Rusoro Mining Reports its 2008 Financial Results

01 Mayo 2009 - 1:27PM

Marketwired Canada

Rusoro Mining Ltd. (TSX VENTURE:RML) ("Rusoro" or the "Company") is pleased to

report its financial results for the year ended December 31, 2008. The Company's

audited consolidated financial statements and management's discussion and

analysis (MD&A) for the year ended December 31, 2008 have been filed on SEDAR

(www.sedar.com).

All amounts set out in the Company's financial statements and MD&A are audited

and in United States dollars, unless otherwise stated.

The following is a synopsis of the year ended December 31, 2008 and related

information. For detailed information regarding Rusoro's 2008 year-end, please

refer to the Audited Financials Statements and the MD&A which have been filed on

SEDAR at www.sedar.com and can be found on the Company's website at

www.rusoro.com.

During 2008 the Company's highlights were:

- Acquired a 50% interest in the Isidora Mine and various exploration properties

from Hecla Mining Company ("Hecla") (and all together the "Hecla-Venezuela

Acquisition").

- Created a mixed enterprise, 50% owned by the Company and 50% owned by the

Venezuelan government (the "Mixed Enterprise") to jointly operate the Isidora

Mine and other exploration properties acquired from Hecla.

- Marked its first full year as a gold producer, with 99,663 ounces produced

(2007: 9,433 ounces). Based on the Company's evaluation of the accounting

treatment of the Hecla-Venezuela Acquisition and the commitment agreement

entered into with the Ministry of Mines and Basic Industries of Venezuela for

the creation of the Mixed Enterprise, the Company proportionately consolidated

50% of the results of the Isidora Mine from December 23, 2008 to December 31,

2008. Had the Company consolidated 100% of the results of the Isidora Mine from

the date of the Hecla-Venezuela Acquisition on July 4, 2008, the combined

production of the Company for 2008 would have been 115,789 ounces of gold and

for the fourth quarter of 2008 would have been 38,868 ounces of gold.

- Completed an $80 million syndicate financing led by Peter Hambro Mining Plc.

- Settled with the Venezuelan government the dispute over the government's

ownership interest in the Choco Mine, to a final 5% indilutable ownership

interest, held by the government.

- Advanced construction of the Alvarez underground ramp which will provide

access to main mineralized areas in the contiguous San Rafael and El Placer

concessions.

Subsequent to year end, the highlights were:

- On March 19, 2009 the Company completed an equity financing by way of

short-form prospectus. As a result the Company issued 133,334,000 common shares

at C$0.60 per common share for gross proceeds of C$80,000,400. Net proceeds were

approximately C$75 million after deducting a cash commission paid to the

underwriters equal to 6.0% of gross proceeds and other professional fees.

- the Company is expecting to report in its Q1 2009 interim financial statements

a substantial improvement in its results of operations and operating cash flows

compared to 2008 as a result of a reduction of its operating costs reported in

US dollars.

Financial result for 2008:

The Company's revenue for 2008 was $70.3 million from 97,582 ounces of gold sold

at a realized price of $720 per ounce (2007 - $3.5 million from 5,922 ounces

sold at $590 per ounce).

Net loss for the year was $72.2 million (2007 - $32.2 million). Main

contributors to the loss were stock-based compensation of $22.8 million (2007 -

$16.8 million), impairment of mineral properties of $19.3 million (2007 - $0.3

million) which from this amount $13.5 million relates to the Company's Minoro

mineral property in Honduras which the Company does not currently plan to pursue

exploration work on in the near future, general and administrative expenses

other than stock-based compensation of $19.7 million (2007 - $14.4 million) and

loss from mine operations of $11.3 million (2007 - $4.6 million) which mining

amortization of $17.5 million (2007 - $0.2 million) is a main component.

Financial results for Q4 2008 (3 months):

The Company's revenue for Q4 2008 was $20.7 million from the sale of 22,825

ounces of gold at an average realized price of $908 (2007 - $3.5 million from

5,922 ounces sold at $590 per ounce).

Net loss for Q4 2008 was $14.8 million (2007 - $13.0 million). Main contributors

to the loss in Q4 2008 were the impairment of mineral properties of $19 million

as mentioned above and $3.3 million in unsuccessful acquisition and litigation

costs related to the unsolicited take-over bid made for Gold Reserve Inc. which

more than offset an income tax recovery of $4.6 million and foreign exchange

gain of $2.5 million recorded in Q4 2008.

Outlook

During 2009, the Company expects to increase its gold production profile to

170,000 ounces of gold from its 95%-owned Choco mine and its 50%-owned Isidora

Mine. Total combined cash costs per ounce for 2009 are expected to be less than

$400 per ounce as discussed in the MD&A.

ON BEHALF OF THE BOARD

George Salamis, President

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

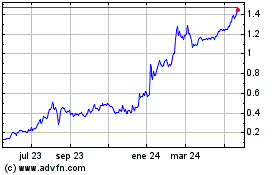

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

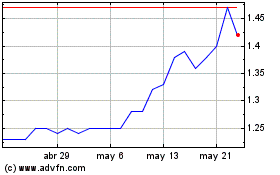

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024