THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the year ended December 31, 2009.

The Company reported a net loss of $101,963 ($0.004 per basic share) compared to

net income of $628,056 ($0.026 per basic share) for the year ended December 31,

2008. The decrease in net income of $730,019 is primarily attributable to the

difference in foreign exchange gains and losses experienced in each of the two

years. Partially mitigating this impact is the positive net effect of higher

revenue from rental incinerator services and lower income tax expense, offset by

lower incinerator sales and other revenues.

"2009 was a challenging year for the oilfield services industry. The economic

downturn, coupled with reduced demand for oil and gas, led to a curtailment of

drilling activities and delays to capital expenditure decisions by Questor's

customers. As a result, Questor's revenues were impacted, down by 11 percent

from 2008. Despite the economic downturn, the Company has continued to

experience a high level of interest in its technology solutions and currently

has close to $40 million of bids outstanding with prospective customers all over

the world. The Company's confirmed sales order backlog is currently $1.9

million," said Audrey Mascarenhas, President and Chief Executive Officer.

"The Company relied on the strength of its balance sheet to provide the

financial capacity to focus on research and development activities in the areas

of product development and waste heat to power solutions. To capitalize on

society's heightened focus on sustainability and social responsibility, efforts

continued in raising market awareness of the technological solutions available

to address zero flaring policies and regulations emerging in many jurisdictions,

both international and local. With over 14.5 billion cubic feet of gas flared

daily worldwide, the market potential for Questor's technology is significant.

In the North American oil and gas sector alone there are currently more than

10,800 solution gas flares in Alberta and over 30,000 in the United States.

Converting only 10 percent of the flares to incineration would generate in

excess of $400 million of sales revenue.

The Company's incineration technology is increasingly seen as one of the viable

solutions to achieve zero flaring. Questor is positioning to take advantage of

the market opportunities this trend presents." Ms. Mascarenhas added, "The

Company remains focused on managing the business and we are optimistic about the

Company's future given the global attitudes evolving towards air quality,

minimization of carbon emissions, energy efficiency, corporate responsibility

and sustainability."

2009 OPERATIONAL HIGHLIGHTS

Relative to the strategic priorities, the following selected events and

achievements demonstrate Questor's progression in 2009:

-- Awarded its first international contract of some significance since

2007. Questor entered into a USD $950,000 incinerator sales contract

with a large U.S.-based global integrated energy company for a project

located in Indonesia and for which delivery is anticipated to occur in

third quarter 2010.

-- Provided waste gas incinerator equipment on a long-term rental basis to

its first heavy oil in situ combustion application. Questor's

incinerator technology has been deployed to handle low heat content sour

waste gases with high flow rates at a heavy oil operation located in

southwest Saskatchewan. This project's success establishes the

prospective application of Questor's products in oil sands development.

-- Installed an incinerator on a long-term rental basis to combust the

fugitive vapours at a loading/offloading facility in Fort Saskatchewan,

Alberta. This application demonstrates a viable technology to handle

vapours generated during shipping operations.

-- Developed and tested a scaled-down version of its successful, larger

incinerators to address the growing market for efficient combustion of

waste gases characterized by low flow and atmospheric pressure. This

unit has applicability particularly for the combustion of casing head

gas that is currently vented and hence generating carbon equivalent

greenhouse gas emissions.

-- Advanced the development of a process to convert waste gas to heat

and/or power. Questor completed its first design of a heat recovery

module to operate in tandem with Questor's incinerator products.

Construction of the prototype commenced in late 2009 and was completed

in first quarter 2010. Testing is expected to conclude in second quarter

2010.

