UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10

(Amendment No. 1)

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or 12(g) of The Securities Exchange Act of 1934

AXIS

TECHNOLOGIES GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

26-1326434

|

|

(State

of incorporation)

|

|

(IRS

Employer Identification Number)

|

|

|

|

|

|

|

|

|

|

2055

S. Folsom, Lincoln NE

|

|

68522

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(Registrant's

telephone number)

(866)

458-9880

Securities

to be registered pursuant to Section 12(b) of the Act:

|

Title

of each class to be so registered

|

|

Name

of each exchange on which each class is to be

registered

|

|

Not

Applicable

|

|

|

Securities

to be registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $0.001 per share

(Title of

class)

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

|

Accelerated

filer

|

|

Non-accelerated

filer

|

|

Smaller

reporting company

|

T

|

AXIS

TECHNOLOGIES GROUP, INC.

TABLE

OF CONTENTS

|

Item 1

|

|

|

3

|

|

|

|

|

|

|

Item 1A

|

|

|

8

|

|

|

|

|

|

|

Item 2

|

|

|

11

|

|

|

|

|

|

|

Item 3

|

|

|

14

|

|

|

|

|

|

|

Item 4

|

|

|

14

|

|

|

|

|

|

|

Item 5

|

|

|

15

|

|

|

|

|

|

|

Item 6

|

|

|

16

|

|

|

|

|

|

|

Item 7

|

|

|

19

|

|

|

|

|

|

|

Item 8

|

|

|

19

|

|

|

|

|

|

|

Item 9

|

|

|

19

|

|

|

|

|

|

|

Item 10

|

|

|

20

|

|

|

|

|

|

|

Item 11

|

|

|

21

|

|

|

|

|

|

|

Item 12

|

|

|

23

|

|

|

|

|

|

|

Item 13

|

|

|

23

|

|

|

|

|

|

|

Item 14

|

|

|

23

|

|

|

|

|

|

|

Item 15

|

|

|

23

|

EXPLANATORY

NOTE

We are

filing this General Form for Registration of Securities on Form 10 to register

our common stock, par value $0.001, pursuant to Section 12(g) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

Once we

have completed this registration, we will be subject to the requirements of

Regulation 13A under the Exchange Act, which will require us to file annual

reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on

Form 8-K, and we will be required to comply with all other obligations of the

Exchange Act applicable to issuers filing registration statements pursuant to

Section 12(g).

As used

in this Form 10, unless the context requires otherwise, "we", "us", “our”,

“Axis”, "Company" or “Issuer” means Axis Technologies Group, Inc. and its

consolidated subsidiaries. Our principal place of business is located at 2055

South Folsom, Lincoln, Nebraska 68522.

CAUTION

REGARDING FORWARD-LOOKING INFORMATION

All

statements contained in this Form 10, other than statements of historical facts

that address future activities, events or developments are forward-looking

statements, including, but not limited to, statements containing the words

"believe," "anticipate," "expect" and words of similar import. These statements

are based on certain assumptions and analyses made by us in light of our

experience and our assessment of historical trends, current conditions and

expected future developments as well as other factors we believe are appropriate

under the circumstances. However, whether actual results will conform to the

expectations and predictions of management is subject to a number of risks and

uncertainties that may cause actual results to differ materially.

Such

risks include, among others, the following: international, national and local

general economic and market conditions: our ability to sustain, manage or

forecast our growth; raw material costs and availability; new product

development and introduction; existing government regulations and changes in, or

the failure to comply with, government regulations; adverse publicity;

competition; the loss of significant customers or suppliers; fluctuations and

difficulty in forecasting operating results; changes in business strategy or

development plans; business disruptions; the ability to attract and retain

qualified personnel; the ability to protect technology; and other factors

referenced in this filing.

Consequently,

all of the forward-looking statements made in this Form 10 are qualified by

these cautionary statements and there can be no assurance that the actual

results anticipated by management will be realized or, even if substantially

realized, that they will have the expected consequences to or effects on our

business operations.

Item

1. Business.

Axis

Technologies Group, Inc. (the “Company”), a Delaware corporation which was

incorporated on September 30, 1997 under the name C2i Solutions, Inc., through

its wholly owned operating subsidiary, Axis Technologies, Inc., a Delaware

corporation is in the business of the development and marketing of daylight

harvesting fluorescent lighting ballasts that use natural lighting to reduce

electricity consumption. A ballast is an electronic component that

regulates voltage in lighting. The Company’s market for advertising

and selling the product currently lies within North America.

The Company was originally

incorporated as C2i Solutions, Inc. in September 1997. The Company

was subject to the reporting requirements of the Exchange Act until it withdrew

as a reporting company in March 2001. Subsequent thereto, after

several name changes, the Company became Riverside Entertainment in May

2004. On October 25, 2006, the Company acquired all of the

issued and outstanding shares of its subsidiary company Axis Technologies, Inc.

in a share exchange transaction. Axis Technologies, Inc. had a

total of six shareholders, each of which exchanged all of their ownership

interest in the subsidiary for shares in the Company. In exchange for

their shares, the owners of the subsidiary shares received a combined total of

45,000,000 newly issued restricted shares of the Company which resulted in a

change of control of the Company. As a result of the transaction, the

existing management of Axis Technologies, Inc. became new management of the

Company.

The

Company’s primary products are self-contained electronic, dimming and daylight

harvesting, fluorescent ballasts. The Company markets energy-saving

electronic components for the commercial lighting sector and has spent over two

years in its product development. The Company develops, tests, and

patents unique technology to create energy efficient products that meet federal

energy code standards and encourage Green initiatives for high-profile

companies. Extensive testing was conducted to ensure product

reliability, and energy-saving properties. The Company has obtained

and owns the patent rights for our ballasts’ unique control system, and has

trademarked our slogan “The Future of Fluorescent Lighting”. UL

(Underwriters Laboratory), the lighting industry’s certification authority, has

approved our products for use in the United States and Canada.

The

Company’s target market is small to large commercial users of fluorescent

lighting including office buildings, wholesale and retail buildings, hospitals,

schools and government buildings. We have

arrangements with sales representatives, electrical distributors,

electrical contractors, retrofitters, ESCO’s (Energy Service Companies), and

OEM’s (Original Equipment Manufacturers) to market, distribute and install the

Company’s products.

We have

not been in bankruptcy, receivership, or any similar proceeding, and have not

defaulted on the terms of any note, loan, lease, or other indebtedness or

financing arrangement requiring us to make any material payments.

Market

for Electronic Dimming Ballasts

We

believe the market for electronic ballasts to be in excess of $700 million in

annual sales. Based on the market data, we anticipate that this

market will continue moderate growth for the next ten to fifteen

years. Although the overall economic outlook for the U.S. is

presently not optimistic, we do not believe that the sales of our products will

correlate with the overall economic conditions because of the present need to

establish more efficient use of energy and reduce energy

costs. However, due to switching costs of our customers and the

higher price of our products, there can be no assurance that our products will

be accepted by the market.

