TIDMBOCH

RNS Number : 7759I

Bank of Cyprus Holdings PLC

09 August 2023

Independent review report to Bank of Cyprus Holdings Public

Limited Company

Report on the consolidated condensed interim financial

statements

Our conclusion

We have reviewed Bank of Cyprus Holdings Public Limited

Company's consolidated condensed interim financial statements (the

"interim financial statements") in the Interim Financial Report of

Bank of Cyprus Holdings Public Limited Company for the six month

period ended 30 June 2023 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Transparency

(Directive 2004/109/EC) Regulations 2007, as amended, Part 2

(Transparency Requirements) of the Central Bank (Investment Market

Conduct) Rules 2019 and the applicable requirements of the

Disclosure Guidance and Transparency Rules of the UK's Financial

Conduct Authority .

The interim financial statements, comprise:

-- The Interim Consolidated Balance Sheet as at 30 June 2023;

-- the Interim Consolidated Income Statement and the Interim

Consolidated Statement of Comprehensive Income for the period then

ended;

-- the Interim Consolidated Statement of Cash Flows for the period then ended;

-- the Interim Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the Interim

Financial Report have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Transparency

(Directive 2004/109/EC) Regulations 2007, as amended, Part 2

(Transparency Requirements) of the Central Bank (Investment Market

Conduct) Rules 2019 and the applicable requirements of the

Disclosure Guidance and Transparency Rules of the UK's Financial

Conduct Authority .

As disclosed in note 3.2 to the interim financial statements,

the financial reporting framework that has been applied in the

preparation of the full annual financial statements of the group is

applicable law and International Financial Reporting Standards

(IFRSs) as adopted by the European Union.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (Ireland) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' ("ISRE (Ireland) 2410") issued for use in Ireland. A review

of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (Ireland)

and, consequently, does not enable us to obtain assurance that we

would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the Interim

Financial Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (Ireland) 2410. However future events or

conditions may cause the group to cease to continue as a going

concern.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The Interim Financial Report, including the interim financial

statements, is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the Interim

Financial Report in accordance with the Transparency (Directive

2004/109/EC) Regulations 2007, as amended, Part 2 (Transparency

Requirements) of the Central Bank (Investment Market Conduct) Rules

2019 and the applicable requirements of the Disclosure Guidance and

Transparency Rules of the UK's Financial Conduct Authority . In

preparing the Interim Financial Report including the interim

financial statements, the directors are responsible for assessing

the group's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern and using the going

concern basis of accounting unless the directors either intend to

liquidate the group or to cease operations, or have no realistic

alternative but to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the Interim Financial Report based on our

review. Our conclusion, including our Conclusions relating to going

concern, is based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report. This report, including the conclusion, has been

prepared for and only for the company for the purpose of complying

with the Transparency (Directive 2004/109/EC) Regulations 2007, as

amended, Part 2 (Transparency Requirements) of the Central Bank

(Investment Market Conduct) Rules 2019 and the applicable

requirements of the Disclosure Guidance and Transparency Rules of

the UK's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

PricewaterhouseCoopers

Chartered Accountants

8 August 2023

Dublin

Alternative Performance Measures Disclosures

30 June 2023

DEFINITIONS

Allowance for Allowance for expected credit losses on loans comprises:

expected credit (i) allowance for expected credit losses (ECL) on

losses on loans loans and advances to customers (including allowance

for expected credit losses on loans and advances

to customers classified as non-current assets held

for sale, where applicable) , (ii) the residual fair

value adjustment on initial recognition of loans

and advances to customers (including residual fair

value adjustment on initial recognition of loans

and advances to customers held for sale, where applicable

), (iii) allowance for expected credit losses on

off-balance sheet exposures ( financial guarantees

and commitments) disclosed on the balance sheet within

other liabilities and (iv) the aggregate fair value

adjustment on loans and advances to customers classified

and measured at FVPL.

