NEW

YORK, Oct. 4, 2024 /PRNewswire/ -- Report on how

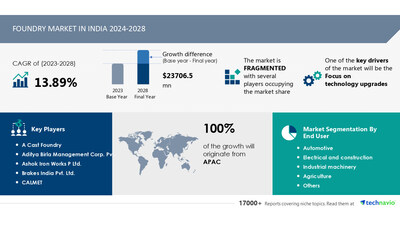

AI is redefining market landscape - The Global Foundry

Market size is estimated to grow by USD

23.70 billion from 2024-2028, according to Technavio. The

market is estimated to grow at a CAGR of over 13.89% during

the forecast period. Focus on technology upgrades is driving

market growth, with a trend towards institute of indian

foundrymen (IIF) in-plant training program.

However, environmental issues leading to increasing

environmental cost poses a challenge - Key market players include A

Cast Foundry, Aditya Birla Management Corp. Pvt. Ltd., Ashok Iron Works P Ltd., Brakes India Pvt. Ltd.,

CALMET, Cooper Corp., DCM Ltd., Electrosteel Castings Ltd., Fortune

Foundries Pvt. Ltd., Gujarat Metal Cast Industries Pvt. Ltd.,

Hackforth Holding GmbH and Co. KG, Jayaswal Neco

Industries Ltd., JSW Group, Kalyani Group, Kirloskar Ferrous

Industries Ltd., Larsen and Toubro Ltd., Menon and Menod Ltd.,

Nelcast Ltd., Tata Sons Pvt. Ltd., and The Sanmar Group.

Key insights into market evolution with

AI-powered analysis. Explore trends, segmentation, and growth

drivers- View the snapshot of this report

|

Foundry Market

Scope

|

|

Report

Coverage

|

Details

|

|

Base year

|

2023

|

|

Historic

period

|

2018 - 2022

|

|

Forecast

period

|

2024-2028

|

|

Growth momentum &

CAGR

|

Accelerate at a CAGR of

13.89%

|

|

Market growth

2024-2028

|

USD 23706.5

million

|

|

Market

structure

|

Fragmented

|

|

YoY growth 2022-2023

(%)

|

11.12

|

|

Regional

analysis

|

India

|

|

Performing market

contribution

|

APAC at 100%

|

|

Key

countries

|

India

|

|

Key companies

profiled

|

A Cast Foundry, Aditya

Birla Management Corp. Pvt. Ltd., Ashok Iron Works P Ltd., Brakes

India Pvt. Ltd., CALMET, Cooper Corp., DCM Ltd., Electrosteel

Castings Ltd., Fortune Foundries Pvt. Ltd., Gujarat Metal Cast

Industries Pvt. Ltd., Hackforth Holding GmbH and Co. KG, Jayaswal

Neco Industries Ltd., JSW Group, Kalyani Group, Kirloskar

Ferrous Industries Ltd., Larsen and Toubro Ltd., Menon and Menod

Ltd., Nelcast Ltd., Tata Sons Pvt. Ltd., and The Sanmar

Group

|

Market Driver

The Indian Institute of Foundry (IIF) is dedicated to enhancing

skills in the foundry industry through education and training. In

Kolkata, IIF operates a center for

skill development, offering a modular training program equivalent

to a foundry technology degree, recognized by the Ministry of Human

Resource Development (HRD). IIF conducts technical seminars with

the help of its 26 chapters across India, providing exposure to industry best

practices and latest technology. The Kolhapur chapter collaborates

with the local government and polytechnic institute to offer skill

development programs. IIF's in-plant training program, Yogyata

Vikas, provides doorstep training for workmen in eight languages,

with trainers from the industry. Ten modules cover basic topics,

and training is flexible and convenient for foundries. IIF members

pay USD150 per day plus service tax,

while non-members pay USD225 per day

plus service tax. Foundries provide facilities and bear expenses

for trainers and accommodations. A maximum of 25 workmen can

participate per program. Such initiatives are essential for the

growth of the foundry market in India.

