Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3)

(“

Vizsla Silver” or the

“

Company”) is pleased to announce that it has

entered into an agreement with PI Financial Corp. as co-lead

underwriter and joint bookrunner on its own behalf and on behalf of

a syndicate of underwriters (the “

Underwriters”)

including Canaccord Genuity Corp. as co-lead underwriter and joint

bookrunner, pursuant to which the Underwriters have agreed to

purchase, on a “bought deal” basis, 13,800,000 units of the Company

(the “

Units”), at a price of $1.45 per Unit (the

“

Offering Price”) for gross proceeds of

$20,010,000 (the “

Offering”).

Each Unit shall consist of one common share in

the capital of the Company (a “Common Share”) and

one-half of one common share purchase warrant (each whole common

share purchase warrant, a “Warrant”). Each Warrant

shall be exercisable into one common share of the Company (a

“Warrant Share”) for a period of 24 months from

closing at an exercise price of $2.00 per Warrant Share.

The Company has granted the Underwriters an

option, exercisable at the Offering Price for a period of 30 days

following the Closing Date (as defined herein), to purchase up to

an additional 15% of the number of Units sold under the Offering to

cover over-allotments, if any and for market stabilization

purposes. The Offering is expected to close on or about November

15, 2022 (the "Closing Date") and is subject to

the Company receiving all necessary regulatory approvals.

The net proceeds of the Offering will be used to

advance the exploration and development of Panuco, including the

delivery of a resource update in the fourth quarter of 2022, as

well as for working capital and general corporate purposes.

The Units will be offered by way of a prospectus

supplement in each of the Provinces of Canada (other than the

Province of Quebec) and may also be offered by way of private

placement in the United States and such other jurisdictions as

agreed between the parties.

The securities to be offered pursuant to the

Offering have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the "U.S. Securities

Act") or any U.S. state securities laws, and may not be

offered or sold in the United States or to, or for the account or

benefit of, United States persons absent registration or any

applicable exemption from the registration requirements of the U.S.

Securities Act and applicable U.S. state securities laws.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About the Panuco Project

The newly consolidated Panuco silver-gold

project is an emerging high-grade discovery located in southern

Sinaloa, Mexico, near the city of Mazatlán. The 6,761-hectare, past

producing district benefits from over 86 kilometres of total vein

extent, 35 kilometres of underground mines, roads, power, and

permits.

The district contains intermediate to low

sulfidation epithermal silver and gold deposits related tosiliceous

volcanism and crustal extension in the Oligocene and Miocene. Host

rocks are mainly continental volcanic rocks correlated to the

Tarahumara Formation.

Panuco hosts an estimated in-situ indicated

mineral resource of 61.1 Moz AgEq and an in-situ inferred resource

of 45.6 Moz AgEq. A NI 43-101 technical report, titled “National

Instrument 43-101 Technical Report for the Panuco Project Mineral

Resource Estimate Concordia, Sinaloa, Mexico” was filed on SEDAR on

April 7, 2022, with an effective date of March 1, 2022 was prepared

by Tim Maunula, P.Geo., Principal Geologist, T. Maunula &

Associates Consulting Inc. and Kevin Murray, P.Eng, Manager Process

Engineering, Ausenco.

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration

and development company headquartered in Vancouver, BC, focused on

advancing its flagship, 100%-owned Panuco silver-gold project

located in Sinaloa, Mexico.

To date, Vizsla Silver has completed over

210,000 metres of drilling at Panuco leading to the discovery of

several new high-grade veins. For 2022, Vizsla Silver has budgeted

over 120,000 metres of resource/discovery-based drilling, designed

to upgrade, and expand the maiden resource as well as test other

high priority targets across the district.

For more information and to sign-up to the

mailing list, please contact:

Michael Konnert, President and Chief Executive OfficerTel: (604)

364-2215Email: info@vizslasilver.caWebsite:

www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING

STATEMENTS

This news release includes certain

“Forward‐Looking Statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward‐looking information” under applicable Canadian securities

laws. When used in this news release, the words “anticipate”,

“believe”, “estimate”, “expect”, “target”, “plan”, “forecast”,

“may”, “would”, “could”, “schedule” and similar words or

expressions, identify forward‐looking statements or information.

These forward‐looking statements or information relate to, among

other things: the intended use of proceeds from the Offering, the

expected closing date of the Offering, and publication of a

resource update in the fourth quarter of 2022.

Forward‐looking statements and forward‐looking

information relating to any future mineral production, liquidity,

enhanced value and capital markets profile of Vizsla Silver, future

growth potential for Vizsla Silver and its business, and future

exploration plans are based on management’s reasonable assumptions,

estimates, expectations, analyses and opinions, which are based on

management’s experience and perception of trends, current

conditions and expected developments, and other factors that

management believes are relevant and reasonable in the

circumstances, but which may prove to be incorrect. Assumptions

have been made regarding, among other things, the price of silver,

gold and other metals; costs of exploration and development; the

estimated costs of development of exploration projects; Vizsla

Silver’s ability to operate in a safe and effective manner and its

ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver’s current

views with respect to future events and are necessarily based upon

a number of other assumptions and estimates that, while considered

reasonable by management, are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors, both known and unknown, could

cause actual results, performance or achievements to be materially

different from the results, performance or achievements that are or

may be expressed or implied by such forward‐looking statements or

forward-looking information and Vizsla Silver has made assumptions

and estimates based on or related to many of these factors. Such

factors include, without limitation: the Company’s dependence on

one mineral project; precious metals price volatility; risks

associated with the conduct of the Company’s mining activities in

Mexico; regulatory, consent or permitting delays; risks relating to

reliance on the Company’s management team and outside contractors;

risks regarding mineral resources and reserves; the Company’s

inability to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks and

unknowns inherent in all mining projects, including the inaccuracy

of reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; employee relations, labour unrest or unavailability;

the Company’s interactions with surrounding communities and

artisanal miners; the Company’s ability to successfully integrate

acquired assets; the speculative nature of exploration and

development, including the risks of diminishing quantities or

grades of reserves; stock market volatility; conflicts of interest

among certain directors and officers; lack of liquidity for

shareholders of the Company; litigation risk; and the factors

identified under the caption “Risk Factors” in Vizsla Silver’s

management discussion and analysis. Readers are cautioned against

attributing undue certainty to forward‐looking statements or

forward-looking information. Although Vizsla Silver has attempted

to identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be anticipated, estimated or intended. Vizsla Silver does

not intend, and does not assume any obligation, to update these

forward‐looking statements or forward-looking information to

reflect changes in assumptions or changes in circumstances or any

other events affecting such statements or information, other than

as required by applicable law.

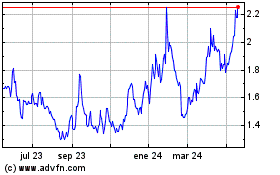

Vizsla Silver (TSXV:VZLA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

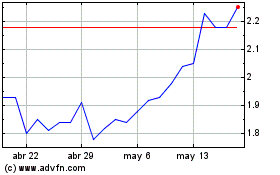

Vizsla Silver (TSXV:VZLA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025