Further to its news release dated March 27, 2024,

Quisitive

Technology Solutions Inc. (“Quisitive” or the

“Company”) (TSXV: QUIS, OTCQX: QUISF), a premier Microsoft

Cloud and AI solutions provider, announces that it has completed

the sale of its BankCard USA Merchant Services, Inc.

(“

BankCard”) business unit to BUSA Acquisition Co.

(the “Acquiror”), a Nevada incorporated entity owned by a

consortium of current employees of BankCard, including Shawn

Skelton, Scott Hardy and Jason Hardy, as well as other arm’s length

third parties (the “Transaction”).

With the sale of BankCard now complete,

Quisitive has successfully exited its payments division,

transforming into a unified entity centered around cloud services.

As a premier global partner of Microsoft, the Company is poised to

deliver transformative cloud solutions and maintain exceptional

customer service standards. The strategic disposition of the

BankCard and PayiQ operations underscores a deliberate transition

to a dedicated focus on Cloud and AI Solutions. Concentrating on

this area enables Quisitive to channel its resources and energy

toward a sector ripe with growth prospects, including a beneficial

Microsoft partnership, emerging AI technologies, and cloud service

advancements. Additionally, the financial benefits of these

transactions, such as the elimination of earnouts and the inflow of

cash, have positioned Quisitive to decrease its financial

leverage.

Pursuant to the terms of the Transaction, the

consideration received by Quisitive for the sale of BankCard

included: (i) US$40,000,000 in cash, subject to customary

adjustments; (ii) the return of 133,095,158 common shares of

Quisitive (the “Quisitive Shares”) to a wholly-owned subsidiary of

Quisitive, which were held by the Acquiror, and will be cancelled

shortly following the completion of the Transaction; and (iii)

delivery by the former vendors of BankCard of a settlement

agreement releasing Quisitive (and certain of its subsidiaries) of

any and all obligations to pay a US$10,000,000 earnout payment

(plus accrued interest of US$539,178.08). Total fees payable by the

Company in connection with the Transaction were approximately US$2

million, which includes payments to the Company’s advisors listed

under the heading “Advisors” below and the sole finder’s fees

payable by the Company to William Blair & Company, L.L.C. in

accordance with the policies of the TSX Venture Exchange (“TSXV”).

The Company also confirms that the summary of the key terms of the

Transaction previously disclosed in the news release dated March

27, 2024, remain unchanged.

“As we close this chapter, the strategic

divestiture of our payments segment marks a pivotal moment for

Quisitive”, said Mike Reinhart, CEO of Quisitive. “This is not

merely a sale, it's a calculated move towards concentrating our

prowess where we truly excel – as a spearhead in cloud solutions,

in synergy with our powerful Microsoft partnership. This transition

embodies our commitment to innovation and customer excellence, as

we leverage emerging AI capabilities and cloud technology to

deliver unparalleled service. It's a transformative step for

Quisitive, as we streamline our focus and harness financial

strength for sustained growth and value creation.”

Advisors

William Blair & Company, L.L.C. acted as

financial advisor and Bass, Berry & Sims PLC and Cassels Brock

& Blackwell LLP acted as legal counsel to the Company in

connection with the Transaction. Stikeman Elliott LLP and Shearman

& Sterling LLP acted as legal counsel to the Acquiror.

McDermott Will & Emery LLP acted as legal counsel to the

Lenders.

Corporate Updates

The Company today announces that it has issued

an aggregate of 1,162,823 deferred share units (“DSUs”) to

independent directors that vest after one year, an aggregate of

4,790,770 restricted share units (“RSUs”) to officers of the

Company which will fully vest three years from the date of

issuance, and an aggregate of 267,265 RSUs to officers of the

Company which will fully vest one year from the date of issuance.

Once vested, each RSU represents the right to receive one Quisitive

Share or the equivalent cash value thereof, at the Company's

direction, while each DSU entitles the holder to receive one

Quisitive Share, or in certain circumstances a cash payment equal

to the value of the Quisitive Shares, at the time the holder ceases

to be a director of the Company.

About Quisitive:Quisitive

(TSXV: QUIS, OTCQX: QUISF) is a premier, global Microsoft partner

leveraging the power of the Microsoft cloud platform and artificial

intelligence, alongside custom and proprietary technologies, to

drive transformative outcomes for its customers. Our Cloud

Solutions business focuses on helping enterprises across industries

leverage the Microsoft platform to adopt, innovate, and thrive in

the era of AI. For more information, visit www.Quisitive.com and

follow @BeQuisitive.

Quisitive Investor ContactMatt Glover and John

YiGateway Investor RelationsQUIS@gatewayir.com 949-574-3860

Tami AndersChief of Stafftami.anders@quisitive.com

972.573.0995

Cautionary Note Regarding Forward Looking

Information

This news release contains certain

“forward‐looking information” and “forward‐looking statements”

