Robex Resources Inc. (TSXV: RBX) (“

Robex” or the

“

Company”) is pleased to announce a Mineral

Resource Estimate update prepared by Micon International Co Limited

(“

Micon”) for the Mansounia Central and Mansounia

South deposits (collectively, the “

Mansounia

Deposit”) in accordance with National Instrument 43-101 –

Standards of Disclosure for Mineral Projects (“

NI

43-101”), (the “

Mansounia 2024 MRE

Update”).

Highlights of the Mansounia 2024 MRE

Update include:

-

The total contained gold for the Mansounia Indicated Mineral

Resources is reported as 303koz following the conversion of 35% of

Inferred Mineral Resources to Indicated Mineral Resources compared

to the previously announced Mansounia 2023 MRE update1; and

-

The Mansounia 2024 MRE update increases the total in-situ contained

gold of the Kiniero Gold Project Indicated Mineral Resources by 23%

compared to the previous 2023 Kiniero Gold Project Feasibility

Study MRE.

Aurelien Bonneviot, Chief Executive Officer

commented: “I am very encouraged by the results of the Mansounia

infill drilling program. They have confirmed the geological

potential of the 5km mineralisation trend from Sabali North to

Mansounia South and our ability to convert Inferred Mineral

Resources to Indicated Mineral Resources.”

Mansounia Deposit Indicated Mineral

Resources reinforce prospectivity of the Kiniero

Project

Following completion of the first phase of

infill drilling at the Mansounia Deposit, Robex reports a

significant conversion of Inferred Mineral Resources to Indicated

Mineral Resources, resulting in an increase of the in-situ Kiniero

Gold Project Indicated Mineral Resources. The results are shown in

the tables below. The high conversion rate supports the geological

interpretation and mineralisation model for the Mansounia

Deposit.

The Mansounia 2024 MRE Update prepared by Micon

includes the Mansounia Central and Mansounia South deposits, and

has been prepared based on a 126 Reverse Circulation

(“RC”) infill drilling program on a 30m-by-30m

grid totaling 11,029 meters. A single block kriging drill hole

spacing study was used to inform the infill drill grid spacing and

Mineral Resource classification.

Table 1: Mineral Resources of the

Mansounia Deposit, effective May

16th, 2024

|

Pit |

Mineral

ResourceClassification |

Tonnage(Mt) |

Grade(g/t Au) |

Contained Gold(koz) |

|

Mansounia |

Indicated |

9.4 |

1.00 |

303 |

|

Inferred |

19.4 |

0.94 |

589 |

Notes:

- The Mineral Resource Estimate has

been prepared in accordance with NI 43-101 and has an effective

date of May 16th, 2024.

- To demonstrate Reasonable Prospects

for Eventual Economic Extraction (RPEEE), open pit Mineral

Resources were constrained by an optimised pit shell. All blocks

above the cut-off and within the pit shell were included in the

Mineral Resources. Micon created the optimised pit shell.

- Cut-off grades for Mineral Resource

reporting were calculated using a gold price of US$ 1,950 oz and

are: laterite 0.5 g/t Au; saprolite (oxide) 0.3 g/t Au; saprock

(transition) 0.7 g/t Au; and fresh 0.9 g/t Au.

- Mineral Resources are not Mineral

Reserves and have not demonstrated economic viability. There is no

certainty that all or any part of the estimated Mineral Resources

will be converted into Mineral Reserves.

- Average density values used are:

laterite 2.12 t/m3; saprolite (oxide) 1.66 t/m3; saprock

(transition) 2.46 t/m3; and fresh 2.66 t/m3.

- Grade interpolation by ordinary

kriging using a rotated block model (azimuth 40°) with a block size

of 12 m (X) by 12 m (Y) by 5 m (Z). Outlier management used grade

capping for extreme outliers and a restricted search neighbourhood

for outliers on a domain-by-domain basis.

- Mineral Resources in volumes with a

drill grid spacing of 30 m by 30 m were classified as Indicated

Mineral Resources based on the results of a single block kriging

drill hole spacing study updated as part of the Mansounia 2024 MRE

Update. All other volumes were classified as Inferred Mineral

Resources. To limit extrapolation, a wireframe was used to

constrain the interpolated blocks to approximately 10 m below the

base of the drilling and 40 m lateral to the drilling.

