Heritage Oil Interim Management Statement

16 Mayo 2014 - 1:00AM

Marketwired Canada

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES

Heritage Oil Plc (TSX:HOC)(LSE:HOIL), an independent upstream exploration and

production company, issues its Interim Management Statement for the period from

1 January 2014 to 15 May 2014.

Corporate highlights

-- Total revenues of $50.4 million in the first quarter 2014, of which

$48.1 million was from OML 30, Nigeria, and $2.3 million was from the

interest in the Zapadno Chumpasskoye Field, Russia. Revenue from OML 30,

was impacted negatively by an enforced shut-in at a third party terminal

where the crude is exported and there being an underlift at quarter end

resulting in an inventory build-up

-- On 30 April 2014, Heritage received a cash offer of 320 pence per share,

which had been recommended by an independent board committee composed of

the Non-Executive Directors of Heritage

-- Heritage cash of $74.4 million, as at 31 March 2014

Operational highlights

-- Average net daily production for the first three months of 2014 was

9,864 bopd, of which 9,216 bopd was from OML 30, Nigeria, 33% higher

than the same period in 2013, although 18% lower than Q4 2013, as a

result of the shut-in at the crude export terminal

-- Production at the Zapadno Chumpasskoye Field, Russia, for the first

three months of 2014 averaged 648 bopd

-- Maintenance work over OML 30 is progressing as planned

-- Work programmes in Tanzania continued, with the processing of 2D seismic

data on Rukwa which has identified several prospects in the Rukwa South

licence area. Interpretation of a geochemical survey of the Kyela

licence is proceeding

-- Work programmes in Papua New Guinea ("PNG") progressed with the

acquisition and processing of seismic and evaluation of legacy datasets

-- As a result of an enforced shut-in at OML 30 during the first quarter of

2014, total production, net to Heritage, for 2014 is estimated in the

range of 14,500-18,000 bopd

PRODUCTION

Production for the first three months of 2014, from OML 30, Nigeria, averaged

approximately 9,216 bopd net to Heritage, 33% higher than the same period in

2013. Production in the first quarter of this year was impacted by a leak on the

undersea tanker loading pipeline at the third party owned Forcados crude oil

terminal. This stopped export shipments for approximately one month thereby

forcing OML 30 to shut-in for a similar time once storage had reached capacity.

The terminal resumed shipments in early April and operations recommenced in OML

30.

During the first quarter gross production of over 50,000 bopd had been achieved.

Net revenues of $48.1 million were achieved from three liftings in the first

quarter of 2014, and it is expected that these will take place on a monthly

basis going forward. There was an underlift at quarter end resulting in an

inventory build-up. Installation of gas compressors, refurbishment of equipment,

statutory inspection and testing of all pressure vessels, and inspection of all

wellheads and pipelines continue to support well optimisation. New compressors

for Afiesere and Kokori will be commissioned once production has stabilised. The

installation of two new compressor engines in Olomoro is making a positive

impact on uptime, which should result in further increases in production.

Commencement of development drilling remains on track for the second half of the

year.

Production at the Zapadno Chumpasskoye Field, Russia, for the first three months

of 2014 averaged 648 bopd, net to Heritage, 47% higher than the same period in

2013 due to a temporary mechanical issue in 2013 that has since been rectified.

As a result of the enforced shut-in, 2014 production guidance, net to Heritage,

is estimated in the range of between 14,500-18,000 bopd, with an expected year

end gross production exit rate from OML 30 of between 65,000 and 70,000 bopd.

EXPLORATION

Papua New Guinea

In 2013 Heritage expanded its portfolio into onshore PNG through the farm-in to

four onshore licences. In April 2013, Heritage entered into an agreement with

Esrey Energy Ltd ("Esrey Energy") to acquire interests in Petroleum Prospecting

Licence 319 ("PPL 319") and appraisal licence Petroleum Retention Licence 13

("PRL 13"). The work programme began with the acquisition of the first 62

kilometres of 2D seismic data over the Tuyuwopi structure in PPL 319. Processing

of the new seismic data, combined with the reprocessing of c.300 kilometres of

legacy seismic data over these licences was completed in late February 2014.