(collectively, “forward‐ looking statements”) within the meaning of

applicable Canadian securities legislation regarding Quisitive and

its business. Any statement that involves discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward‐looking

statements. Forward‐ looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward‐looking statements. These forward-looking statements

include, but are not limited to, statements relating to: the

anticipated benefits of the Transaction to Quisitive and its

shareholders; the future growth potential of the Company on a

post-Transaction basis; the financial outlook of the Company on a

post-Transaction basis; the possible impact of any potential

transactions referenced herein on the Company's shareholders and

any potential future arrangements and engagements in regards to any

such potential transactions; possibility of improved future market

conditions; and future financial performance.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: the expected

results from the completion of the Transaction; fluctuations in

general macroeconomic conditions; fluctuations in securities

markets; the Company’s limited operating history; future capital

needs and uncertainty of additional financing; the competitive

nature of the technology industry; unproven markets for the

Company’s product offerings; lack of regulation and customer

protection; the need for the Company to manage its future strategic

plans; the effects of product development and need for continued

technology change; protection of proprietary rights; network

security risks; the ability of the Company to maintain properly

working systems; foreign currency trading risks; use and storage of

personal information and compliance with privacy laws; use of the

Company’s services for improper or illegal purposes; global

economic and financial market conditions; uninsurable risks;

changes in project parameters as plans continue to be evaluated;

and those factors described under the heading "Risks Factors" in

the Company's annual information form dated May 23, 2023 available

on SEDAR+ at www.sedarplus.ca. Although the forward-looking

statements contained in this news release are based upon what

management of the Company believes, or believed at the time, to be

reasonable assumptions, the Company cannot assure shareholders that

actual results will be consistent with such forward-looking

statements, as there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking statements and

information. There can be no assurance that forward-looking

information, or the material factors or assumptions used to develop

such forward-looking information, will prove to be accurate. The

Company does not undertake any obligations to release publicly any

revisions for updating any voluntary forward-looking statements,

except as required by applicable securities law.

Neither the TSXV nor its Regulation Services

provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Additional Early Warning Disclosure

In connection with the execution and delivery of

the stock purchase agreement dated March 27, 2024 among Quisitive,

Quisitive Payment Solutions, Inc. and Shawn Skelton, Jason Hardy,

Scott Hardy, Felix Danciu, Elmcore Group Inc., Vijay Jog, William

Hui-Chung Chang and Gary Prioste (collectively, the “BUSA

Stockholders”), and in order to effect the Transaction in

accordance with the terms thereof, the BUSA Stockholders entered

into certain related agreements in support of the Transaction,

including a contribution and transfer agreement and a stockholders’

agreement pertaining to, among other things, the capitalization of

the Acquiror, BUSA Holdings Corp. (“BUSA Holdings”) and certain

post-closing governance arrangements following the completion of

the Transaction. In connection with closing of the Transaction, as

a part of the consideration payable by the Acquiror for the

acquisition of all of the issued and outstanding common stock of

BankCard, 133,095,158 Quisitive Shares (representing approximately

33% of the issued and outstanding common shares of Quisitive on a

non-diluted basis) were returned to the Seller. As a result,

effective upon closing of the Transaction and as of the date of

this news release, the Acquiror ceased to beneficially own, or have

control or direction over, directly or indirectly, any Quisitive

Shares.

The address and head office of the Acquiror is

located at 2625 Townsgate Road, Suite 100, Westlake Village, CA

91361, USA. An amended early warning report has or will be filed by

the Acquiror, on behalf of itself, BUSA Holdings and the BUSA

Stockholders, in accordance with applicable securities laws and

will be available on SEDAR+ at www.sedarplus.ca or may be obtained

directly from the Acquiror upon request. To obtain a copy of the

early warning report, please contract Felix Danciu at

+1.312.488.4008, Fax: +1.312.561.3134, Email:

felix.danciu@elmcore.com.

In connection with the equity awards issued by

the Company today, Mr. Reinhart was granted 3,749,298 RSUs. Prior

to the grant of the RSUs and the closing of the Transaction, Mr.

Reinhart beneficially owned an aggregate of 25,186,507 Quisitive

Shares and 3,988,224 RSUs representing approximately 6.2% of the

total issued and outstanding Quisitive Shares on a non-diluted

basis and approximately 7.1% of the total issued and outstanding

Quisitive Shares on partially diluted basis. Following the grant of

the RSUs and the completion of the Transaction (including the

cancellation of 133,095,158 Quisitive Shares), Mr. Reinhart has

ownership and control over 25,186,507 Quisitive Shares and

7,737,522 RSUs, representing approximately 9.2% of the issued and

outstanding Quisitive Shares on a non-diluted basis and

approximately 11.7% of the issued and outstanding Quisitive Shares

on a partially diluted basis. The RSUs were granted to Mr. Reinhart

in accordance with the Company’s long-term incentive compensation

program. Mr. Reinhart’s holdings in securities of Quisitive may be

increased or decreased in the future in accordance with applicable

securities legislation as considered appropriate by him in light of

various factors that he may deem relevant, including, but not

limited to, his investment criteria, market conditions and other

factors.

For the purposes of this notice, the address for

Mr. Reinhart is 1431 Greenway Drive, Suite 1000, Irving, TX 75038

USA. An early warning report has or will be filed by Mr. Reinhart

in accordance with applicable securities laws and will be available

on SEDAR+ or may be obtained directly from Mr. Reinhart upon

request. To obtain a copy of the early warning report, please

contract Mike Reinhart at 972.536.1025 or by e-mail at

mike.reinhart@quisitive.com.

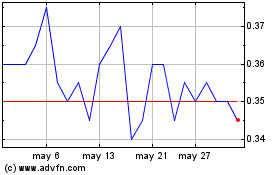

Quisitive Technology Sol... (TSXV:QUIS)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Quisitive Technology Sol... (TSXV:QUIS)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025