Rusoro Mining Reports Q1 2011 Financial Results

30 Junio 2011 - 7:30AM

Marketwired Canada

Rusoro Mining Ltd. (TSX VENTURE:RML) ("Rusoro" or the "Company") reports its

financial results for the three months ended March 31, 2011 ("Q1 2011"). The

Company's consolidated financial statements and management's discussion and

analysis ("MD&A") for Q1 2011 have been filed on SEDAR (www.sedar.com).

All amounts set out in this news release and the Company's unaudited

consolidated financial statements and MD&A are expressed in United States

dollars, unless otherwise stated.

The following is a synopsis of the Q1 2011 financial results. For detailed

information regarding Rusoro's Q1 2011 results, please refer to the unaudited

consolidated financial statements and related MD&A for Q1 2011, which can also

be found on the Company's website at www.rusoro.com.

The Company's highlights for Q1 2011 were:

-- Average realized gold price per ounce sold of $1,292 (three months ended

March 31, 2010 ("Q1 2010"): $718) and cash cost per ounce sold of $1,294

(Q1 2010: $587). The higher average realized gold price is a result of a

higher international spot price per ounce of gold in Q1 2011 and due to

the change in Venezuelan laws during May, 2010, which effectively

changed, going forward, the rate at which the translations of

transactions and balances from Venezuelan Bolivars Fuertes ("BsF") to US

dollars were performed ("the Change in Translation Rate") (see

"Venezuela Currency Exchange and Gold Sales" section of the MD&A). The

higher cash cost per ounce sold is mainly due to the lower production

ore grade, the Change in Translation Rate and an increase in labour

costs resulting from the Venezuelan inflation rate.

-- Gold production of 17,742 ounces of finished gold (dore form) (Q1 2010:

27,986 ounces) (2011 revised guidance: 98,000 ounces) and gold sold of

22,052 ounces (Q1 2010: 22,760 ounces).

-- During Q1 2011, the Company exported 11,817 ounces of finished gold at

the international spot price per ounce, less associated costs and

commissions.

The Company's highlights subsequent to Q1 2011 were:

-- During the period subsequent to Q1 2011 and up to the date of this news

release, the Company exported 7,824 ounces of finished gold at the

international spot price per ounce, less associated costs and

commissions.

-- On June 10, 2011, the Company did not perform the repayment of the

convertible loan for $30 million (see news release "Rusoro Mining

Reports on its Loan Repayment Status", dated June 14, 2011, as filed on

SEDAR). The Company is currently holding discussions with the lenders

for the granting of an extension to the loan repayment period for a

sufficient amount of time to allow the Company to complete financing

options that it is currently evaluating to fund the retirement of the

loan and general corporate purposes.

Results for Q1 2011

-- Revenue increased to $28.5 million (22,052 ounces sold) in Q1 2011 from

$16.3 million (22,760 ounces sold) in Q1 2010 due to the increase in the

average international spot price of gold to $1,384 in Q1 2011 from

$1,109 in Q1 2010, and due to the Change in Translation Rate.

-- Mining operating expenses and depreciation and depletion increased to

$30.1 million and $3.2 million, respectively, in Q1 2011 from $13.5

million and $2.9 million in Q1 2010. This cost increase is primarily due

to the Change in Translation Rate. Operational factors impacting the

amount of tonnes mined, tonnes milled and average ore grade realized

also negatively impacted production costs in Q1 2011 at the Choco Mine

and Isidora Mine.

-- General and administrative expenses decreased to $1.8 million in Q1 2011

from $2.8 million in Q1 2010 significantly due to increased efficiencies

and the non-renewal of consulting agreements with two senior officers of

the Company.

-- Interest on the Company's convertible loan decreased to $1.5 million in

Q1 2011 from $2.6 million in Q1 2010 due to the partial retirement of

the convertible loan during 2010.

-- Gain on revaluation of derivative financial liabilities increased to

$2.2 million in Q1 2011 from $0.2 million in Q1 2010 due to the issuance

and subsequent revaluation of Canadian dollar warrants, which were

issued in June 2010 as part of the convertible loan refinancing

transaction.