T8

Ballasts

Our

current and primary product is the patented T8 Axis Daylight Harvesting Dimming

Ballast. This ballast uses simple technology that transforms the

standard ballast, into a dynamic energy saving system that can reduce lighting

energy costs by up to 70% over a magnetic ballast utilizing T12

lamps. A report titled “Demonstration of Efficient Lighting

Conversion of the Lincoln Electric System Administration System” written by

Lincoln Electric System engineers, dated October 2004 shows a 69% energy

savings, and an 88% energy savings. The Axis Ballast utilizes an

individual photo sensor to automatically adjust the amount of electrical current

flowing to the light fixture and then dims or increases lighting in conjunction

with the amount of available sunlight. Based on our knowledge, the

Axis Ballast is the only ballast on the market that has automatic dimming

controls integrated into each ballast. This feature reduces the costs

of acquisition and installation by up to two-thirds over that of competing

dimming systems, which require that first, a dimming ballast must be acquired,

then a separate control system, and a separate photocell; then all components

must be “hard-wired” together, and then “commissioned” or “balanced” in order to

operate properly. This extra equipment and labor can cost three times

the acquisition and installation cost of the Axis ballast

system.

T5HO

Ballasts

We plan

to introduce a line of dimming and daylight harvesting ballasts with the same

control system as our present T8 ballasts which utilize 32 watt, T8 lamps; that

would utilize T5HO (54 watt, High Output) lamps. These lamps are

smaller in diameter and put out more light per lamp than T8

lamps. They are used mainly in “high-bay” fixtures which are normally

installed in warehouses, gymnasiums, larger retail stores,

etc. Skylights are frequently installed in these applications, and a

dimming ballast as provided by Axis would be an economical choice to greatly

reduce the lighting energy needed to illuminate these spaces.

This

ballast is in the process of being developed and will be submitted to UL for

testing and approval. All electronic products must to submitted to,

and approved by, a testing agency such as UL (Underwriters Laboratories) before

they can be sold in the US and/or Canada. UL tests for safety-related

issues only, not for any operational claims made by the

manufacturer. UL requires that from 4 to 6 complete samples be

submitted for their proprietary testing. A typical timeline for a

product going through the UL approval process may take 90 days. Once

approval is obtained from UL, the product can be sold.

Status

of New Products

Load

Shedding Ballast:

In

October of 2007, we commenced development work on a new line of wireless

addressable, load shedding ballasts. Using our affiliate membership,

in which we pay an annual membership fee with the California Lighting Technology

Centerat the University of California-Davis, we have been working with the CLTC

personnel to develop an additional line of Axis ballasts that would specifically

address peak demand load shedding. Our load shedding ballast is

currently under design. The component architecture is scheduled for completion

at the end of 2008. Testing and UL approval will follow, with the

preliminary production run and beta testing of ballasts scheduled for the end of

the first quarter of 2009.

Full

inventory should be in our warehouse by the end of the second quarter of

2009. Most utility companies charge their customers a surcharge or “peak

demand” charge during those times of day when the load on the power plants are

at the highest. Usually this means the power companies must start up

higher cost generators, and/or buy power from the electrical grid at higher

rates. Our ballast would allow the power companies the ability to

reduce the lighting load for their customers during those peak demand periods by

sending a signal to their subscriber customers. This would provide a

benefit for both the utility company and their customers. Several

utility companies have expressed interest in working with us to complete the

development of the load shedding ballasts in order to provide for the

installation of the ballasts in their customer facilities. A utility

company in the Northeast has verbally committed to purchasing the load shedding

ballast as soon as it is available, and will be conducting the first beta

testing. We are designing it to the needs of utility “Advanced Metering

Infrastructure” (AMI) communication requirements. The volume of ballasts

purchased from this one utility would be significant, and all other major

utilities will have similar applications for this product. The U.S.

federal government has mandated that power companies nation-wide reduce their

greenhouse gas emissions and reduce energy consumption by January of

2009. Axis is not privy to exactly the reductions being mandated by

the Federal Government on any specific utility company, but factors such as

energy costs and energy demands are part of the equation. We believe

that the January 2009 deadline will not be reached by the vast majority of the

utility companies and, accordingly, we believe that they will be interested in

energy-saving products such as the Axis ballasts.

Because

both the Load Shedding Ballast and T5HO Ballast are simpler, more cost

effective, and directly serve the market needs, we believe these qualities

create a competitive advantage for us and allow us to gain a larger acceptance

in the market.

Competition

The

energy saving electronic component market is very competitive. There

are other companies that manufacture dimming ballasts, such as Advance,

Sylvania, GE and others. These companies have larger financial

resources, including larger operating, staffing and advertising

budgets. These companies are also better-known than us. We

believe that most of these ballasts from competitive companies, however,

primarily require that a separate control system be installed, that separate

photosensors be installed, and that all components must be “hard-wired”

together, then “commissioned” (adjusted) in order to work

properly. These systems cost about three times that of our system

because of the extra components to purchase and labor to

install. Also, because of their complexity, they have proved

cumbersome to maintain.

The other

type of general competition for our ballasts is standard electronic

ballasts. Even though the Axis ballast system is cost-efficient and

has demonstrated to reduce up to 40% of the lighting energy costs over these

ballasts, the end consumer is many times reluctant to pay the switching costs to

install the Axis dimming system.

With

regard to our daylight harvesting products, to our knowledge, there are

currently no direct competitors to this technology. However, we do

experience indirect competition from other lower cost ballasts, which have a

lower installation cost and which do not utilize the daylight harvesting

technique, as an alternative solution. To minimize the effects of

competition, we are working with energy agencies to promote the usage and

acceptance of our products. We are also continuously upgrading and

improving the performance and reliability of our ballasts. We believe

that our products’ lower acquisition costs, lower installation costs, and

improved energy savings will differentiate our ballasts from the current

ballasts in the market and increase our products’ acceptance in the

market.

Principal

Suppliers and Manufacturers

On August

23, 2003, we entered into an exclusive Manufacturing Agreement with Shanghai

Gold Lighting Co, Ltd. (SGLC) to manufacture and supply our products, which

includes our ballasts and other electronic equipment. The initial

term of our Manufacturing Agreement is 5 years which will automatically renew in

subsequent one year terms unless terminated by the parties.

Under

the Manufacturing Agreement, we have a minimum annual commitment to purchase

$1.5M worth of products from SGLC. Although we have not met our

minimum annual commitment, SGLC has never asserted a breach of the

agreement. Rather the parties have adjusted the prices to compensate

for the lower volume. If either party materially breaches its

obligations under the Manufacturing Agreement and fails to cure the material

breach within 90 days of the receipt of notice, the non-breaching party may

terminate the agreement. Otherwise, either party may terminate the

agreement for its convenience upon 90 days notice to the other

party. Notwithstanding the foregoing, this agreement may immediately

be terminated if either party materially breaches its confidentiality and

intellectual property obligations.

At

this time, Shanghai Gold Lighting Company, Ltd. headquartered in Shanghai,

China, is our sole provider for all merchandise, manufacturing and equipment

produced and sold by us. They are an ISO 9002 rated manufacturer

which builds ballasts and other electronic equipment for other companies within

the industry in addition to us. As an ISO 9002 rated manufacturer,

Shanghai Gold Lighting Company has been certified by the International

Organization for Standardization to meet established quality control and

management standards to ensure that their manufacturing processes have complied

with rigorous quality control metrics and requirements. They have supplied us

with high quality and reliable products, and at competitive

prices. All component materials are sourced and provided by Shanghai

Gold, and our ballasts are built to our specifications and under the direct

supervision of the Underwriters Laboratory. UL has representatives in

China and they supervise the manufacturing to make certain that all components

that go in to the assembly of the Axis ballasts, are themselves individually UL

approved.