- Totals presented in this table

reported from the Mineral Resource models, are subject to rounding,

and may not total exactly.

- The Mansounia license is currently

in the process of conversion from exploration to exploitation.

Table 2: Comparison of the Mansounia 2023

MRE and 2024 MRE Updates

|

Pit |

Mineral Resource Classification |

2023 MRE1

Update |

2024 MRE Update |

|

Tonnage (Mt) |

Grade (g/t Au) |

Contained Gold (koz) |

Tonnage (Mt) |

Grade(g/t Au) |

Contained Gold (koz) |

|

Mansounia |

Indicated |

- |

- |

- |

9.4 |

1.00 |

303 |

|

Inferred |

28 |

0.96 |

879 |

19.4 |

0.94 |

589 |

Notes:

- Micon completed the 2023 MRE update

for Mansounia in December 2023. Reported Inferred Mineral Resources

differ from December 22nd press release due to updated cut-off

grade values being used.

Figure 1. Plan view map of

Mansounia shows the completed drilling and modelled grade shell

wireframes.

Figure 2. Plan view map of

Mansounia showing the completed drilling with assay results for the

2024 infill RC drilling, and the block model coloured by Mineral

Resource classification constrained to Mineral Resources within the

US$ 1,950 RPEEE pit shell and above cut-off (laterite 0.5 g/t Au;

saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t

Au).

Figure 3. Plan view map of

Mansounia showing the block model constrained to Mineral Resources

within the US$ 1,950 RPEEE pit shell and above cut-off (laterite

0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9

g/t Au).

Figure 4. Cross-sections A-B

show the (top) modelled grade shell wireframes that remain open at

depth; (middle) interpolated block Au grades, to limit

extrapolation a volume was used to constrain the interpolated

blocks to approximately 10 m below the base of the drilling and 40

m lateral to drilling; (bottom) interpolated block Au grades

constrained to Mineral Resources within the US$ 1,950 pit shell and

above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au;

saprock 0.7 g/t Au; and fresh 0.9 g/t Au). Drill collars coloured

black are from the 2024 RC infill drill program.

Figure 5. Cross-sections A-B

show the (top) resource classification within the US$ 1,950 pit

shell; and (bottom) the Mineral Resource classification constrained

to Mineral Resources within the US$ 1,950 pit shell and above

cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t

Au; and fresh 0.9 g/t Au). Drill collars coloured black are from

the 2024 RC infill drill program.

Scientific and Technical

Information

The information in this announcement which

relates to the updated Mineral Resource Estimate is based upon

information prepared by or under the supervision of Dr. Ryan

Langdon, PhD, MCSM, MEarthSci, CGeol, FGS, who is a Qualified

Person as defined by NI 43-101 and a professional registered with

the Geological Society of London, and does not or did not have at

the relevant time an affiliation with the Company or its

subsidiaries, except that of independent consultant/client

relationship. Dr. Ryan Langdon is a Senior Mineral Resource

Geologist with Micon International Co Limited and has over 12

continuous years of exploration and mining experience in various

mineral deposit styles. Dr. Ryan Langdon has reviewed and approved

the technical information in this news release. Dr. Langdon has

also approved information relating to exploration, drilling and

sampling.

In this news release, the terms "mineral

resource", "inferred mineral resource", "indicated mineral

resource", "mineral reserve", "preliminary economic assessment",

"pre-feasibility study" and "feasibility study" have the meanings

ascribed to those terms in the Definition Standards on Mineral

Resources and Mineral Reserves adopted by the Canadian Institute of

Mining Metallurgy and Petroleum (“CIM Definition

Standards”) and incorporated into NI 43-101.

About Robex Resources Inc.

Robex is a multi-jurisdictional West African

gold production and development company with near-term exploration

potential.

The Company is dedicated to safe, diverse and

responsible operations in the countries in which it operates with a

goal to foster sustainable growth.

Robex has been operating the Nampala Mine in

Mali since 2017 and is advancing the long-life low-AISC Kiniero

Project in Guinea, which demonstrates a c. 10-year mine life with

c. 1Moz of Mineral Reserves.

Robex is supported by two strategic shareholders

and has the ambition to become a mid-tier gold producer in West

Africa.

