TSX VENTURE COMPANIES

ANSELL CAPITAL CORP. ("ACP")

(formerly Ansell Capital Corp. ("ACP.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Private

Placement-Non-Brokered, Reinstated for Trading

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing Ansell Capital Corp's (the

'Company') Qualifying Transaction (the 'QT') and related transactions,

all as principally described in its filing statement dated November 20,

2008 (the 'Filing Statement'). As a result, effective at the opening on

Wednesday, March 25, 2009, the Company will no longer be considered a

Capital Pool Company and will be reinstated for trading. The QT includes

the following matters, all of which have been accepted by the Exchange:

1. Acquisition of 70% Interest in the Guijoso Property (the "Property")

located in Mexico:

TSX Venture Exchange has accepted for filing an Earn In Agreement dated

August 5, 2008 as amended October 16, 2008 and February 27, 2009 (the

'Agreement') among the Company, and Fury Explorations Ltd. ('Fury'),

pursuant to which the Company has agreed to earn and acquire 70% of

Fury's interest in and to the Guijoso Property. Fury holds an option to

acquire a 100% interest in the Guijoso Property pursuant to an underlying

option agreement between Fury and several individuals. The Company can

earn a 70% interest in the Property by paying to Fury the sum of

US$275,000; issuing a total of 1,800,000 common shares of the Company at

a deemed price of $0.15 per share; and spending US$2,000,000 in

exploration expenditures on the Guijoso Property all on the following

schedule:

(a) Non-refundable deposit of US$25,000 on May 7, 2008 (which amount has

been paid);

(b) Issue 400,000 Common Shares on Final Exchange Approval;

(c) Incur exploration expenditures on the Guijoso Property in the amount

of US$200,000 on or before November 2, 2009 in a program which is to

include diamond drilling;

(d) Pay to Fury the sum of US$25,000 and 400,000 common shares by April

12, 2009;

(e) Incur exploration expenditures on the Guijoso Property in an amount

of not less than US$575,000 on or before March 2, 2010;

(f) Pay to Fury the sum of US$75,000 and 500,000 common shares by March

2, 2010;

(g) Incur exploration expenditures on the Guijoso Property in the amount

of US$1,225,000 on or before March 2, 2011; and

(h) Pay to Fury the sum of US$150,000 and 500,000 Common Shares by March

2, 2011.

The Property is an exploration stage mineral resource property with

silver being the principally targeted natural resource.

A finder's fee of 386,000 common shares will be paid in stages to Scott

Parsons in connection with the acquisition of the Property.

Insider / Pro Group Participation: None. At the time the transaction was

agreed to, the Company was at arm's length to Fury.

The Exchange has been advised that the above transactions, which did not

require shareholder approval of the Company, have been completed. For

additional information, refer to the Filing Statement, which has been

accepted for filing by the Exchange.

2. Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced June 19, 2008 and November

25, 2008:

Number of Shares: 2,548,332 shares

Purchase Price: $0.12 per share

Warrants: 1,274,166 share purchase warrants to purchase

1,274,166 shares

Warrant Exercise Price: $0.20 for a one year period

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Rahoul Sharan Y 516,666

Finders' Fees: Bolder Investment Partners, Ltd. will receive

an 8% finder's fee of 97,200 common shares.

JMW Capital Corp. (Judith McCall and Jevin

Werbes) will receive an 8% finder's fee of

24,000 common shares.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

3. Reinstated for Trading:

Effective at the opening Wednesday, March 25, 2009, trading will be

reinstated in the common shares of Ansell Capital Corp. on TSX Venture

Exchange. The Company is classified as a 'Mineral Exploration' company.

Capitalization: Unlimited common shares with no par value of

which 9,863,000 common shares are issued and

outstanding

Escrow: 2,567,000 common shares are subject to 36

month staged release escrow

Symbol: ACP same symbol as CPC but with .P removed

Company Contact: Toma Sojonky

Company Address: 3rd Floor, Bellevue Centre

235-15th Street

West Vancouver, BC V7T 2X1

Company Phone Number: (604) 921-1810

Company Fax Number: (604) 921-1898

TSX-X

---------------------------------------------------------------------------

ARMADILLO RESOURCES LTD. ("ARO")

(formerly Armadillo Resources Ltd. ("ARO.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Private

Placement-Non-Brokered, Resume Trading

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing Armadillo Resources Ltd.'s

(the 'Company' or 'Armadillo')) Qualifying Transaction (the 'QT') and

related transactions, all as principally described in its filing

statement dated March 12, 2009 and as amended March 20, 2009 (the 'Filing

Statement'). As a result, effective at the opening on Wednesday, March

25, 2009, the Company will no longer be considered a Capital Pool Company

and will resume trading. The QT includes the following matters, all of

which have been accepted by the Exchange:

1. Acquisition of 60% interest in the Waverly Tangier Property (the

"Property"):

The First Option (60%):

TSX Venture Exchange has accepted for filing an Option and Royalty

Agreement dated January 8, 2009, as amended February 25, 2009 (the

'Agreement') between the Company and Silver Phoenix Resources Inc.