Test

results of each production run are provided to us by the factory before

shipment.

Our

operations will suffer a setback if our relationship with Shanghai Gold Lighting

Company is terminated. However, should we cease to do business with

Shanghai Gold Lighting Company, we can replace their services with other similar

vendors. Additionally, we are currently in the process of soliciting

additional providers to diversify our dependence on a sole

supplier.

Customers

For

our fiscal year ended December 31, 2007, one customer accounted for twenty-three

percent (23%) of our sales revenue and for the six months ended June 30, 2008,

two customers accounted for sixty-four percent (64%) of our sales

revenues. We are, however, in the process of talking with several

utilities who have indicated an interest in adopting our products to further

broaden our customer base.

In

efforts to expand our customer base, we have established relationships,

typically on a standard purchase order basis, with large wholesale distributors

such as Grainger, Graybar, Consolidated Electrical Distributors (CED), Crescent,

Wesco, Rexel, FSG, Winlectric; and smaller distributors across the country such

as Jewel, Munro, Walter’s Wholesale, Shepherd, Gilman, Kriz-Davis, American

Light, Loeb, Platt, Motors & Controls who market and distribute our ballasts

to third parties usually building owners. It should be noted,

however, that we did not use any objective criteria for naming such customers

mentioned above. We have named most of the major national electrical

distributors, and a few of the smaller regional electrical distributors with

which we have done business. Nevertheless, there are countless other

distributors and OEM fixture manufacturers nationwide that were not

mentioned.

Our ballasts

are marketed and sold through these distributors to, among others, electrical

contractors and building owners. To date, there has been no material

change to the constituency of our significant customers.

Building

owners can retrofit their existing light fixtures with the Axis ballast. Our

ballast can be sold individually for retrofit of existing fixtures, eliminating

the need to replace the fixture, as well as in fixtures supplied by

manufacturers for new installation. Axis does not typically sell

direct to building owners, but sells to electrical distributors, Energy Service

Companies, and fixture manufacturers, who then sell to the building

owners. The building owners become Axis “customers” because they are

utilizing our ballasts.

We

have relationships with over 30 fluorescent fixture manufacturers who have

factory-installed our ballasts in their fixtures for re-sale to their

customers. Many of these original equipment manufacturers have made a

catalog entry featuring their own “dimming/daylight harvesting” fixture which

utilizes our ballasts.

Governmental

Approvals and the Effect of Regulations on our Business

There

are many states that have passed legislation that requires lighting controls at

a minimum, and in some cases (California for example), there are requirements

that new construction and major lighting retrofits incorporate daylight

harvesting. These regulations are specific to lighting, and there are

many further regulations in place from cities and states, that are requiring

government buildings to save a certain amount of all forms of energy by

specified dates. We believe that our dimming ballast system can help

greatly in achieving these energy-reduction goals. All states in the

United States are required to adopt an energy standard. The three main energy

efficiency codes are from ASHRAE (American Society of Heating, Refrigerating,

and Air-Conditioning Engineers), the IEC (International Electric Code), and

California Title 24 Building Standards. The latest versions of these

codes include requirements for daylighting and daylighting controls. While the

three code standards had existed autonomously in previous years, they are

working together to create a consistency of standards, across all three

agencies, for lighting energy efficiency.

Newer

and stricter energy efficiency codes mandated by the U.S. Federal government

will encourage the use of our products. The Energy Policy Act of 2005 has

mandated minimum energy reductions, and President Bush signed approval on

Executive Order 13243 issued in January of 2007. The executive order requires a

30% energy reduction in Federal buildings, from 2003 energy levels, by 2015.

These standards apply to all buildings owned, and leased, by the Federal

government. We believe that due to these new regulations, the size of

the electronic ballast market will expand significantly. While these

new regulations do not expose us to additional liabilities, the Axis ballast can

help these Federal buildings adhere to and comply with these

requirements. With exception to standard business licenses and the

certification of our products by the Underwriters Laboratory, we are not

required to obtain any additional governmental approvals. We can obtain our

standard business licenses with minimal cost and can renew them with relative

ease.

License

Agreement

On

January 1, 2008, we entered into a license agreement with The Regents of the

University of California, a California Corporation, (“Regents”). Only

one other company has a license from the Regents. While the other

company is not prohibited from competing with us, that company uses the license

for a different application and purpose. The material terms of the

License Agreement are as follows:

|

-

|

We

are granted a co-exclusive license to make, have made, use, offer for

sale, import, sell, and have sold the Simplified Daylight Harvesting

Technology which has been developed by

Regents;

|

|

-

|

We

have paid the Regents a $5,000.00 License

Fee

|

|

-

|

Until

the first sale of the Simplified Daylight Harvesting Technology products

and services, we will pay to the Regents a license maintenance fee of

$3,000 on each of the one-year, two-year, and three-year anniversaries of

the license and $5,000 on each subsequent one-year anniversary of the

license thereafter.

|

|

-

|

Additionally,

royalties calculated as a percentage of net sales shall be paid to the

Regents which may vary from 0.85% to 1.70% based upon the components that

are sold.

|

|

-

|

Earned

royalties will be paid quarterly to the

Regents

|

|

-

|

Beginning

in the first calendar year in which the sale of the Simplified Daylight

Harvesting Technology products and services occur, we will pay the Regents

a minimum annual royalty in accordance to the following payment

schedule:

|

|

|

o

|

Five

Thousand Dollars ($5,000.00) for the first calendar

year;

|

|

|

o

|

Six

Thousand Dollars ($6,000.00) for the second calendar

year;

|

|

|

o

|

Eight

Thousand Dollars ($8,000.00) for the third calendar

year;

|

|

|

o

|

Ten

Thousand Dollars ($10,000.00) for the fourth calendar

year;

|

|

|

o

|

Ten

Thousand Dollars ($10,000.00) for each subsequent calendar year thereafter

for the life of the license which is until the last patent expires or is

abandoned, whichever is later.

|

Our

current daylight harvesting system does not utilize the CLTC

(California Lighting Technology Center)

technology. Payments will begin when we begin selling ballasts

equipped with the CLTC technology, which is currently being designed for

integration into our ballast.

The

duration of the license is for the life of the patents. Termination

by either Licensee or Licensor are contained in the agreement.

OTHER

MATTERS

Employees

Not

including our executive officers, the Company currently has five full-time

employees and no part-time employees. We believe our relationship

with our employees is good. Currently, we do not have full-time

employees devoted only to research and development.