For more information

ROBEX RESOURCES INC

Aurélien Bonneviot, Chief Executive OfficerStanislas Prunier,

Investor Relations & Corporate Development

+1 581 741-7421

Email: investor@robexgold.comwww.robexgold.com

FORWARD-LOOKING INFORMATION AND FORWARD-LOOKING

STATEMENTS

Certain information set forth in this news

release contains “forward‐looking statements” and “forward‐looking

information” within the meaning of applicable Canadian securities

legislation (referred to herein as

“forward‐looking

statements”). Forward-looking statements are included to

provide information about Management’s current expectations and

plans that allows investors and others to have a better

understanding of the Company’s business plans and financial

performance and condition.

Statements made in this news release that

describe the Company’s or Management’s estimates, expectations,

forecasts, objectives, predictions, projections of the future or

strategies may be “forward-looking statements”, and can be

identified by the use of the conditional or forward-looking

terminology such as “aim”, “anticipate”, “assume”, “believe”,

“can”, “contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “guidance”, “guide”, “indication”, “intend”,

“intention”, “likely”, “may”, “might”, “objective”, “opportunity”,

“outlook”, “plan”, “potential”, “should”, “strategy”, “target”,

“will” or “would” or the negative thereof or other variations

thereon. Forward-looking statements also include any other

statements that do not refer to historical facts. Such statements

may include, but are not limited to, statements regarding: the

perceived merit and further potential of the Company’s properties;

the Company’s estimate of mineral resources and mineral reserves;

capital expenditures and requirements; the Company’s access to

financing; preliminary economic assessment and other development

study results; exploration results at the Company’s properties;

budgets; strategic plans; market price of precious metals; the

Company’s ability to successfully advance the Kiniero Gold Project

on the basis of the results of the feasibility study with respect

thereto, as the same may be updated from time to time, the whole in

accordance with the revised timeline previously disclosed by the

Company; the potential development and exploitation of the Kiniero

Gold Project and the Company’s existing mineral properties and

business plan, including the completion of feasibility studies or

the making of production decisions in respect thereof; work

programs; permitting or other timelines; government regulations and

relations; optimization of the Company’s mine plan; the future

financial or operating performance of the Company and the Kiniero

Gold Project; exploration potential and opportunities at the

Company’s existing properties; costs and timing of future

exploration and development of new deposits; the Company’s ability

to enter into definitive documentation in respect of the USD115

million project finance facility for the Kiniero Gold Project

(including a USD15 million cost overrun facility, the

“Facilities”), including the Company’s ability to

restructure the Taurus USD35 million bridge loan and adjust

the mandate to accommodate for the revised timeline of the enlarged

project; timing of entering into definitive documentation for the

Facilities; and if final documentation is entered into in respect

of the Facilities, the drawdown of the proceeds of the Facilities,

including the timing thereof.

Forward-looking statements and forward-looking

information are made based upon certain assumptions and other

important factors that, if untrue, could cause the actual results,

performance or achievements of the Company to be materially

different from future results, performance or achievements

expressed or implied by such statements or information. There can

be no assurance that such statements or information will prove to

be accurate. Such statements and information are based on numerous

assumptions, including: the ability to execute the Company’s plans

relating to the Kiniero Gold Project as set out in the feasibility

study with respect thereto, as the same may be updated from time to

time, the whole in accordance with the revised timeline previously

disclosed by the Company; the Company’s ability to complete its

planned exploration and development programs; the absence of

adverse conditions at the Kiniero Gold Project; the absence of

unforeseen operational delays; the absence of material delays in

obtaining necessary permits; the price of gold remaining at levels

that render the Kiniero Gold Project profitable; the Company’s

ability to continue raising necessary capital to finance its

operations; the Company’s ability to restructure the Taurus

USD35 million bridge loan and adjust the mandate to

accommodate for the revised timeline of the enlarged project; the

Company’s ability to enter into definitive documentation for the

Facilities on acceptable terms or at all, and to satisfy the

conditions precedent to closing and advances thereunder (including

satisfaction of remaining customary due diligence and other

conditions and approvals); the ability to realize on the mineral

resource and mineral reserve estimates; and assumptions regarding

present and future business strategies, local and global

geopolitical and economic conditions and the environment in which

the Company operates and will operate in the future.

