Euro Declines As ECB Announces New Instrument To Contain Bond Rout

15 Junio 2022 - 7:00AM

RTTF2

The euro fell against its major counterparts during the European

session on Wednesday, after the European Central Bank announced

plans to create a new instrument to address a surge in bond yields

of indebted nations in the bloc.

The Governing Council decided to mandate the relevant Eurosystem

Committees together with the ECB services to accelerate the

completion of the design of a new anti-fragmentation instrument,

the central bank said in a statement after an unscheduled

meeting.

The ECB has pledged to act against resurgent fragmentation risks

since the gradual process of policy normalisation was initiated in

December 2021, it said.

"The pandemic has left lasting vulnerabilities in the euro area

economy which are indeed contributing to the uneven transmission of

the normalisation of our monetary policy across jurisdictions."

The ECB added that it would reinvest redemptions from its

pandemic emergency purchase programme in a flexible manner.

Data from Eurostat showed that Eurozone industrial production

recovered in April but the pace of growth remained weak.

Industrial output rose 0.4 percent month-on-month in April,

reversing a 1.4 percent fall in March, which was revised down from

a 1.8 percent decline estimated initially.

The euro weakened to 0.8615 against the pound, after rising to

0.8721 at 2:30 am ET, which was its highest level since February

2021. If the euro falls further, it may find support around the

0.84 level.

The euro dropped to 1.0403 against the greenback and 140.08

against the yen, following its prior 2-day highs of 1.0508 and

141.49, respectively. The euro is likely to challenge support

around 1.02 against the greenback and 134.00 against the yen.

After touching a 6-day high of 1.0478 at 1:30 am ET, the single

currency moved down to 1.0406 against the franc. On the downside,

1.02 is possibly seen as its next support level.

The euro slipped to 1.4974 against the aussie and 1.3457 against

loonie, down from its prior fresh 3-week high of 1.5190 and a fresh

2-week high of 1.3607, respectively. The euro may locate support

around 1.45 against the aussie and 1.32 against the loonie.

The euro touched 1.6641 against the kiwi, falling from near a

4-month high of 1.6853 seen at 3:30 am ET. The euro is seen finding

support around the 1.65 level.

Looking ahead, the Fed announces its decision on interest rate

at 2:00 pm ET. Economists widely expect the Fed to raise rates by

50 basis points to 1.5 percent.

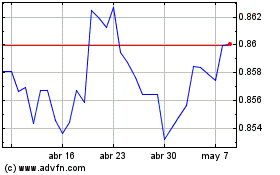

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

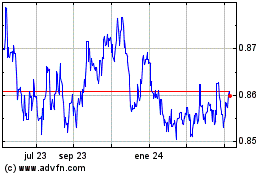

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024