Rusoro Mining Reports Net Income of $0.5 Million for Q1 2009 and Record Production of 39,503 Ounces of Gold

01 Junio 2009 - 4:05PM

Marketwired Canada

Rusoro Mining Ltd. ("Rusoro" or the "Company") (TSX VENTURE:RML) is pleased to

report its financial results for the three-month period ended March 31, 2009

("Q1 2009"). The Company's Q1 2009 consolidated financial statements and

management's discussion and analysis (MD&A) have been filed on SEDAR

(www.sedar.com).

All amounts set out in this news release are unaudited and in United States

Dollars unless otherwise stated.

Q1 2009 Highlights

- 40,632 ounces of gold sold at a realized price of $742 and with a cash cost

per ounce of $378.

- Record production of 39,503 ounces of gold.

- Net income of $0.5 million and net income before income taxes and

non-controlling interest of $2.0 million.

- Positive cash flow from operating activities of $6.8 million.

- Advancement of Alvarez underground ramp is on track towards the goal of

intercepting the main mineralized zone of San Rafael and El Placer contiguous

concessions in Q1 2010.

- Completed an equity financing by way of short-form prospectus for net proceeds

of $60.2 million.

- Ended the quarter with $65.6 million in cash, cash equivalents and short-term

investments and a convertible loan of $79.3 million (including its equity

component) that is due on June 10, 2010.

Key Operating Statistics for Q1 2009 are as follows:

The data below is for 100% of the Choco Mine (open-pit mining operation)

and 50% of the Isidora Mine (underground mining operation).

-----------------------------------------------

3 months ended 3 months ended

March 31, 2009 March 31, 2008

-----------------------------------------------

Choco Isidora Total Choco Isidora Total

---------------------------------------------------------------------------

Ore tonnes mined ('000 t) 645 9 654 476 n/a 476

Ore tonnes milled ('000 t) 573 7 580 617 n/a 617

Average grade (g/t) 1.9 23.2 2.2 1.4 n/a 1.4

Average recovery rate (%) 87% 90% 87% 87% n/a 87%

Gold produced (ounces) 33,729 5,774 39,503 25,040 n/a 25,040

Gold sold (ounces) 34,274 6,358 40,632 16,659 n/a 16,659

Total mining operating

expenses $(000) 13,133 5,236 18,369 7,932 n/a 7,932

Minus:

- stock based

compensation $(000) 10 - 10 18 n/a 18

- asset retirement

obligation accretion

$(000) 125 54 179 - n/a -

- fair value differential

of inventory acquired

$(000)(1) - 2,813 2,813 - n/a -

-----------------------------------------------

Total cash costs

$(000)(2) 12,998 2,369 15,367 7,914 - 7,914

-----------------------------------------------

Total cash costs

per ounce sold(3) $379 $373 $378 $475 - 475

-----------------------------------------------

Average spot gold price n/a n/a 908 n/a n/a 925

Average realized

gold price(4) n/a n/a 742 n/a n/a 702

Discount to spot

gold price n/a n/a 18% n/a n/a 24%

---------------------------------------------------------------------------

1) In calculating cash costs per ounce sold the Company has excluded the

difference between the book value and fair value of inventory acquired

at the date of acquisition of the 50% interest in the Isidora Mine.

2) Total cash costs used in the calculation of cash costs per ounce is

calculated as mining operating expenses from the consolidated statement

of operations excluding stock-based compensation, accretion expense

related to the asset retirement obligation and expense of the fair value

differential between the book value and fair value of inventory acquired

at the date of acquisition of the 50% interest in the Isidora Mine.

3) Cash costs per ounce sold is a non-GAAP measure. Total cash costs per

ounce sold as shown above is calculated by dividing the total cash costs

by the gold ounces sold during the period. Cash costs per ounce sold

includes all expenditures incurred at the mine site such as mining,

processing, administration, royalties and production taxes but excludes

reclamation, capital and exploration expenditures and the fair value

differential between the book value and fair value of inventory acquired

at the date of acquisition of the 50% interest in the Isidora Mine.

4) Average realized gold price is impacted by a discount to spot price of

gold as indicated under the heading "Venezuelan Exchange Controls and

Revenue" in the MD&A and by the timing of gold sales.

Choco Mine

During Q1 2009, the Company's 95%-owned Choco Mine produced 33,729 oz and had a

cash cost per ounce sold of $379. Cash costs were less than forecasted due

mainly to lower processing costs and higher-grade (g/t) ore processed. Gold

production is on track. The Company's guidance for 2009 of 135,000 ounces of

gold production at Choco Mine at $420 cost per ounce remains unchanged.

Isidora Mine

During Q1 2009, the Company's 50% owned Isidora Mine produced 11,548 oz (5,774

net to the Company) and had a cash cost per ounce sold of $373. Cash costs were

higher than expected due mainly to production falling behind guidance for 2009.

The Company continues to forecast 70,000 ounces of gold production at Isidora

Mine for 2009 (35,000 net to the Company) at $290 cost per ounce.

The Company is on schedule with its exploration program at Isidora Mine designed

to expand existing resources to support future gold production with 5,981 meters

of drilling (13 holes) completed during Q1 2009.

Correction of Previously Reported Q4 2008 Production Figures

The Company reported in a news release dated January 14, 2009 that the Company's

production at the Choco Mine Mill for Q4 2008 was 38,868 ounces of gold at a

total cash cost per ounce of $358. This included 11,903 ounces of gold

production representing 100% of the ore produced from the Isidora Mine. However

the Company later determined as part of the closing of the 2008 audited

financial statements that proportionate consolidation of a 50% interest and only

9 days of operations of the Isidora Mine during Q4 2008 was appropriate. The

Company reached this conclusion after making a comprehensive assessment as part

of the audit of the financial statements of the various facts and circumstances

derived from the Hecla-Venezuela Acquisition and Mixed Enterprise Agreement.

Therefore the MD&A for the year 2008 does not report production data and cash

cost per ounce for a 100% interest in the Isidora Mine and for the production

for the entire fourth quarter of 2008 as did the news release. The above

resulted in a corrected production figure of 27,464 ounces of gold for Q4 2008

and a corrected cash cost per ounce figure of $502 for Q4 2008. For further

details in regards to these corrected figures please refer to the MD&A for the

year ended December 31, 2008.

ON BEHALF OF THE BOARD

George Salamis, President

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

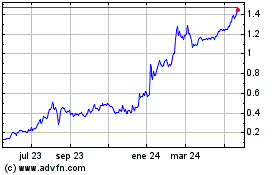

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

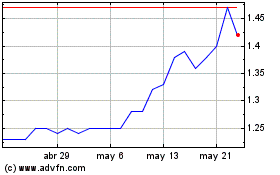

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024