Sparton Closes $2 Million Bridge Financing to Complete Initial Acquisition of Profitable Coal/Germanium/Uranium Opportunity

06 Octubre 2008 - 8:37AM

Marketwired Canada

NOT FOR DISSEMINATION TO UNITED STATES NEWSWIRES OR FOR DISSEMINATION IN THE

UNITED STATES.

Sparton Resources Inc. (TSX VENTURE:SRI) (the "Company") is pleased to announce

that its subsidiary, Sparton Energy Inc. ("SEI") has closed a US$2 million

bridge loan (the "Loan") provided by a Quam Limited ("Quam") subsidiary company,

Quam Ventures BVI Ltd. The proceeds of the Loan will be used to complete SEI's

previously announced acquisition of an initial 60% share interest in Linxing 306

Huajun Coal Co. Ltd. Lincang City (" Huajun "), which owns the Huajun coal and

germanium producing operations in Yunnan, China. This will result in SEI taking

over control of the operations and the cash flow at Huajun, which latter is

currently estimated to be approximately US$ 125,000 per month based on recent

concentrate sales. SEI has completed the sourcing of experienced technical and

financial staff to effect transition of the operational and management changes.

As previously announced (see news release dated June 24, 2008), Quam Securities

Company Limited ("Quam Securities") of Hong Kong a Quam subsidiary, has entered

into an engagement letter with SEI to raise up to US$10 million in convertible

debentures of SEI (the "Convertible Debentures") on a "best efforts", private

placement basis (the "Financing"). Quam Securities through a subsidiary intends

to subscribe for US$ 2 million of the Convertible Debenture on closing of a

minimum of US$5 million in Convertible Debenture sales. The proceeds from the

sale of a full US$10 million of Convertible Debentures will be partially used

for purchase of an additional 25% share interest in Huajun and for technical

upgrades to those operations. (See news release dated April 17, 2008 for details

of this transaction).

The Financing proceeds will also provide capital for the final design,

permitting and construction of a pilot plant and uranium extraction testing

facility in the Lincang area, which will be built at the Huajun site. Following

final testing, commercial plant design and feasibility work, these funds will

then support the construction of a commercial uranium extraction plant for

Lincang area waste coal ash, and support SEI's ongoing international secondary

uranium recovery programs.

Various conditions precedent, including receipt of all required regulatory and

corporate approvals, and completion of independent due diligence reviews have

now been met or completed, allowing the closing of the Loan part of this

transaction.

BRIDGE LOAN TERMS

The Loan is for a principal amount of $US2 million, will carry interest at 10%

annually and is repayable on or before maturity on March 31, 2009. The maturity

date may be extended to May 31, 2009 under certain conditions. The loan will be

repaid out of proceeds of funds from the Convertible Debenture sales as long as

a minimum of US$ 5 million in Convertible Debentures are sold by Quam Securities

or SEI alternately raises a similar minimum amount. SEI intends to repay the

Loan when US$ 5 million in Convertible Debentures are sold. Quam has indicated

it intends to subscribe for US$2 million of the Financing for its subsidiary's

account, subject to an additional US$3 million being raised under the Financing.

In addition to the interest payable on the principle amount of the Loan, SEI has

issued up to 2,648,700 SEI preference shares (the Preference Shares"),

representing a 7.7 % fully diluted interest in SEI, which will be reduced on a

scaled basis, if the aggregate gross proceeds of the Financing do not meet or

exceed $US 10 million. If no Convertible Debentures are sold the interest in SEI

will be reduced to 5%. Quam may elect to convert these Preference Shares into

common shares of SEI, or, Quam may elect to convert the full number of

Preference Shares into 3,555,000 Bonus Common Shares of the Company at a value

of C$0.11 per Bonus Common Share.

SEI and the Company are providing security for the Convertible Debentures to

both Quam and any debenture holders in the form of a guarantee backed by the

Huajun shares, SEI's interest in the agreements and operating vehicles related

to the secondary uranium recovery programs in Yunnan, and the Company's

estimated 6% working interest in the Chebucto gas field offshore of Nova Scotia,

Canada. This security will be removed under certain terms and conditions related

to repayment of the Loan and financial performance of SEI's operations in China.

QUAM LIMITED

Quam Limited is a listed Hong Kong (952 SEHK) based financial services group

comprised of several renowned Hong Kong businesses, including Quam Securities,

Quam Capital, Quam Asset Management, Quam Wealth Management, Quamnet.com and

Quam Investor Relations. Utilizing both its online and offline resources, Quam

offers one-stop financial services in Hong Kong and China for corporations and

individual investors alike. It also provides capital markets assistance in

Tokyo, Bangkok, Dubai, Hong Kong and through its representative offices or

wholly-owned foreign enterprises in Shenzhen, Shanghai, Shenyang of China. The

Company has been associated with Quam as its financial advisor in Hong Kong for

more than two years.

DISCUSSION

The proceeds of the Financing will further the Company's goal of becoming a

profitable operating company through its subsidiaries, and provide immediate

cash flow to the Company through SEI. The medium term objectives are to upgrade

the Huajun operations and enhance their profitability by increasing output and

upgrading the current production of germanium concentrate to pure germanium

metal. Additionally, utilizing its proprietary technology, the Company will move

forward with its uranium extraction program from Lincang coal ash, through its

joint venture with China National Nuclear Corporation ("CNNC") and plans to

complete a bulk test plant, feasibility study, and ongoing construction of a

commercial production facility in the Lincang area.

Experienced SEI operating staff will now oversee the Lincang operations and

organize the design and implementation of the new germanium metal production

plant. Engineering design and permitting for this work are in the final stages.

Lyntek Inc., the Company's process engineering consultant, has completed an

initial design for the uranium extraction bulk test plant and this has been

submitted for review to the PRC environmental permitting authorities in

cooperation with the Number 4 Production and Research Institute of CNNC.

Sparton's international exploration, development, and evaluation programs are

being carried out under the direct supervision of A. Lee Barker, P. Eng., P

Geol., the Company's President and CEO who is a Qualified Person under National

Instrument 43-101.

This press release contains "forward-looking statements" within the meaning of

applicable Canadian securities legislation. Generally, forward-looking

statements can be identified by the use of forward- looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget", "scheduled",

"planned", "estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases or state

that certain actions, events or results "may" ,"could", "would", "might" or

"will be taken", "occur" or "be achieved". Forward-looking statements are

subject to known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, closing of transactions,

performance or achievements of the Company to be materially different from those

expressed or implied by such forward-looking statements, including but not

limited to: risks related to exploration and development, the environment, local

and foreign government regulation, currency fluctuation infrastructure, capital

markets and additional funding requirements and the departure of key executives

as well as those factors discussed in the Company's documents filed on SEDAR

(www.sedar.com).

Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking statements. The

Company does not undertake to update any forward-looking statements that are

contained herein, except in accordance with applicable securities laws. Further

information on Sparton Resources Inc. is available at www.sedar.com.

This news release and the information contained herein does not constitute an

offer of securities for sale in the United States and securities may not be

offered or sold in the United States absent registration or exemption from

registration.

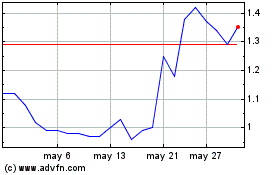

Sintana Energy (TSXV:SEI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

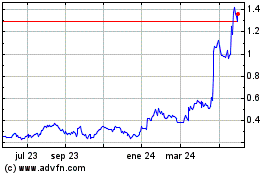

Sintana Energy (TSXV:SEI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024