Heritage Oil Announces 2013 Interim Results

29 Agosto 2013 - 1:00AM

Marketwired Canada

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES.

Heritage Oil Plc (TSX:HOC)(LSE:HOIL), an independent upstream exploration and

production company, announces the publication of its interim results for the six

months ended 30 June 2013. All dollars are US dollars unless otherwise stated.

Operational Highlights

-- Heritage's operations have been transformed by the acquisition of an

interest in OML 30, Nigeria

-- OML 30 achieved record gross production, since acquisition, of c.44,000

bopd in August 2013, with a first half average gross production for the

licence of 15,327 bopd

-- Net average daily production of 7,197 bopd in the first half 2013.

Production, net to Heritage, for the month of July 2013 averaged

c.11,000 bopd, over 50% higher than the first half of the year

-- Continued the work programmes in Tanzania through the processing of 2D

seismic on Rukwa and the processing and interpretation of seismic across

the Kyela licence

-- Expanded the exploration portfolio with the farm-in to two licences in

Papua New Guinea ("PNG"); Petroleum Prospecting Licence No:319 ("PPL

319") and Petroleum Retention Licence No:13 ("PRL 13"), which are in a

proven hydrocarbon bearing region

-- Acquired first 62 kilometres of seismic across the Tuyuwopi structure in

PPL 319, PNG, confirming a drilling location

Corporate Highlights

-- Very strong growth in revenues in the first half of the year with $238

million generated from operations in Nigeria and Russia

-- Cash generated from operations of $135 million in the six months ended

30 June 2013

-- Cash position as at 30 June 2013 of approximately $113 million,

excluding $51 million used as part security in respect of OML 30 which

was released back to the Company on 22 August 2013 and replaced with

alternative security granted by Heritage

-- Successfully completed the refinancing of the bridge loan facility with

a five year $500 million Senior Secured Revolving Reserves Based Lending

Facility

-- Heritage has sought leave to appeal to the High Court the judgment in

the English Commercial Court case brought against the Company and

Heritage Oil & Gas Limited, received in June 2013

Outlook

-- Gross production from OML 30, Nigeria, for the second half of 2013 is

expected to average 45,000 bopd, nearly triple that of the first half of

the year. This results in a full year expected average for 2013 of

c.30,000 bopd

-- Average gross production for 2014 is estimated in the range of 60,000 to

65,000 bopd

-- The increase in production from OML 30 for the remainder of this year

will be achieved by the installation of new equipment, working over

existing wells and commencing production from the Uzere West field which

has been shut-in for nearly two years

-- First exploration drilling in Tanzania and PNG slated for 2014

-- Development drilling of OML 30, Nigeria, scheduled to commence in the

summer of 2014

Tony Buckingham, Chief Executive Officer, commented:

"We have started the second half of the year remaining resolutely focused on our

existing operations in Nigeria to ensure we extract maximum value from our

asset. Our ongoing operations have been transformed with record revenues,

profits and cash flows achieved. We expect to see further significant production

gains during the remainder of the year from the operational, engineering and

comprehensive community programmes undertaken so far. Considerable cash flow can

be generated from our OML 30 interests to fund our exploration portfolio in the

short term and longer term provide surplus funds for a sustainable dividend

stream to our investors. Activity will be focused on delivering production

growth over the next twelve months whilst also providing a step up in

exploration drilling. The Company is positioned to offer a balanced portfolio

with upside from both production and exploration."

Heritage's 2013 Interim Report and Accounts is available on its website at

www.heritageoilplc.com.

Copies of these filings may be obtained under Heritage Oil's SEDAR profile at

www.sedar.com.

Notes to Editors

-- Heritage is listed on the Main Market of the London Stock Exchange. The

trading symbol is HOIL. Heritage has a further listing on the Toronto

Stock Exchange (TSX:HOC).

-- Heritage is an independent upstream exploration and production company

engaged in the exploration for, and the development, production and

acquisition of, oil and gas internationally.

-- Shoreline Natural Resources Limited is a private limited Nigerian

company established by Heritage (through a wholly owned subsidiary) and

Shoreline Power Company Limited and has a 45% interest in OML 30 with

National Petroleum Development Company holding the remaining 55%

interest.

-- Heritage has producing assets in Nigeria and Russia and exploration

assets in Tanzania, Papua New Guinea, Malta, Libya and Pakistan.

-- For further information please refer to our website,

www.heritageoilplc.com.

If you would prefer to receive press releases via email please contact Jeanny So

(jeanny@chfir.com) and specify "Heritage press releases" in the subject line.

FORWARD-LOOKING INFORMATION:

Except for statements of historical fact, all statements in this news release -

including, without limitation, statements regarding production estimates and

future plans and objectives of Heritage - constitute forward-looking information

that involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate; actual results and future events

could differ materially from those anticipated in such statements. Factors that

could cause actual results to differ materially from anticipated results include

risks and uncertainties such as: risks relating to estimates of reserves and

recoveries; production and operating cost assumptions; development risks and

costs; the risk of commodity price fluctuations; political and regulatory risks;

and other risks and uncertainties as disclosed under the heading "Risk Factors"

in its Prospectus dated 6 August 2012, as supplemented by a supplementary

prospectus dated 23 August 2012, and elsewhere in Heritage documents filed from

time-to-time with the London Stock Exchange and other regulatory authorities.

Further, any forward-looking information is made only as of a certain date and

the Company undertakes no obligation to update any forward-looking information

or statements to reflect events or circumstances after the date on which such

statement is made or reflect the occurrence of unanticipated events, except as

may be required by applicable securities laws. New factors emerge from time to

time, and it is not possible for management of the Company to predict all of

these factors and to assess in advance the impact of each such factor on the

Company's business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any

forward-looking information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Heritage Oil Plc

Tony Buckingham, CEO / Paul Atherton, CFO

+44 (0) 1534 835 400

info@heritageoilplc.com

Heritage Oil Plc - Investor Relations

Tanya Clarke

+44 (0) 20 7518 0838

ir@heritageoilplc.com

Media Enquiries

Ben Brewerton/ Natalia Erikssen

+44 (0) 20 7831 3113

heritageoil.sc@fticonsulting.com

Canada

Cathy Hume / Jeanny So

+1 416 868 1079 x231 / x225

cathy@chfir.com / jeanny@chfir.com

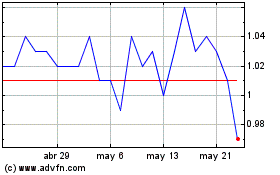

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

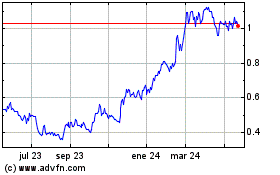

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024