises several other cryptocurrency and

fintech businesses including Secure Digital Markets and Inetco

Systems Limited.

Terry Rhode was one of Rosenau Transport’s

longest-serving employees and a partial owner. Before starting with

Rosenau Transport in 1998, he was a management consultant and

advised various businesses on ways to streamline their operations

and has returned to that role at a board level. He is well-versed

in every aspect of administration including: accounting and IT,

operations, change management, project management, sales and

pricing. Terry’s final role at Rosenau Transport was Vice President

of Corporate Development and Chairman of the board for the Rosenau

group of companies.

At the Meeting, resolutions were also passed to

appoint Kingston Ross Pasnak LLP as auditors of Bitcoin Well and to

approve the Amended Stock Option Plan, as described in the Bitcoin

Well Management Information Circular dated May 3, 2022 with slight

amendments as presented at the Meeting.

Additional details regarding the Meeting are

available on the Bitcoin Well website (www.bitcoinwell.com), via

SEDAR (www.sedar.com) or can be requested from the Company.

About Bitcoin Well Bitcoin Well

offers convenient, secure and reliable ways to buy, sell and use

bitcoin. Bitcoin Well is on a mission to shift the relationship

that society has with money by offering an ecosystem of products

and services that make Bitcoin accessible and understood. This

ecosystem includes self custodial financial offerings (both

in-person and online); technology development, including SaaS and

internal technology developments through Ghostlab, the technology

arm of the business; and educational resources designed with the

needs of both the customers, and the industry, in mind.

Sign up for our newsletter and follow us on

LinkedIn, Twitter, YouTube, Facebook, and Instagram to keep up to

date with our business. For OTC location information visit

bitcoinwell.com/locations.

Bitcoin Well Contact Information For investor

& media information, please contact:

Myles Dougan, Director of Investor

RelationsTel: 587 982 2769m.dougan@bitcoinwell.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Forward-Looking Information: Certain

statements contained in this news release may constitute

forward-looking information. Forward-looking information is often,

but not always, identified by the use of words such as

"anticipate", "plan", "estimate", "expect", "may", "will",

"intend", "should", or the negative thereof and similar

expressions. Forward-looking information involves known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking information.

Bitcoin Well actual results could differ materially from those

anticipated in this forward-looking information as a result of

regulatory decisions, competitive factors in the industries in

which Bitcoin Well operates, prevailing economic conditions, and

other factors, many of which are beyond the control of Bitcoin

Well.

Bitcoin Well believes that the expectations reflected in the

forward-looking information are reasonable, but no assurance can be

given that these expectations will prove to be correct and such

forward-looking information should not be unduly relied upon.

Any forward-looking information contained in this news release

represents Bitcoin Well expectations as of the date hereof, and is

subject to change after such date. Bitcoin Well disclaims any

intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by applicable securities

legislation.For more information, see the Cautionary Note Regarding

Forward Looking Information found in the Bitcoin Well quarterly

Management Discussion and Analysis.

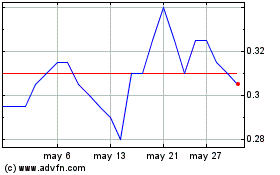

Neptune Digital Assets (TSXV:NDA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

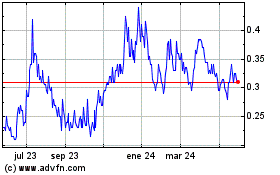

Neptune Digital Assets (TSXV:NDA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024