-- Foreign exchange loss was $3.7 million in Q1 2011 compared to a foreign

exchange gain of $3.6 million in Q1 2010. The foreign exchange gain

experienced in Q1 2010 was due to the Company having a negative net

monetary position (assets less liabilities) and the change in

translation rate from BsF 5.97/$1.00 (December 31, 2009) to BsF

7.00/$1.00 (March 31, 2010), which created gains on the translation of

the net monetary position as the Company's liabilities denominated in

BsF became less costly to settle.

-- Deferred tax recovery increased to $7.9 million in Q1 2011 from $3.1

million in Q1 2010 due to declining results at the Choco Mine and the

Isidora Mine.

-- Net loss amounted to $1.4 million during Q1 2011 compared to net profit

of $1.2 million during Q1 2010.

Operating Performance

The following table summarizes key operating statistics for 100% of the Choco

Mine and 50% of the Isidora Mine:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

3 Months Ended March 3 Months Ended March

31, 2011 31, 2010

------------------------------------------------

Choco Isidora Total Choco Isidora Total

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Ore tonnes mined ('000 t) 83 9 92 396 6 402

Ore tonnes milled ('000 t) 363 6 369 371 4 375

Average grade (g/t) 1.28 16.40 1.53 2.18 23.51 2.41

Average recovery rate (%) 93 90 93 93 90 93

Gold produced (ounces) 13,956 3,786 17,742 25,142 2,844 27,986

Gold sold (ounces) 17,410 4,642 22,052 20,821 1,939 22,760

Total mining operating

expenses $(000) 24,612 5,531 30,143 12,171 1,352 13,523

- decommissioning and

restoration provision

accretion $(000) (227) (176) (403) (92) (80) (172)

- impairment of

inventories $(000) (1,201) - (1,201) - - -

----------------------------------------------------------------------------

Total cash costs $(000)(1) 23,184 5,355 28,539 12,079 1,272 13,351

----------------------------------------------------------------------------

Total cash costs per ounce

sold $(2) 1,332 1,154 1,294 580 656 587

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average spot gold price per

ounce $ n/a n/a 1,384 n/a n/a 1,109

Average realized gold price

per ounce sold $ 1,285 1,319 1,292 716 735 718

----------------------------------------------------------------------------

The following notes are applicable to the above tables:

1. Total cash costs used in the calculation of cash costs per ounce is

calculated as mining operating expenses from the consolidated statement

of comprehensive income (loss) excluding accretion expense related to

the decommissioning and restoration provision and expense for impairment

of inventories.

2. Cash costs per ounce sold is a non-IFRS measure. Total cash costs per

ounce sold is calculated by dividing the total cash costs by the gold

ounces sold during the period. Cash costs per ounce sold includes all

expenditures related to the mine such as mining, processing,

administration, royalties and production taxes but excludes reclamation,

capital and exploration expenditures, and impairments of inventories.

Outlook

During 2011, the Company expects to produce 98,000 ounces of finished gold from

the Choco Mine and its 50% interest in the Isidora Mine. Total cash costs per

ounce sold for 2011 are expected to be $1,050 per ounce. For the cost per ounce

estimate, the Company assumes that the Venezuelan government will not devalue

the currency in reaction to the highly inflationary economy. As a result, a

BsF/US dollar average exchange rate during the year for translation of BsF

4.30/$1.00 is forecasted. Any increase in the rate will likely generate a

reduction in the Company's expected costs and capital expenditures.

Cautionary non-IFRS measures

Total cash costs per ounce sold is a non-IFRS measure. The Company believes

that, in addition to conventional measures, prepared in accordance with IFRS,

certain investors use the cash costs per ounce data to evaluate the Company's

performance and ability to generate cash flow. Accordingly, it is intended to

provide additional information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with IFRS as it

does not have any standardized meaning prescribed by IFRS. Data used in the

calculation of total cash costs per ounce may not conform to other similarly

titled measures provided by other precious metals companies.

ON BEHALF OF THE BOARD

Andre Agapov, President & CEO

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

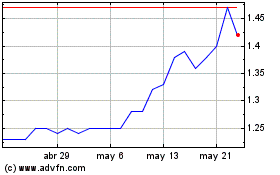

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

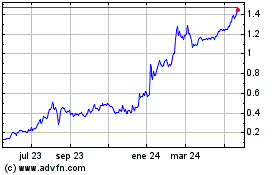

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024