THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the year ended December 31, 2013.

The Company's audited annual financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS").

The Company reported the highest profit in its history of $2,544,049 ($0.101 per

basic share) 145 percent higher than profit of $1,040,356 ($0.042 per basic

share) for the year ended December 31, 2012. The increase in profit was due to

increased incinerator sales during the year, partially offset by lower rental

and combustion services revenues and increased administration costs.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except shares outstanding)

Increase

For the years ended December 31 2013 2012 (decrease)

----------------------------------------------------------------------------

Revenue 9,574,950 6,684,475 2,890,475

Gross profit(1) 4,725,576 3,078,180 1,647,396

EBITDA(1) 3,454,374 1,723,363 1,731,011

Profit and total comprehensive

income 2,544,049 1,040,356 1,503,693

Cost of sales as a percent of

revenue(1) 50.6% 53.9% (3.3%)

Funds flow from operations

before movements in non-cash

working capital(1) 3,543,893 1,826,443 1,717,450

----------------------------------------------------------------------------

As at December 31 Increase

2013 2012 (decrease)

----------------------------------------------------------------------------

Total assets 14,029,829 9,798,449 4,231,380

Non-current liabilities 175,130 223,295 (48,165)

Shares outstanding(2)

Basic 25,102,165 24,869,255 232,910

Diluted 25,939,888 25,144,794 795,094

Earnings per share - Basic 0.101 0.042 0.059

- Diluted 0.098 0.041 0.057

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of Questor's Management's Discussion and

Analysis for the year ended December 31, 2013.

(2) Weighted average.

"We continued to penetrate the U.S. market moving from 47% of total unit sales

revenue last year to 52% this year. In addition, with a second unit going to

Russia in 2013 and two into Europe our exposure in those markets continues to

grow. While the number of units we sold in 2013 was more than double the prior

year, current year sales were muted by the deferral of the anticipated fourth

quarter delivery of eight units to a Canadian oilsands operator. Those units

were delivered in the first quarter of 2014" said Audrey Mascarenhas, President

and Chief Executive Officer. "In 2013 we sold five units from our rental fleet

to customers with short delivery times frames and have more units in fabrication

than we have ever had in the past to meet upcoming sale and rental commitments,

using cash generated from operations. We expect demand for our incinerators to

intensify, particularly in the U.S. as the effective date for the new EPA

regulations draws nearer."

"Questor's product quality and combustion expertise are becoming more recognized

on a daily basis globally" she continued. "Our incineration technology is unique

in its ability to allay public concerns regarding air quality and is capable of

meeting emissions standards across a wide range of applications. Emissions

legislation introduced in the United States and Europe are expected to continue

to increase interest in our incinerators as companies look for solutions to

flaring and emissions control."

"We are well positioned to pursue growth opportunities in North America and

Europe in the coming year," concluded Ms. Mascarenhas.

2013 OPERATIONAL HIGHLIGHTS

Relative to the Company's strategic priorities, the following selected events

and achievements demonstrate Questor's progression in 2013:

-- Generated revenue of $9,574,950, the highest in the Company's history,

up 43% from the prior year.

-- Demonstrated the Company's technical expertise and competence in the

destruction of low heat content gases through the deployment of

incineration equipment and related technology to shale gas and oil sands

developments and to amine, dehydration and other crude oil and natural

gas processing applications. As a result, certain customers have

identified Questor's technology as best practice and specify the use of

the Company's solutions in their tenders to third parties for field

equipment.

-- Exploited the growing demand arising from the industry's focus on shale

gas opportunities investing $4.4 million in 2013 in the fabrication of

units for rental fleet additions or for sale to customers with short

lead times.

-- Delivered in second quarter 2013 the second of the Company's

incineration units into Russia. The Russian market holds strong

potential for Questor as that country focuses on opportunities to reduce

waste gas flaring. Additional orders for sale or rental units in Russia

are expected to be received in 2014.

-- Advanced the development and commercialization of a process to recover

waste heat from incineration and convert the heat to power, purchasing

in early 2014 all of the outstanding shares of ClearPower Systems Inc.,

which has prototype technology to deliver 50kW of power from waste heat.

-- Engaged in discussions with fabricators in Europe with respect to the

potential to have incinerators for sale or rent in European markets

fabricated in closer proximity to the customer.

