UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign

Private Issuer

Pursuant to Rules 13a-16

or 15d-16 under

the Securities

Exchange Act of 1934

For the month

of November 2023

Commission File

Number: 001-37909

AZURE POWER GLOBAL LIMITED

5th Floor, Southern Park, D-II,

Saket Place, Saket, New Delhi 110017, India

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Background

In August 2023, Azure

Power Solar Energy Private Limited and Azure Power Energy Ltd (the “Companies” or “Azure”) received a proposal

from certain noteholders (“Noteholders”) holding a certain amount of US$350,101,000 5.65% Senior Notes due 2024 issued by

Azure Power Solar Energy Private Limited (the “2024 Notes”) and US$414,000,000 3.575% Senior Notes due 2026 issued by Azure

Power Energy Ltd (the “2026 Notes,” and together with the 2024 Notes, the “Notes”) suggesting that the Companies

should consider a consent solicitation in connection with the Notes (the “Consent Solicitation”).

Azure does not believe

that it requires any Consent Solicitation in order for it to remain in compliance with its obligations under the Notes but considers that

it might be worth undertaking such a transaction.

In this regard, in order

to progress discussions with the Noteholders, Azure entered into a confidentiality agreement with the Noteholders, whereby Azure agreed

to disclose certain information to the Noteholders, and Azure would cleanse

the non-public information by way of an announcement after a specified period, such non-public information to include but not limited

to (i) that the Companies and the Noteholders have engaged in discussions concerning the Consent Solicitation, and (ii) certain

confidential information which constitute material non-public information which was provided by Azure to the Noteholders. Azure is furnishing

the information included in this Report on Form 6-K to satisfy its disclosure obligations under the confidentiality agreement.

Updates Regarding

Consent Solicitation

Further to

discussions with the Noteholders about the terms of a potential Consent Solicitation, the Companies launched such Consent

Solicitation on November 28, 2023.

The terms of the Consent

Solicitation include:

| ● | an undertaking to make a tender offer (i) to purchase an outstanding principal amount of

U.S.$40,000,000 of the 2024 Notes by March 2024, (ii) to purchase an outstanding principal amount of U.S.$12,000,000 of the 2026

Notes by March 2024 and an outstanding principal amount of U.S.$8,000,000 of the 2026 Notes by August 2024; |

| ● | certain amendments with respect to the reporting covenant of the

indentures governing the 2024 Notes and the 2026 Notes, as well as certain confirmations to be provided by Noteholders with

respect to such indentures; and |

| ● | certain amendments to the restricted payments and limitations on amendments of onshore debt covenants

in the indenture governing the 2024 Notes to allow for the implementation of a cash-neutral intercompany transaction. |

Noteholders should refer to the Consent Solicitation Statement

for the relevant terms of the Consent Solicitation as well as instructions on how consents may be submitted in respect of the

same. A copy of the Consent Solicitation Statement is attached to this Report on Form 6-K as Exhibit 99.1.

