Heritage Oil Announces Results for the Year Ended 31 December 2013

30 Abril 2014 - 1:00AM

Marketwired Canada

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES.

Heritage Oil Plc (TSX:HOC)(LSE:HOIL) ("Heritage" or the "Company"), an

independent upstream exploration and production company, announces its results

for the twelve months ended 31 December 2013. All figures are in US dollars

unless otherwise stated.

2013 Operational Highlights

-- Production from OML 30, Nigeria, increased during the year and record

gross production since acquisition, of over 50,000 bopd has been

achieved

-- Maintenance work over OML 30 is progressing as planned

-- 2013 average production from the interest in OML 30, Nigeria, net to

Heritage of 8,919 bopd and net production from Russia of 577 bopd

-- Continued the work programme in Tanzania through processing of 2D

seismic data on Rukwa which has identified several prospects in the

retained Rukwa South licence area. A geochemical survey of the Kyela

licence has been completed and interpretation of the data is proceeding

to schedule

-- Expanded the exploration portfolio with the farm-in to four licences in

Papua New Guinea ("PNG"); Petroleum Prospecting Licence 319 ("PPL 319"),

Petroleum Retention Licence 13 ("PRL 13"), Petroleum Prospecting Licence

337 ("PPL 337") and Petroleum Prospecting Licence 437 ("PPL 437")

-- Work programmes in PNG commenced with the acquisition and processing of

seismic and evaluation of legacy datasets

2013 Financial Highlights(1)

-- Total revenues, net to Heritage, for 2013 of $431.9 million

-- Profit after tax from continuing operations of $100.4 million, an

increase of 104% year-on-year

-- Operating cash flows of $235.3 million in 2013 compared to cash outflows

of $207.5 million in 2012

-- Successfully completed the refinancing of the bridge loan facility with

a five year $550 million Senior Secured Revolving Reserves Based Lending

Facility drawn by Shoreline Natural Resources Limited ("Shoreline") in

Nigeria

-- Heritage cash at 31 December 2013 of $183.8 million

Outlook

-- Continued investment in OML 30 during 2014, including the installation

of gas lift compressors, refurbishment of equipment, statutory

inspection and testing of all pressure vessels and inspection of all

wellheads and pipelines continue to support well optimisation, which

will result in further increases in production

-- Development drilling on OML 30 remains on track for commencing in the

second half of 2014

-- As a result of an enforced shut-in at OML 30 during the first quarter of

this year, total production, net to Heritage, for 2014 is estimated in

the range of 14,500-18,000 bopd

-- 2014 expected year end exit gross production rate from OML 30 between

65,000 and 70,000 bopd

-- Exploration activity is set to increase with multi-well drilling

campaigns planned for PNG and Tanzania

-- Continue to look for further opportunities to create value

-- Intention to become a long-term sustainable dividend payer commencing

within the next 12 months

Tony Buckingham, Chief Executive Officer, commented:

"2013 has been an extraordinary year for Heritage and Shoreline with a step

change in production and operating cash flow enabling us to expand our

exploration portfolio through acquiring additional exciting exploration

opportunities. Our progress during 2013 resulted from the continued development

of OML 30 in Nigeria and the decision to enter Papua New Guinea, whilst

continuing with our work programme in Tanzania. Our balanced portfolio includes

significant producing fields and an enlarged exploration portfolio providing

both geographic and operational diversification. Cash flow generation from OML

30 is now so robust that it is our intention to become a long-term sustainable

dividend payer commencing within the next 12 months."

(1) In order to be prudent, the Group has changed the accounting policy for the

proportion of Shoreline it consolidates into its results and it now

proportionally consolidates Shoreline's financial results using 90% which is the

eventual economic rights before completion of the partner's option.

Heritage's 2013 Annual Report and Accounts will be available on its website at

www.heritageoilplc.com.

Copies of these filings may be obtained under Heritage Oil's SEDAR profile at

www.sedar.com.

Conference call

Conference call

There will be an analyst teleconference hosted by Paul Atherton, Chief Financial

Officer, at 12:30pm British Summer Time today. The presentation that accompanies

the call will be available on the Heritage Oil website (www.heritageoilplc.com).

To access the call please dial the appropriate number below shortly before the

scheduled start time and ask for the Heritage Oil Plc conference call or quote

the following conference code to the operator: 8555827

The dial in details are:

UK dial in: 0800 279 4992

International dial in: +44 (0) 207 136 2055

Notes to Editors

-- Heritage is listed on the Main Market of the London Stock Exchange and

is a constituent of the FTSE 250 Index. The trading symbol is HOIL.

Heritage has a further listing on the Toronto Stock Exchange (TSX:HOC).

-- Heritage is an independent upstream exploration and production company

engaged in the exploration for, and the development, production and

acquisition of, oil and gas internationally.

-- Heritage has producing assets in Nigeria and Russia and exploration

assets in Tanzania, Papua New Guinea, Malta, Libya and Pakistan.

-- All dollars are US$ unless otherwise stated.

-- For further information please refer to our website,

www.heritageoilplc.com.

If you would prefer to receive press releases via email please contact Jeanny So

(jeanny@chfir.com) and specify "Heritage press releases" in the subject line.

FORWARD-LOOKING INFORMATION:

Except for statements of historical fact, all statements in this news release -

including, without limitation, statements regarding production estimates and

future plans and objectives of Heritage - constitute forward-looking information

that involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate; actual results and future events

could differ materially from those anticipated in such statements. Factors that

could cause actual results to differ materially from anticipated results include

risks and uncertainties such as: risks relating to estimates of reserves and

recoveries; production and operating cost assumptions; development risks and

costs; the risk of commodity price fluctuations; political and regulatory risks;

and other risks and uncertainties as disclosed under the heading "Risk Factors"

in its Prospectus dated 6 August 2012, as supplemented by a supplementary

prospectus dated 23 August 2012, and elsewhere in Heritage documents filed from

time-to-time with the London Stock Exchange and other regulatory authorities.

Further, any forward-looking information is made only as of a certain date and

the Company undertakes no obligation to update any forward-looking information

or statements to reflect events or circumstances after the date on which such

statement is made or reflect the occurrence of unanticipated events, except as

may be required by applicable securities laws. New factors emerge from time to

time, and it is not possible for management of the Company to predict all of

these factors and to assess in advance the impact of each such factor on the

Company's business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any

forward-looking information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Heritage Oil Plc

Tony Buckingham

CEO

+44 (0) 1534 835 400

Heritage Oil Plc

Paul Atherton

CFO

+44 (0) 1534 835 400

info@heritageoilplc.com

Heritage Oil Plc

Tanya Clarke

Investor Relations

+44 (0) 20 7518 0838

Heritage Oil Plc

Claire Harrison

Investor Relations

+44 (0) 20 7518 0827

ir@heritageoilplc.com

www.heritageoilplc.com

Media Enquiries

Ben Brewerton

+44 (0) 20 7831 3113

heritageoil.sc@fticonsulting.com

Canada

Cathy Hume

+1 416 868 1079 x231

cathy@chfir.com

Canada

Jeanny So

+1 416 868 1079 x225

jeanny@chfir.com

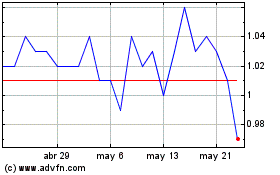

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

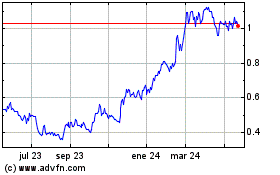

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024