Red Pine Exploration Inc. (TSXV: RPX, OTCQB: RDEXF) (“

Red

Pine” or the “

Company”) is pleased to

announce that it has closed its previously announced “best efforts”

private placement (the “

Offering”) for gross

proceeds of approximately $7.745 million, including full exercise

of the Agents’ Option (as defined in the press release of the

Company dated March 31, 2023). The Offering consisted of: (i)

5,675,000 units of the Company (the “

Units”) at a

price of $0.20 per Unit (the “

Issue Price”); (ii)

11,538,230 tranche 1 flow-through units of the Company (the

“

Tranche 1 FT Units”) at a price

of $0.235 per Tranche 1 FT Unit; and (iii) 13,679,000 tranche 2

flow-through units of the Company (the “

Tranche 2

FT Units” and together with the Units and

the Tranche 1 FT Units, the “

Offered Securities”)

at a price of $0.285 per Tranche 2 FT Unit.

The Offering was co-led by Haywood Securities

Inc. (“Haywood”) and 3L Capital Inc.

(“3L”) on behalf of a syndicate of agents

including Laurentian Bank Securities Inc. (together with Haywood

and 3L, the “Agents”). Haywood acted as sole

bookrunner in connection with the Offering.

Each Offered Security consists of one common

share in the capital of the Company (a “Common

Share”) and one-half of one common share purchase warrant

of the Company (each whole purchase warrant, a

“Warrant”). Each Warrant entitles the holder to

acquire one Common Share (a “Warrant Share”) at a

price per Warrant Share of $0.25 until May 8, 2024.

Each Common Share and Warrant underlying the

Tranche 1 FT Units and the Tranche 2 FT Units qualify as a

“flow-through share” within the meaning of subsection 66(15) of the

Income Tax Act (Canada) (the “Tax Act”). The gross

proceeds from the sale of Tranche 1 FT Units and Tranche 2 FT Units

will be used by the Company to incur eligible “Canadian exploration

expenses” that will qualify as “flow-through mining expenditures”

as such terms are defined in the Tax Act (the “Qualifying

Expenditures”) related to the Company's projects in

Canada. All Qualifying Expenditures will be renounced in favour of

the subscribers of the Tranche 1 FT Units and the Tranche 2 FT

Units effective December 31, 2023. The net proceeds from the sale

of Units will be used by the Company for ongoing exploration at the

Wawa Gold Project, working capital and general corporate

purposes.

In consideration for their services, the Company

(i) paid the Agents a cash commission equal to 6% of the gross

proceeds, and (ii) issued to the Agents 1,853,533 compensation

options (the “Compensation Options”). Each

Compensation Option is exercisable to acquire one Common Share at

the Issue Price until May 8, 2025.

All securities issued in connection with the

Offering are subject to a hold period in Canada expiring September

9, 2023. The Offering remains subject to final acceptance of the

TSX Venture Exchange.

An insider of the Company purchased 75,000 Units

under the Offering. Such transaction constitutes a “related party

transaction” within the meaning of TSX Venture Exchange Policy 5.9

and Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). The Company has relied on the exemptions from

the valuation and minority shareholder approval requirements of MI

61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in

respect of such insider participation. The Company did not file a

material change report more than 21 days before the closing of the

Offering because the details of the insider participation were not

finalized until closer to the closing and the Company wished to

close the Offering as soon as practicable for sound business

reasons.

The Offered Securities have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

About Red Pine Exploration

Inc.

Red Pine Exploration Inc. is a gold exploration

company headquartered in Toronto, Ontario, Canada. The Company’s

shares trade on the TSX Venture Exchange under the symbol “RPX” and

on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten

Greenstone Belt of Ontario, a region that has seen major investment

by several producers in the last five years. Its land package hosts

numerous historic gold mines and is over 6,900 hectares in size.

Led by Quentin Yarie, CEO, who has over 25 years of experience in

mineral exploration, Red Pine is strengthening its position as a

major mineral exploration and development player in the

Michipicoten region.

For more information about the Company, visit

www.redpineexp.com

Or contact:

Quentin Yarie, President and CEO, (416)

364-7024, qyarie@redpineexp.com

Or

Carrie Howes, Director Corporate Communications,

(416) 644-7375, chowes@redpineexp.com

Cautionary Note Regarding

Forward-Looking Information

This news release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of the Company

with respect to future business activities and operating

performance.

Forward-looking information is often identified

by the words “may”, “would”, “could”, “should”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “estimate”, “expect” or similar

expressions. Forward-looking information contained in this news

release includes but may not be limited to: the expected use of

proceeds of the Offering and receipt of TSX Venture Exchange final

approval of the Offering. Investors are cautioned that

forward-looking information is not based on historical facts but

instead reflect management’s expectations, estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the statements are made. Such opinions, assumptions and

estimates are inherently subject to a variety of risks and

uncertainties that could cause actual events or results to differ

materially from those projected and undue reliance should not be

placed on such information, as unknown or unpredictable factors

could have material adverse effects on future results, performance

or achievements. Among the key factors that could cause actual

results to differ materially from those projected in the

forward-looking information are the following: the Company’s

expectations in connection with the projects and exploration

programs being met, the impact of general business and economic

conditions, global liquidity and credit availability on the timing

of cash flows and the values of assets and liabilities based on

projected future conditions, fluctuating gold prices, currency

exchange rates (such as the Canadian dollar versus the United

States Dollar), variations in ore grade or recovery rates, changes

in accounting policies, changes in the Company’s mineral reserves

and resources, changes in project parameters as plans continue to

be refined, changes in project development, construction,

production and commissioning time frames, the possibility of

project cost overruns or unanticipated costs and expenses, higher

prices for fuel, power, labour and other consumables contributing

to higher costs and general risks of the mining industry, failure

of plant, equipment or processes to operate as anticipated,

unexpected changes in mine life, seasonality and weather, costs and

timing of the development of new deposits, success of exploration

activities, permitting time lines, government regulation of mining

operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, and limitations on

insurance.

This information is qualified in its entirety by

cautionary statements and risk factor disclosure contained in

filings made by the Company, including the Company’s annual

information form, financial statements and related MD&A for the

year ended July 31, 2022, and the interim financial reports and

related MD&A for the period ended January 31, 2023, filed with

the securities’ regulatory authorities in certain provinces of

Canada and available at www.sedar.com.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and does not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

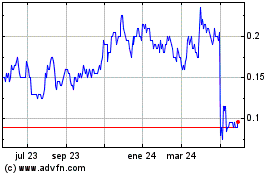

Red Pine Exploration (TSXV:RPX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

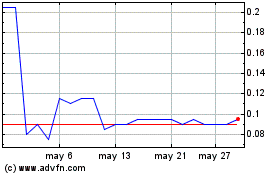

Red Pine Exploration (TSXV:RPX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025