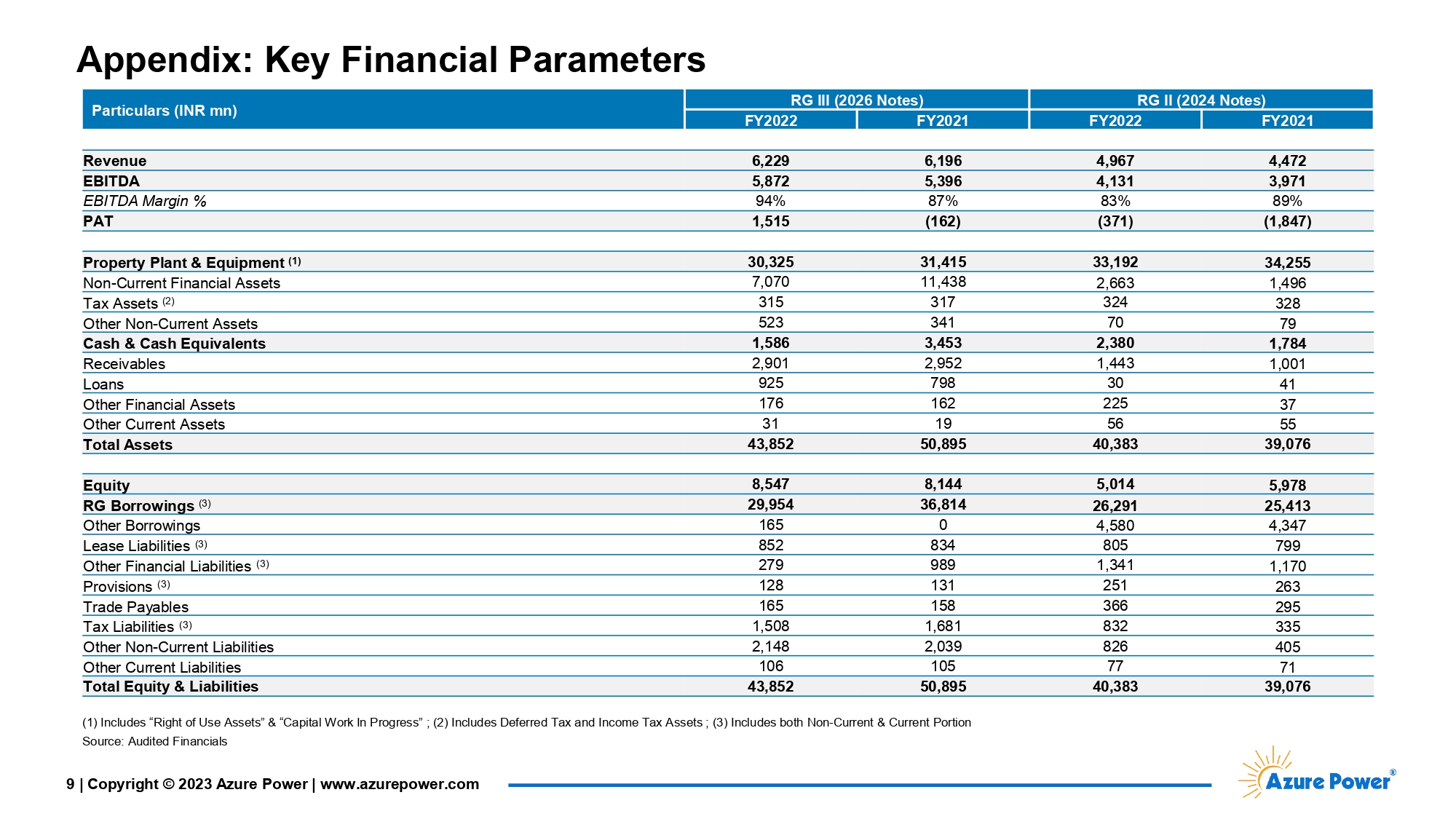

In addition, the Companies

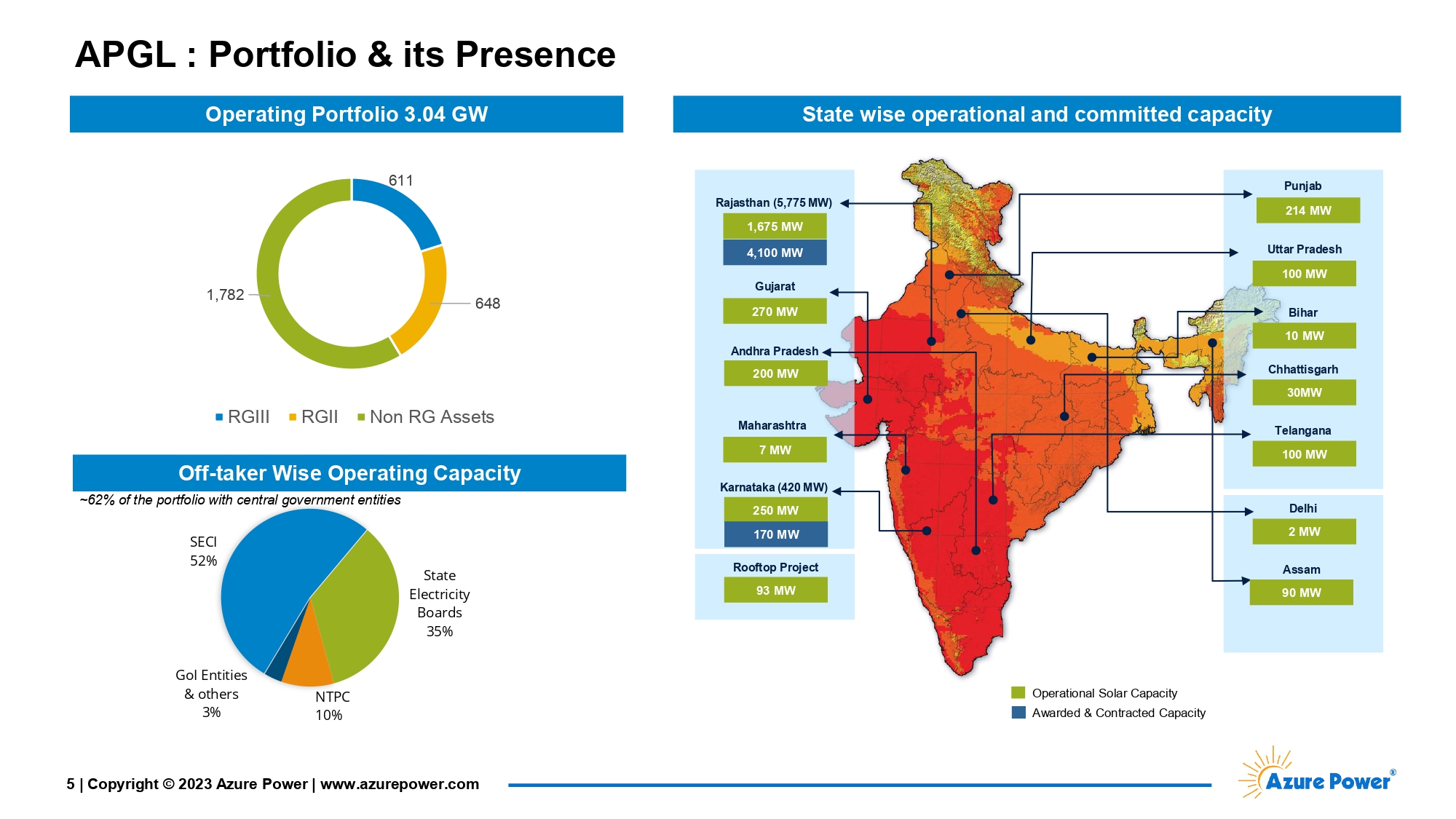

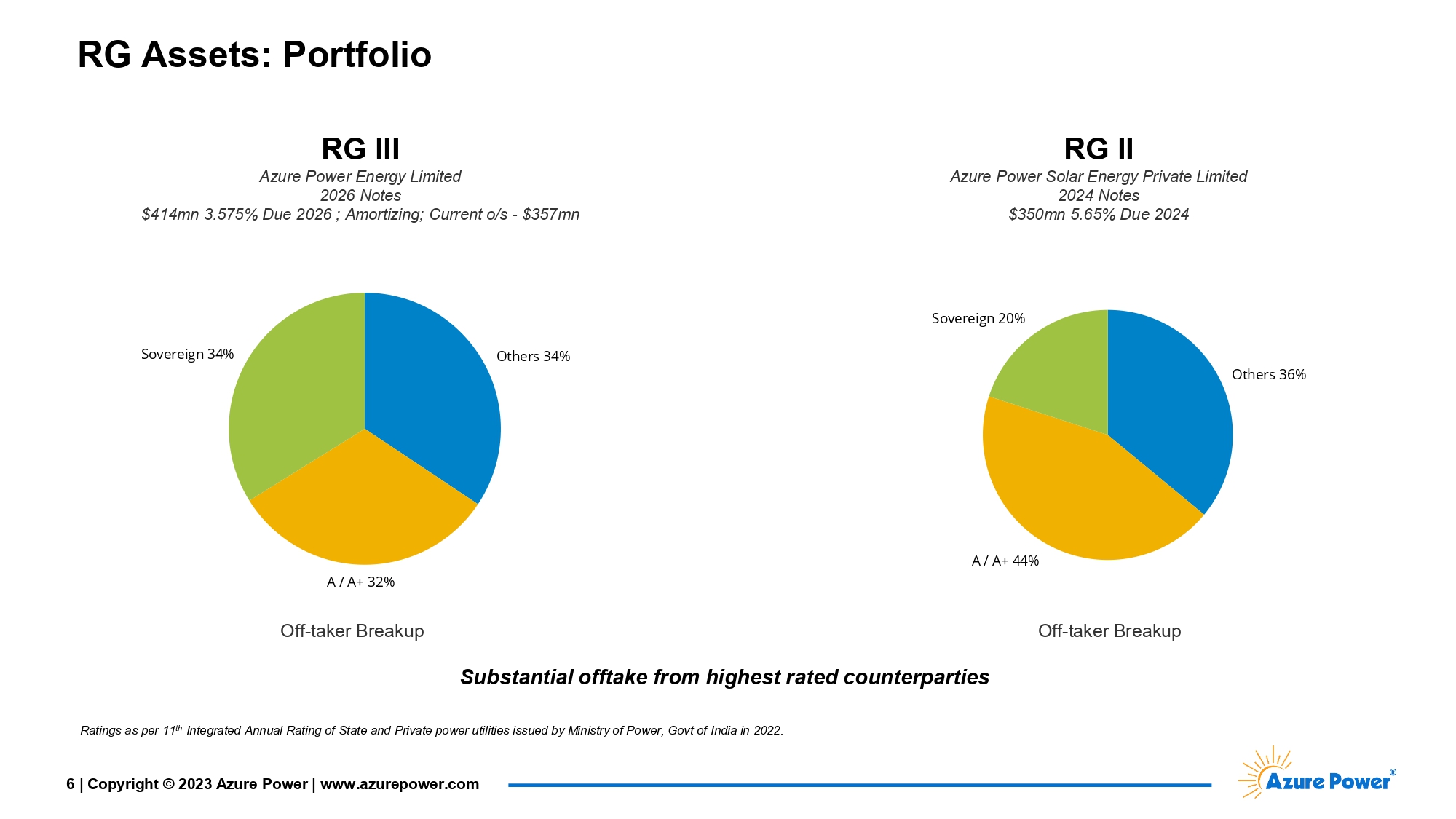

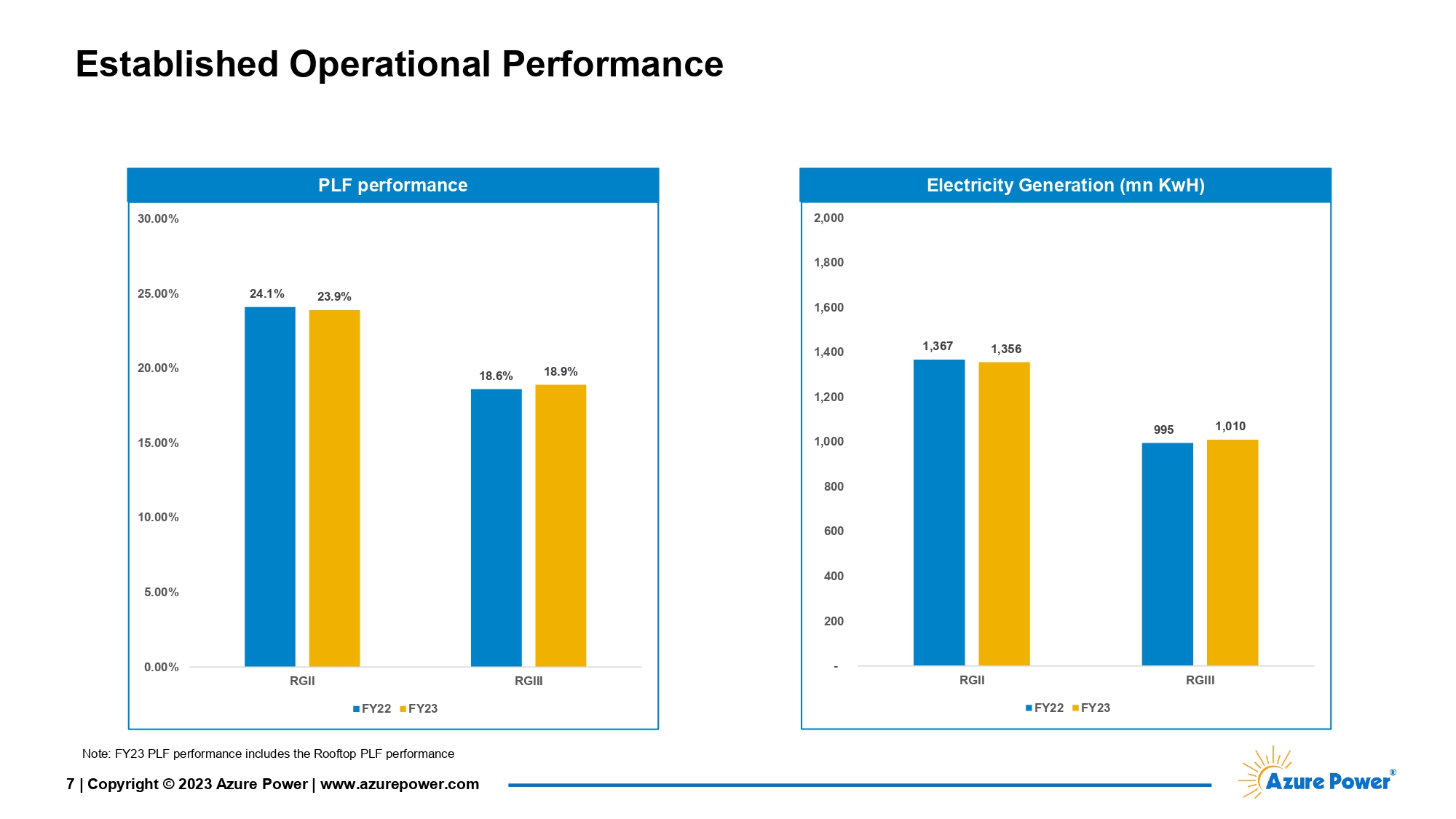

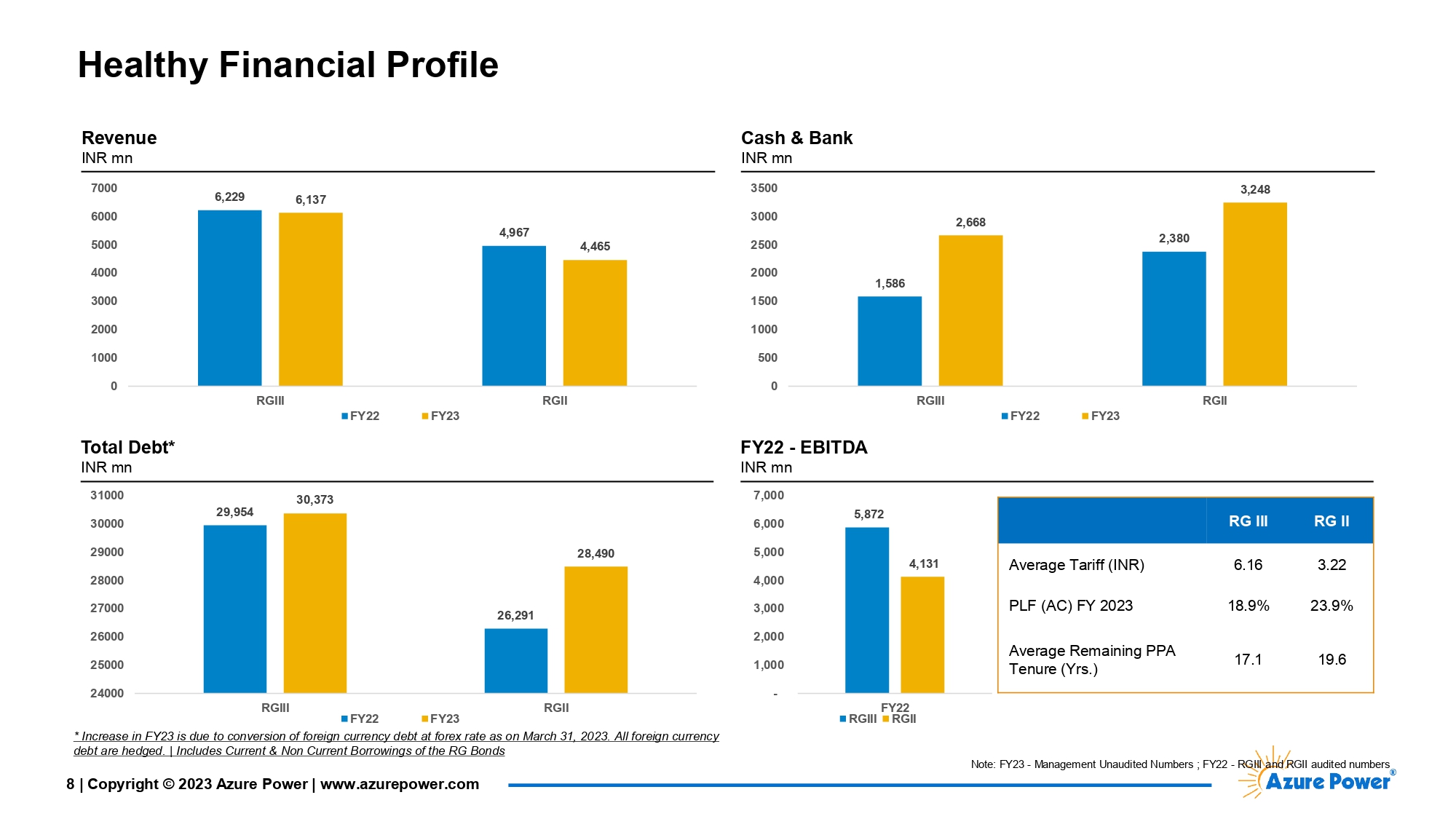

have provided certain confidential information to the Noteholders with respect to (1) the unaudited financial data of Azure Power Solar

Energy Private Limited and the other restricted subsidiaries under the indenture governing the 2024 Notes (“RG-II”), and (2)

the unaudited financial data of Azure Power Energy Limited and the other restricted subsidiaries under the indenture governing the 2026

Notes (“RG-III”) (collectively, the “Confidential Information”), set forth below.

| |

a) |

As of September 30, 2023, the cash and bank balance (including non-current) of RG-II was INR 3,654 million. |

| |

b) |

As of September 30, 2023, the cash and bank balance (including non-current) of RG-III was INR 3,279 million. |

Investor Update

Azure is also providing certain business and financial updates to investors. A copy of the investor presentation is attached to this Report

on Form 6-K as Exhibit 99.2.

Forward-Looking Statements

This Report contains

forward-looking statements. Forward-looking statements can be identified by the use of words such as “may,” “should,”

“expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“intends,” “continue” or similar terminology. These statements reflect only Azure’s current expectations

and are not guarantees of future events. These statements are subject to risks and uncertainties that could cause actual results and events

to differ materially from those contained in the forward-looking statements. Such risks and uncertainties include, but are not limited

to, Azure’s ability to negotiate and execute any definitive agreement with respect to the proposed Consent Solicitation and obtaining

required consents and satisfying other conditions precedent for the Consent Solicitation which may be outside Azure’s control. These

forward-looking statements speak only as of the date on which the statements were made. Azure undertakes no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

EXHIBIT INDEX

The following exhibit is furnished as part of this Current Report on

Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: November 28, 2023 |

| |

| |

|

AZURE POWER GLOBAL LIMITED |

| |

| |

|

By: |

/s/ Sugata Sircar |

| |

|

Name: |

Sugata Sircar |

| |

|

Title: |

Group Chief Financial Officer |

3

Exhibit 99.1

IMPORTANT: You must read

the following disclaimer before continuing. The following disclaimer applies to the attached consent solicitation statement (the “Consent

Solicitation Statement”), whether received by e-mail or otherwise received as a result of electronic communication and you are

therefore advised to read this disclaimer page carefully before reading, accessing or making any other use of the attached document. By

accessing the attached Consent Solicitation Statement, you agree to be bound by the following terms and conditions, including any modifications

to them from time to time, each time you receive any information from the Issuers (as defined below) as a result of such access.

The attached Consent Solicitation

Statement should not be forwarded or distributed to any other person and should not be reproduced in any manner whatsoever. Any forwarding,

distribution or reproduction of the Consent Solicitation Statement in whole or in part is unauthorized. Failure to comply with this direction

may result in a violation of applicable laws and regulations.

Confirmation of your

representation: You have been sent the attached Consent Solicitation Statement on the basis that you have confirmed to Barclays Bank

PLC, The Hongkong and Shanghai Banking Corporation Limited and MUFG Securities Asia Limited Singapore Branch (the “Solicitation

Agents”) or their respective affiliates, that (i) you are a holder of the (a) 5.65% Senior Notes due 2024 issued by Azure Power

Solar Energy Private Limited and/or (b) 3.575% Senior Notes due 2026 issued by Azure Power Energy Ltd (each of Azure Power Solar Energy

Private Limited and Azure Power Energy Ltd is herein referred to as the “Issuer” and together, the “Issuers”),

(ii) you are not a Sanctions Restricted Person (as defined in the attached document) and you are not a person to whom it is unlawful to

send the attached Consent Solicitation Statement or to make the proposals contained in the attached Consent Solicitation Statement, in

each case under applicable laws and regulations and (iii) you consent to delivery by electronic transmission.

The Consent Solicitation

Statement has been sent to you in electronic form. You are reminded that documents transmitted via this medium may be altered or changed

during the process of transmission and consequently none of the Issuers, Azure Power Global Limited (the “Parent”),

