Rusoro Mining Ltd. (TSX VENTURE: RML) is pleased to report that

gold production and cash costs remained strong at the Choco 10 Mill

for the month of January 2009. The Company is encouraged with the

much improved performance at the Choco 10 mill over the past five

months and looks forward to this operational trend continuing and

to meeting its targets for 2009. Production highlights for January

2009 and operational targets for 2009 include:

- Group-wide, Rusoro produced 14,835 oz Au in January (a

record), compared to the 14,261 oz Au produced in December 2008 and

38,868 oz Au produced for Q4 2008. January 2009's production was up

by 75% over the same month (January) 2008.

- Group-wide cash costs, on a combined basis, in January 2009

were US$315/oz (unaudited), down from December's all-time low of

US$347/oz, or US$358/oz for Q4 2008 (unaudited). Management

believes there is further scope to reduce costs at all

operations.

- 2009 Gold Production Guidance - 170,000 to 190,000 oz, at

sustained cash cost below US$400/oz.

- This positive momentum from increased production and decreased

costs is expected to carry-on through 2009.

- Mine Development: Increible 6 development on track to begin

production in H2, 2009. SREP (San Rafael/El Placer) on schedule to

begin commercial gold production in Q1, 2010.

Link to Charts for Production and Cash Costs Comparisons and

2009 Production Guidance:

http://media3.marketwire.com/docs/rml223charts.pdf.

Unaudited Consolidated 2008 Full Year Performance

As stated in the press release of January 14, 2009, Q4 2008

operating results were very strong at Rusoro's Venezuelan gold

mining operations. The production challenges experienced by the

Company while commissioning the upgraded operations during the

first 3 quarters of 2008 were largely addressed heading into Q4.

Concurrent with the turnaround at the operations the Company has

taken advantage of strengthening gold prices to launch an

aggressive expansion program to leverage further the productivity

gains realized to date. The Company expects to complete a scoping

study in Q2 2009 and a bankable feasibility for the Choco 10 mine

and mill in 2010, to confirm the viability of an expansion to over

400,000 oz Au/yr. With timely confirmation of the appropriate

studies, the Company will target expansion completion for 2012.

Sustainability of Increased Production Levels and Low Cash

Operating

At Choco 10 operations, Rusoro was able to demonstrate a strong

increase in production in Q4 2008 (38,868 oz Au) over the preceding

three quarters of 2008 and an impressive 40% increase over the same

period of the previous year (Q4 2007). During this period, the cash

costs have dramatically improved, culminating in a record low cost

for Q4 2008 (US$358/oz). This trend has continued into 2009 with a

monthly record amount of gold produced (14,835 oz Au) at a record

low cash cost (US$315/oz) at the mill in January 2009.

The strong increase in production and the vast improvement in

operating cash costs are the culmination of a number of initiatives

which include improvements made to the haulage fleet

availabilities, mill availabilities, modifications made to the

primary mine haulage contract and optimization of the mine plan.

Key to these initiatives was the expanded ore development at both

the Choco 10 and Isidora mines ensuring that the mill with have

sufficient ore to process at capacity and in turn that the gold in

circuit is maximized to further increase production - thus

eliminating issues that plagued the operations through the first

half of 2008. The Company now has about two years of ore developed

at each mine and will continue with an aggressive ore development

program moving forward.

For these reasons, Rusoro's management believes that the current

production profile is sustainable and that there are further

improvements that can still be made to optimize operations.

2009 Outlook: Consolidated Guidance

Based on the previously discussed increase in processing

capacity and the on-going overall productivity improvements

throughout our operations, the Company has provided updated

guidance for 2009.

- Gold production of 170,000 oz to 190,000 oz (53% improvement

over 2008 and 170% over 2007).

- Cash costs per gold ounce of US$310 to US$375 on a

consolidated basis.

SREP/Increible 6 Development Projects

At SREP, the surface work, boxcut and portal through the

difficult saprolite into bedrock was completed during Q4 2008. The

Alvarez ramp, which is being constructed to access the main SREP

ore bodies at about 200 m depth, has been further advanced, for a

total access length of approximately 460 m. The company expects to

complete the 1.5 km ramp in Q3 2009 and begin first stage

production shortly thereafter with commercial production scheduled

to begin in Q1 2010. All mining permits are in place to affect

mining at SREP and the mine will produce at an annualized rate of

120 k oz Au/yr. An updated NI 43-101 resource estimate was

completed in Q4 2008 and currently stands at 399 k oz Au indicated

(639 kt @ 19.4 g/t) and 524 k oz Au inferred (703 kt @ 23.2

g/t).

At the Increible 6, the engineering has been completed for

roads, waste dumps, and pit designs with new road construction

connecting the Increible 6 to the Choco 10 mill underway. Reserve

and condemnation drilling was completed in Q4 2008 and the Company

expects to initiate gold production from surface oxides during the

second half of 2009 upon final permitting. Ore will be trucked 8km

to the Choco 10 mill for processing. The current NI 43-101 resource

estimation for the Increible 6 stands at 1.59 Moz Au indicated

(23.5 Mt @ 2.11 g/t) and 1.1 Moz Au inferred (17.5 Mt @ 1.95

g/t).

Rusoro's President, George Salamis noted, "We are committed to

ensuring the continuation of the positive operational trend of the

past five months as we work to reach our targets for 2009. We will

continue with a number of initiatives that have been on-going and

the Company believes that further improvements are attainable as we

continue to streamline cash costs at the mines."

Rusoro CEO, Andre Agapov stated, "We are delighted that the

operational results from Choco 10 continue to impress. With our

current operations continuing to strengthen and our plan to bring

two brand new mining operations, Increible 6 and the SREP,

on-stream over the next year we continue to execute our production

growth strategy to the benefit of our shareholders."

Qualified Person: Mr. Gregory Smith, P.Geo, the Vice-President

Exploration of the Company, is the Qualified Person as defined by

National Instrument 43-101, and is responsible for the accuracy of

the scientific and technical aspects of this news release.

About Rusoro Mining

Rusoro is a junior gold producer with a large land position in

the prolific Bolivar State region of Venezuela. The Company

operates the Choco 10 and Isidora Mines, processing the ore through

the Choco 10 mill facility near the town of El Callao. The Company

produced over 100,000 oz Au in 2008 and is on schedule to have two

additional mines (Increible 6 and SREP) in production by Q4 2009

and Q1 2010, respectively.

ON BEHALF OF THE BOARD

George Salamis, President

Forward-looking statements: This document contains statements

about expected or anticipated future events and financial results

that are forward-looking in nature and as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, the regulatory process and actions,

technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential

delays or changes in plans, the occurrence of unexpected events,

and the Company's capability to execute and implement its future

plans. Actual results may differ materially from those projected by

management. For such statements, we claim the safe harbour for

forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

The TSX Venture Exchange has not reviewed and does not take

responsibility for the adequacy or accuracy of this release.

Contacts: Rusoro Mining Ltd. George Salamis President (604)

632-4044 or Toll Free: 1-800-668-0091 (604) 632-4045 (FAX) Email:

info@rusoro.com Website: www.rusoro.com

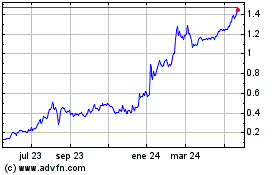

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

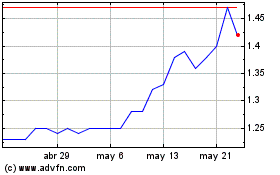

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024