Cost to income Cost to income ratio is calculated as total expenses

ratio per the underlying basis (as defined below) divided

by total income as per the underlying basis (as defined

below).

Digitally engaged This is the ratio of digitally engaged individual

customers ratio customers to the total number of individual customers.

Digitally engaged customers are the individuals who

use the digital channels of BOC PCL (mobile banking

app, browser and ATMs) to perform banking transactions,

as well as digital enablers such as a bank-issued

card to perform online card purchases, based on an

internally developed scorecard.

Gross loans Gross Loans comprise: (i) gross loans and advances

to customers measured at amortised cost before the

residual fair value adjustment on initial recognition

(including loans and advances to customers classified

as non-current assets held for sale, where applicable)

and (ii) loans and advances to customers classified

and measured at FVPL adjusted for the aggregate fair

value adjustment.

The residual fair value adjustment on initial recognition

relates mainly to loans acquired from Laiki Bank

(calculated as the difference between the outstanding

contractual amount and the fair value of loans acquired

at acquisition).

Interest earning Interest earning assets include: cash and balances

assets with central banks, plus loans and advances to banks,

plus net loans and advances to customers (including

net loans and advances to customers classified as

non-current assets held for sale , where applicable

) (as defined below), plus deferred consideration

receivable ('DPP'), plus investments (excluding equities,

mutual funds and other non-interest bearing investments).

Legacy exposures Legacy exposures are exposures relating to

(i) Restructuring and Recoveries Division (RRD),

(ii) Real Estate Management Unit (REMU), and

(iii) Non-core overseas exposures.

Leverage ratio The leverage ratio is the ratio of tangible total

equity to total assets as presented on the balance

sheet. Tangible total equity comprises of equity

attributable to the owners of the Company and Other

equity instruments minus intangible assets.

Loan credit Loan credit losses comprise: (i) credit losses to

losses cover credit risk on loans and advances to customers,

(ii) net gains on derecognition of financial assets

measured at amortised cost relating to loans and

advances to customers and (iii) net gains on loans

and advances to customers at FVPL, for the period/year.

Loan credit Loan credit losses charge (cost of risk) (year to

losses charge date) is calculated as the loan credit losses (as

(cost of risk) defined) (annualised based on year to date days)

divided by the average gross loans (as defined).

The average gross loans are calculated as the average

of the opening balance and the closing balance of

Gross loans (as defined), for the reporting period/year.

Net fee and Fee and commission income less fee and commission

commission income expense divided by total income (as defined).

over total income

Net Interest Net interest margin is calculated as the net interest

Margin income (annualised based on year to date days) divided

by the quarterly average interest earning assets

(as defined). Quarterly average interest earning

assets exclude interest earning assets of any discontinued

operations at each quarter end, if applicable.

Net loans and Net loans and advances to customers comprise gross

advances to loans (as defined) net of allowance for expected

customers credit losses on loans (as defined, but excluding

allowance for expected credit losses on off-balance

sheet exposures disclosed on the balance sheet within

other liabilities).

Net loans to Net loans to deposits ratio is calculated as the

deposits ratio gross loans (as defined) net of allowance for expected

credit losses on loans (as defined), divided by customer

deposits.

Net performing Net performing loan book is the total net loans and

loan book advances to customers (as defined) excluding net

loans included in legacy exposures (as defined).

New lending New lending includes the disbursed amounts of the

new and existing non-revolving facilities (excluding

forborne or re-negotiated accounts) as well as the

average year to date change (if positive) of the

current accounts and overdraft facilities between

the balance at the beginning of the period and the

end of the period. Recoveries are excluded from this

calculation since their overdraft movement relates

mostly to accrued interest and not to new lending.

Non-performing As per the EBA standards and European Central Bank's

exposures (NPEs) (ECB) Guidance to Banks on Non-Performing Loans (which

was published in March 2017), NPEs are defined as

those exposures that satisfy one of the following

conditions:

(i) The borrower is assessed as unlikely to pay its

credit obligations in full without the realisation

of the collateral, regardless of the existence of

any past due amount or of the number of days past

due.