the Trustee (as defined in the attached document), the Collateral Agents (as defined in the attached document), the Paying Agent (as defined

in the attached document), the Solicitation Agents or any person who controls, or is a director, officer, employee or agent of the Issuers,

the Parent, the Trustee, the Collateral Agents, the Paying Agent or the Solicitation Agents nor any affiliate of any such person accepts

any liability or responsibility whatsoever in respect of any difference between the Consent Solicitation Statement distributed to you

in electronic format and the hard copy version available to you on request from the Solicitation Agents at the address specified at the

end of the attached Consent Solicitation Statement.

You are reminded that the

attached Consent Solicitation Statement has been delivered to you on the basis that you are a person into whose possession this Consent

Solicitation Statement may lawfully be delivered in accordance with the laws of the jurisdiction in which you are located and you may

not nor are you authorized to deliver the attached Consent Solicitation Statement to any other person.

Restrictions: Nothing

in this electronic transmission constitutes an offer to buy, sell or exchange any securities in the United States or any other jurisdiction.

The distribution of this

Consent Solicitation Statement in certain jurisdictions may be restricted by law. Persons into whose possession this Consent Solicitation

Statement comes are required by the Issuers, the Parent, the Trustee, the Collateral Agents, the Paying Agent, the Solicitation Agents

and the Information and Tabulation Agent (as defined in the attached document) to inform themselves about, and to observe, any such restrictions.

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR

IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek your own independent financial

advice immediately from your stockbroker, bank manager, solicitor, accountant or other independent adviser (financial or otherwise).

CONSENT SOLICITATION STATEMENT

Azure

Power Solar Energy Private Limited

Azure

Power Energy Ltd

(each

incorporated in Mauritius with limited liability)

Solicitation

of Consents to amend certain provisions of the Indentures relating to the 2024 Notes and the 2026 Notes

| Notes

Description |

CUSIP

/ ISIN / Common Code |

Principal

Amount |

Consent

Fee |

| Rule

144A |

Regulation

S |

5.65%

Senior Notes due 2024 issued

by Azure Power Solar Energy

Private Limited (the “2024 Notes”) |

CUSIP:

05502TAA6

ISIN: US05502TAA60

Common Code: 199526375 |

CUSIP:

V04008AA2

ISIN: USV04008AA29

Common Code: 199527568 |

US$350,101,000 |

US$6

per US$1,000

principal amount of the Notes |

3.575%

Senior Notes due 2026

issued by Azure Power Energy Ltd

(the “2026 Notes” and, together with

the 2024 Notes, the “Notes”) |

CUSIP:

05502V AA1

ISIN: US05502VAA17

Common Code: 237768736 |

CUSIP:

V0002U AA5

ISIN: USV0002UAA52

Common Code: 237768752 |

US$414,000,000(1) |

US$6(2)

per US$1,000

principal amount of the Notes |

| Notes: |

(1) |

The aggregate

principal amount of the 2026 Notes of US$414,000,000 is subject to a pool factor of 0.8631 (the “2026 Notes Pool Factor”)

following partial mandatory amortization redemptions pursuant to the terms and conditions of the 2026 Notes. The aggregate outstanding

principal amount of the 2026 Notes following such partial mandatory amortization redemptions is US$357,323,400. |

| |

(2) |

The Consent Fee for the

2026 Notes will be paid following the application of the 2026 Notes Pool Factor. |

This consent solicitation statement dated November

28, 2023 (the “Consent Solicitation Statement”) contains details of (i) proposed amendments (the “Proposed

Amendments”) to the terms of (A) the indenture dated as of September 24, 2019 (the “2024 Indenture”) among

Azure Power Solar Energy Private Limited as issuer, Azure Power Global Limited as parent (the “Parent”) and HSBC Bank

U.S.A., National Association, as trustee (the “Trustee”), notes collateral agent (the “Notes Collateral Agent”)

and common collateral agent (the “Common Collateral Agent” and together with the Notes Collateral Agent, the “Collateral

Agents”), and (B) the indenture dated as of August 19, 2021 (the “2026 Indenture” and together with the

2024 Indenture, the “Indentures”) among the Azure Power Energy Ltd as issuer (each of Azure Power Solar Energy Private

Limited and Azure Power Energy Ltd is herein referred to as the “Issuer” and together, the “Issuers”

or “we” or “us”), the Parent, the Trustee and the Common Collateral Agent and (ii) the consent offer to the holders

of the Notes (the “Noteholders”) described herein. HSBC Bank U.S.A., National Association was appointed as the paying

agent, transfer agent and registrar (the “Paying Agent”) with respect to the 2024 Notes and the 2026 Notes. Capitalized

terms used but not defined herein shall, unless the context otherwise requires, have the meaning given to them in the Indentures.