-- Built market awareness and recognition for Questor's expertise in

matters relating to air quality as demonstrated by invitations to

present at several events worldwide:

-- Canadian Prairie Air & Waste Management and Northern Section (CPANS)

2009 Conference in Edmonton, Alberta, Canada in April 2009 on the

topic of "Embracing Climate Change";

-- Global Gas Flaring: A Burning Concern Summit in New Delhi, India in

September 2009 on the topic of "Curbing Climate Change: A Simple and

Sustainable Solution" during the "Emerging Gas Utilization

Technologies: Possibilities and Barriers" portion of the international

Summit;

-- 2009 Northeast BC Energy Conference in Dawson Creek, British Columbia,

Canada in September 2009 on the topic of "Waste Gas Combustion:

Economic, Efficient and Effective";

-- U.S. Environmental Protection Agency sponsored "Natural Gas STAR 2009

Annual Implementation Workshop" in San Antonio, Texas, USA in October

2009;

-- Acid Gas Injection Symposium in Calgary, Alberta, Canada in October

2009 on the topic of "Acid Gas: When to Inject and When to

Incinerate"; and

-- Managing Total Emissions Conference in Calgary, Alberta, Canada in

November 2009 on the topic of "Best Practices for the Combustion and

Conservation of Solution and Waste Gas".

-- Achieved recognition of Questor's growth when the Company was selected

for Alberta Venture's 2010 Fast Growth 50 list, an annual ranking

honoring fifty of the fastest growing companies in Alberta. Questor

ranked 17th in the top 25 fastest growing companies with revenue under

$20 million. This is the second year in succession that Questor has been

selected for the Fast Growth 50 list.

Audrey Mascarenhas has been invited to serve as a Society of Petroleum Engineers

("SPE") Distinguished Lecturer for the 2010-2011 lecture season. Drawing on her

technical expertise and experiences with Questor's waste gas combustion

technology, Ms. Mascarenhas will be speaking on the topics of sustainable

development and the environment. SPE is a key resource to its membership

worldwide for technical information and practices in the oil and gas industry.

SUBSEQUENT TO DECEMBER 31, 2009

More recently, Ms. Mascarenhas presented at the 2010 EnviroArabia Conference

held in the Kingdom of Bahrain on the topic of "Clearing the Air - Safely and

Efficiently". A copy of this presentation is available on the Company's website.

On May 6, 2010, Ms. Mascarenhas will present a paper entitled "Platform Waste

Gas Combustion: Efficiently, Safely, Reliably and Economically" at the Society

of Petroleum Engineers Offshore Technology Conference to be held in Houston,

Texas, USA.

The Company is pleased to announce that RB Milestone Group, LLC ("RBMG") has

invited Questor onto their Portal Network(TM) platform. RBMG is an equity

research firm that provides a variety of cutting-edge equity research and

investor relations solutions through its proprietary platform The Portal

Network(TM). This web-based platform is an interactive research and investor

relations hub and is host to a vast range of novel product offerings. As a

result of this relationship, RBMG will be creating an interactive Portal page

for the Company, which will assist the Company with its day-to-day investor

relations functions amongst its existing shareholders and appropriate Portal

members. The Company encourages all of its existing shareholders and company

followers to access Questor's Portal page on The Portal Network(TM) by

navigating to the following link, http://www.rbmilestone.com/register, to sign

up.

The Company also announced today that effective April 26, 2010, subject to

regulatory approval, the grant of share options to select officers and employees

entitling the purchase of up to 300,000 common shares at $0.27 per share,

exercisable for a period of five years and vesting in accordance with the

provisions of the Company's share option plan.

Questor's audited financial statements and Management's Discussion and Analysis

for the years ended December 31, 2009 and 2008 will be available shortly on the

Company's website at www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield services company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

---------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

BALANCE SHEETS

As at December 31 2009 2008

---------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 3,080,997 $ 3,259,037