(ii) Defaulted or impaired exposures as per the approach

provided in the Capital Requirement Regulation (CRR),

which would also trigger a default under specific

credit adjustment, diminished financial obligation

and obligor bankruptcy.

(iii) Material exposures as set by the Central Bank

of Cyprus (CBC), which are more than 90 days past

due.

(iv) Performing forborne exposures under probation

for which additional forbearance measures are extended.

(v) Performing forborne exposures previously classified

as NPES that present more than 30 days past due within

the probation period.

From 1 January 2021 two regulatory guidelines came

into force that affect NPE classification and Days-Past-Due

calculation. More specifically, these are the RTS

on the Materiality Threshold of Credit Obligations

Past-Due (EBA/RTS/2016/06), and the Guideline on

the Application of the Definition of Default under

article 178 (EBA/GL/2016/07).

The Days-Past-Due (DPD) counter begins counting DPD

as soon as the arrears or excesses of an exposure

reach the materiality threshold (rather than as of

the first day of presenting any amount of arrears

or excesses). Similarly, the counter will be set

to zero when the arrears or excesses drop below the

materiality threshold. Payments towards the exposure

that do not reduce the arrears/excesses below the

materiality threshold, will not impact the counter.

For retail debtors, when a specific part of the exposures

of a customer that fulfils the NPE criteria set out

above is greater than 20% of the gross carrying amount

of all on-balance sheet exposures of that customer,

then the total customer exposure is classified as

non--performing; otherwise only the specific part

of the exposure is classified as non--performing.

For non--retail debtors, when an exposure fulfils

the NPE criteria set out above, then the total customer

exposure is classified as non--performing.

Material arrears/excesses are defined as follows:

* Retail exposures: Total arrears/excess amount greater

than EUR100

* Exposures other than retail: Total arrears/excess

amount greater than EUR500

and the amount in arrears/excess is at least 1% of

the customer's total exposure.

The NPEs are reported before the deduction of allowance

for expected credit losses on loans (as defined).

Non-recurring Non-recurring items as presented in the 'Consolidated

items Income Statement on the underlying basis' relate

to 'Advisory and other transformation costs - organic'

(2022: Non-recurring items relate to: (i) Advisory

and Other transformation costs-ongoing (ii) Provisions/net

loss relating to NPE sales, (iii) Restructuring and

other costs relating to NPE sales, and (iv) Restructuring

costs - Voluntary Staff Exit Plan (VEP), as applicable).

NPE coverage The NPE coverage ratio is calculated as the allowance

ratio for expected credit losses on loans on an underlying

basis (as defined) over NPEs (as defined).

NPE ratio The NPE ratio is calculated as the NPEs (as defined)

divided by gross loans (as defined).

Operating profit Operating profit on an underlying basis comprises

profit before loan credit losses (as defined), impairments

of other financial and non-financial assets, provisions

for litigation, claims, regulatory and other matters

(net of reversals), tax, profit attributable to non-controlling

interests and non-recurring items (as defined).

Operating profit Operating profit return on average assets is calculated

return on average as the annualised (based on year to date days) operating

assets profit on an underlying basis (as defined) divided

by the quarterly average of total assets for the

relevant period. Average total assets exclude total

assets of discontinued operations at each quarter

end, if applicable.

Profit/(loss) Profit/(loss) after tax and before non-recurring

after tax and items (attributable to the owners of the Company)

before non-recurring is the operating profit (as defined) adjusted for

items (attributable loan credit losses (as defined), impairments of other

to the owners financial and non-financial assets, provisions for

of the Company) litigation, claims, regulatory and other matters

(net of reversals), tax and (profit)/loss attributable

to non-controlling interests.

