MARKET WRAPS

Watch For:

Housing Starts for December; Weekly Jobless Claims; Philadelphia

Fed Business Outlook Survey for January; EIA Weekly Petroleum

Status Report

Today's Top Headlines/Must Reads:

- The $8.8 Trillion Cash Pile That Has Stock-Market Bulls

Salivating

- Oil-Demand Growth Slowdown Marks Return to Prepandemic Trends,

IEA Says

- Biden Accedes to Tougher Immigration Policy to Deflect

Criticism, Secure Ukraine Aid

Opening Call:

Stock futures inched higher on Thursday, as Treasury yields

dipped and stress eased in Asian markets.

"The recent very strong correlation between bonds and equities

that started bearishly for both in August around the QRA [quarterly

refunding announcement] and flipped bullish in October around the

QRA, has flipped bearish again in 2024," Deutsche Bank said.

"History tells us the tight correlation won't last forever, and

one will break out from the other, but for now the relationship is

lockstep[...], " Deutsche added.

Traders were pricing the chances of at least a 25 basis point

rate cut by the Federal Reserve at its March meeting at 63%, down

from 73.3% a week ago.

"The recent divergence between market expectations for rate cuts

and the recent Fed rhetoric is gradually tilting toward the Fed's

stance," SPI Asset Management said.

Premarket Movers

Alcoa reported a narrower-than-expected adjusted loss in the

fourth quarter and a revenue decline of 2.5% to $2.6 billion, which

just edged estimates. The company said it expects lower production

in 2024. The stock was down 0.4%.

Apple again has been banned from selling current versions of the

Apple Watch with blood oxygen sensors in the U.S. in connection

with a patent-infringement case filed against it by Masimo. Apple

shares slipped in premarket trading. Masimo was up 0.4%.

Boeing rose 1.6%. India's Akasa Air has ordered 150 Boeing 737

MAX planes. The order doesn't include the 737 MAX 9, which has been

grounded by the FAA.

Sheryl Sandberg said she plans to leave the board at Meta

Platforms. Shares of Meta were up 0.3%.

Plug Power fell 14% after disclosing in a filing that it will be

selling up to $1 billion of shares. The company said it entered

into an at-the-market issuance sales agreement with B. Riley

Securities that would allow it to sell up to $1 billion in common

stock.

Taiwan Semiconductor Manufacturing reported fourth-quarter

profit that fell 19% from a year earlier but still topped analysts'

expectations. Revenue in U.S. dollars fell 1.5% in the quarter to

$19.62 billion but rose but 13.6% from the third quarter.

U.S.-listed shares were up 4%.

Wednesday's Post-Close Movers

Discover Financial Services reported fourth-quarter earnings of

$1.54 a share, down from a year ago and below the $2.50 a share

that analysts surveyed by FactSet expected. The company's

charge-off rate jumped to 4.11%, up from 2.13% a year ago. Shares

fell 10%.

LiveRamp said it expects to report revenue of $174 million for

its fiscal third quarter, up 10% from the same period a year

earlier and above the company's guidance of $165 million. The

company also struck a deal to buy data clean room software provider

Habu in a cash-and-stock deal that the companies valued at $200

million. Shares rose 9%.

R1 RCM completed its $675 million deal to buy Acclara from

Providence. R1 said it expects the Acclara deal and the new

partnership to generate more than $625 million in revenue by year

five of the partnership. Shares rose more than 3%.

Forex:

The dollar edged slightly lower after strong gains on Wednesday

but continued to trade on a strong footing due to rising yields

spurring general risk-off sentiment in markets, Danske Bank

Research said.

"The general risk-off sentiment in markets alongside rising

yields is adding support to the dollar for the time being."

However, since the euro is also performing "decently," keeping

EUR/USD only just below 1.09, Danske said.

EUR/USD is expected to trade in a tight 1.0880-1.0950 range on

Thursday, although ING still expects it to fall to 1.08 by the end

of the first quarter.

Sterling continued to edge higher after Wednesday's inflation

data caused investors to scale back expectations for interest-rate

cuts, and it could be on course to perform better than many

analysts had expected.