Foundry Market Trends: Energy Efficiency and Sustainability Lead

the Way The foundry industry is witnessing significant trends that

are shaping its future. Energy efficiency and sustainable practices

are at the forefront, with lightweight materials like aluminum

gaining popularity in sectors such as electric vehicles and

aerospace. Advanced manufacturing techniques, including casting

processes and metal castings, are being adopted for precision and

customization. OEMs in industries like electronics, construction,

and industrial machinery are demanding green foundry practices,

leading to the implementation of pollution control technologies.

Sustainability is also driving the adoption of 3D printing and AI

in casting designs. Aluminum, non-ferrous, ductile iron, gray iron,

and steel castings are in high demand due to their strength and

durability. The aerospace and automotive sectors are major

consumers, with direct and indirect employment opportunities

increasing. Environmental regulations are pushing the industry

towards outsourcing to foundries with advanced technologies and

expertise. Precision casting and electrical foundries are also

gaining traction, with the Internet of Things and customization

driving innovation.

Request Sample of our comprehensive

report now to stay ahead in the AI-driven market evolution!

Market Challenges

- The Indian foundry market is facing challenges due to

increasing government regulations on waste disposal from foundries.

Most Indian foundries are MSMEs with limited market

capitalization, making it difficult for them to invest in waste

recycling technologies and comply with new regulations. Foundries

produce harmful gases and solid waste, primarily from non-ferrous

and steel metals, which contain cadmium, lead, zinc, and other

hazardous elements. Cupola furnaces contribute significantly to air

pollution. To mitigate environmental concerns, the government and

industry associations have established rules and guidelines. These

include safe handling of pollutants, proper disposal of hazardous

waste, and water recycling. Foundries are upgrading to efficient

induction furnaces and gas-fired furnaces to minimize pollution.

Additionally, the development of waste reduction products,

minimizing negative environmental impact, and enhancing process

efficiency through right-first-time production are encouraged.

However, upgrading to these efficient processes and technologies

involves substantial costs, making it challenging for small

foundries to compete in the market due to low profit margins and

increased capital investment. These factors may hinder the growth

of the Indian foundry market during the forecast period.

- Foundry Market Overview: The foundry industry faces various

challenges in today's business landscape. Sustainability is a major

concern with the need for green foundry practices and pollution

control technologies. Customization is essential for meeting

diverse client needs, leading to an increase in customized casting

solutions like Gray Iron Casting, NonFerrous Casting, Ductile Iron

Casting, Steel Casting, Malleable Casting, Die casting, and Sand

casting. Outsourcing and automation through industrial machinery,

including electrical and construction equipment, are vital for cost

savings and efficiency. Large foundries are adopting automation,

robotics, and digitalization to stay competitive. Environmental

regulations impact Ferrous Foundries and Non-Ferrous Foundries

alike, driving the adoption of advanced pollution control

technologies. The construction sector is a significant consumer of

casting products, from Metal alloys to Foundry chemicals. Trade

shows and investment casting provide opportunities for businesses

to showcase their innovative casting solutions and expand their

network. Staying updated on the latest trends, such as precision

casting and direct/indirect employment, is crucial for success in

the foundry market.

Discover how AI is revolutionizing market

trends- Get your access now!

Segment Overview

This foundry market report extensively covers market

segmentation by

- End-user

- 1.1 Automotive

- 1.2 Electrical and construction

- 1.3 Industrial machinery

- 1.4 Agriculture

- 1.5 Others

- Type

- 2.1 Gray iron casting

- 2.2 Non-ferrous casting

- 2.3 Ductile iron casting

- 2.4 Steel casting

- 2.5 Malleable casting

- Geography

1.1 Automotive- The Indian auto components industry

has witnessed growth since 2010, driven by a resilient end-user

market, improved consumer sentiment, and a revived financial

system. This sector contributes approximately 7% to India's GDP and provides employment to nearly

20 million people. A stable government framework, rising purchasing

power, a vast domestic market, and continuous infrastructure

development make India an

attractive investment destination. In 2023, India produced over 25.5 million vehicles, and

by April 2024, the production of

passenger vehicles, three-wheelers, two-wheelers, and quadricycles

surpassed 2.35 million units. However, regulatory changes, such as

the shift to BS-VI emission norms, are projected to influence the

industry. Vehicle prices have risen due to the adoption of new

emission technologies. The demand for lighter automobiles has

boosted the usage of non-ferrous metals in automobile

manufacturing. Furthermore, the expanding middle class in

India has fueled automobile

production growth. The automobile industry accounts for over 40% of

India's 10-12 million tons per

annum casting capacity. Given the industry's ongoing trends, the

Indian foundry market is anticipated to expand substantially during

the forecast period.