Research

and Development

During

the last two full fiscal years, we have collaborated with the California

Lighting and Technology Center through the Regents of the University of

California by engaging in research and development activities and

have signed a licensing agreement with them effective as of January

1, 2008. We are an affiliate member of the CLTC. We have

contracted to license their Simplified Daylight Harvesting photosensor

technology. We are further contracting with them in the integration of the

technology, internal product testing, and public program testing for technology

demonstration. In addition, we have active discussions in methods to accelerate

the deployment of the daylight harvesting technology into the lighting industry,

through private industry and utility rebate programs. In the event

that we undertake research and development activities in the future, the costs

of those efforts will not be bourn directly by our consumers. Future

research and development programs will integrate more government and energy

industry sponsorship through private or governmental sponsored

grants.

Expenses

for research and development over the last two years have been minimal, as our

existing products were developed prior to that period.

Intellectual

Property

In

November, 2005, we were issued a patent (Patent #6,969,955) for a term of

17 years from the date of issuance that covers North America (expires

November, 2022) to protect the ATI ballast and its unique control system, which

utilizes a 7-position dipswitch to provide pre-set fixed output from 100% to 40%

in approximately 10% increments; and an integral photo sensor which further dims

the fixture to as much as an 80% reduction depending on available

daylight. The ATI ballast is an apparatus and method for providing

dimming control of an electronic ballast circuit that includes a electronic

ballast circuit that is electrically connected to a plurality of input voltage

terminals that can receive alternating current and the electronic ballast

circuit is electrically connected to the plurality of fluorescent lamp

terminals. The technology for our patent primarily involves the

dimming control settings of the tuning dip-switch function, the dip switch and

photosensor housings, and the integration of controls with the ballast circuit

board. The intellectual property relating to the license with the

California Lighting Technology Center is for a programming

algorithm, used for the control and function of the

photosensor.

Axis,

by agreement with Shanghai Gold Lighting Company, granted to Shanghai Gold

Lighting Company the intellectual property rights relating to our ballasts for

the Asian market.

In

September, 2005, the Company trademarked our slogan “The Future of Fluorescent

Lighting” (under trademark # 78437293).

Environmental

Matters

We

currently do not manufacture any product or conduct any activity that is subject

to environmental laws. All manufacturing is undertaken by a third

party. Nevertheless, it is possible that our activities could fall within the

ambit of environmental regulation in the future.

Item

1A. Risk Factors.

An

investment in our common stock involves a high degree of risk. You

should carefully consider the risks described below before deciding to purchase

shares of our common stock. If any of the events, contingencies,

circumstances or conditions described in the risks below actually occurs, our

business, financial condition or results of operations could be seriously

harmed. The trading price of our common stock could, in turn,

decline, and you could lose all or part of your investment.

RISK

FACTORS CONCERNING OUR BUSINESS AND OPERATIONS:

WE HAVE A

LIMITED OPERATING HISTORY, WHICH MAY MAKE IT DIFFICULT FOR INVESTORS TO PREDICT

OUR FUTURE PERFORMANCE BASED ON OUR CURRENT OPERATIONS.

We have a

limited operating history upon which investors may base an evaluation of our

potential future performance. As a result, there can be no assurance that we

will be able to develop consistent revenue sources, or that our operations will

be profitable. Our prospects must be considered in light of the risks, expense

and difficulties frequently encountered by companies in an early stage of

development.

We must,

among other things, determine appropriate risks, rewards and level of investment

in each project, respond to economic and market variables outside of our

control, respond to competitive developments and continue to attract, retain and

motivate qualified employees. There can be no assurance that we will be

successful in meeting these challenges and addressing such risks and the failure

to do so could have a materially adverse effect on our business, results of

operations and financial condition.

WE HAVE

EXPERIENCED SUBSTANTIAL OPERATING LOSSES AND MAY INCUR ADDITIONAL OPERATION

LOSSES IN THE FUTURE.

During

the twelve month period ended December 31, 2007, we have incurred a net loss of

$775,019 and during the six months ended June 30, 2008, we have incurred a net

loss of $884,794, and have not generated significant revenues to date. We may

continue to incur losses until we are able to generate sufficient revenues and

cash flows from our marketing and distribution of ballasts in the commercial

lighting market discussed herein. If we are unable to generate sufficient

revenues and cash flows to meet our costs of operations, we could be forced to

curtail or cease our business operations without obtaining additional

financing.

WE COULD

CEASE TO OPERATE AS A GOING CONCERN.

We have

had and could have in the future losses, deficits and deficiencies in liquidity,

which could impair our ability to continue as a going concern.

In

Note #2 to our consolidated financial statements, our independent auditors have

indicated that certain factors raise substantial doubt about our ability to

continue as a going concern. During our periods of operation, we have

suffered recurring losses from operations and have been dependent on existing

stockholders and new investors to provide the cash resources to sustain our

operations. During the year ended December 31, 2007, we had a

negative working capital position of $300,089, an accumulated deficit of

$2,247,944, and a stockholder’s deficit of $277,667. For the six

months ended June 30, 2008, we had an additional net loss of

$844,794. During the years ended December 31, 2007 and 2006, we

reported net losses and negative cash flows from operations as

follows:

|

|

|

2007

|

|

|

2006

|

|

|

|

|

|

|

|

|

|

|

Loss

from operations

|

|

$

|

(756,868

|

)

|

|

$

|

(364,299

|

)

|

|

Net

loss from continuing operations

|

|

$

|

(775,019

|

)

|

|

$

|

(438,799

|

)

|

|

Net

cash (used in) operating activities

|

|

$

|

(763,382

|

)

|

|

$

|

(521,215

|

)

|

Our

long-term viability as a going concern is dependent on certain key factors, as

follows:

|

--

|

Our

ability to continue to obtain sources of outside financing that will

supplement current revenue and allow us to continue to develop and market

our products.

|

|

--

|

Our

ability to increase profitability and sustain a cash flow level that will

ensure support for continuing operations as well as to continue to develop

and market our products.

|

WE MAY

NEED ADDITIONAL FINANCING WHICH WE MAY NOT BE ABLE TO OBTAIN ON ACCEPTABLE

TERMS. IF WE ARE UNABLE TO RAISE ADDITIONAL CAPITAL, AS NEEDED, THE FUTURE

GROWTH OF OUR BUSINESS AND OPERATIONS WOULD BE SEVERELY LIMITED.

A

limiting factor on our growth, including its ability to penetrate new markets,

attract new customers, and deliver products and services in the commercial

lighting market, is our limited capitalization compared to other companies in

the industry. While we are currently able to fund all basic operating

costs with our current financing in April 2008, it is possible that we may

require additional funding in the future to achieve all of our proposed

objectives.

If we

raise additional capital through the issuance of debt, this will result in

increased interest expense. If we raise additional funds through the

issuance of equity or convertible debt securities, the percentage ownership of

the Company held by existing shareholders will be reduced and our shareholders

may experience significant dilution. In addition, new securities may

contain rights, preferences or privileges that are senior to those of our common

stock. If additional funds are raised by the issuance of debt or

other equity instruments, we may become subject to certain operational

limitations (for example, negative operating covenants). There can be

no assurance that acceptable financing necessary to further implement our plan

of operation can be obtained on suitable terms, if at all. Our

ability to develop our business, fund expansion, develop or enhance products or

respond to competitive pressures, could suffer if we are unable to raise the

additional funds on acceptable terms, which would have the effect of limiting

our ability to increase our revenues or possibly attain profitable operations in

the future.