This document is intended to solicit the consent

of the Noteholders (the “Consent”), upon the terms and subject to the conditions set forth in this Consent Solicitation

Statement (as may be amended or supplemented from time to time), to the Proposed Amendments to the Indentures (the “Consent Solicitation”).

See “The Proposed Amendments.” The relevant Issuer will pay, or procure to be paid (via the Paying Agent), a cash payment

of US$6 for each US$1,000 principal amount of Notes (the “Consent Fee”) (rounded to the nearest cent with half a cent

rounded upwards and as adjusted for the 2026 Notes by the 2026 Notes Pool Factor in the case of the 2026 Notes) to Noteholders who have

properly delivered valid Consents with respect to the 2024 Notes or the 2026 Notes on or before 5:00 p.m. New York City time, on December

7, 2023, unless extended by the Issuers in their sole discretion (the “Consent Expiration Deadline”), subject to the

satisfaction of the conditions set forth herein, including the Requisite Consent Condition (as defined herein). The Consent Fee will be

paid as soon as reasonably practicable following the Consent Expiration Deadline, but in any event by no later than December 18, 2023

(the “Consent Settlement Date”).

The “Requisite Consent Condition”

refers to the receipt of valid Consents with respect to a majority in aggregate principal amount of each of the outstanding 2024 Notes

and 2026 Notes (the “Requisite Consents”). The Requisite Consent Condition will not have been satisfied if the Requisite

Consents have been received in one series of Notes but not in the other series of Notes on or prior to the Consent Expiration Deadline.

If the Requisite Consent Condition is not satisfied and/or the other conditions set forth herein are not satisfied or waived in respect

of both series

of Notes, then (i) no Consent Fee will be paid

to any of the Noteholders, irrespective of whether or not such Noteholder has delivered a valid Consent, and (ii) the Proposed Amendments

will not take effect.

Subject to the satisfaction of the Requisite

Consent Condition, and satisfaction or waiver of the General Conditions and other conditions contained in this Consent Solicitation Statement,

each of the Issuers, the Parent, the Trustee and the Collateral Agents may execute a supplemental indenture (each a “Supplemental

Indenture” and together, the “Supplemental Indentures”) to each of the Indentures implementing the Proposed

Amendments promptly following the Consent Expiration Deadline. The Supplemental Indentures will become effective upon execution, but

the Proposed Amendments will not become operative until the Consent Fee for properly delivered Consents is paid by the relevant Issuer

to the relevant Noteholders, which is expected to occur on the Consent Settlement Date. The provisions of each of the Indentures to be

modified in connection with the Proposed Amendments will remain in effect in the form in which they exist before the effectiveness of

the Proposed Amendments until the Consent Settlement Date, whereupon the Proposed Amendments will be binding on all holders of Notes

that remain outstanding.

Any questions and requests for assistance in

connection with this Consent Solicitation Statement may be directed to Barclays Bank PLC, The Hongkong and Shanghai Banking Corporation

Limited and MUFG Securities Asia Limited Singapore Branch, as the Solicitation Agents for the Consent Solicitation (the “Solicitation

Agents”) at their respective addresses and telephone numbers set forth on the back cover of this Consent Solicitation Statement.

Any questions and requests for assistance with regard to the procedures for participating in this Consent Solicitation or for additional

copies of this Consent Solicitation Statement may be directed to Morrow Sodali Limited, as the information and tabulation agent for the

Consent Solicitation (the “Information and Tabulation Agent”), at its address and telephone number set forth on the

back cover of this Consent Solicitation Statement.

All Noteholders are entitled to deliver Consents.

Any Noteholder wishing to participate in this Consent Solicitation must submit, or arrange to have submitted on its behalf, a valid Consent

to DTC, prior to the Consent Expiration Deadline and before the deadline set by DTC. Only Direct Participants (as defined herein) in

DTC may submit a Consent through DTC. By submitting a valid Consent to DTC, the Direct Participant authorizes the disclosure of their

identity and account details. If you are not a Direct Participant in DTC, you must arrange for the Direct Participant through which you

hold the Notes to submit a Consent on your behalf to DTC prior to the deadline specified by DTC. Where the context requires, the term

“Noteholder” will be deemed to include DTC in the name of Cede & Co., as the registered holder, and participants listed

on the DTC securities position listing where DTC has authorized such DTC participants to deliver Consents as if they were registered

Noteholders in accordance with DTC’s ATOP (as defined herein) procedures.

The Proposed Amendments described in this Consent

Solicitation Statement have been considered by a group of Noteholders who hold, in aggregate, approximately 33.46% of the principal amount

of the 2024 Notes and 32.70% of the principal amount of the 2026 Notes. We believe this group of Noteholders intends to vote in favor

of the Proposed Amendments in respect of their respective holdings of the Notes.

As of the date of this Consent Solicitation Statement,

the 2026 Notes Pool Factor applies to the 2026 Notes such that the outstanding principal amount of the 2026 Notes corresponds to the

2026 Notes Pool Factor multiplied by the nominal amount of the 2026 Notes shown in the records of the Clearing Systems (as defined herein).

The Consent Fee to be paid to each Noteholder

of the 2026 Notes will be subject to the outstanding principal amount of Notes instructed by the relevant Noteholder after the 2026 Notes

Pool Factor has been applied.

Please handle this matter through your broker,

dealer, bank, trust company or other nominee. Beneficial owners of Notes should contact the broker, dealer, commercial bank, trust company

or other nominee through which they hold their Notes to see whether such nominee applies different deadlines to participate in this Consent

Solicitation than those set forth in this Consent Solicitation Statement, and, if so, should follow those deadlines. For more information

regarding the procedures for delivering your Consent, see “Solicitation Procedures” in this Consent Solicitation Statement.

The period during which Consents will be accepted

will commence on November 28, 2023 (“Commencement Date”) and will expire at the Consent Expiration Deadline. Subject to Section

9.04 of each Indenture, a Consent delivered by a Noteholder may not be revoked unless the Consent Expiration Deadline has not occurred

on or before 5:00 p.m. New York City time, on December 11, 2023 (the “Longstop Date”). The Issuers expressly reserve the

right at any time prior to the Consent Expiration Deadline to, provided that the Execution Date has not occurred, (i) terminate or withdraw

this Consent Solicitation whether or not the Requisite Consents have been received, for any reason, (ii) amend the terms of this Consent

Solicitation whether or not the Requisite Consents have been received, provided that the amendments do not adversely affect the rights

or obligations of, or impose any additional obligation on, any Noteholder, (iii) increase the amount of the Consent Fee to be paid pursuant

to this Consent Solicitation, or (iv) waive any of the conditions of this Consent Solicitation, subject to applicable law and terms of

the Indentures. Subject to applicable law, the Issuers may, in their sole discretion, extend the Consent Expiration Deadline from time

to time. The Issuers shall notify the Noteholders of any such extension, amendment, modification, waiver, termination or withdrawal as

set forth below. In the event the Issuers have not received the Requisite Consents on or before the Consent Expiration Deadline, as explained

herein, the Consent Solicitation will be deemed withdrawn. The Supplemental Indentures will become effective upon the execution and delivery

by the relevant Issuer, the Parent, the Trustee and the relevant Collateral Agent of the applicable Supplemental Indenture, provided that

the Proposed Amendments will not become operative until the Consent Fee for properly delivered Consents is paid by the relevant Issuer

to the relevant Noteholders, which is expected to occur on the Consent Settlement Date.

| Solicitation Agents |

| Barclays |

HSBC |

MUFG |

The date of this Consent Solicitation Statement

is November 28, 2023

IMPORTANT

INFORMATION

The Parent and the Issuers

accept responsibility for the information contained in this Consent Solicitation Statement and confirm that, to the best of their knowledge

(having taken all reasonable care to ensure that such is the case), the information contained in this Consent Solicitation Statement is

in accordance with the facts and does not omit anything likely to affect the import of such information.

This document does not constitute

or form part of, and should not be construed as, an offer for sale or subscription of, or a solicitation of any offer to buy or subscribe

for, any securities of the Issuers or any other entity. The distribution of this document and the making of this Consent Solicitation

may nonetheless be restricted by law in certain jurisdictions. Persons into whose possession this document comes are required by the Issuers,

the Parent, the Solicitation Agents, the Information and Tabulation Agent, the Trustee, the Collateral Agents and the Paying Agent to

inform themselves about, and to observe, any such restrictions. None of the Solicitation Agents, the Information and Tabulation Agent,

the Trustee, the Collateral Agents or the Paying Agent (nor their respective directors, employees, officers, agents or affiliates or any

person who controls any of them) will incur any liability for their own failure or the failure of any other person or persons to comply

with the provisions of any such restrictions.

This document does not constitute

and should not be considered as an advertisement, invitation, sale, an offer to sell, offer to purchase, or a solicitation to sell or

solicitation to purchase or subscribe for securities (whether to the public or by way of private placement) within the meaning of the

(Indian) Companies Act, 2013, as amended from time to time or other applicable laws, regulations and guidelines of India, nor shall it

or any part of it form basis of or relied on in connection with any contract, commitment or any investment decision in relation thereto

in India. The notes will not be offered or sold, and have not been offered or sold in India by means of any offering document or other

document or material relating to the notes, directly or indirectly, to any person or to the public in India. This document is not an offer document

or an OM or a “private placement offer cum application letter” or a “prospectus” under the (Indian) Companies Act,

2013, as amended from time to time, the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations,

2018, as amended from time to time or any other applicable law in India and no such document will be circulated or distributed to any

person in India. This document has not been and will not be registered as a “prospectus” or a statement in lieu of prospectus

in respect of a public offer, information memorandum or “private placement offer cum application letter” or any other offering

material with any registrar of companies in India, the Reserve Bank of India, the Securities and Exchange Board of India or any other

statutory or regulatory body of like nature in India, save and except for any information relating to the notes which is mandatorily required

to be disclosed or filed in India under any applicable Indian laws.

This Consent Solicitation

Statement has not been filed with or reviewed by any federal or state securities commission or regulatory authority of any country, nor

has any such commission or authority passed upon the accuracy or adequacy of this Consent Solicitation Statement. Any representation to

the contrary is unlawful and may be a criminal offense.

