Marengo Announces Yandera Copper-Molybdenum-Gold Project Feasibility Study and Company Update

17 Mayo 2013 - 12:09AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Marengo Mining Limited (TSX:MRN)(ASX:MMC)(POMSoX:MMC) ("Marengo", or the

"Company") provides the following update on its Yandera Copper-Molybdenum-Gold

Project in Papua New Guinea ("PNG"), following a review of the progress of

recent technical work in support of a Feasibility Study in consultation with its

major shareholder, The Sentient Group ("Sentient").

The Company's Board of Directors has decided that additional work is required in

a number of specific areas before a final Feasibility Study can be prepared,

specifically:

-- Identifying an alternative cost-competitive source of power for the

Project after Marengo's preferred third party power provider decided to

withdraw from the proposed power supply arrangements.

The Feasibility Study indicates that Yandera has the potential to generate

substantial cash flows. However in the absence of a power solution that can

support the Project, it is exposed to escalating capital and operating costs.

Further opportunities to enhance the Project include:

-- A review of optimized ore throughput rates;

-- Reviewing the option of Deep Sea Tailings Placement (DSTP) rather than a

land-based Tailings Management Facility (TMF); and

-- Further optimisation of the mine plan.

A detailed review of recent technical work in support of a Feasibility Study

will be undertaken by the technical committee established by Marengo and

Sentient to implement a programme to enhance project returns. The objective of

this review is to help ensure that the Yandera Project is robust at all phases

of the commodity price cycle.

Sentient, which is providing funding support to Marengo through a recently

announced US$15 million private placement of convertible debentures, will be

involved with Marengo's project team in this next phase of technical

optimisation.

The Sentient Group manages over US$2.7 billion of funds invested in the

development of metal, mineral and energy assets across the globe through its

Cayman-based, 10 year closed-end private equity Sentient Global Resources Funds.

Marengo has already commenced high-level discussions with the PNG Government

regarding other potential power supply options for the Yandera Project. Power is

a major issue currently confronting a number of PNG mining companies seeking to

develop major new resource projects in-country.

Marengo will continue to work closely with the PNG Government to resolve the

power issue and also to explore other strategic options for Yandera's

development.

The Company's Chinese partner, the major engineering, construction and mining

company, China Nonferrous Metal Industry's Foreign Engineering and Construction

Co Ltd (NFC), has also reiterated its support for the Project and will be

closely involved in working with Marengo and Sentient during the next phase of

technical optimisation.

The Engineering, Procurement and Construction ("EPC") pricing provided by NFC in

February 2013 provides a strong foundation for project development and Yandera

remains one of NFC's premier offshore development projects.

The President of NFC, Mr Wang Hongqian, recently commented: "Marengo's Yandera

Project is a high priority for NFC. We remain fully supportive of Marengo as it

advances the development of the project."

The Company has initiated a review of administration, consultant and corporate

overheads in order to ensure that costs are controlled and maintained at an

appropriate level for this next phase of activity.

Marengo's President/CEO, Mr Les Emery: "Yandera is a large copper resource and

this fact is clearly recognised by our strategic partners. However, the recent

withdrawal of our preferred third party power provider has resulted in an

unexpected cost escalation which negatively impacted on the current rate of

economic return.

"Accordingly, we have decided to defer completion of work in relation to a

Feasibility Study and undertake a focused optimisation program. We are confident

that this work has the potential to make substantial improvements to the Project

that could deliver lasting benefits for all stakeholders."

CORPORATE

The Company wishes to advise that, following the completion of the Canadian

redomicile, Mr. Dean Richardson has been appointed Marengo's Corporate

Secretary.

Les Emery, President/CEO

This news release does not constitute an offer to sell or the solicitation of an

offer to buy any ordinary shares within the United States. The ordinary shares

have not been offered and will not be registered under the United States

Securities Act of 1933, as amended (the "1933 Act"), or any state securities

laws. Accordingly, the ordinary shares may not be offered or sold in the United

States or to U.S. persons (as such terms are defined in Regulation S under the

1933 Act) unless registered under the 1933 Act and applicable state securities

laws or an exemption from such registration are granted.

NOTES

Certain statements in this report contain forward-looking information. These

statements address future events and conditions and, as such, involve known and

unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements to be materially different from any future

results, performance or achievements expressed or implied by the statements.

Such factors include, among others, the results of future exploration, risks

inherent in resource estimates, increases in various capital costs, availability

of financing and the acquisition of additional licences, permits and surface

rights. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date the statements were

made, and readers are advised to consider such forward-looking statements in

light of the risks set forth in the company's continuous disclosure filings as

found at the (Canadian) SEDAR website.

For further information on the Project and the resources contained therein,

please refer to the Company's Canadian NI 43-101 and Australian JORC compliant

technical report "Yandera Copper Project, Madang Province, Papua New Guinea"

(dated May 2012) which is available on the Company's website and at the

(Canadian) SEDAR website.

For further information on the Yandera Project, including a description of

Marengo's standard data verification processes, quality assurance and quality

control measures, and details of the key assumptions, parameters and methods

used to estimate the mineral resources set out in this report and the extent to

which the estimate of previously declared mineral resources set out herein may

be materially affected by any known environmental, permitting, legal, title,

taxation, socio-political, marketing or relevant issues, readers are directed to

the technical report entitled "Technical Report on the Yandera

Copper-Molybdenum-Gold Project Madang Province, Papua New Guinea", dated May 14,

2012, which is available on the Company's website and at the (Canadian) SEDAR

website.

The resources disclosed herein are preliminary in nature and include inferred

mineral resources that are considered too speculative geologically to have the

economic considerations applied to them to be categorized as Mineral Reserves.

There is no certainty that the Mineral Resources disclosed herein will be

realized or converted to mineral reserves. Mineral Resources which are not

Mineral Reserves do not have demonstrated economic viability.

It should be noted that the Memorandum of Understanding between Marengo and NFC

referred to in this report is non-binding and that no party is under any

obligation to proceed. Accordingly, there is no certainty that a transaction

will proceed. It should be noted that the Investment and Co-operation Agreement

between Marengo and Petromin, referred to in this report is non-binding on

Petromin and that Petromin is not under any obligation to proceed. Accordingly,

there is no certainty that a transaction will proceed.

The information disclosed herein is subject to change and receipt of the

feasibility study. No decisions to place the project into commercial production

has been made and any such decision is subject to a review of many factors

including those matters set out in the feasibility study when it is received by

the company.

COMPANY NO. 822513-3 / ARBN: 161 356 930

MARENGO MINING (AUSTRALIA) LIMITED (ABN: 57 099 496 474)

YANDERA MINING COMPANY LIMITED (COMPANY NO. 1-53202)

MARENGO MINING (PNG) LIMITED (COMPANY NO. 1-76844)

FOR FURTHER INFORMATION PLEASE CONTACT:

Marengo Mining Limited - Australia

Dean Richardson

VP-Investor Relations

+61 8 9429 0000

deanr@marengomining.com

Marengo Mining Limited - North America

Victoria Russell

Investor Relations

+1 416 644 8680

investor@marengomining.com

www.marengomining.com

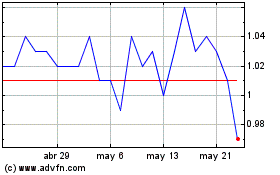

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

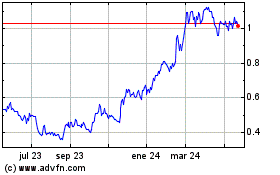

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024