WE DEPEND

ON KEY EMPLOYEES AND PERSONNEL TO OPERATE OUR BUSINESS, WHICH COULD ADVERSELY

AFFECT OUR ABILITY TO OPERATE IF WE ARE UNABLE TO RETAIN OR REPLACE THESE

PERSONS.

Our

future success is largely dependent upon its existing management team, including

Kipton P. Hirschbach, our Chief Executive Officer, and

Jim Erickson, our President. The loss of either of these officers or

directors through injury, death or termination of employment could result in the

investment of significant time and resources for recruiting and replacement. We

do not have employment agreements with our executive officers and do not

maintain any key man insurance on their lives for our

benefit. Additionally, the loss of the services of our executive

officers could have a serious and adverse effect on our business, financial

condition and results of operations. There is also no assurance that

as we grow, the existing team can successfully manage our growth or that we can

attract the new talent that will be necessary to run the Company at a high

level. Our success will also depend upon our ability to recruit and retain

additional qualified senior management personnel. Competition is intense for

highly skilled personnel in our industry and, accordingly, no assurance can be

given that we will be able to hire or retain sufficient personnel.

WE FACE

COMPETITION FROM SEVERAL SOURCES, WHICH MAY MAKE IT MORE DIFFICULT TO INTRODUCE

NEW PRODUCTS INTO THE COMMERCIAL LIGHTING MARKET.

The

market segments in which the Company competes are rapidly evolving and intensely

competitive, and have many competitors in different industries, including both

lighting and energy industries. These competitors include

market-specific retailers and specialty retailers. Many of the

Company’s current and potential competitors have longer operating histories,

larger customer bases, greater brand recognition and significantly greater

financial, marketing and other resources than we have. They may be

able to operate with a lower cost structure, and may be able to adopt more

aggressive pricing policies. Competitors in both the retail lighting

and energy industries also may be able to devote more resources to technology

development and marketing than the Company

WE MAY

ISSUE ADDITIONAL SHARES OF COMMON STOCK IN THE FUTURE, WHICH COULD CAUSE

DILUTION TO ALL SHAREHOLDERS.

We may

seek to raise additional equity capital in the future. Any issuance

of additional shares of our common stock will dilute the percentage ownership

interest of all shareholders and may dilute the book value per share of our

common stock.

WE RELY

ON THIRD PARTY INDUSTRY VENDORS FOR MANUFACTURING SERVICES AND PROCESSING

FACILITIES.

At this

time, we depend on Shanghai Gold Lighting Company, Ltd. (“SGLC”) headquartered

in Shanghai, China for all merchandise, manufacturing and equipment produced and

sold by us. Should we cease to do business with our sole manufacturer

or should SGLC cease to do business and is unable to provide their services to

us, our business may be disrupted because a suitable replacement may be

difficult to retain. While we believe that SGLC’s facilities have the

capacity to meet our current production needs and our current demands, we cannot

be certain that these facilities will continue to meet our needs or future

demands. In addition, these facilities are subject to certain risks of damage,

including fire that would disrupt production of our products. To the extent we

are forced to find alternate facilities, it would likely involve delays in

manufacturing and potentially significant costs

WE DEPEND

ON A LIMITED NUMBER OF CUSTOMERS FOR A SIGNIFICANT PERCENTAGE OF OUR REVENUES,

AND ANY LOSS CANCELLATION, REDUCTION OR DELAY IN PURCHASES BY THESE CUSTOMERS

COULD HARM OUR BUSINESS.

A limited

number of customers have, historically, consistently accounted for a significant

portion of our revenues. For the fiscal year ended December 31, 2007, we had one

customer account for 23% of our sales and 38% of our outstanding accounts

receivable and as of March 31, 2008, we had two customers who accounted for 61%

of sales and 57% of outstanding accounts receivable. For the

fiscal year ended December 31, 2006, we had two customers account for 50% of our

sales and 58% of our outstanding accounts receivables. Revenues from our major

customer may decline or fluctuate significantly in the future. We are attempting

to expand our customer base by entering into working agreements with large

wholesale distributors and manufacturers. Accordingly, our success will depend

on our ability to develop and manage relationships with our distributors and

utility companies who market and utilize our ballasts, and we expect that the

majority of our revenues will continue to depend on sales of our products to a

limited number of customers for the foreseeable future. We may not be able to

offset any decline in revenues from our existing major customer with revenues

from new customers or other existing customers. Because of our reliance on a

limited number of customers, any decrease in revenues from, or loss of, one or

more of these customers without a corresponding increase in revenues from other

customers would harm our business, operating results and financial condition. In

addition, any negative developments in the business of our existing significant

customer could result in significantly decreased sales to this customer, which

could seriously harm our business, operating results and financial

condition.

RISK

FACTORS CONCERNING INVESTMENT IN OUR COMPANY:

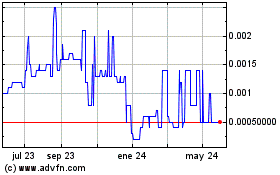

THERE IS

ONLY A LIMITED PUBLIC MARKET FOR OUR SHARES, AND IF AN ACTIVE MARKET DOES NOT

DEVELOP, INVESTORS MAY HAVE DIFFICULTY SELLING THEIR SHARES.

There is

a limited public market for our common stock. We cannot predict the

extent to which investor interest in the

Company will lead to the development of an

active trading market or how liquid

that trading market might become. If a trading market does not

develop or is not sustained, it may be difficult for investors to sell shares of

our common stock at a price that is attractive. As a result, an

investment in our common stock may be illiquid and investors may not be able to

liquidate their investment readily or at all when he/she desires to

sell.

OUR

COMMON STOCK IS DEEMED TO BE "PENNY STOCK," WHICH MAY MAKE IT MORE DIFFICULT FOR

INVESTORS TO SELL THEIR SHARES DUE TO SUITABILITY REQUIREMENTS.

The SEC

has adopted regulations that define a “penny stock”, generally, to be an equity

security that has a market price of less than $5.00 per share or an exercise

price of less than $5.00 per share, subject to specific exemptions. The market

price of our common stock has been less than $5.00 per share. This designation

requires any broker or dealer selling our securities to disclose certain

information concerning the transaction, obtain a written agreement from the

purchaser and determine that the purchaser is reasonably suitable to purchase

the securities. These rules may restrict the ability of brokers or dealers to

sell our common stock and may affect the ability of stockholders to sell their

shares. In addition, since our common stock is currently quoted on the Pink

Sheets, stockholders may find it difficult to obtain accurate quotations of our

common stock, may experience a lack of buyers to purchase our shares or a lack

of market makers to support the stock price.

FUTURE

SALES BY OUR STOCKHOLDERS MAY ADVERSELY AFFECT OUR STOCK PRICE AND OUR ABILITY

TO RAISE FUNDS IN NEW STOCK OFFERINGS.

Sales of

our common stock in the public market could lower our market price for our

common stock. Sales may also make it more difficult for us to sell equity

securities or equity-related securities in the future at a time and price

that management deems acceptable or at all.

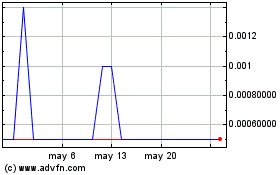

THERE IS

LIMITED LIQUIDITY IN OUR SHARES.