("Silver Phoenix") under which Armadillo has been granted an option (the

"First Option") to earn a 60% interest in a block of contiguous mineral

claims having a total area of approximately 4,446 hectares located

approximately 50 kilometers north of Revelstoke, British Columbia known

as the Waverly-Tangier Property.

To exercise the First Option the Company must:

1. make aggregate cash payments of $350,000;

2. issue an aggregate of 625,000 shares;

3. incur an aggregate of $3,000,000 in exploration expenditures on the

Property; and,

4. pay 100% of all of the costs required to have a feasibility study done

with respect to the Property and have the Feasibility Report prepared and

delivered to the Joint Venture not later than December 31, 2015.

The Second Option (10%) and Net Smelter Royalty ('NSR'):

Under the Agreement Armadillo also has the option to acquire a further

10% interest in the Property if it exercises the First Option and gives a

notice to that effect within 30 days after completion of the exercise of

the First Option. For further information please read the Filing

Statement.

The Property is an exploration stage mineral resource property with

silver being the principally targeted natural resource.

Any interests that the Company earns through the exercise of the Options

will be subject to Silver Phoenix's right to receive a 3.0% net smelter

return royalty.

There is no finder's fee payable in connection with the acquisition of

the Property.

Insider / Pro Group Participation: None. The Company is at arm's length

to Silver Phoenix.

The Exchange has been advised that the above transactions, which did not

require shareholder approval of the Company, have been completed. For

additional information, refer to the Filing Statement, which has been

accepted for filing by the Exchange.

2. Private Placement-Non-Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced March 3, 2009:

Number of Shares: 1,500,000 shares

Purchase Price: $0.20 per share

Warrants: 1,500,000 half "A" share purchase warrants to

purchase 750,000 shares at $0.30 per share for

a 6 month period.

1,500,000 half "B" share purchase warrants to

purchase 750,000 common shares at $0.40 per

share for a 12 month period

Number of Placees: 3 placees

Insider/Pro Group

Participation: None

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

3. Resume Trading:

Effective at the opening Wednesday, March 25, 2009, the common shares of

Armadillo Capital Corp. will resume trading on TSX Venture Exchange. The

Company is classified as a 'Mineral Exploration' company.

Capitalization: Unlimited common shares with no par value of

which 8,707,500 common shares are issued and

outstanding

Escrow: 1,650,000 common shares are subject to 36

month staged release escrow

Symbol: ARO same symbol as CPC but with .P removed

Company Contact: Les Kjosness, President

Company Address: Suite 928, 470 Granville Street

Vancouver, BC V6C 1V5

Company Phone Number: (604) 681-8222

Company Fax Number: (604) 681-8282

Company Email Address: les@goldenarchresources.com

TSX-X

---------------------------------------------------------------------------

CONIAGAS RESOURCES LTD. ("CNY")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced February 9, 2009:

Number of Shares: 12,000,000 shares

Purchase Price: $0.15 per share

Warrants: 12,000,000 share purchase warrants to purchase

12,000,000 shares

Warrant Exercise Price: $0.25 for a two year period

Number of Placees: 37 placees

Finder's Fee: An aggregate of 840,000 units payable to PI

Financial Corp. and Axemen Resource Capital.

Each unit consists of one common share and one

common share purchase warrant.

For further details, please refer to the Company's news release dated

March 20, 2009.

TSX-X

---------------------------------------------------------------------------

FJORDLAND EXPLORATION INC. ("FEX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced February 18, 2009:

Number of Shares: 2,054,000 shares

Purchase Price: $0.07 per share

Number of Placees: 17 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Scott Hunter P 329,000

Peter Krag-Hansen Y 100,000

Les Entreprises de

Richard Atkinson Ltee.

(Richard C. Atkinson) Y 429,000

G. Ross McDonald Y 100,000

Finder's Fee: 34,320 shares payable to Haywood Securities

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

GENIUS WORLD INVESTMENTS LIMITED ("GNW.P")

BULLETIN TYPE: Halt

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

Effective at the open, March 24, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

GLEN EAGLE RESOURCES INC. ("GER")

BULLETIN TYPE: Halt

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

Effective at 6:57 a.m. PST, March 24, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

GLEN EAGLE RESOURCES INC. ("GER")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

Effective at 9:15 a.m. PST, March 24, 2009, shares of the Company resumed

trading, an announcement having been made over Canada News Wire.

TSX-X

---------------------------------------------------------------------------

NORTHERN ABITIBI MINING CORP. ("NAI")

BULLETIN TYPE: Property Asset or Share Purchase Agreement

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to an

Arm's length Option Agreement (the "Agreement") dated March 19, 2007.