ING said it will probably soon have to cut its current forecasts

for EUR/GBP to rise to 0.88 later this quarter and 0.90 later this

year, which now look too aggressive.

The inflation data resulted in a reduction of 20 basis points in

2024 U.K. rate-cut expectations, supporting sterling across the

board, ING added.

Bonds:

The 10-year Treasury yield has scope to rise above the 55-day

exponential moving average, which is currently at 4.163%, UOB

Global Economics & Markets Research said.

Price movements and technical signals suggest the yield could

rise further, but upward momentum appears somewhat tentative, so it

remains to be seen whether there's sufficient momentum for the

yield to clearly breach mid-December high of 4.295%, it said.

On the downside, support is at 3.900% ahead of late-December low

of 3.783%, UOB added.

Energy:

Oil prices inched higher following OPEC's growth expectations

for demand, and as Middle East tensions and a cold blast in the

U.S. raised concerns over supply disruptions.

"For now, the flat price remains firmly below $80/bbl and with

the balance expected to be fairly comfortable over 1H24,

significant upside is probably limited," ING said.

Metals:

Base metals and gold rose slightly on a softer dollar, but

weakening expectations of early interest-rate cuts this year

continued to weigh on sentiment.

"Concerns about resurging inflationary pressures due to

geopolitical uncertainty in the Middle East, combined with a robust

economy, suggest that the Fed may not need to rush into

implementing monetary policy easing," Sucden Financial said.

ANZ said that going forward, gold "is set to benefit from easing

monetary policy, elevated geopolitical risks and strong central

bank buying."

Copper

Copper prices have already likely bottomed, Macquarie said,

which had previously seen them cratering deep into 2024.

It now expects a more balanced copper market this year, with

prices averaging US$8,125/ton, up some 3.8% on its prior

forecast.

TODAY'S TOP HEADLINES

Hyundai and Kia Emerge as Tesla's Biggest U.S. Rivals

As the electric-vehicle race heats up, a pair of Korean

automakers are pulling ahead of larger rivals in the U.S. to emerge

as Tesla's biggest competition.

Hyundai Motor and affiliate Kia jointly captured the No. 2 slot

last year in U.S. electric-vehicle sales, trailing only Tesla,

which still holds a commanding lead. Analysts say the allied

carmakers, both a part of South Korea's Hyundai Motor Group

conglomerate, are poised to cement or advance their lead over

non-Tesla rivals this year with fresh EV models and aggressive

pricing.

Chip Giant TSMC Foresees Delay at Second Arizona Plant

Taiwanese chip maker TSMC said it expected to delay production

at the second of two semiconductor plants it is building in

Arizona, and cast uncertainty on an earlier statement that the

plant would produce an advanced type of chip.

The statement by TSMC Chairman Mark Liu at a news conference

Thursday offered further evidence that the $40 billion Arizona

project is running into challenges in meeting aggressive timeline

targets.

China Goes All In on Green Industry to Jolt Ailing Economy

China is doubling down on manufacturing to reboot its economy

after a turbulent year, a strategy that risks igniting new tensions

over trade as countries step up support for prized industries and

global growth teeters.

The push for new growth drivers comes as figures showed the

world's second-largest economy expanded in 2023 at its weakest rate

in decades, aside from the three years when China was closed to the

outside world during the Covid-19 pandemic. A drawn-out property

crunch means Beijing can no longer rely on debt-fueled real-estate

investment to power the economy, and officials have shown little

appetite to shift activity decisively toward consumer spending.

The U.S. Plan for a Postwar Middle East Isn't Gaining Much

Traction

WASHINGTON-Biden administration officials say the path toward a

more stable Middle East goes through the ruins of Gaza. But that

goal keeps running into the harsh realities of a region plunged

into conflict.

The latest blows to the White House plans are the persistent

attacks by Houthi forces in Yemen against international shipping in

the Red Sea-a show of Arab support for Palestinian militants in

Gaza against Israel that has prompted the U.S. and its allies to

hit dozens of areas controlled by the Iran-backed Houthis with air

and missile strikes. The exchanges are pulling the U.S. into a

wider conflict and threaten to worsen regional tensions.