Accounts receivable 864,260 1,761,597

Income and other taxes receivable 306,850 6,226

Inventory 433,145 384,914

Prepaid expenses and deposits 101,072 80,340

Deferred expenses 2,356 29,160

Future income tax asset 50,113 -

---------------------------------------------------------------------------

4,838,793 5,521,274

Property and equipment 1,418,524 1,176,529

Intangibles 15,682 44,680

Deferred expenses - 30,575

---------------------------------------------------------------------------

$ 6,272,999 $ 6,773,058

---------------------------------------------------------------------------

---------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 348,150 $ 667,792

Current portion of long-term debt 15,232 37,498

Income and other taxes payable 19,034 285,795

Deferred revenue and deposits 198,641 146,707

Future income tax liability 2,281 9,281

---------------------------------------------------------------------------

583,338 1,147,073

Long-term debt - 15,232

Other long-term liabilities - 30,575

Future income tax liability 74,057 26,710

---------------------------------------------------------------------------

657,395 1,219,590

---------------------------------------------------------------------------

Shareholders' equity

Share capital 5,265,736 5,265,736

Contributed surplus 447,651 283,552

Retained earnings (deficit) (97,783) 4,180

---------------------------------------------------------------------------

5,615,604 5,553,468

---------------------------------------------------------------------------

$ 6,272,999 $ 6,773,058

---------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF INCOME (LOSS), COMPREHENSIVE INCOME (LOSS)

AND RETAINED EARNINGS (DEFICIT)

For the years ended December 31 2009 2008

---------------------------------------------------------------------------

Revenue

Incinerator sales and services $ 2,277,762 $ 2,583,199

Incinerator rentals and services 1,098,385 954,396

Combustion services 478,419 678,660

---------------------------------------------------------------------------

3,854,566 4,216,255

Less: Direct costs 2,537,337 2,818,502

---------------------------------------------------------------------------

1,317,229 1,397,753

---------------------------------------------------------------------------

Other revenue 102,608 254,896

Expenses

General and administrative 1,374,672 1,328,469

Foreign exchange loss (gain) 100,205 (707,664)

Depreciation and amortization 41,090 40,459

---------------------------------------------------------------------------

1,515,967 661,264

---------------------------------------------------------------------------

Income (loss) before interest expense and

income tax expense (96,130) 991,385

Interest expense

Short-term debt 1,456 5,196

Long-term debt 2,016 2,016

---------------------------------------------------------------------------

Income (loss) before income tax expense (99,602) 984,173

Income tax expense (recovery)

Current income tax 12,127 391,328

Future income tax (9,766) (35,211)

---------------------------------------------------------------------------

Net income (loss) and comprehensive income

(loss) (101,963) 628,056

Retained earnings (deficit), beginning of year 4,180 (623,876)

---------------------------------------------------------------------------

Retained earnings (deficit), end of year $ (97,783) $ 4,180

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net income (loss) per share

Basic and diluted $ (0.004) $ 0.026

Weighted average number of shares

outstanding

Basic 24,007,370 23,830,287

Diluted 24,007,370 24,491,573

---------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

For the years ended December 31 2009 2008

---------------------------------------------------------------------------

Operating activities

Net income (loss) $ (101,963) $ 628,056

Items not involving cash:

Depreciation 133,174 122,122

Amortization 28,998 28,998

Unrealized foreign exchange loss (gain) 178,974 (295,204)

Future income tax (9,766) (35,211)

Share-based compensation 164,099 152,011

Gain on disposition of assets - (98,269)

Write-down of inventory 12,660 38,912

---------------------------------------------------------------------------

406,176 541,415

Net change in non-cash working capital (21,022) (190,352)

---------------------------------------------------------------------------

385,154 351,063

---------------------------------------------------------------------------

Investing activities

Additions of property and equipment (372,373) (51,663)

Dispositions of property and equipment - 139,733

---------------------------------------------------------------------------

(372,373) 88,070

---------------------------------------------------------------------------

Financing activities

Repayment of short-term debt - (191,186)

Repayment of long-term debt (37,498) (60,659)

Net proceeds from issuance of common shares - 21,250

---------------------------------------------------------------------------

(37,498) (230,595)

---------------------------------------------------------------------------

Effect of exchange rates on cash (153,323) 296,502

---------------------------------------------------------------------------

Increase (decrease) in cash and cash equivalents (178,040) 505,040

Cash and cash equivalents, beginning of year 3,259,037 2,753,997

---------------------------------------------------------------------------

Cash and cash equivalents, end of year $ 3,080,997 $ 3,259,037

---------------------------------------------------------------------------

---------------------------------------------------------------------------

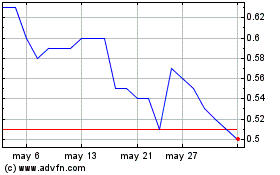

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024