Further seismic data acquisition over leads within the licences has commenced in

first quarter 2014 with a total of approximately 170 kilometres of data expected

to be acquired, in order to firm up these leads into additional drillable

prospects. Well and logistical planning continues to enable drilling of the

Tuyuwopi prospect in the short term.

In October 2013, Heritage agreed with Kina Petroleum Limited ("Kina Petroleum")

to farm-in to two licences, Petroleum Prospecting Licence 337 ("PPL 337") and

Petroleum Prospecting Licence 437 ("PPL 437"). On PPL 337 two wells are proposed

to be drilled this year; one located at the Raintree prospect where a

Pliocene/Miocene age reef target is identified, and the second located on or

adjacent to the Banam anticline where several Neogene age clastic targets have

been identified. Detailed well planning is on-going. PPL 337 has good road

access and is close to potential local gas markets and the deep water port of

Madang, which may be suitable for LNG export.

Tanzania

Focused interpretation over the Rukwa South licence area has identified several

prospects, for which detailed mapping and evaluation is ongoing.

A geochemical survey of the Kyela licence has been completed and interpretation

of the data is continuing. Infill seismic acquisition, designed and positioned

using all available data, will increase the density of the seismic grid and

enhance the mapping of potential prospects. The survey is planned for the second

half of 2014.

A multi-well drilling programme across the two licences is planned for 2014/2015.

CORPORATE

As at 31 March 2014, Heritage had a cash position of $74.4 million.

The average realised commodity price achieved in Nigeria was $110.51 per barrel

in the first quarter of 2014. Over the quarter, there were three liftings in

Nigeria which generated revenues net to Heritage of $48.1 million, compared to

$216.4 million in the same period last year. Revenues in Q1 2013 were boosted by

the sale of inventories that had built up as there were no sales in 2012 since

the licence was acquired in November 2012. Revenue of $2.3 million was received

from operations in Russia in the first quarter 2014, compared to $1.7 million in

the first quarter of 2013.

RECOMMENDED CASH OFFER

On 30 April 2014, Energy Investments Global Ltd ("Bidco") announced, pursuant to

Rule 2.7 of the City Code on Takeovers and Mergers, that it had reached

agreement with an independent board committee composed of the Non-Executive

Directors of Heritage on the terms of a recommended cash offer through which the

entire issued and to be issued ordinary share capital of Heritage (other than

shares held by Heritage in treasury and 57,748,991 ordinary shares legally or

beneficially owned by Albion Energy Limited, a shareholder of Heritage whose

share capital is beneficially owned by Anthony Buckingham) will be acquired by

Bidco, a wholly owned subsidiary of Al Mirqab Capital SPC.

Under the terms of the offer, each shareholder will be entitled to receive 320

pence in cash per ordinary share. It is intended that the offer will be

implemented by way of a court sanctioned scheme of arrangement under Article 125

of the Companies (Jersey) Law 1991 and is conditional upon obtaining certain

shareholder approvals.

The scheme document containing further information about the offer and notices

of meetings, together with forms of proxy, will be posted to shareholders in due

course with completion expected to occur this summer.

UGANDA

There have been no changes to the various proceedings related to the sale of the

Group's interests in Uganda in 2010 since the publication of the Annual Report

on 30 April 2014, apart from the following:

Heritage Oil & Gas Limited ("HOGL") and Heritage made an application to the

Court of Appeal for permission to appeal the first instance judgment of Mr

Justice Burton in June 2013. Permission to appeal against the judgment was

granted in September 2013. This appeal was heard in the Court of Appeal on 7 and

8 May 2014 and Heritage and HOGL are now awaiting a decision from the Court of

Appeal. This decision is expected during the next 3 months.