Historically,

the volume of trading in our common stock has been low. A more active public

market for our common stock may not develop or, even if it does in fact develop,

may not be sustainable. The market price of our common stock may fluctuate

significantly in response to factors, some of which are beyond our control.

These factors include:

|

|

·

|

the

announcement of new products or product enhancements by us or our

competitors;

|

|

|

·

|

developments

concerning intellectual property rights and regulatory

approvals;

|

|

|

·

|

quarterly

variations in our results of operations or the results of operations of

our competitors;

|

|

|

·

|

developments

in our industry; and

|

|

|

·

|

general

market conditions and other factors, including factors unrelated to our

own operating performance.

|

Recently,

the stock market in general has experienced extreme price and volume

fluctuations. Continued market fluctuations could result in extreme volatility

in the price of shares of our common stock, which could cause a decline in the

value of our shares. Price volatility may be worse if the trading volume of our

common stock is low.

THE CONCENTRATED OWNERSHIP OF OUR

CAPITAL STOCK

MAY

BE AT ODDS WITH YOUR INTERESTS,

AND

HAVE THE EFFECT OF DELAYING OR

PREVENTING A CHANGE IN CONTROL OF OUR COMPANY.

Our

common stock ownership is highly concentrated. Our directors,

officers, key personnel and their affiliates as a group beneficially own or

control the vote of approximately 52% of our outstanding capital stock, and

control the Company. They will be able to continue to exercise significant

influence over all matters affecting the Company, including the election of

directors, formation and execution of business strategy and approval of mergers,

acquisitions and other significant corporate transactions, which may have an

adverse effect on the stock price. They may have conflicts of interest and

interests that are not aligned with yours in all respects. As a

result of the concentrated ownership of our stock, a relatively small number of

shareholders, acting together, will be able to control all matters requiring

shareholder approval. This concentration of ownership may have the

effect of delaying, preventing or deterring a change in control of our company.

It may affect the market price of our common stock

Item

2. Financial Information.

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

The

following information should be read in conjunction with the financial

statements and notes thereto appearing elsewhere in this Form

10. This discussion contains forward-looking statements about our

future expectations and are within the meaning of applicable federal securities

laws, and are not guarantees of future performance. When used herein,

the words “may,” “should,” “anticipate,” “believe,” “appear,” “intend,” “plan,”

“expect,” “estimate,” “approximate” and similar expressions are intended to

identify such forward-looking statements. These statements involve

risks and uncertainties inherent in our business, including those set forth

under the caption “Risk Factors,” appearing elsewhere in this disclosure

statement, and are subject to change at any time. Our actual results

could differ materially from these forward-looking statements. We

undertake no obligation to update publically any forward-looking

statement.

Overview.

We are in

the business of developing and marketing energy-saving electronic components for

the commercial lighting sector. Our primary products are self-contained

electronic, dimming and daylight harvesting, fluorescent ballasts. A “ballast”

is an electronic component that regulates voltage in lighting. We

develop, test, and patent unique technology to create energy efficient products

that meet federal energy code standards and encourage Green initiatives for

high-profile companies. Extensive testing is conducted to ensure

product reliability and energy-saving properties. We have obtained

and own the patent rights for our ballasts’ unique control system and have

trademarked our slogan “The Future of Fluorescent Lighting”. UL (Underwriters

Laboratory), the lighting industry’s certification authority, has approved our

products for use in the United States and Canada.

Our

current and primary product is the patented T8 Axis Daylight Harvesting Dimming

Ballast. This ballast uses simple technology that transforms the

standard ballast, into a dynamic energy saving system that can reduce lighting

energy costs by up to 70%. The Axis Ballast utilizes an individual

photo sensor to automatically adjust the amount of electrical current flowing to

the light fixture and then dims or increases lighting in conjunction with the

amount of available sunlight. The Axis Ballast is the only ballast on

the market that has automatic dimming controls integrated into each

ballast. This feature reduces the costs of acquisition and

installation by up to two-thirds over that of competing dimming

systems.

We have

developed a high-output T5HO ballast that capitalizes on the features of our

current T8 Axis Ballast. This ballast is in the process of being

submitted to UL for testing and approval.

We plan

to introduce a line of dimming and daylight harvesting ballasts that would

support and complement T5 lamps. The T5 lamps are used mainly in

“high-bay” fixtures which are installed in warehouses, gymnasiums, etc. in

conjunction with Skylights. Because skylights are frequently

installed in this type of application, the T5 lamp that is provided by Axis

would be an applicable choice to serve as an economical dimming

ballast.

Our next

generation ballast is a wirelessly addressable, load shedding ballast, which

offers power companies the ability to reduce the lighting load (load shedding)

for their customers during peak demand periods. Most utility

companies charge their customers a surcharge or “peak demand” charge during

those times of day when the load on the power plants are at the

highest. Usually this means the power companies must start up higher

cost generators, and/or buy power from the electrical grid at even higher

rates. This ballast allows the consumer or the power company to

reduce the output of the ballast. The consumer who installs this

ballast can agree to participate in the power company’s Peak Demand Reduction

Program which can offer reduced electric rates. This ballast is being

developed through our affiliate membership with the California Lighting

Technology Center (CLTC) at the University of California,

Davis. Additionally, several utility companies have expressed

interest in working with us to complete the development of the load shedding

ballasts in order to provide for the installation of the ballasts in their

customers' facilities.

The U.S.

Government has mandated that power companies nation-wide reduce their greenhouse

gas emissions and reduce energy consumption. There are many states

that have passed legislation that require lighting controls, and in some cases

(California for example), there are requirements that new construction projects

and major lighting retrofits incorporate daylight harvesting. These

regulations are specific to lighting, and there are many further regulations in

place from cities and states, that require government buildings to save a

certain amount of all forms of energy by specified dates. We believe

that the Axis dimming ballast system can help greatly in achieving these

energy-reduction goals.

Our

target market is small to large commercial users of fluorescent lighting

including office buildings, wholesale and retail buildings, hospitals, schools

and government buildings. In order to achieve our sales goals, we

have contracted with sales representatives, electrical distributors, electrical

contractors, retrofitters, ESCO’s (Energy Service Companies), and OEM’s

(Original Equipment Manufacturers) to market, distribute and install the

Company’s products.

Our

revenues consist primarily of sales of our T8 fluorescent ballasts to electrical

distributors and OEM’s for placement in commercial and governmental

buildings. Our next generation ballast is expected to be sold

primarily to utility companies in addition to our existing customer

market.

Recent

increases in energy costs have spurred many government agencies and private

companies to work towards decreasing their energy consumption. This

“green” movement has helped to increase the awareness of our

product. Our company is dedicated to helping our nation reduce its

energy consumption and greenhouse gas emissions.