White House Meeting Revives Hopes for Ukraine, Border Deal

WASHINGTON-Congressional leaders struck a cautiously optimistic

tone Wednesday on reaching a deal combining tighter border security

with aid for Ukraine, as they emerged from meeting with President

Biden at the White House.

House Speaker Mike Johnson (R., La.) said the hour-and-20-minute

sit down was "productive" while reiterating Republicans' demand

that changing border law was a condition for further funding Kyiv,

which is one piece of a stalled $110.5 billion foreign-aid package

championed by Biden.

Write to ina.kreutz@wsj.com

TODAY IN CANADA

Earnings:

Blackline Safety 4Q

Economic Calendar (ET):

Nothing scheduled

Stocks to Watch:

Simply Solventless Acquires Recreational Cannabis Brand

Lamplighter

Expected Major Events for Thursday

00:01/UK: Dec RICS Residential Market Survey

04:30/JPN: Nov Revised Industrial Production

09:00/FRA: Jan IEA Oil Market Report

09:30/UK: 4Q Bank of England Credit Conditions Survey

09:30/UK: 4Q Bank of England's Bank Liabilities Survey

10:00/ITA: Nov Balance of Payments

11:00/FRA: Nov OECD Harmonised Unemployment Rates

11:00/FRA: 3Q OECD Quarterly Labour Market Situation

13:00/RUS: Weekly International Reserves

13:30/US: Dec New Residential Construction - Housing Starts and

Building Permits

13:30/US: Jan Philadelphia Fed Business Outlook Survey

13:30/US: 01/13 Unemployment Insurance Weekly Claims Report -

Initial Claims

15:30/US: 01/12 EIA Weekly Natural Gas Storage Report

16:00/US: 01/12 EIA Weekly Petroleum Status Report

21:30/US: Federal Discount Window Borrowings

21:30/US: Foreign Central Bank Holdings

23:30/JPN: Dec CPI (Nation), CPI ex-food (Nation)

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Thursday

1st Source Corp (SRCE) is expected to report $1.15 for 4Q.

American National Bankshares Inc (AMNB) is expected to report

$0.69 for 4Q.

Ames National Corp (ATLO) is expected to report for 4Q.

Bank OZK (OZK) is expected to report $1.46 for 4Q.

Banner Corp (BANR) is expected to report $1.30 for 4Q.

Capstar Financial Holdings (CSTR) is expected to report $0.26

for 4Q.

Chino Commercial Bancorp (CCBC) is expected to report for

4Q.

Commerce Bancshares Inc (CBSH) is expected to report $0.82 for

4Q.

Concentrix Corp (CNXC) is expected to report for 4Q.

EBET Inc (EBET) is expected to report for 4Q.

FNB Corp (FNB) is expected to report $0.32 for 4Q.

Fastenal Co (FAST) is expected to report $0.45 for 4Q.

Fastenal Co (FAST) is expected to report.

First Horizon Corp (FHN) is expected to report $0.27 for 4Q.

Five Point Holdings LLC (FPH) is expected to report for 4Q.

Greene County Bancorp (GCBC) is expected to report for 2Q.

Home BancShares Inc (HOMB) is expected to report $0.44 for

4Q.

Independent Bank Corp (INDB) is expected to report $1.24 for

4Q.

Insteel Industries (IIIN) is expected to report $0.05 for

1Q.

J.B. Hunt Transport Services Inc (JBHT) is expected to report

$1.77 for 4Q.

KeyCorp (KEY) is expected to report $0.04 for 4Q.

M&T Bank Corp (MTB) is expected to report $3.10 for 4Q.

Metropolitan Bank Holding Corp (MCB) is expected to report $1.48

for 4Q.

Northern Trust Corp (NTRS) is expected to report $0.85 for

4Q.

Oak Valley Bancorp (OVLY) is expected to report for 4Q.

OceanFirst Financial Corp (OCFC) is expected to report $0.42 for

4Q.

OrganiGram Holdings Inc (OGI,OGI.T) is expected to report for

1Q.

PPG Industries Inc (PPG) is expected to report $1.48 for 4Q.