Paul Atherton, Chief Financial Officer, commented:

"Operations at OML 30 were impacted during the first quarter, but recommenced in

early April 2014 so that we have been able to build on our progress in 2013.

Nigeria remains the focus for 2014, with increasing production from OML 30,

whilst concurrently progressing exploration programmes in PNG and Tanzania."

A copy of the full announcement is available on Heritage's website at

www.heritageoilplc.com.

Notes to Editors

-- Heritage is listed on the Main Market of the London Stock Exchange and a

constituent of the FTSE 250 Index. The trading symbol is HOIL. Heritage

has a further listing on the Toronto Stock Exchange (TSX:HOC).

-- Heritage is an independent upstream exploration and production company

engaged in the exploration for, and the development, production and

acquisition of, oil and gas internationally.

-- Shoreline Natural Resources Limited is a private limited Nigerian

company established by Heritage, through a wholly owned subsidiary, and

Shoreline Power Company Limited and has a 45% interest in OML 30 with

National Petroleum Development Company holding the remaining 55%

interest.

-- Heritage has producing assets in Nigeria and Russia and exploration

assets in Tanzania, PNG, Malta, Libya and Pakistan.

-- All dollars are US$ unless otherwise stated.

-- For further information please refer to our website,

www.heritageoilplc.com

If you would prefer to receive press releases via email please contact Jeanny So

(jeanny@chfir.com) and specify "Heritage press releases" in the subject line.

FORWARD-LOOKING INFORMATION:

Except for statements of historical fact, all statements in this news release -

including, without limitation, statements regarding production estimates and

future plans and objectives of Heritage - constitute forward-looking information

that involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate; actual results and future events

could differ materially from those anticipated in such statements. Factors that

could cause actual results to differ materially from anticipated results include

risks and uncertainties such as: risks relating to estimates of reserves and

recoveries; production and operating cost assumptions; development risks and

costs; the risk of commodity price fluctuations; political and regulatory risks;

and other risks and uncertainties as disclosed under the heading "Risk Factors"

in its Prospectus dated 6 August 2012, as supplemented by a supplementary

prospectus dated 23 August 2012, and elsewhere in Heritage documents filed from

time-to-time with the London Stock Exchange and other regulatory authorities.

Further, any forward-looking information is made only as of a certain date and

the Company undertakes no obligation to update any forward-looking information

or statements to reflect events or circumstances after the date on which such

statement is made or reflect the occurrence of unanticipated events, except as

may be required by applicable securities laws. New factors emerge from time to

time, and it is not possible for management of the Company to predict all of

these factors and to assess in advance the impact of each such factor on the

Company's business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any

forward-looking information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Heritage Oil Plc

Tony Buckingham

CEO

+44 (0) 1534 835 400

Heritage Oil Plc

Paul Atherton

CFO

+44 (0) 1534 835 400

info@heritageoilplc.com

Heritage Oil Plc - Investor Relations

Tanya Clarke

+44 (0) 20 7518 0838

Heritage Oil Plc - Investor Relations

Claire Harrison

+44 (0) 20 7518 0827

ir@heritageoilplc.com

Media Enquiries

Ben Brewerton

+44 (0) 20 7831 3113

heritageoil.sc@fticonsulting.com

Canada

Cathy Hume

+1 416 868 1079 x231

cathy@chfir.com

Jeanny So

+1 416 868 1079 x225

jeanny@chfir.com

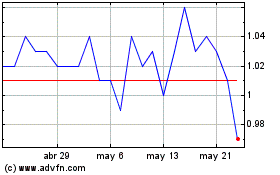

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

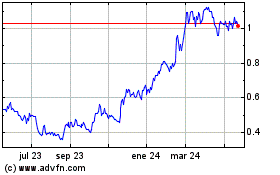

Kraken Robotics (TSXV:PNG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024