Certain important factors could cause the

Company’s actual results, performance or achievements to differ

materially from those in the forward-looking statements including,

but not limited to: geopolitical risks and security challenges

associated with its operations in West Africa, including the

Company’s inability to assert its rights and the possibility of

civil unrest and civil disobedience; fluctuations in the price of

gold; limitations as to the Company’s estimates of mineral reserves

and mineral resources; the speculative nature of mineral

exploration and development; the replacement of the Company’s

depleted mineral reserves; the Company’s limited number of

projects; the risk that the Kiniero Gold Project will never reach

the production stage (including due to a lack of financing); the

Company’s capital requirements and access to funding; changes in

legislation, regulations and accounting standards to which the

Company is subject, including environmental, health and safety

standards, and the impact of such legislation, regulations and

standards on the Company’s activities; equity interests and royalty

payments payable to third parties; price volatility and

availability of commodities; instability in the global financial

system; the effects of high inflation, such as higher commodity

prices; fluctuations in currency exchange rates; the risk of any

pending or future litigation against the Company; limitations on

transactions between the Company and its foreign subsidiaries;

volatility in the market price of the Company’s shares; tax risks,

including changes in taxation laws or assessments on the Company;

the Company obtaining and maintaining titles to property as well as

the permits and licenses required for the Company’s ongoing

operations; changes in project parameters and/or economic

assessments as plans continue to be refined; the risk that actual

costs may exceed estimated costs; geological, mining and

exploration technical problems; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes and

other risks of the mining industry; delays in obtaining

governmental approvals or financing; the effects of public health

crises, such as the COVID-19 pandemic, on the Company’s activities;

the Company’s relations with its employees and other stakeholders,

including local governments and communities in the countries in

which it operates; the risk of any violations of applicable

anticorruption laws, export control regulations, economic sanction

programs and related laws by the Company or its agents; the risk

that the Company encounters conflicts with small-scale miners;

competition with other mining companies; the Company’s dependence

on third-party contractors; the Company’s reliance on key

executives and highly skilled personnel; the Company’s access to

adequate infrastructure; the risks associated with the Company’s

potential liabilities regarding its tailings storage facilities;

supply chain disruptions; hazards and risks normally associated

with mineral exploration and gold mining development and production

operations; problems related to weather and climate; the risk of

information technology system failures and cybersecurity threats;

and the risk that the Company may not be able to insure against all

the potential risks associated with its operations.

Although the Company believes its expectations

are based upon reasonable assumptions and has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. These factors are not intended to represent a complete

and exhaustive list of the factors that could affect the Company;

however, they should be considered carefully. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information.

The Company undertakes no obligation to update

forward-looking information if circumstances or Management’s

estimates, assumptions or opinions should change, except as

required by applicable law. The reader is cautioned not to place

undue reliance on forward-looking information. The forward-looking

information contained herein is presented for the purpose of

assisting investors in understanding the Company’s expected

financial and operational performance and results as at and for the

periods ended on the dates presented in the Company’s plans and

objectives, and may not be appropriate for other purposes.

See also the "Risk Factors" section of the

Company's Annual Information Form for the year ended December 31,

2023, available under the Company’s profile on SEDAR+ at

www.sedarplus.ca or on the Company's website at www.robexgold.com,

for additional information on risk factors that could cause results

to differ materially from forward-looking statements. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

____________________1 Refer to press release dated December

22nd, 2023.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9af5ba2-8faf-47f4-9a03-aef13998b29b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8222743-83c7-4d48-a1d5-c427411fbce9

https://www.globenewswire.com/NewsRoom/AttachmentNg/f2841f92-5837-4119-9fb9-672daae669b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/deed518d-b77c-42fc-be5c-8aafabe2d884

https://www.globenewswire.com/NewsRoom/AttachmentNg/3496410d-aa79-4a46-8a77-24b5396c3772

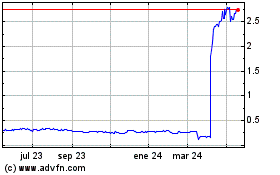

Robex Resources (TSXV:RBX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

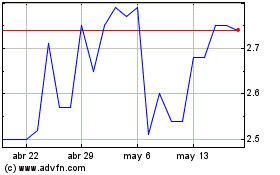

Robex Resources (TSXV:RBX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025