Download a Sample of our

comprehensive report today to discover how AI-driven innovations

are reshaping competitive dynamics

Research Analysis

Foundry Market: A Thriving Industry of Metal Castings The

foundry market is a dynamic and diverse industry that encompasses

various processes such as Ferrous Foundries and Non-Ferrous

Foundries, including Sand Casting, Die Casting, and various types

of Casting Designs like Gray Iron Casting, Ductile Iron Casting,

Malleable Casting, and NonFerrous Casting. This sector caters to

numerous industries, including Construction, Aerospace,

Electronics, and Industrial Machinery. Large foundries play a

significant role in producing Metal Castings for OEMs (Original

Equipment Manufacturers) and various sectors. The Construction

sector benefits from foundry products in infrastructure

development, while the Aerospace industry relies on high-precision

castings for aircraft components. The Electronics industry utilizes

foundry-produced castings in various applications, from consumer

electronics to telecommunications infrastructure. The advent of 3D

printing and the Internet of Things (IoT) has introduced new

opportunities for foundries in prototyping and custom

manufacturing. Direct and Indirect Employment in the foundry sector

is substantial, with numerous jobs available in design, production,

and maintenance roles. The industry continues to evolve, adapting

to technological advancements and market demands.

Market Research Overview

Foundries are essential manufacturing hubs producing metal

castings through various processes such as Ferrous (iron-based) and

Non-Ferrous (aluminum, zinc, etc.) foundries. Die casting, sand

casting, investment casting, and other techniques shape molten

metal into desired forms. The construction sector, automotive,

aerospace, electronics, and other industries rely on large

foundries for components. Automation and robotics are transforming

foundries, with digitalization and green practices enhancing energy

efficiency and sustainability. Metal alloys are crucial, with

lightweight materials like aluminum gaining prominence in electric

vehicles. Trade shows showcase foundry chemicals, casting products,

and advanced manufacturing techniques. Energy efficiency,

sustainable practices, and pollution control technologies are

crucial. Sustainability, customization, and the Internet of Things

(IoT) are shaping the future. Outsourcing, precision casting, and

OEM partnerships are common. Green foundry practices, 3D printing,

casting designs, and artificial intelligence are also trending.

Direct and indirect employment opportunities are significant, with

environmental regulations driving innovation. Industries like

electrical, construction, and industrial machinery utilize various

casting processes, including Gray Iron Casting, NonFerrous Casting,

Ductile Iron Casting, Steel Casting, and Malleable Casting.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- End-user

-

- Automotive

- Electrical And Construction

- Industrial Machinery

- Agriculture

- Others

- Type

-

- Gray Iron Casting

- Non-ferrous Casting

- Ductile Iron Casting

- Steel Casting

- Malleable Casting

- Geography

-

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory

company. Their research and analysis focuses on emerging market

trends and provides actionable insights to help businesses identify

market opportunities and develop effective strategies to optimize

their market positions.

With over 500 specialized analysts, Technavio's report library

consists of more than 17,000 reports and counting, covering 800

technologies, spanning across 50 countries. Their client base

consists of enterprises of all sizes, including more than 100

Fortune 500 companies. This growing client base relies on

Technavio's comprehensive coverage, extensive research, and

actionable market insights to identify opportunities in existing

and potential markets and assess their competitive positions within

changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download

multimedia:https://www.prnewswire.com/news-releases/foundry-market-to-grow-by-usd-23-70-billion-2024-2028-with-ai-driven-insights-on-technology-upgrades-boosting-growth---technavio-302267048.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/foundry-market-to-grow-by-usd-23-70-billion-2024-2028-with-ai-driven-insights-on-technology-upgrades-boosting-growth---technavio-302267048.html

SOURCE Technavio