Results

of Operation

For the Year Ended

December 31,

2007

:

Consolidated

net sales for the years ended December 31, 2007 and 2006 totaled $162,195 and

$157,857, respectively. Net sales increased $4,338 or 3%. There was

limited growth in 2007 as the Company was focusing its efforts on the

integrating our product into utility rebate programs and additional product

development. The primary nature of a utility rebate program is through a

prescriptive dollar amount, per ballast, given to the end user (building owner)

for the purchase of a ballast. An alternative method is a calculated

rebate based on the total project cost, and produced energy savings, paid as a

lump sum for the project. In some cases, the utility purchases the

product, and then supplies it at no cost to the end user. Cost of

goods sold for the years ended December 31, 2007 and 2006 was $126,589 and

$118,352, respectively. After deducting costs of goods sold,

including warehouse salaries and allocated overhead, we finished the year with

$35,606 in gross profit, compared to $39,505 for 2006. This decrease in gross

profit of $3,899 was primarily related to an isolated warranty

claim.

For the

year ended December 31, 2007, operating expenses increased $388,670 or 96% to

$792,474. The increase in operating expenses is a result of our continued

efforts to enhance our current product, develop our next generation products,

and in building market awareness of our company and

products. Compared to a year ago, we have seen increases in salaries,

sales & marketing efforts and professional fees.

For the

year ended December 31, 2007, interest expense was $20,845 compared to $74,500

for the prior period. This decrease of $53,655 was primarily the

result of paying off some higher interest rate debt early on in

2007.

For the

year ended December 31, 2007, the net loss was $775,019 compared to a net loss

of $438,799 for the year ended December 31, 2006.

Three-month period from

April 1,

2008

to

June 30,

2008

:

Consolidated

net sales for the three months ended June 30, 2008 and 2007 totaled $163,083 and

$35,070, respectively, for an increase of $128,013. This increase is due to

increased sales to a distributor working with utility companies and their rebate

programs. Cost of goods sold for the three months ended June 30, 2008 and 2007

was $150,372 and $27,085, respectively. The increase is primarily due to our

increase in sales. After deducting costs of goods sold, including warehouse

salaries and allocated overhead, we finished the three months ended June 30,

2008 with $12,711 in gross profit, compared to a gross profit of $7,985 for the

three months ended June 30, 2007.

For

the three months ended June 30, 2008, operating expenses totaled $218,180

compared to $212,297 for the three months ended June 30, 2007.

For

the three months ended June 30, 2008, interest expense was $559,030 compared to

$5,043 for the three months ended June 30, 2007. This increase of

$553,987 was the result of the Company issuing a convertible note

payable. The details of this note are listed below.

For

the three months ended June 30, 2008, the net loss was $762,054 compared to a

net loss of $207,574 for the three months ended June 30, 2007.

Six-month period from

January 1, 2008 to June 30, 2008

:

Consolidated

net sales for the six months ended June 30, 2008 and 2007 totaled $285,792 and

$42,478, respectively, for an increase of $243,314. This increase is due to

increased sales to a distributor working with utility companies and their rebate

programs. Cost of goods sold for the six months ended June 30, 2008 and 2007 was

$246,741 and $48,302, respectively. The increase is primarily due to our

increase in sales. After deducting costs of goods sold, including warehouse

salaries and allocated overhead, we finished the six months ended June 30, 2008

with $39,051 in gross profit, compared to a negative gross profit of $5,824 for

the six months ended June 30, 2007.

For

the six months ended June 30, 2008, operating expenses totaled $364,348 compared

to $451,678 for the six months ended June 30, 2007. This decrease was the result

of lower salaries paid to employees and lower advertising expenses due to

reduced public relations costs.

For

the six months ended June 30, 2008, interest expense was $561,950 compared to

$12,101 for the six months ended June 30, 2007. This increase of

$549,849 was the result of the Company issuing a convertible note

payable. The details of this note are listed below.

Assets

and Employees; Research and Development

At

December 31, 2007 our ballast inventory represents 68% of our assets. Inventory

is manufactured in China and is shipped to our warehouse in Lincoln,

Nebraska. The time from ordering the product to receipt of the

product can exceed 90 days. We are currently working to reduce this

turnaround time to 60 days. We maintain our inventory at levels that

are deemed reasonable based upon projected sales.

At this

time, we do not anticipate purchasing or selling any significant equipment or

other assets in the near term. Neither do we anticipate any imminent or

significant changes in the number of our employees. We may, however, increase

the number of independent sales representatives in the event that we expand into

other markets or our current market significantly increases.

We expect

that we will invest time, effort, and expense in the continued development and

refinement of our current and next generation ballasts, through our relationship

with CLTC and the power companies.

Liquidity

and Capital Resources; Anticipated Financing Needs

For the Year Ended

December 31,

2007

:

For the

year ended December 31, 2007, we incurred net operating losses aggregating

$775,019 which was the result of funding marketing and advertising, business

development and other activities as discussed above. We funded these operations

primarily through cash of $634,723 received from private placements of our

common stock during the year.

Overall,

we used $763,382 of cash in operating for the year ended December 31, 2007,

compared to $521,215 for the prior year. Cash used in operations for the year

ended December 31, 2007 included a net loss of $775,019, which was offset by

$3,669 of non-cash expenses for depreciation and amortization. Changes in

operating assets and liabilities also offsetting the loss were increases in

accounts payable and other accrued expenses of $98,692 and decreases in prepaid

expense of $33,489. Other changes in operating assets and liabilities increasing

the cash used were an increase in accounts receivable and inventory of $25,218

and $98,995, respectively. Cash used in operations for the year ended December

31, 2006 included a net loss of $438,799 which was increased from a net overall

change in operating assets and liabilities totaling $84,670 with an offset of

non-cash items totaling $2,254. Cash flows used in investing activities included

purchases of equipment of $909 for 2007 compared to $8,005 for 2006. Cash flows

from financing activities for the year ended December 31, 2007 was $582,569

compared to $706,276 for the prior year. Cash flows from financing activities

for 2007 included issuance of common stock for $634,723 offset by payments on

the bank note of $52,154. In 2006, the Company received stock proceeds of

$1,015,548 offset by note payments of $309,272.

For the Six Months Ended

June 30, 2008

Cash

of $335,528 was used in operating activities during the six months ended June

30, 2008, compared to $512,731 in cash used for the six months ended June 30,

2007. Cash provided by operations, for the six months ended June 30, 2008,

included a net loss of $884,794, which included $555,865 of non-cash expenses

for stock issued for services, depreciation, amortization, share-based

compensation, and interest expense related to the issuance of warrants. Changes

in operating assets and liabilities contributing to the use of cash primarily

included increases in accounts receivable and prepaid expenses of $22,123, and a

decrease in accounts payable and accrued salary to officers/stockholders of

$18,212, while an increase in other accrued expenses of $184 and a decrease in

inventory and inventory deposits of $33,552 offset the loss from operations.

Cash used in operations for the six months ended June 30, 2007 included a net

loss of $467,556 in addition to an overall net decrease in operating assets and

liabilities which totaled $46,690.

Cash

flows used in investing activities for the six months ended June 30, 2008

totaled $1,094, compared to $908 used for the six months ended June 30, 2007.

Cash flows from financing activities for the six months ended June 30, 2008

included debt issuance costs incurred of $203,572 and payments on the bank note

of $195,074, offset by cash proceeds from debt issuance of

$1,218,000. Cash flows from financing activities for the six months

ended June 30, 2007 included the issuance of common stock for $435,135 offset by

payments on the bank note of $51,990. The Company’s cash balance as

of June 30, 2008 is $497,260.

