Red Pine Exploration Inc. (TSXV: RPX, OTCQB: RDEXF) ("

Red

Pine" or the "

Company") is pleased to

announce that it has entered into a net smelter return royalty

agreement (the “

Royalty Agreement”) with

Franco-Nevada Corporation (“

Franco-Nevada”) for

the purchase and sale of a 1.5% net smelter return royalty (the

“

Royalty”) on its Wawa Gold Project

(“

Wawa”) located in Ontario for immediate cash

proceeds to the Company of C$6,750,000.

Proceeds from the sale of the Royalty will be

used for continued exploration and advancement of Wawa, and ongoing

working capital.

Quentin Yarie, President & CEO of Red Pine

commented, “We are thrilled to welcome Franco-Nevada as a new

partner into the Red Pine and Wawa story. Red Pine has been

fortunate to have strong support from existing partners, and the

addition of Franco-Nevada, a true leader in the gold space, brings

further validation to the Wawa Gold Project. On the back of this

non-dilutive financing, and with over C$10M in cash on hand, we are

well positioned to deliver on our exploration goals, including

ongoing infill and expansion drilling, an updated mineral resource

estimate defining the open pit exploration target, and a potential

preliminary economic assessment.”

Paul Brink, President & CEO of Franco-Nevada

commented, “We are excited to be supporting Red Pine in its

advancement of the Wawa Gold Project. We believe that the

Michipicoten Greenstone Belt has great geological potential and are

pleased to be partnering with Red Pine with the objective of

advancing a new mine to production in Ontario.”

Pursuant to the Royalty Agreement, Franco-Nevada

has been granted a one time option, exercisable within 30 business

days of Red Pine providing notice to Franco-Nevada confirming both

(i) a board-approved construction decision at Wawa, and (ii)

completion of a feasibility study at Wawa, to purchase an

additional 0.5% net smelter return royalty (the “Additional

Royalty”) at a cost of 1.0x the net present value of the

Additional Royalty, which is to be calculated based on the value of

the mineral reserves within the Wawa feasibility study, after

applying a 5% discount rate, and utilizing the then-prevailing

analyst consensus commodity price forecasts.

Advisor and Counsel

Haywood Securities Inc. acted as exclusive

financial advisor to Red Pine with respect to the sale of the

Royalty. Wildeboer Dellelce LLP acted as legal counsel to Red

Pine.

About Red Pine Exploration

Inc.

Red Pine Exploration Inc. is a gold exploration

company headquartered in Toronto, Ontario, Canada. The Company’s

shares trade on the TSX Venture Exchange under the symbol “RPX” and

on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten

Greenstone Belt of Ontario, a region that has seen major investment

by several producers in the last five years. Its land package hosts

numerous historic gold mines and is over 6,900 hectares in size.

Led by Quentin Yarie, CEO, who has over 25 years of experience in

mineral exploration, Red Pine is strengthening its position as a

major mineral exploration and development player in the

Michipicoten region.

For more information about the Company, visit

www.redpineexp.com

Or contact:

Quentin Yarie, President and CEO, (416)

364-7024, qyarie@redpineexp.com

Or

Carrie Howes, Director Corporate Communications,

(416) 644-7375, chowes@redpineexp.com

Cautionary Note Regarding

Forward-Looking Information

This news release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of the Company

with respect to future business activities and operating

performance.

Forward-looking information is often identified

by the words “may”, “would”, “could”, “should”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “estimate”, “expect” or similar

expressions. Forward-looking information contained in this news

release includes but may not be limited to:” the potential for a

hybrid pit and underground project”. Investors are cautioned that

forward-looking information is not based on historical facts but

instead reflect management’s expectations, estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the statements are made. Such opinions, assumptions and

estimates are inherently subject to a variety of risks and

uncertainties that could cause actual events or results to differ

materially from those projected and undue reliance should not be

placed on such information, as unknown or unpredictable factors

could have material adverse effects on future results, performance

or achievements. Among the key factors that could cause actual

results to differ materially from those projected in the

forward-looking information are the following: the Company's

expectations in connection with the projects and exploration

programs being met, the impact of general business and economic

conditions, global liquidity and credit availability on the timing

of cash flows and the values of assets and liabilities based on

projected future conditions, fluctuating gold prices, currency

exchange rates (such as the Canadian dollar versus the United

States Dollar), variations in ore grade or recovery rates, changes

in accounting policies, changes in the Company's mineral reserves

and resources, changes in project parameters as plans continue to

be refined, changes in project development, construction,

production and commissioning time frames, the possibility of

project cost overruns or unanticipated costs and expenses, higher

prices for fuel, power, labour and other consumables contributing

to higher costs and general risks of the mining industry, failure

of plant, equipment or processes to operate as anticipated,

unexpected changes in mine life, seasonality and weather, costs and

timing of the development of new deposits, success of exploration

activities, permitting time lines, government regulation of mining

operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, and limitations on

insurance.

This information is qualified in its entirety by

cautionary statements and risk factor disclosure contained in

filings made by the Company, including the Company’s annual

information form, financial statements and related MD&A for the

year ended July 31, 2022, and the interim financial reports and

related MD&A for the period ended April 30, 2023, filed with

the securities’ regulatory authorities in certain provinces of

Canada and available at www.sedar.com.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and does not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

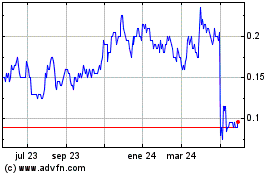

Red Pine Exploration (TSXV:RPX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

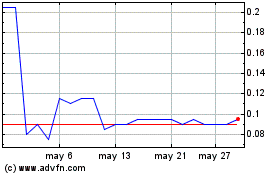

Red Pine Exploration (TSXV:RPX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025