Recipients of this Consent

Solicitation Statement and the accompanying materials should not construe the contents hereof or thereof as legal, business or tax advice.

Each recipient should consult its own attorney, business advisor and tax advisor as to legal, business, tax and related matters concerning

this Consent Solicitation Statement.

Unless the context otherwise

requires, all references in this Consent Solicitation Statement to “Noteholders” include (a) each person who is shown

in the records of DTC as a Noteholder (each a “Direct Participant”); and (b) each beneficial owner holding the Notes,

directly or indirectly, in an account in the name of a Direct Participant acting on such beneficial owner’s behalf, except that

for the purposes of any payment to

a Noteholder, to the extent the beneficial owner of the Notes is not a Direct Participant, such payment

will only be made by DTC to the relevant Direct Participant and the making of such payment by or on behalf of the relevant Issuer to DTC

and by DTC to such Direct Participant will satisfy the respective obligations of the relevant Issuer and DTC in respect of the Notes.

A Noteholder who is a Sanctions

Restricted Person (as defined in “Representations, Warranties and Covenants”) may not participate in the Consent Solicitation.

No steps taken by a Sanctions Restricted Person to deliver its Consent to the Proposed Amendments pursuant to the Consent Solicitation

will be accepted by the Issuers and such Sanctions Restricted Person will not be eligible to receive the Consent Fee in any circumstances.

The restrictions described in this paragraph shall only apply to the extent that it would not be unenforceable by reason of breach of

any provision of (i) Council Regulation (EC) No 2271/96 of November 22, 1996 (the “EU Blocking Regulation”) (or any

law or regulation implementing the EU Blocking Regulation in any member state of the European Union) or (ii) the EU Blocking Regulation

as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018.

The Consent Solicitation

is being conducted in a manner eligible for use of the Automated Tender Offer Program (“ATOP”) of DTC. As of the date

of this Consent Solicitation Statement, all of the Notes are registered in the name of the nominee of DTC. In turn, the Notes are recorded

in DTC’s books in the names of Direct Participants in DTC (the “DTC Participants”) who hold the Notes either

for themselves or for the ultimate beneficial owners. In order to cause Consents to be delivered, DTC Participants must electronically

deliver a Consent by causing DTC to transfer and surrender its Notes to the Information and Tabulation Agent in accordance with DTC’s

ATOP procedures. In order to be valid, such transfers must be in minimum denominations of US$200,000 and integral multiples of US$1,000

in excess thereof. In respect of the 2026 Notes, these amounts are prior to the application of the 2026 Notes Pool Factor. By making such

transfer, DTC Participants will be deemed to have delivered a Consent with respect to any Notes so transferred and surrendered. DTC will

verify each transfer and surrender of Notes and confirm electronic delivery of a Consent by sending an Agent’s Message (as defined

herein) to the Information and Tabulation Agent. Any Notes transferred and surrendered will be held by the Information and Tabulation

Agent and will not be available for transfer to third parties until the Information and Tabulation Agent returns the Notes as described

under “Solicitation Procedures.” The term “Agent’s Message” means a message transmitted by

DTC, received by the Information and Tabulation Agent and forming part of the Book-Entry Confirmation (as defined herein), which states

that DTC has received an express acknowledgment from the DTC Participant delivering Consents which are the subject of such Book-Entry

Confirmation that such DTC Participant (i) has received and agrees to be bound by the terms of the Consent Solicitation as set forth in

this Consent Solicitation Statement and that the relevant Issuer may enforce such agreement against such DTC Participant, and (ii) consents

to the Proposed Amendments and the execution and delivery of the applicable Supplemental Indenture as described in this Consent Solicitation

Statement.

Noteholders who hold the Notes

through Euroclear or Clearstream must follow the procedures established by the relevant Clearing System for delivering Consents in this

Consent Solicitation. The deadlines set by each of Euroclear and Clearstream may be earlier than the relevant deadlines specified in this

Consent Solicitation Statement. In addition, Noteholders should be aware that their banks, brokers or other nominees may establish their

own earlier deadlines.

UNDER NO CIRCUMSTANCES

SHOULD ANY PERSON TENDER OR DELIVER NOTES IN CONNECTION WITH THIS CONSENT SOLICITATION AT ANY TIME. For the avoidance of doubt, a

transfer and surrender of notes in accordance with DTC’s ATOP procedures for purposes of delivering a Consent shall not be considered

a tender or delivery of Notes for purposes of the prior sentence.

No person is authorized

in connection with this Consent Solicitation to give any information or to make any representation not contained in this document and

any such information or representation must not be relied on as having been authorized by or on behalf of the Issuers, the Parent, the

Trustee, the Collateral Agents, the Paying Agent, the Solicitation Agents, the Information and Tabulation Agent or any of their respective

affiliates or any other person. None of the Solicitation Agents, the Information and Tabulation Agent, the Trustee, the

Collateral Agents,

the Paying Agent or their respective directors, employees, officers, agents or affiliates or any person who controls any of them has separately

verified the information contained herein. Accordingly, no representation, warranty or undertaking, express or implied, is made and no

responsibility or liability is accepted by the Solicitation Agents, the Information and Tabulation Agent, the Trustee, the Collateral

Agents, the Paying Agent or any of their respective directors, employees, officers, agents or affiliates or any person who controls any

of them as to the accuracy or completeness of the information contained in this document or any other information provided by it in connection

with this Consent Solicitation. None of the Solicitation Agents, the Information and Tabulation Agent, the Trustee, the Collateral Agents,

the Paying Agent or their respective directors, employees, officers, agents or affiliates or any person who controls any of them accepts

any responsibility for this document, makes any representation or recommendation regarding this document or this Consent Solicitation

or owes any duty to any Noteholder. Noteholders must make their own independent decisions as to whether to deliver a Consent.

The Issuers expressly reserve

the right at any time prior to the Consent Expiration Deadline, provided that the Execution Date has not occurred, to (i) terminate or

withdraw this Consent Solicitation whether or not the Requisite Consents have been received, for any reason, (ii) amend the terms of this

Consent Solicitation whether or not the Requisite Consents have been received, provided that the amendments do not adversely affect the

rights or obligations of, or impose any additional obligation on, any Noteholder, (iii) increase the amount of the Consent Fee to be paid

pursuant to this Consent Solicitation or (iv) waive any of the conditions of this Consent Solicitation, subject to applicable law and

terms of the Indentures. In addition, each of the Issuers will execute and deliver to the Trustee and the relevant Collateral Agent the

applicable Supplemental Indenture subject to the satisfaction of the Requisite Consent Condition and other conditions in this Consent

Solicitation Statement after the Consent Expiration Deadline. The Supplemental Indentures will become effective upon execution, but the

Proposed Amendments will not become operative until the Consent Fee for properly delivered Consents is paid by the relevant Issuer (via

the Paying Agent) to the relevant Noteholders, which is expected to occur on the Consent Settlement Date.

The Solicitation Agents

are acting exclusively for the Issuers, the Parent and their respective affiliates in relation to this Consent Solicitation and for no

one else and will not regard any other person as its customer or be responsible to anyone other than the Issuers, the Parent and their

respective affiliates for providing the protections afforded to customers of the Solicitation Agents or for providing advice in relation

to this Consent Solicitation. The Solicitation Agents and their respective affiliates may, to the extent permitted by applicable law,

have or hold a position in the Notes or from time to time provide investment services in relation to, or engage in transactions involving,

the Notes and the Solicitation Agents and/or their respective affiliates may, to the extent permitted by applicable law, make or continue

to make a market in, or vote in respect of, or act as principal in any transactions in, or relating to, or otherwise act in relation to,

the Notes.

The Solicitation Agents

and the Information and Tabulation Agent and/or their respective affiliates are entitled to hold positions in the Notes either for their

own account or for the account, directly or indirectly, of third parties. Noteholders are informed by the Solicitation Agents that the

Solicitation Agents and the Information and Tabulation Agent and/or their respective affiliates may hold significant positions in the

Notes. The Solicitation Agents and the Information and Tabulation Agent and/or their respective affiliates are entitled to continue to

hold or dispose of, in any manner they may elect, any Notes that they may hold as at the date of this Consent Solicitation Statement and

the Solicitation Agents and the Information and Tabulation Agent are entitled, from such date, to acquire further Notes, subject to applicable

law and the Solicitation Agents and the Information and Tabulation Agent may or may not submit or deliver valid consent instructions or

votes in respect of such Notes. No such submission or non-submission by the Solicitation Agents or the Information and Tabulation Agent

should be taken by any Noteholder or any other person as any recommendation or otherwise by the Solicitation Agents or the Information

and Tabulation Agent, as the case may be, as to the merits of participating or not participating in the Consent Solicitation.

Each person receiving this

Consent Solicitation Statement is deemed to acknowledge that such person has not relied on the Solicitation Agents, the Trustee, the Collateral

Agents, the Paying Agent or the Information and Tabulation Agent or any of their respective directors, officers, representatives, agents,

advisers, employees, affiliates or any person who controls any of them in connection with its decision on how or whether to vote in relation

to the Proposed Amendments in respect of any Notes. Each such person must make its own analysis and investigation regarding the Proposed

Amendments and make its own voting decision, with particular reference to its own investment objectives and experience, and any other

factors which may be relevant to it in connection with such voting decision. If such person is in any doubt about any aspect of the Proposed

Amendments and/or the action it should take, it should consult its independent professional advisers.

This Consent Solicitation

is not being made to, and no Consents are being solicited from, Noteholders in any jurisdiction in which it is unlawful to make such Consent

Solicitation or grant such Consents. However, the Issuers may, in their sole discretion, take such actions as they may deem necessary

to solicit Consents in any jurisdiction and may extend this Consent Solicitation to, and solicit Consents from, persons in any such jurisdiction.

In any jurisdiction in which the securities laws or blue sky laws require this Consent Solicitation to be made by a licensed broker or

dealer, this Consent Solicitation will be deemed to be made on behalf of the Issuers by the Solicitation Agents or one or more registered

brokers or dealers that are licensed under the laws of such jurisdiction.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Consent Solicitation

Statement contains certain forward-looking statements based on estimates and assumptions.