Platinum Group Metals Ltd (PLG,PTM.T) is expected to report for

1Q.

Quantum Corp (QMCO) is expected to report $-0.09 for 2Q.

RF Industries (RFIL) is expected to report $-0.10 for 4Q.

RVL Pharmaceuticals PLC (RVLPQ) is expected to report for

3Q.

Richelieu Hardware (RCH.T) is expected to report $0.52 for

4Q.

Technical Communications Corp (TCCO) is expected to report for

4Q.

Texas Capital Bancshares Inc (TCBI) is expected to report $0.57

for 4Q.

Truist Financial Corp (TFC) is expected to report for 4Q.

WNS (Holdings) Ltd - ADR (WNS) is expected to report $0.72 for

3Q.

Westamerica Bancorp (WABC) is expected to report $1.46 for

4Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Allakos Cut to Hold From Buy by Jefferies

American Axle Cut to Sell From Neutral by UBS

Ansys Cut to Neutral From Buy by Rosenblatt

Ansys Cut to Peer Perform From Outperform by Wolfe Research

Automatic Data Raised to Neutral From Underperform by B of A

Securities

Axonics Cut to Hold From Buy by Needham

Bally's Cut to Neutral From Outperform by Macquarie

Burlington Stores Raised to Overweight From Neutral by Piper

Sandler

Carrols Restaurant Cut to Hold From Buy by Craig-Hallum

Century Casinos Cut to Neutral From Outperform by Macquarie

CrowdStrike Holdings Cut to Hold From Buy by WestPark

Capital

Definitive Healthcare Cut to Hold From Buy by Needham

DXC Technology Cut to Sell From Neutral by Citigroup

ExlService Raised to Buy From Neutral by Citigroup

FB Financial Cut to Market Perform From Outperform by Hovde

Group

Fisker Cut to Market Perform From Outperform by TD Cowen

Ford Motor Cut to Neutral From Buy by UBS

Fortinet Cut to Equal-Weight From Overweight by Capital One

Full House Resorts Cut to Neutral From Outperform by

Macquarie

Hertz Global Raised to Overweight From Equal-Weight by Morgan

Stanley

Inspired Entertainment Cut to Neutral From Outperform by

Macquarie

Luminar Technologies Cut to Hold From Buy by Deutsche Bank

Maplebear Raised to Outperform From Peer Perform by Wolfe

Research

Marathon Digital Raised to Buy From Neutral by BTIG

Mattel Cut to Equal-Weight From Overweight by Morgan Stanley

Morgan Stanley Cut to Market Perform From Outperform by Keefe,

Bruyette & Woods

Morgan Stanley Cut to Neutral From Overweight by JP Morgan

Nutanix Raised to Outperform From Market Perform by William

Blair

OneMain Holdings Cut to Market Perform From Outperform by

Northland Capital Markets

Polaris Raised to Overweight From Equal-Weight by Morgan

Stanley

Red Rock Resorts Raised to Outperform From Neutral by

Macquarie

Rent the Runway Cut to Neutral From Overweight by Piper

Sandler

Revolve Group Raised to Overweight From Neutral by Piper

Sandler

Rivian Automotive Cut to Hold From Buy by Deutsche Bank

Spirit Airlines Cut to Negative From Neutral by Susquehanna

Spirit Airlines Cut to Neutral From Buy by Seaport Global

Twist Bioscience Raised to Buy From Neutral by Goldman Sachs

Visteon Raised to Buy From Neutral by UBS

Wynn Resorts Raised to Outperform From Neutral by Macquarie

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 18, 2024 06:16 ET (11:16 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

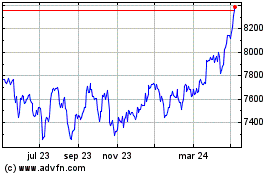

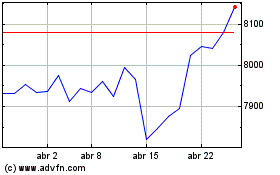

FTSE 100

Gráfica de índice

De Abr 2024 a May 2024

FTSE 100

Gráfica de índice

De May 2023 a May 2024