Rusoro Mining Ltd.: 43-101 Report Filed for Isidora and Twin Shear Projects Acquired From Hecla Mining

07 Agosto 2008 - 7:01AM

Marketwired Canada

Rusoro Mining Ltd. (TSX VENTURE:RML) is pleased to report that a 43-101 report

prepared by independent consultants Micon International Ltd. for the Isidora and

Twin Shear gold projects has been filed. Both projects were part of the assets

acquired in the acquisition of Hecla Mining Company's Venezuelan assets. The

total resources outlined in the report for Isidora confirmed the resources

originally estimated by Rusoro with the Twin Shear estimation out performing all

previous estimates by adding 482,000 Inferred gold ounces to the Company's total

resources.

Highlights of the report include;

- Proven and Probable Mineral Reserves at Isidora (March 2008) are 168,000 oz Au

(161,900 t @ 32.3 g/t Au). Mineral resources for Isidora are 331,000 oz Au

(470,000 t @ 21.9 g/t Au) of Measured and Indicated and 45,000 oz Au (99,000 t @

14.1 g/t Au) of Inferred.

- Mineral resource for the Twin Shear Zone is 482,000 oz Au (1.2 Mt averaging

12.5 g/t Au) of Inferred.

- The company now has a total of 6.87 M oz Au (84.5 Mt @ 2.52 g/t Au) Measured

and Indicated and 6.81 M oz Au (109.6 Mt @ 1.93 g/t Au) Inferred.

Rusoro President, George Salamis, states that, "The Company is very pleased that

the overall resource reported in the technical report is more favorable than

originally thought. This combined with both deposits being open from an

exploration perspective makes both projects very exciting moving forward."

The Mineral Reserves were estimated using a cut-off grade based on actual

operating costs from 2007 and were adjusted for production up to March 31, 2008.

Total direct operating costs used are $308.98/t of diluted ore with an assumed

gold price of $570/oz and a mill recovery of 94.4%.

The Isidora Mine Resources were estimated by mine staff and confirmed by Micon

as the independent QP. The estimates were completed using an 8 g/t Au cut-off, a

cap of 200 g/t Au with densities of 2.68 for vein material and 2.88 for waste

rock. The Twin Shear Resource was estimated by Scott Wilson RPA using a cut-off

of 8 g/t Au and a grade cap of 50 g/t Au with a density of 2.7 used for all

material.

Mineral resource estimates which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources may be

materially affected by environmental, permitting, legal, title, taxation,

socio-political, marketing, or other relevant issues. The quantity and grade of

reported inferred resources in these estimates are uncertain in nature and there

has been insufficient exploration to define these inferred resources as an

indicated or measured mineral resource and it is uncertain if further

exploration will result in upgrading them to an indicated or measured category.

Diamond drilling was conducted by independent contractors for Hecla Mining

principally using HQ-diameter drill holes. Mineralized sections were split using

a core saw and the second half of core remains for inspection and/or additional

tests. All sample analyses were conducted by independent contractors using

industry standard fire assays. A stringent QA/QC program was utilized including

the insertion of standards and check assays for all ore grade samples.

All aspects of the reserve and resource estimates as well as the QA/QC are

described in detail in the analysis in the technical report by Micon

International with contributions from Scott Wilson RPA for information relevant

to the Twin Shear deposit and resource estimate.

Qualified Person: Mr. Gregory Smith, P.Geo, the Vice-President Exploration of

the Company, is the Qualified Person as defined by National Instrument 43-101,

and is responsible for the accuracy of this news release.

About Rusoro Mining: Rusoro Mining is a junior gold producer with a large land

position in the prolific Bolivar State region of Venezuela. The Company operates

the Choco 10 and Isidora Mines, processing the ore through the Choco Mill

facility near the town of El Callao. The Company has significant 43-101

compliant gold resources and will produce approximately 150,000 oz/Au in 2008.

Rusoro is scheduled to drill up to 300,000 meters in 2008 to expand and upgrade

its gold ounces for projected production expansion at both the Choco 10 Mill in

El Callao and the Emilia Mill in El Dorado where the SREP Mine should be

operating by year end.

ON BEHALF OF THE BOARD

George Salamis, President

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

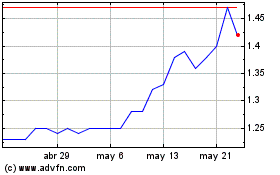

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

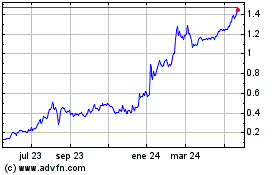

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024