These forward-looking statements

are not historical facts, but only predictions and generally can be identified by use of statements that include phrases such as “may,”

“will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

Similarly, statements that describe each Issuer’s future financial position and results of operations, strategy, plans, objectives,

goals, targets, and future developments in the markets where each Issuer participates or is seeking to participate are forward-looking

statements. These forward-looking statements are based on each Issuer’s current expectations only, and are subject to a number of

risks, uncertainties and assumptions, including the risk factors described herein under “Risk Factors; Special Considerations”

and the other risk factors set forth in the “Risk Factors” section of the Parent’s annual report on Form 20-F for the

fiscal year ended March 31, 2022, as filed with the SEC on October 12, 2023. Noteholders are urged to consider these factors carefully

in evaluating the forward-looking statements.

These forward-looking statements

contained in this Consent Solicitation Statement speak only as of the date of this Consent Solicitation Statement, and no obligation has

been undertaken by the Issuers or the Parent to publicly update or revise any forward-looking statements made in this Consent Solicitation

Statement or elsewhere as a result of new information, future events or otherwise, except as required by applicable laws and regulations.

DOCUMENTS AVAILABLE

This Consent Solicitation

Statement and all notices related to the Consent Solicitation as well as copies of the Indentures will be made available on https://projects.morrowsodali.com/azurepower

(the “Consent Website”), the access to which is subject to eligibility confirmation and registration.

DEFINITIONS

In this Consent Solicitation

Statement, unless the context otherwise requires, the following words and expressions have the meanings set forth opposite them below

and any capitalized terms used herein but not defined below shall have the meanings given to them in the Indentures.

| 2024 Indenture |

The indenture dated as of September 24, 2019 among APSEPL, the Parent, the Trustee and the Collateral Agents governing the 2024 Notes. |

| |

|

| 2024 Supplemental Indenture |

The supplemental indenture to be entered into among APSEPL, the Parent, the Trustee and the Collateral Agents giving effect to the Proposed Amendments to the 2024 Indenture, substantially in the form as set out in Exhibit A. |

| |

|

| 2026 Indenture |

The indenture dated as of August 19, 2021 among APEL, the Parent, the Trustee and the Common Collateral Agent governing the 2026 Notes. |

| |

|

| 2026 Supplemental Indenture |

The supplemental indenture to be entered into among APEL, the Parent, the Trustee and the Common Collateral Agent giving effect to the Proposed Amendments to the 2026 Indenture, substantially in the form as set out in Exhibit B. |

| |

|

| APEL |

Azure Power Energy Ltd. |

| |

|

| APSEPL |

Azure Power Solar Energy Private Limited. |

| |

|

| Business Day |

Any day that is not a Saturday, Sunday, legal holiday or other day on which banking institutions in Hong Kong, the City of New York, London, Mauritius, Singapore or India (or in any other place in which payments on the Notes are to be made) are authorized by law or governmental regulation to close. |

| |

|

| Clearing Systems |

DTC, Euroclear and/or Clearstream, where the context permits, and each a “Clearing System.” |

| |

|

| Clearstream |

Clearstream Banking S.A. |

| |

|

| Collateral Agent |

HSBC Bank U.S.A., National Association. |

| |

|

| Consent Website |

https://projects.morrowsodali.com/azurepower,

the document posting website operated by the Information and Tabulation Agent for the purpose of the Consent Solicitation,

the access to which is subject to eligibility confirmation and registration. |

| |

|

| DTC |

The Depository Trust Company. |

| |

|

| Euroclear |

Euroclear Bank SA/NV. |

| |

|

| Execution Date |

The date that the relevant Issuer, the Parent, the Trustee and the relevant Collateral Agent execute the applicable Supplemental Indenture giving effect to the Proposed Amendments. The Supplemental Indentures will become effective upon execution, but the Proposed Amendments will not become operative until the Consent Fee for properly delivered Consents pursuant to the Consent Solicitation is paid by the relevant Issuer to the relevant |

| |

Noteholders, which is expected to occur on the Consent Settlement Date. |

| |

|

| Group |

The Parent together with its subsidiaries. |

| |

|

| Indentures |

The 2024 Indenture and 2026 Indenture. |

| |

|

| Issuers |

Azure Power Solar Energy Private Limited and Azure Power Energy Ltd (each an “Issuer” and collectively the “Issuers”) |

| |

|

| Notes |

The 2024 Notes and 2026 Notes. |

| |

|

| Parent |

Azure Power Global Limited. |

| |

|

| Proposed Amendments |

The proposed amendments to certain terms of each of the Indentures,

as set out in the section titled “Proposed Amendments” of this Consent Solicitation Statement. |

| |

|

| Requisite Consent Condition |

The receipt of the Requisite Consents. |

| |

|

| Requisite Consents |

Properly delivered (or deemed to be delivered) and not validly revoked Consents by Noteholders relating to at least a majority in aggregate principal amount of each of the outstanding 2024 Notes and 2026 Notes to approve the Proposed Amendments under this Consent Solicitation Statement. |

| |

|

| SGXNET |

The website maintained by the Singapore Exchange Securities Trading Limited (“SGX”) for the submission of announcements required under the SGX’s listing rules as from time to time amended, modified or supplemented. |

| |

|

| Supplemental Indentures |

The 2024 Supplemental Indenture and 2026 Supplemental Indenture, or any of them (as the context requires). |

TABLE OF CONTENTS

| |

Page |

| DEFINITIONS |

v |

| |

|

| SUMMARY TIMETABLE |

8 |

| |

|

| SUMMARY OF THE CONSENT SOLICITATION AND THE PROPOSED AMENDMENTS |

10 |

| |

|

| RISK FACTORS; SPECIAL CONSIDERATIONS |

16 |

| |

|

| THE ISSUERS |

22 |

| |

|

| THE PROPOSED AMENDMENTS |

24 |

| |

|

| CONDITIONS OF THE CONSENT SOLICITATION |

29 |

| |

|

| SOLICITATION PROCEDURES |

31 |

| |

|

| MAURITIUS TAXATION |

38 |

| |

|

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES TO NOTEHOLDERS |

39 |

| |

|

| INFORMATION AND TABULATION AGENT |

46 |

| |

|

| SOLICITATION AGENTS |

47 |

| |

|

| EXHIBIT A — FORM OF THE 2024 SUPPLEMENTAL INDENTURE |

49 |

| |

|

| EXHIBIT B — FORM OF THE 2026 SUPPLEMENTAL INDENTURE |

55 |

SUMMARY TIMETABLE

In relation to the times

and dates indicated below, the Noteholders holding Notes in DTC should note the particular practices and policies of DTC regarding their

communications or procedural deadlines, which will determine the latest time at which Consents may be delivered to DTC (which may be earlier

than the deadlines set forth below) so that they are received by the Information and Tabulation Agent within the deadlines set forth below.

All notices to Noteholders

will be given through delivery to DTC for communication to Direct Participants, via the Consent Website and through announcements released

via SGXNET.

| Date |

|

Calendar date and/or time |

|

Event |

| |

|

|

|

|

| Commencement Date |

|

November 28, 2023 |

|

Commencement of the Consent Solicitation. The Consent Solicitation Statement will be made available on the Consent Website. |

| |

|

|

|

|

| Consent Expiration Deadline |

|

5:00 p.m., New York City time on December 7, 2023 |

|

The latest time and date for Noteholders to deliver their Consents (including for the purpose of being eligible to receive the Consent Fee on the Consent Settlement Date). |

| |

|

|

|

|

| Announcement of Results |

|

Promptly after the Consent Expiration Deadline, but in any event no later than three Business Days after the Consent Expiration Deadline |

|

Announcement of whether the Issuers have received the Requisite Consents pursuant to this Consent Solicitation and satisfaction of the other conditions set out herein. |

| |

|

|

|

|

| Execution Date |

|

Promptly following the announcement of results, provided that the Requisite Consent Condition and other conditions set out in this Consent Solicitation Statement are satisfied |

|

The date that the relevant Issuer, the Parent, the Trustee and the relevant Collateral Agent execute the applicable Supplemental Indenture. The Supplemental Indentures will become effective upon execution, but the Proposed Amendments will only become operative upon payment of the Consent Fee by the relevant Issuer (via the Paying Agent) to the relevant Noteholders, which is expected to occur on the Consent Settlement Date. |

| |

|

|

|

|

| Consent Settlement Date |

|

As soon as reasonably practicable following the announcement of results, but in any event no later than December 18, 2023 |

|

Subject to the Issuers receiving the Requisite Consents on or

before the Consent Expiration Deadline and to the satisfaction (or waiver) of other conditions described herein, the date of payment

of the Consent Fee to such Noteholders who have properly delivered their valid Consent on or |

| |

|

|

|

prior to the Consent Expiration Deadline. |

The Issuers reserve the right

to extend the Consent Expiration Deadline in their sole discretion. In such a case, the date of the announcement of the results of this

Consent Solicitation, the Execution Date and the Consent Settlement Date will be adjusted accordingly. Noteholders should inform themselves

of any earlier deadlines that may be imposed by the Clearing Systems and/or any intermediaries, which may affect the timing of the submission

of a Consent.

The Issuers will publicly

announce the commencement date of the Consent Solicitation, any extension of the Consent Expiration Deadline, other notifications or amendments

relating to the Consent Solicitation, the results of the Consent Solicitation and the payment of the Consent Fee by the issue of a press

release and/or a notice sent via the DTC, Euroclear or Clearstream and the Consent Website.

