Rusoro Mining Raises US$80 Million Via Exchangeable Loan

10 Junio 2008 - 1:00AM

Marketwired Canada

Rusoro Mining Ltd. ("Rusoro") (TSX VENTURE:RML) is pleased to announce that

Peter Hambro Mining Plc ("PHM") has agreed to make a strategic US$20 million

investment in Rusoro and its affiliates (collectively the "Rusoro Group") as

part of a larger US$80 million senior secured exchangeable loan (the "Loan"),

exchangeable into shares of Rusoro at C$1.25 per Rusoro share. The remainder of

the Loan will be funded by a syndicate including funds which are investment

managed by BlackRock Investment Management International Limited, GLG Partners

Limited and Lansdowne Partners Limited as well as Endeavour Mining Capital Corp.

(collectively, the "Lenders"). Rusoro will act as a guarantor of the Loan.

Proceeds from the Loan will be used for regional consolidation opportunities

approved by the Lenders and for general corporate purposes. PHM has also entered

into an option agreement with the other Lenders which gives PHM the right to

acquire from them at a price of C$2.20 per share, the Rusoro shares which such

other Lenders may receive upon exchange of their Loan (the "Option Agreement").

PHM, the second largest Russian gold mining company, along with a syndicate of

institutional investors described above, has agreed to provide the Rusoro Group

with the US$80 million Loan. The principal terms of the Loan include: 10% annual

coupon payable semi-annually, 2 year term, exchangeable at any time at C$1.25

per Rusoro common share, pro-rata participation in future equity fundings for

the term of the Loan (subject to prepayment or exchange), and secured by share

pledges over Rusoro's principal assets including Choco 10. The Lenders have also

entered into the Option Agreement (described above) with PHM. The Loan will be

drawn down today and be made available in two tranches. US$28 million will be

available immediately for general corporate purposes, with the remaining US$52

million made available once pre-agreed strategic milestones are met.

Exchange of PHM's US$20 million loan into shares would give PHM an interest of

approximately 4.0% of the partially diluted shares in Rusoro, being the common

shares currently in issue plus the aggregate of the shares to be issued on

exercise of the exchange right by PHM in respect of its Loan participation, but

excluding any shares that PHM could receive pursuant to the Option Agreement.

Full exercise of the Option Agreement would give PHM an interest of

approximately 14.2% of the partially diluted shares in Rusoro (being calculated

on the same basis as above, but allowing for full exercise of the Option

Agreement and full exchange of the Loan).

PHM has two principal operating mines in the Amur region in the Russian Far

East. In 2007, PHM's total attributable gold production was c.297,000 ounces and

PHM continues to be one of the industry's lowest cost producers with a cash

operating cost at Pokrovskiy, one of its principal operating mines, of US$143

per ounce (as at Dec. 31 2007). PHM has offices in London, Moscow and

Blagoveschensk and PHM's shares are traded on the AIM market of the London Stock

Exchange under the symbol POG.

Commenting on the transaction, Rusoro CEO Andre Agapov states: "We are delighted

to welcome PHM's strategic investment as we implement our strategy to become a

major gold producer in Venezuela."

Commenting further, Peter Hambro, Executive Chairman of PHM, said: "We have

always said that any investment outside Russia would need to have a

Russo-centric rationale and the Rusoro investment is just such an opportunity.

With it we have a strategic investment in a growing gold producer that is backed

by proven reserves and resources and a successful management team."

Advisors

Rusoro's financial advisor is Endeavour Financial International Corporation and

its legal advisors are Anfield Sujir Kennedy & Durno in Canada and Gersten

Savage LP in the United States.

Qualified Person: Mr. Gregory Smith, P.Geo, the Vice-President Exploration of

the Company, is the Qualified Person as defined by National Instrument 43-101,

and is responsible for the accuracy of the technical information in this news

release.

ON BEHALF OF THE BOARD

Vladimir Agapov, Chairman

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

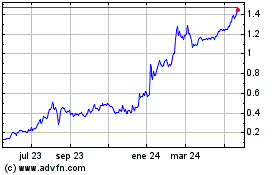

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

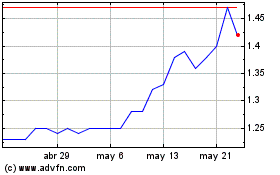

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024