Eurozone Private Sector Growth Strongest In Almost A Year

23 Abril 2024 - 3:39AM

RTTF2

The euro area private sector expanded the most in nearly a year

in April as the continuing downturn in the manufacturing activity

was offset the strength in the service sector, flash survey results

from S&P Global showed on Tuesday. The composite output index

registered 51.4 in April, up from 50.3 in March. The reading stayed

above economists' forecast of 50.8.

The private sector expanded for the second month in a row in

April after a continual decline over the nine months to February.

The score signaled the strongest growth since last May.

Service sector output expanded for a third consecutive month

with the pace of expansion strongest since eleven months, while

manufacturing output shrank for a thirteenth straight month.

New orders for services advanced at the fastest pace since last

May but orders for manufactured goods declined at an accelerated

rate.

Employment grew for a fourth month in a row after two months of

marginal declines at the end of 2023. The rate of net job creation

accelerated to the highest since last June.

Manufacturing supplier delivery times shortened for a third

successive month and improved to the greatest degree since last

August. Both input costs and average selling prices increased at

faster rates in April. At composite level, input costs posted the

joint-fastest rise seen over the past year.

Selling price inflation accelerated from March's four-month low

and stayed above long-run average.

Business expectations about the coming twelve months cooled

slightly but was the second highest recorded over the past 14

months, the survey showed.

"…our GDP forecast suggests a 0.3 percent expansion in the

second quarter, matching the growth rate seen in the first quarter,

both measured against the preceding quarter," Hamburg Commercial

Bank chief economist Cyrus de la Rubia said.

The PMI figures are poised to test the European Central Bank's

willingness to cut interest rates in June as input costs increased

amid higher oil prices and higher wages. Nonetheless, the ECB is

expected to cut rates in June, the economist noted. "However, we

doubt that the central bank will adopt a "pragmatic speed", as

suggested by Francois Villeroy de Galhau from the ECB. Instead, we

expect a more cautious approach," Rubia said.

Further, the survey showed that solid growth outside of France

and Germany was again reported. Germany returned to growth in April

and France moved closer to stabilization.

Germany's private sector expanded for the first time in ten

months in April underpinned by a solid rise in services

activity.

The flash composite output index rose more-than-expected to 50.5

in April from 47.7 in the previous month. The reading was seen at

48.6.

The services PMI posted a ten-month high reading of 53.3 in

April, up from 50.1 in the previous month. Economists had forecast

the index to climb to 50.6.

At 42.2, the manufacturing PMI rose moderately from 41.9 in

March but remained below forecast of 42.8.

Driven by the renewed expansion in the service sector, France's

flash HCOB composite output index hit an 11-month high of 49.9 from

48.3 in the previous month.

While services activity expanded for the first time since May

2023, the accelerated decline in manufacturing output weighed on

the pace of overall expansion.

The services PMI registered 50.5, which was the highest score in

eleven months. The score was forecast to climb to 48.9 from 48.3 in

February.

By contrast, the manufacturing PMI dropped to a three-month low

of 44.9 from 46.2 a month ago. The expected score was 46.9.

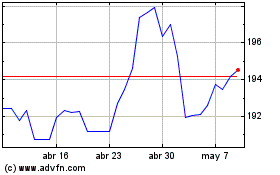

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Abr 2024 a May 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De May 2023 a May 2024