On April

25, 2008, the Company issued a convertible debt instrument generating net cash

proceeds of $1,218,000 for working capital purposes and to pay off the Company’s

bank note which was due on June 10, 2008. The convertible note

payable is a 10% Senior Secured Convertible Promissory Note in the principal

amount of $1,388,889. The face amount of the note of $1,388,889 was reduced by

an original issue discount of $138,889 and other issuance costs of $32,000 to

arrive at net proceeds of $1,218,000. The note has a maturity date of

April 25, 2010 and is secured by all assets of the Company. The note accrues

interest at a rate of 10% per annum, and such interest is payable on a quarterly

basis commencing July 26, 2008, with the principal balance of the Note, together

with any accrued and unpaid interest thereon, due in twelve monthly installments

beginning May 1, 2009. The note is convertible at the option of the holder at

any time into shares of the Company's common stock at an initial conversion

price of $0.26 per share.

Under

the terms of the Note and as additional consideration for the loan, the Company

issued a five-year warrant to purchase up to 5,341,880 shares of its common

stock at an exercise price of $0.26 per share which was deemed to have a fair

market value of $861,778. As a result of the warrant being issued

with the Note, a beneficial conversion feature was determined to be embedded in

the Note. The Company calculated the intrinsic value of the

beneficial conversion feature and as it exceeded the fair value

allocated to the Note, the amount of the beneficial conversion feature to be

recorded was limited to the proceeds allocated to the Note. Accordingly, the

beneficial conversion feature was calculated to be $388,222 and was recorded as

an additional discount on the Note. Since the Note was convertible on

the issuance date, the entire beneficial conversion feature cost was charged to

interest expense immediately.

Non-cash

interest expense for the six months ended June 30, 2008 of $531,145 is

attributable to the immediate amortization of the beneficial conversion feature

and the amortization of debt issuance costs and warrant

discounts.

In

addition to the net proceeds of $1,218,000 received from the convertible debt

issuance on April 25, 2008 and anticipated revenue increases from the sale of

our current ballasts, we expect to seek additional capital funding in the amount

of approximately $500,000 for the final development and introduction of our next

generation ballast, as well as for the purchase of adequate

inventory. Assuming that we successfully obtain additional funding,

we believe that such funding will be sufficient to finance our operations

through December 31, 2009. Thereafter, we believe that revenues from our current

and next generation products will be sufficient to fund

operations.

Additional

financing may not be available on terms favorable to us, especially in light of

current debt and equity markets. If additional funds are raised by the issuance

of our equity securities, such as through the issuance and/or exercise of common

stock warrants, then existing stockholders will experience dilution of their

ownership interest. If additional funds are raised by the issuance of debt or

other types of (typically preferred) equity instruments, then we may be subject

to certain limitations in our operations, and issuance of such securities may

have rights senior to those of the then existing holders of our common stock. If

adequate funds are not available or not available on acceptable terms, we may be

unable to fund expansion, develop or enhance products or respond to competitive

pressures.

Item

3. Properties.

The

Company currently has one (1) office located in Lincoln NE. The

address is as follows:

2055

South Folsom

Lincoln,

NE 68522

On March

1, 2003, the Company leased the office warehouse location, comprised of

approximately 2,800 square feet of space which is held under a 36 month lease at

a rate of approximately $1,300 per month (with payments started in March

2003). The Company currently leases this office warehouse location on

a month-to-month basis at a current rate of $1,302 per month. The

Company uses 1,000 square feet as their corporate office and 1,800 square feet

of warehouse with additional square footage as needed. The Company believes that

these properties are adequate for its corporate office and operational needs at

this time.

Item

4. Security Ownership of Certain Beneficial Owners and

Management.

The

following table shows the beneficial ownership of our common stock as

of September 11, 2008. The table shows the amount of shares owned

by:

(1) each

person known to us who owns beneficially more than five

percent of the outstanding shares of any class of the Company's stock,

based on the number of shares outstanding as of September

11, 2008;

(2) each

of the Company's Directors and Executive

Officers; and

(3) all of its Directors and Executive Officers as a group.

The

percentage of shares owned is based on 62,267,767 shares being outstanding as

of September 11, 2008. Where the beneficially owned shares

of any individual or group in the following table includes any

options, warrants, or other rights to

purchase shares in the Company's stock, the

percentage of shares owned includes such shares as if the right to

purchase had been duly exercised.

|

Title

of Class

|

Name

and Address of Beneficial Owner

|

Amount

and Nature of Beneficial Ownership

|

Percent

of Class

|

|

Common

|

Kipton P. Hirschbach

|

10,663,507

|

17.12%

|

|

|

Director/CEO

|

|

|

|

|

2055

South Folsom

|

|

|

|

|

Lincoln,

NE 68522

|

|

|

|

Common

|

Jim Erickson

|

10,663,507

|

17.12%

|

|

|

Director/President/Principal

Financial

|

|

|

|

|

Officer

|

|

|

|

|

2055

South Folsom

|

|

|

|

|

Lincoln,

NE 68522

|

|

|

|

Common

|

John F. Hanson

|

10,663,507

|

17.12%

|

|

|

Director

|

|

|

|

|

3410

N. 140

th

Street

|

|

|

|

|

Omaha,

NE 68154

|

|

|

|

Common

|

David P. Petersen

|

131,091

(1)

|

0.21%

|

|

|

Director

|

|

|

|

|

17162

O Street

|

|

|

|

|

Omaha,

NE 68135-1423

|

|

|

|

Common

|

All

Directors and Officers as a Group

|

32,121,612

|

51.58%

|

|

|

(a

total of 4)

|

|

|

|

Common

|

Mark B. Gruenewald

|

10,663,507

|

17.12%

|

|

|

4215 So. 147

th

Plaza,

#102

|

|

|

|

|

Omaha,

NE 68137

|

|

|

______________________

(1)

Includes 60,000 shares due

MPC Capital Funding, Inc. in which Mr. Petersen has shared voting and

investment power, which have not yet been issued.

Item

5. Directors and Executive Officers.

The

following table sets forth the names, ages, and positions of our current

directors and executive officers. Our Board of Directors elects our executive

officers annually. Our directors serve one-year terms or until their successors

are elected, qualified and accept their positions. The executive officers serve

terms of one year or until their death, resignation or removal by the Board of

Directors. There are no family relationships or understandings between any of

the directors and executive officers. In addition, there was no arrangement or

understanding between any executive officer and any other person pursuant to

which any person was selected as an executive officer.

|

Name

|

Age

|

Position

|

|

|

|

|

|

Kipton P. Hirschbach

|

63

|

Director,

Chief Executive Officer

|

|

Jim Erickson

|

44

|

Director,

President, Principal Financial Officer

|

|

John F. Hanson

|

45

|

Director

|

|

David P. Petersen

|

51

|

Director

|

Mr. Kipton P.

Hirschbach

serves and has served as the CEO, Secretary/Treasurer and

director of Axis Technologies, Inc. since February 2003 and of Axis Technologies

Group, Inc. since October 2006. Prior to joining Axis,

Mr. Hirschbach was operations and later general manager of Gillette Dairy,

Inc., a manufacturer of dairy products, for approximately 23