-- Built market awareness and recognition for Questor's expertise in

matters relating to air quality through presentations made by invitation

at several events worldwide including:

-- Ms. Mascarenhas made a presentation called "Clearing the Air" in

February 2013 as part of an Alberta Oil and Gas Mission to Poland

and again in mid-May at the ACI Tight and Shale Gas Summit in

Istanbul, Turkey.

-- She also presented, along with the Company's Chief Operating Officer

to senior executives at several major U.S. oil and gas companies in

Houston in late April of 2013 regarding capabilities of the

Company's incinerators/thermal oxidizers.

-- On May 10th, 2013 Ms Mascarenhas made a presentation at the Western

Energy Summit entitled "Climbing to New Heights with Clean Air

Solutions".

-- A further mission took Ms. Mascarenhas in late May of 2013 to

Bahrain, Abu Dhabi and Oman, where she participated in the latter

country in workshops focused on clean air solutions and attended

meetings with corporate and government individuals who had expressed

interest in Questor's technology.

-- Ms. Mascarenhas attended at the SelectUSA Investment Summit in

Washington, DC on October 31, 2013

-- She was keynote speaker at the Society of Petroleum Engineers

("SPE") luncheon on the 21st of November in Oklahoma City.

-- She travelled to Mexico at the end of November to present at the

Pemex Technology Exchange Forum.

-- Copies of these presentations are available on the Company's website.

SUBSEQUENT TO DECEMBER 31, 2013

At December 31, 2013, the Company had confirmed incinerator sales orders of $4.0

million. Since the beginning of 2014, confirmed incinerator sales orders for an

additional $2.6 million have been received. Of the $6.6 million of associated

revenue to be recorded in relation to these orders, $2.8 million is expected to

be recognized in first quarter 2014 based on customer delivery schedules and

$3.8 million in second quarter 2014. In addition, long term rental contracts

have been signed with four new customers, three of which will be using the

Company's larger units for extended periods.

Questor Technology Inc. was selected to the 2014 TSX Venture 50, first out of 10

in its category of Clean Technology. This is the second year in a row the

Company has earned the honor which is a ranking of strong performers on TSX

Venture Exchange. It is comprised of ten companies from each of the following

five sectors: Mining, Oil & Gas, Diversified Industries, Clean Technology and

Technology & Life Sciences.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Tuesday, June 24, 2014 at 3:00 p.m. MDT in the Company's Corporate

Offices at 1121, 940 - 6th Avenue S.W, Calgary, Alberta. In addition to the

formal business items, management will be presenting an overview of Questor's

results for the financial year ended December 31, 2013 and first quarter ended

March 31, 2014 and discussing the Company's strategic initiatives for 2014.

Questor's audited financial statements and notes thereto and management's

discussion and analysis for the year ended December 31, 2013 will be available

shortly on the Company's website at www.questortech.com and through SEDAR at

www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases enabling regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the crude oil and

natural gas industry, this technology is applicable to other industries such as

landfills, water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

QUESTOR TECHNOLOGY INC.

STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

December 31 December 31

As at Notes 2013 2012

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 7,323,303 $ 4,405,624

Trade and other receivables 2,863,257 2,304,478

Inventories 2,359,276 670,959

Prepaid expenses and deposits 124,163 88,378

Current tax assets 77,849 25,158

----------------------------------------------------------------------------

Total current assets $ 12,747,848 7,494,597

----------------------------------------------------------------------------

Non-current assets

Property and equipment 1,256,066 2,295,529

Intangible assets 25,915 8,323

----------------------------------------------------------------------------

Total non-current assets 1,281,981 2,303,852

----------------------------------------------------------------------------

Total assets $ 14,029,829 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities

and provisions $ 1,746,259 $ 894,206

Deferred revenue and deposits 252,356 2,205

Current portion of lease inducement 52,002 26,770

Current tax liabilities 638,527 171,907

----------------------------------------------------------------------------

Total current liabilities $ 2,689,143 $ 1,095,088

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 53,793 97,319

Lease inducement 121,337 125,976

----------------------------------------------------------------------------

Total non-current liabilities 175,130 223,295

----------------------------------------------------------------------------

Total liabilities 2,864,274 1,318,383

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,636,119 5,521,001

Reserves 703,156 676,834

Retained earnings 4,826,280 2,282,231

----------------------------------------------------------------------------

Total equity 11,165,555 8,480,066

----------------------------------------------------------------------------

Total liabilities and equity $ 14,029,829 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Approved by the Board of Directors:

(signed ) "James Inkster" (signed) "Audrey Mascarenhas"

James Inkster, Director Audrey Mascarenhas, Director

QUESTOR TECHNOLOGY INC.

