Ashmore Group PLC Trading Statement (6032Z)

15 Enero 2024 - 1:00AM

UK Regulatory

TIDMASHM

RNS Number : 6032Z

Ashmore Group PLC

15 January 2024

Ashmore Group plc

15 January 2024

SECOND QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces the following update to

its assets under management ("AuM") in respect of the quarter ended

31 December 2023.

Assets under management

Actual Estimated Movement

30 September

2023 31 December 2023 pre reclassification(1)

Theme (US$ billion) (US$ billion) (%)

- External debt 8.9 9.5 +7%

--------------- ------------------- --------------------------

- Local currency 18.4 18.8 +2%

--------------- ------------------- --------------------------

- Corporate

debt(1) 5.5 5.2 +2%

--------------- ------------------- --------------------------

- Blended debt(1) 11.3 12.4 +6%

--------------- ------------------- --------------------------

Fixed income 44.1 45.9 +4%

--------------- ------------------- --------------------------

Equities 6.0 6.5 +8%

--------------- ------------------- --------------------------

Alternatives 1.6 1.6 -

--------------- ------------------- --------------------------

Total 51.7 54.0 +4%

--------------- ------------------- --------------------------

Assets under management increased by US$2.3 billion over the

period, comprising positive investment performance of US$3.9

billion and net outflows of US$1.6 billion.

The Group's net outflows reduced from prior quarters as, while

there continues to be some risk aversion among certain investors,

clients responded to the improving global macro environment.

Equities delivered a net inflow and, within the fixed income

themes, the outflows were broadly spread with no significant

patterns.

The Fed's signalling of the end of its rate hiking cycle and

continued economic stability in many emerging countries delivered

strong performance across Emerging Markets over the three months.

Fixed income indices rose by 6% to 9% and equities increased by 8%,

and the majority of Ashmore's strategies outperformed over the

quarter. Ashmore's longer-term relative performance (over one,

three and five years) remains consistent.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Emerging Markets delivered good returns and outperformed most

developed world indices in 2023 due to superior economic growth,

effective monetary policies and the benefits of a weaker US dollar

as the Fed reaches the end of its tightening cycle. These factors,

along with attractive absolute and relative valuations, will

support Emerging Markets asset prices in 2024, leading to

outperformance and higher allocations from investors who currently

have significantly underweight allocations to Emerging Markets.

Ashmore continues to deliver outperformance for clients across a

broad range of strategies, and activity levels have begun to

reflect the improving outlook for the global macro

environment."

Notes

1. During the quarter, assets totalling US$0.4 billion were

reclassified from corporate debt to blended debt as a result of

changes to benchmarks. The quarter-on-quarter % movements and the

commentary on flows exclude the effects of this reclassification.

Including the reclassification, corporate debt AuM decreased by 5%

and blended debt AuM increased by 10% over the period.

Local currency AuM includes US$6.3 billion of AuM managed in

overlay/liquidity strategies (30 September 2023: US$6.6

billion).

For the translation of US dollar-denominated balance sheet

items, the GBP:USD exchange rate was 1.2748 at 31 December 2023 (30

June 2023: 1.2714; 31 December 2022: 1.2029). For the translation

of US dollar management fees, the average GBP:USD exchange rate

achieved for the first half of the financial year was 1.2572 (H1

2022: 1.1795).

Ashmore will announce its interim results in respect of the six

months ending 31 December 2023 on 7 February 2024.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

ir@ashmoregroup.com

FTI Consulting

Neil Doyle +44 (0)7771 978 220

Kit Dunford +44 (0)7717 417 038

ashmore@fticonsulting.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFDLAIFLIS

(END) Dow Jones Newswires

January 15, 2024 02:00 ET (07:00 GMT)

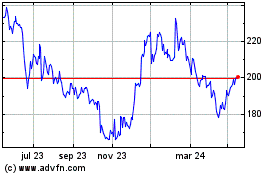

Ashmore (LSE:ASHM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

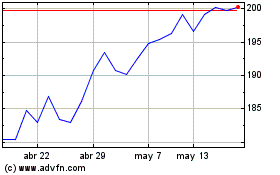

Ashmore (LSE:ASHM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024