Pursuant to the terms of the Agreement, Northern Abitibi Mining Corp.

(the "Company") has acquired an option to acquire 51% interest in Altius

Resources Inc.'s Taylor Brook Nickel-Copper-PGE prospect located in

western Newfoundland. Along with previous consideration, the Company is

required to pay the sum of $50,000 in cash or equivalent market value of

fully paid shares. The Company has elected to issue 476,190 shares at a

deemed price of $0.105 per share.

TSX-X

---------------------------------------------------------------------------

PROBE RESOURCES LTD. ("PBR")

BULLETIN TYPE: Private Placement-Non-Brokered, Correction

BULLETIN DATE: March 24, 2009

TSX Venture Tier 2 Company

Further to the bulletin dated March 23, 2009, the bulletin should have

read as follows:

Further to the bulletin dated February 27, 2009, TSX Venture Exchange

corrects the acceptance of a Non-Brokered Private Placement announced

January 23, 2009 as follows:

Finders' Fees: Becher McMahon Capital Markets Inc. receives

$277,271.90 and 224,000 warrants, each

exercisable for one share at a price of $0.25

per share for a 12 month period.

Canaccord Capital Corporation receives 56,000

warrants, each exercisable for one share at a

price of $0.25 per share for a 12 month

period.

TSX-X

---------------------------------------------------------------------------

RUSORO MINING LTD. ("RML")

BULLETIN TYPE: Prospectus-Share Offering

BULLETIN DATE: March 24, 2009

TSX Venture Tier 1 Company

Effective March 11, 2009, the Company's Prospectus dated March 10, 2009

was filed with and accepted by TSX Venture Exchange (the "Exchange"), and

filed with and receipted by the British Columbia, Ontario, Alberta

Securities Commission, pursuant to the provisions of the Securities Act.

TSX Venture Exchange has been advised that closing occurred on March 19,

2009, for gross proceeds of $80,000,400.

Underwriters: Canaccord Capital Corporation

GMP Securities L.P.

Offering: 133,334,000 shares

Share Price: $0.60 per share

TSX-X

---------------------------------------------------------------------------

SAMEX MINING CORP. ("SXG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: March 24, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced February 20, 2009:

Number of Shares: 7,830,500 shares

Purchase Price: $0.10 per share

Warrants: 7,830,500 share purchase warrants to purchase

7,830,500 shares

Warrant Exercise Price: $0.20 for a five year period

Number of Placees: 60 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Jeffrey Dahl Y 700,000

Peter J. Dahl Y 176,000

Nancy Hall-Chapman P 100,000

David Kells P 50,000

Kenneth MacPherson P 50,000

Brenda McLean Y 50,000

Larry McLean Y 50,000

Finders' Fees: $3,000 payable to RedPlug Capital (Otis

Brandon Munday)

$500 payable to Long Wave Analytics Inc.

(Ian Gordon)

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

SIRIOS RESOURCES INC. ("SOI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: March 24, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the documentation relating

to the acquisition of the 1,680,001 outstanding shares of Magmax

Exploration Inc. ("Magmax") in consideration of 2,520,000 shares of the

Company at a deemed price of $0.09 per share, for a total consideration

of $226,800. This share swap is made under share swap agreements dated

February 19, 2009 between the Company and each of Magmax's nine

shareholders.

In 2008, the Company granted Magmax an exclusive option to acquire a 50%

interest in the Escale gold property located in the James Bay territory,

Quebec. Under the share swap, this option will be annulled.

The Company confirmed the closing of the transaction by way of a press

release on March 12, 2009.

RESSOURCES SIRIOS INC. ("SOI")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actifs ou d'actions

DATE DU BULLETIN : Le 24 mars 2009

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en relation avec

l'acquisition des 1 680 001 actions en circulation d'Exploration magmax

inc. ("Magmax") en contrepartie de 2 520 000 actions de la societe au

prix repute de 0,09 $ l'action, pour une contrepartie totale de 226 800

$. Cet echange d'actions est fait en vertu de conventions d'echange

d'actions datees du 19 fevrier 2009 entre la societe et chacun des neuf

actionnaires de Magmax.

En 2008, la societe a accorde a Magmax une option exclusive pour acquerir

une participation de 50 % dans la propriete aurifere Escale, situee dans

le territoire de la Baie James au Quebec. En vertu de l'echange

d'actions, cette option sera annulee.

La societe a confirme la cloture de cette transaction par voie de

communique de presse le 12 mars 2009.

TSX-X

---------------------------------------------------------------------------

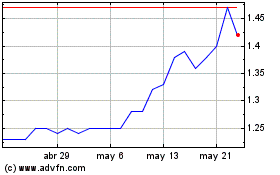

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

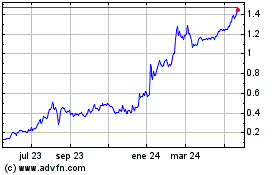

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024