SUMMARY

OF THE CONSENT SOLICITATION AND THE PROPOSED AMENDMENTS

The following summary

highlights only certain aspects of particular provisions of the Consent Solicitation and the Indentures, and is qualified in its entirety

by reference to the more detailed information contained elsewhere in this Consent Solicitation Statement, and any amendments or supplements

thereto. Noteholders are urged to read this Consent Solicitation Statement in its entirety, as it contains important information which

you should read carefully before you make any decision with respect to the Consent Solicitation conducted hereby. This summary does not

purport to be complete and may not contain all information needed by you in making a decision regarding this Consent Solicitation.

| Issuers |

2024 Notes: APSEPL

2026 Notes: APEL |

| |

|

| 2024 Notes |

5.65% Senior Notes due 2024 issued by APSEPL |

| |

Rule 144A

CUSIP: 05502TAA6

ISIN: US05502TAA60

Common Code: 199526375 |

| |

Regulation S

CUSIP: V04008AA2

ISIN: USV04008AA29

Common Code: 199527568 |

| |

|

| 2026 Notes |

3.575% Senior Notes due 2026 issued by APEL |

| |

Rule 144A

CUSIP: 05502V AA1

ISIN: US05502VAA17

Common Code: 237768736 |

| |

Regulation S

CUSIP: V0002U AA5

ISIN: USV0002UAA52

Common Code: 237768752 |

| |

|

| The Consent Solicitation |

The Issuers are soliciting Consents from Noteholders in respect of

a majority of the outstanding aggregate principal amount of each of the Notes to amend certain terms of each of the Indentures. The Requisite

Consents are required in order for the Proposed Amendments to be adopted. The Supplemental Indentures will become effective upon execution,

but the Proposed Amendments will not become operative until the Consent Fee for properly delivered Consents is paid by the relevant Issuer

(via the Paying Agent) to the relevant Noteholders, which is expected to occur on the Consent Settlement Date.

All Consents delivered will be deemed to be Consents to the Proposed

Amendments as a whole. |

| |

|

| Purpose of the Consent Solicitation |

The purpose of the Proposed Amendments is to: |

| |

(i) |

undertake

to make tender offers (i) to purchase an outstanding principal amount of U.S.$40,000,000 of the 2024 Notes by March 25, 2024, (ii) to purchase an outstanding principal amount

of U.S.$12,000,000 of the 2026 Notes by

March 25, 2024 and an outstanding principal amount of U.S.$8,000,000 of the 2026 Notes by August 26, 2024; |

| |

|

|

| |

(ii) |

make

certain amendments and provide certain confirmations with respect to the reporting covenant of each of the Indentures;

and |

| |

|

|

| |

(iii) |

make certain amendments to the Restricted Payments and limitations on amendments of onshore debt covenants in the 2024 Indenture to allow for the implementation of a cash-neutral intercompany transaction. |

| |

|

|

| |

See “The Proposed Amendments - Background to the Consent Solicitation”. |

| Consent Fee |

US$6 for each US$1,000 principal amount of Notes

(rounded to the nearest cent with half a cent rounded upwards). The Consent Fee to be paid to each Noteholder of the 2026 Notes will be

subject to the outstanding principal amount of Notes instructed by the relevant Noteholder after the 2026 Notes Pool Factor has been applied.

All Noteholders who validly deliver a Consent

to the Proposed Amendments prior to the Consent Expiration Deadline will be eligible to receive the Consent Fee, subject to the conditions

set forth herein, including receipt of the Requisite Consents. If the Issuers do not accept the delivered Consents, they will not pay

the Consent Fee in respect of any Consents, and the Proposed Amendments will not become operative. |

| |

|

| Consent Expiration Deadline |

December 7, 2023, unless extended in our sole discretion. |

| |

|

| Execution Date |

Promptly following the announcement of results. |

| |

|

| Consent Settlement Date |

As soon as reasonably practicable following the announcement of results, but in any event no later than December 18, 2023. |

| |

|

| Longstop Date |

December 11, 2023. |

| |

|

| Withdrawal and Revocation |

Provided that the Consent Expiration Deadline occurs on or before the

Longstop Date, (i) subject to Section 9.04 of each Indenture, instructions made in connection with the Consent Solicitation are irrevocable

and (ii) if you participate in the Consent Solicitation, the Consent may not be revoked or withdrawn at any time once you deliver a Consent

to the Proposed Amendments. See “Solicitation Procedures —Revocation of Consents.” |

| |

|

| Sanctions Restricted Person |

A Noteholder who is a Sanctions Restricted Person may not participate in the Consent Solicitation. No steps taken by a Sanctions Restricted Person to deliver its Consent to the Proposed Amendments pursuant to the Consent Solicitation |

| |

will be accepted by the Issuers and such Sanctions Restricted Person will not be eligible to receive the Consent Fee in any circumstances. The restrictions described in this paragraph shall only apply to the extent that it would not be unenforceable by reason of breach of any provision of (i) the EU Blocking Regulation (or any law or regulation implementing the EU Blocking Regulation in any member state of the European Union) or (ii) the EU Blocking Regulation as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018. |

| |

|

| Conditions to the Consent Solicitation |

Our obligation to consummate the Consent Solicitation

is conditioned upon the satisfaction of the (i) Requisite Consent Condition and (ii) the General Conditions, described in “Conditions

of the Consent Solicitation.”

We may terminate or withdraw the Consent Solicitation if any of the

terms and conditions are not satisfied or waived prior to the Consent Expiration Deadline (unless we have executed the Supplemental Indentures).

We may also extend the Consent Solicitation from time to time until the conditions are satisfied or waived. As further described below

in “Extension, Amendments and Termination,” unless we have executed the Supplemental Indentures, we reserve the right

to amend, modify or waive, at any time, the terms and conditions of Consent Solicitation, subject to applicable laws and terms of the

Indentures. |

| |

|

| Procedures for Delivering Consents |

To deliver a Consent with respect to the Notes, a Noteholder must validly deliver a Consent prior to the Consent Expiration Deadline pursuant to the procedures described herein. See “Solicitation Procedures.” |

| |

|

| Automated Tender Offer Program (“ATOP”) |

Each Noteholder wishing to participate in the Consent Solicitation must transmit its Consent through ATOP of DTC as described below, prior to the Consent Expiration Deadline. See “Solicitation Procedures —How to Consent.” |

| |

|

| Consenting through a Custodian |

If you wish to participate in the Consent Solicitation and your Notes are held by a custodial entity, such as a bank, broker, dealer, trust company or other nominee, you must instruct that custodial entity to deliver your Consents on your behalf pursuant to the procedures of that custodial entity. |

| |

|

| |

Custodial entities that are DTC Participants must deliver Consents through ATOP, by which the custodial entity and the beneficial owner on whose behalf the custodial entity is acting agree to be bound by this Consent Solicitation Statement. |

| |

|

| |

Noteholders delivering Consents through DTC’s ATOP procedures must transmit Consents to the Proposed Amendments prior to the Consent Expiration Deadline. DTC |

| |

will verify acceptance of the consent instruction, execute a book-entry record of the delivered Consents and send to the Information and Tabulation Agent a “Book-Entry Confirmation”, which shall include an Agent’s Message. An “Agent’s Message” is a message, transmitted by DTC to, and received by, the Information and Tabulation Agent and forming part of a Book-Entry Confirmation, which states that DTC has received an express acknowledgement from a DTC Participant delivering Consents to the Proposed Amendments that such DTC Participant has received and agrees to be bound by the terms of the Consent Solicitation, and that we may enforce such agreement against the DTC Participant. Delivery of the Agent’s Message by DTC will satisfy the terms of the Consent Solicitation as to execution and delivery of a Consent by the DTC Participant identified in the Agent’s Message. |

| |

|

| |

In order to be valid, Consents must be submitted in respect of a minimum nominal amount of Notes of no less than an aggregate principal amount of US$200,000 and integral multiples of US$1,000 in excess thereof. In respect of the 2026 Notes, these amounts are prior to the application of the 2026 Notes Pool Factor. |

| |

|

| |

For further information, Noteholders should contact the Solicitation

Agents or the Information and Tabulation Agent at their respective telephone numbers and addresses set forth on the back cover page of

this Consent Solicitation Statement or consult their broker, dealer, commercial bank, trust company or nominee for assistance. No guaranteed

delivery procedures are being offered in connection with the Consent Solicitation. You must deliver your Consent in respect of the Consent

Solicitation prior to the Consent Expiration Deadline in order to receive the Consent Fee. Noteholders who intend to deliver Consents

by the Consent Expiration Deadline must allow sufficient time for completion of the delivery procedures during normal business hours of

DTC. Noteholders should be aware that their banks, brokers or other nominees may establish their own earlier deadlines. |

| |

|

| Consequences of failure to deliver Consents |

Noteholders from whom no Consent is delivered prior to the Consent Expiration Deadline will not receive any Consent Fee, even though the Proposed Amendments, if they become effective, will be applicable and binding with respect to all Noteholders and their transferees. |

| |

|

| Extension, Amendments and Termination |

To the extent we are legally permitted to

do so, we expressly reserve the right to at any time prior to the Consent Expiration Deadline to, provided that the Execution Date has

not occurred, (i) terminate or withdraw this Consent Solicitation whether or not the Requisite Consents have been received, for any reason,

(ii) amend the terms of this Consent Solicitation whether or not the Requisite Consents have been |

| |

received, provided that the amendments do not adversely affect the rights or obligations

of, or impose any additional obligation on, any Noteholder, (iii) increase the amount of the Consent Fee to be paid pursuant to this

Consent Solicitation or (iv) waive any of the conditions of this Consent Solicitation, subject to applicable law and the terms of

the Indentures. Any amendment to the Consent Solicitation will apply to all Consents delivered, regardless of when or in what order

such Consents were delivered, subject to applicable law. If we make a material change in the terms of the Consent Solicitation, we

will issue a press release setting forth such changes or other public announcement, disseminate additional materials, if

appropriate, and will extend the Consent Solicitation to the extent required by law. Any material changes or amendments to the

Proposed Amendments, which would adversely affect the rights or obligations of, or impose any additional obligations on, any

Noteholder, will require a new consent solicitation process. New consents will need to be provided in relation to any new consent

solicitation process and any Consent provided in relation to the Proposed Amendments will lapse.