STATEMENTS OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

For the years ended December 31 2013 2012

----------------------------------------------------------------------------

Revenue $ 9,574,950 $ 6,684,475

Cost of sales (4,849,374) (3,606,295)

----------------------------------------------------------------------------

Gross profit 4,725,576 3,078,180

Administration expenses (1,645,923) (1,621,055)

Gain/(loss) on disposal of property and

equipment 14,457 (27,865)

Depreciation of property and equipment (41,261) (41,316)

Amortization of intangible assets (1,218) (1,218)

Net foreign exchange gains 91,363 10,603

Other income 9,689 23,997

----------------------------------------------------------------------------

Profit before tax 3,152,683 1,421,326

Income tax expense (608,634) (380,970)

----------------------------------------------------------------------------

Profit and total comprehensive income $ 2,544,049 $ 1,040,356

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 0.101 $ 0.042

Diluted $ 0.098 $ 0.041

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Issued Retained

capital Reserves earnings Total equity

----------------------------------------------------------------------------

Balance at January 1,

2012 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

Profit and total

comprehensive income - - 1,040,356 1,040,356

Recognition of share-

based payments - 79,520 - 79,520

Issue of ordinary shares

under employee share

option plan 62,786 (24,912) - 37,874

----------------------------------------------------------------------------

Balance at January 1,

2013 $ 5,521,001 $ 676,834 $ 2,282,231 $ 8,480,066

Profit and total

comprehensive income 2,544,049 2,544,049

Recognition of share-

based payments 76,814 76,814

Issue of ordinary shares

under employee share

option plan 115,118 (46,492) 68,626

----------------------------------------------------------------------------

Balance at December 31,

2013 $ 5,636,119 $ 703,156 $ 4,826,280 $ 11,165,555

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

For the years ended December 31 2013 2012

----------------------------------------------------------------------------

Cash flows from (used in) operating activities

Profit and total comprehensive income for

the year $ 2,544,049 $ 1,040,356

Adjustments for:

Income tax expense 608,634 380,970

Loss/(gain) on disposal of property and

equipment (14,457) 27,865

Depreciation of property and equipment 300,473 300,819

Amortization of intangible assets 1,218 1,218

Net unrealized foreign exchange gains 31,162 (5,775)

Expense recognized in respect of equity-

settled share-based payments 72,814 79,520

Write-downs of inventories to net

realizable value - 1,470

----------------------------------------------------------------------------

Funds flow from operations 3,543,893 1,826,443

Movements in non-cash working capital (391,512) 1,609,381

----------------------------------------------------------------------------

Cash generated from operations 3,152,381 3,435,824

Income taxes paid (100,111) (461,059)

----------------------------------------------------------------------------

Net cash generated from operating activities 3,052,270 2,974,765

----------------------------------------------------------------------------

Cash flows (used in) from investing activities

Payments for property and equipment (206,491) (770,781)

Proceeds from disposal of property and

equipment 28,550 -

Additions to intangibles (18,810) -

Interest paid - -

----------------------------------------------------------------------------

Net cash used in investing activities (196,751) (770,781)

----------------------------------------------------------------------------

Cash flows from financing activities

Proceeds from issue of ordinary shares under

employee share option plan 68,625 37,874

----------------------------------------------------------------------------

Net cash from financing activities 68,625 37,874

----------------------------------------------------------------------------

Net increase in cash 2,924,144 2,241,858

Cash at beginning of the year 4,405,624 2,166,301

Effects of exchange rate changes on the

balance of cash held in foreign currencies (6,465) (2,535)

----------------------------------------------------------------------------

Cash at end of the year 7,323,303 $ 4,405,624

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Questor Technology Inc.

Audrey Mascarenhas

President and Chief Executive Officer

(403) 571-1530

(403) 571-1539 (FAX)

amascarenhas@questortech.com

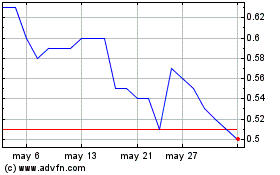

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Questor Technology (TSXV:QST)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025