We have the right, in our sole discretion, to extend the Consent Expiration Deadline and

any other dates (other than the Longstop Date). |

| |

|

| |

Additionally, we expressly reserve the right, in our absolute discretion, to terminate the Consent Solicitation at any time if any of the terms and conditions to the Consent Solicitation are not satisfied or waived at or prior to the Consent Expiration Deadline (unless the Execution Date has occurred). In the event that the Consent Solicitation is terminated, withdrawn or otherwise not consummated prior to the Consent Expiration Deadline, no Consent Fee or other consideration will be paid or become payable. |

| |

|

| Taxation |

For a discussion of certain United States federal and Mauritius income tax consequences of the Consent Solicitation, see “Certain United States Federal Income Tax Consequences to Noteholders” and “Mauritius Taxation,” respectively. |

| |

|

| Original Issue Discount |

The Deemed New Notes (as defined in “Certain United States

Federal Income Tax Consequences to Noteholders”) may be issued with original issue discount (“OID”) for U.S.

federal income tax purposes. In such event, U.S. Holders (as defined in “Certain United States Federal Income Tax Consequences

to Noteholders”) generally will be required to include such OID in their gross income as it accrues in advance of the receipt

of cash payments attributable to such income using the constant yield method. See “Certain United States Federal Income Tax Consequences

to Noteholders—Original Issue Discount.” |

| |

|

| Brokerage commissions |

No brokerage commissions are payable by the Noteholders to us, the Solicitation Agents or the Information and Tabulation Agent. |

| |

|

| Solicitation Agents |

Barclays Bank PLC, The Hongkong and Shanghai Banking Corporation Limited and MUFG Securities Asia Limited Singapore Branch have been retained as the Solicitation Agents in connection with this Consent Solicitation. The address and telephone number of the Solicitation Agents are |

| |

set forth on the back cover of this Consent Solicitation Statement. |

| |

|

| Information and Tabulation Agent |

Morrow Sodali Limited |

| |

|

| Trustee, Collateral Agents and Paying Agent |

HSBC Bank U.S.A., National Association. |

| |

|

| Further information |

Questions about the terms of the Consent Solicitation should be directed to the Solicitation Agents. If you have questions regarding consent procedures or require additional copies of this Consent Solicitation Statement, please contact the Information and Tabulation Agent. |

| |

|

| |

Beneficial owners may also contact their brokers, dealers, commercial banks, trust companies or other nominee for assistance concerning the Consent Solicitation. |

| |

|

| |

ALL DOCUMENTATION RELATING TO THE CONSENT SOLICITATION WILL BE AVAILABLE FROM THE CONSENT WEBSITE (THE ACCESS TO WHICH IS SUBJECT TO ELIGIBILITY CONFIRMATION AND REGISTRATION) AND THE INFORMATION AND TABULATION AGENT. |

RISK

FACTORS; SPECIAL CONSIDERATIONS

Prior to delivering a

valid Consent, Noteholders should carefully consider the factors set forth below as well as (i) the other risk factors set forth in the

“Risk Factors” section of the Parent’s annual report on Form 20-F for the fiscal year ended March 31, 2022, as filed

with the SEC on October 12, 2023 and (ii) the other information set forth in this Consent Solicitation Statement including, but not limited

to, the information described under the heading “Cautionary Statement Regarding Forward-Looking Statements.”

Risks relating

to Delisting and Compliance

The NYSE has delisted the Parent’s

shares.

As a result of the Parent’s

failure to timely file its annual report on Form 20-F with the SEC, the NYSE informed the Parent on December 7, 2022 that it was not in

compliance with the NYSE’s continued listing requirements under the timely filing criteria outlined in Section 802.01E of the NYSE

Listed Company Manual and that it would be provided a six-month extension from the due date of the annual report, August 16, 2022, as

extended from the original due date of August 1, 2022, pursuant to the Form 12b-25 filed with the SEC on August 1, 2022 to file the annual

report on Form 20-F, as well as any other subsequent delayed filings.

On February 14, 2023, the

NYSE granted the Parent’s request for additional time to file its annual report on Form 20-F and any subsequent delayed filings,

stating it would provide an additional trading period through July 15, 2023 subject to reassessment on an ongoing basis and that failure

to file the annual report on Form 20-F and any subsequent delayed filings by the end of this period could result in a trading suspension.

On July 6, 2023, the Parent requested the NYSE for additional time to file its 2022 Annual Report as well as its 2023 Semi-Annual Report

due to continued delays in the completion of audit and review of its internal control over financial reporting.

On July 13, 2023, the NYSE

suspended trading in the Parent’s shares and commenced delisting proceedings (the “Delisting Decision”). On July 26,

2023, the Parent submitted a request for a review of the delisting determination by the NYSE. Following the review, the NYSE Committee

reached a final decision to uphold the delisting determination on October 30, 2023. On October 31, 2023, the NYSE filed a Form 25 notification

of removal from listing with the SEC. The removal of the Parent’s shares from listing on the NYSE became effective on November 13,

2023. Currently, the Parent’s shares are only available to trade on the over-the-counter (or OTC) “expert” market, where

quotations are only directly available to broker dealers and professional investors (not to retail investors).

Following the delisting

from the NYSE, the Parent will continue to adhere to its SEC reporting obligations as long as it is a reporting company under the Exchange

Act. However, there can be no assurance whether or when the Parent’s shares would again be listed for trading on the NYSE or another

U.S. exchange. The delisting could also result in other negative outcomes, including the potential loss or reduction of confidence by

customers, business partners and employees, the potential loss or reduction of investor interests, and fewer business and strategic opportunities,

any of which could have a material adverse impact on the Parent’s results of operations, cash flows and financial conditions.

The Parent’s failure to deliver its

audited consolidated financial statements and the financial statements of its subsidiaries violates covenants in certain of its financing

agreements and could materially and adversely affect its business, results of operations, financial condition and cash flows.

Timely submission of financial

statements of the Parent and/or its subsidiaries is a key covenant in most of its financing agreements. The Parent secured various time

extensions from its lenders in respect of these covenants. The Parent has received time extensions from several lenders for its external

indebtedness but not

from all lenders. In this regard, the Parent’s auditors have provided in their audit report that these “events

raise a substantial doubt about the Company’s ability to continue as a going concern.”

The Parent is currently

under discussions with the remaining lenders to obtain the requisite time extensions and expects to receive the same in due course. The

lenders which have not granted such extensions have rights under the respective financing agreements to take actions including (but not

limited to) acceleration of the repayment of all or some of the indebtedness owed to them and/or security enforcement under the terms

of the applicable financing agreements. Any such actions by lenders also could result in cross-defaults or cross-accelerations of other

indebtedness and could materially and adversely affect the Parent’s business, results of operations, financial condition and cash

flows.

In addition, due to the

Parent’s inability to meet these information covenants to date and/or downgrade in credit ratings, some of its lenders have started

charging it penalty interest rates and/or upward revised the rate of interest. These penalty rates of interest and higher rates of interest

have increased the finance costs for the projects to which these loans relate. While the penalty interest may cease to be charged upon

finalization and submission of the delayed financial statements, the rate of interests which have been revised upwards may not revert

to pervious levels, and, therefore, may result in continued higher cost of funds for the Parent’s debt borrowings for these projects.

The Parent has conducted investigations

into whistle-blower claims and other allegations against certain directors, officers and employees and former officers and directors of

the Parent. The Parent has reported the allegations and its findings to the SEC and the Department of Justice and continues to cooperate

with these authorities.

In May 2022, the Parent

received a whistle-blower complaint that alleged health and safety lapses, procedural irregularities, misconduct by certain employees,

improper payments and false statements relating to one of its projects belonging to a project subsidiary. Following extensive investigation

by the Ethics Committee, supervised by the Board’s Audit and Risk Committee and by external counsel and forensic professionals,

the Parent identified evidence of manipulation and misrepresentation of project data by some employees at that project site. Weak controls

over payments to a vendor and failures to provide accurate information both internally and externally were found, but no direct evidence

that any improper payment was made to any government official was identified. Further, in fiscal year 2023, the Parent reported to the

Solar Energy Corporation of India (“SECI”) that this project had (i) shortfalls in generation and (ii) that it failed

to timely complete and commission the requisite contractually required capacity. On January 3, 2023 and January 4, 2023, SECI advised

the Parent, inter alia, that the project may be liable for damages and penalties for shortfalls in generation and for not commissioning

the full capacity required under its power purchase agreement (“PPA”) in a timely manner.

In September 2022, the Parent

received an additional whistle-blower complaint primarily making similar allegations of misconduct as raised in the May 2022 complaint,

as well as allegations of misconduct related to joint ventures and land acquisition, allegations of its failure to be transparent with

the market and advisors and other allegations. The Ethics Committee, supervised by the Board’s Audit and Risk Committee, with the

support of external counsel and forensic accounting professionals, investigated these September 2022 allegations. The investigation of

the September 2022 complaint identified significant control issues in the process of acquiring land and land use rights in relation to

one of the Parent’s projects. The investigation specified that third party land aggregators may have been involved in improper payments

but no improper transfer of money by the Group was identified. The Parent has made an adjustment (de-capitalization) in the books of accounts

of INR 138 million (US$ 1.8 million) on estimate, as a prudent measure in the given project. Further, the Parent has reviewed the entire

amount paid to land aggregators in other projects to identify any similar issue and after an assessment a further adjustment (decapitalisation)

aggregating to INR 118 million (US$ 1.6 million) has been

made in the books of account on estimate, as a prudent measure, though no improper

payments by the Group could be identified.

The Parent also identified

potential misrepresentations made by former executives to the Board in July 2021 regarding an asset purchase transaction for the development

of a wind project. In addition, it appears the Parent’s former executive officers may have circumvented internal policies in connection

with the approval of another transaction related to another wind project. The Parent was not able to identify any evidence of improper

payments related to either of these transactions. Considering the observations regarding the transactions, the Parent has reassessed the

valuation of the asset purchase and related government orders and did not find any adjustment that needed to be made in the books of account.

The Parent’s investigation

did not substantiate other portions of this September 2022 whistle-blower complaint.

As part of its investigations

of the May 2022 and September 2022 whistle-blower complaints, the Parent also widened its review to include a review of projects commissioned

in fiscal year 2022 and fiscal year 2023 to ensure that similar weaknesses were not present. As part of the investigations, the Parent

identified inconsistencies in project data in certain of its projects, but it identified no improper payments made in connection with

these projects.

The Parent has taken a range

of actions due to these findings, and the employees involved in the misconduct are no longer associated with the Parent. In accordance

with the recommendations of the Ethics Committee, the Board’s Audit and Risk Committee and their legal and forensic advisors, the

Parent is implementing remedial measures in both project control and monitoring. Further, the Parent reported the findings from its investigations