Profit/(loss) Profit/(loss) after tax - organic (attributable to

after tax - the owners of the Company) is the profit/(loss) after

organic (attributable tax and before non-recurring items (as defined) (attributable

to the owners to the owners of the Company), adjusted for the 'Advisory

of the Company) and other transformation costs - organic'.

Return on Tangible Return on Tangible Equity (ROTE) after tax and before

Equity (ROTE) non-recurring items is calculated as Profit/(loss)

after tax and after tax and before non-recurring items (attributable

before non-recurring to the owners of the Company) (as defined) per the

items underlying basis (annualised - (based on year-to-date

days)), divided by the quarterly average of Shareholders'

equity minus intangible assets at each quarter end.

Return on Tangible Return on Tangible Equity (ROTE) is calculated as

Equity (ROTE) Profit/(loss) after tax (attributable to the owners

of the Company) (annualised - (based on year-to-date

days)), divided by the quarterly average of Shareholders'

equity minus intangible assets at each quarter end.

Shareholders' Shareholders' equity comprise total equity adjusted

equity for non-controlling interest and other equity instruments.

Time deposit Calculated as a percentage of the cost (interest

pass-through expense) of Time and Notice deposits over the average

6-month Euribor rate of the period.

Total expenses Total expenses on the underlying basis comprise the

total staff costs, special levy on deposits and other

levies/contributions and other operating expenses

(excluding 'Advisory and other transformation costs-organic',

(on an underlying basis) as reconciled in the table

further below) (2022: total expenses on the underlying

basis comprise total staff costs (excluding 'Restructuring

costs - Voluntary Staff Exit Plan (VEP)') (on an

underlying basis as reconciled in the table further

below), special levy on deposits and other levies/contributions

and other operating expenses (excluding 'Advisory

and other transformation costs-organic', 'Restructuring

and other costs relating to NPE sales', on an underlying

basis as reconciled in the table further below)).

Total income Total income on the underlying basis comprises the

total of net interest income, net fee and commission

income , net foreign exchange gains, net gains/(losses)

on financial instruments ( excluding net gains/(losses)

on loans and advances to customers at FVPL) , net

insurance result, net gains/(losses) from revaluation

and disposal of investment properties and on disposal

of stock of property and other income (on an underlying

basis) . A reconciliation of these amounts between

the statutory and the underlying bases is disclosed

in the Interim Management Report under section 'Group

financial results on the underlying basis'.

RECONCILIATIONS

For the purpose of the 'Alternative Performance Measures

Disclosures', reference to 'Note' relates to the respective note in

the Consolidated Condensed Interim Financial Statements for the six

months ended 30 June 2023.

Reconciliations between the calculations of non-IFRS performance

measures and the most directly comparable IFRS measures which allow

for the comparability of the underlying basis to statutory

information are disclosed below.

On 1 January 2023, the Group adopted IFRS 17 'Insurance

Contracts'. As required by the standard, the Group applied the

requirements retrospectively with comparative information

previously published under IFRS 4 'Insurance Contracts' restated

from 1 January 2022, the transition date and therefore

reconciliations of alternative performance measures have also been

restated, where applicable.

1. Reconciliation of Gross loans and advances to customers

30 June 31 December

2023 2022

EUR000 EUR000

=========== ============

Gross loans and advances to customers as

per the underlying basis (as defined above) 10,277,457 10,217,453

=========== ============

Reconciling items:

=========== ============

Residual fair value adjustment on initial

recognition (Note 18) (74,998) (89,029)

=========== ============

Loans and advances to customers measured

at fair value through profit or loss (Note

18) (210,385) (214,359)

=========== ============

Aggregate fair value adjustment on loans

and advances to customers measured at fair

value through profit or loss 3,261 3,270

----------- ------------

Gross loans and advances to customers at

amortised cost as per the Consolidated Condensed

Interim Financial Statements (Note 18) 9,995,335 9,917,335

=========== ============

2. Reconciliation of Allowance for expected credit losses (ECL)

on loans and advances to customers

30 June 31 December

2023 2022

EUR000 EUR000

========= ============

Allowance for expected credit losses on

loans and advances to customers (ECL) as

per the underlying basis (as defined above) 287,645 281,630

========= ============

Reconciling items:

========= ============

Residual fair value adjustment on initial

recognition (Note 18) (74,998) (89,029)

========= ============

Aggregate fair value adjustment on loans

and advances to customers measured at fair

value through profit or loss 3,261 3,270

========= ============

Provisions for financial guarantees and

commitments (Note 24) (18,007) (17,429)

--------- ------------

Allowance for ECL for impairment of loans

and advances to customers as per the Consolidated

Condensed Interim Financial Statements (Note

18) 197,901 178,442

========= ============

3. Reconciliation of NPEs

30 June 31 December

2023 2022

EUR000 EUR000

=========== ============

NPEs as per the underlying basis (as defined

above) 371,091 410,563

=========== ============

Reconciling items:

=========== ============

POCI (NPEs) (Note 1 below) (35,866) (37,742)

=========== ============

Residual fair value adjustment on initial

recognition of loans and advances to customers

(NPEs) classified as Stage 3 (Note 18) (1,433) (1,803)

----------- ------------

Stage 3 gross loans and advances to customers

at amortised cost as per the Consolidated

Condensed Interim Financial Statements (Note

18) 333,792 371,018

=========== ============

NPE ratio

=========== ============

NPEs (as per table above) (EUR000) 371,091 410,563

=========== ============

Gross loans and advances to customers (as

per table above) (EUR000) 10,277,457 10,217,453

=========== ============

Ratio of NPE/Gross loans (%) 3.6% 4.0%

=========== ============

Note 1 : Gross loans and advances to customers at amortised cost

before residual fair value adjustment on initial recognition

include an amount of EUR35,866 thousand POCI - Stage 3 loans (out

of a total of EUR107,622 thousand POCI loans) (31 December 2022:

EUR37,742 thousand POCI - Stage 3 loans (out of a total of

EUR115,544 thousand POCI loans)) as disclosed in Note 18 of the

Consolidated Condensed Interim Financial Statements for the six

months ended 30 June 2023.

4. Reconciliation of Loan credit losses

Six months ended

30 June

2023 2022

========= ========

EUR000 EUR000

========= ========

Loan credit losses as per the underlying

basis 24,397 23,118

========= ========

Reconciling items:

========= ========

Loan credit losses relating to NPE sales,

disclosed under non-recurring items within

'Provisions/net loss relating to NPE sales'

under the underlying basis - 385

========= ========

24,397 23,503

========= ========

Loan credit losses (as defined) are reconciled

to the statutory basis as follows:

========= ========

Credit losses to cover credit risk on

loans and advances to customers (Note

12) 30,290 23,959

========= ========

Net gains on derecognition of financial

assets measured at amortised cost - loans

and advances to customers (see further

below) (5,902) (2,515)

========= ========

Net losses on loans and advances to customers

at FVPL (Note 10) 9 2,059

--------- --------

24,397 23,503

========= ========

Net gains on derecognition of financial assets measured at

amortised cost on the Interim Consolidated Income Statement amount

to EUR5,861 thousand (30 June 2022: EUR1,648 thousand) and comprise

EUR5,902 thousand (30 June 2022: EUR2,515 thousand) net gains on

derecognition of loans and advances to customers and EUR41 thousand

(30 June 2022: EUR867 thousand) net losses on derecognition of debt

securities measured at amortised cost.

KEY PERFORMANCE RATIOS INFORMATION

For the purpose of the 'Alternative Performance Measures

Disclosures', reference to 'Note' relates to the respective note in

the Consolidated Condensed Interim Financial Statements for the six

months ended 30 June 2023

1. Net Interest Margin

The various components for the calculation of net interest

margin are provided below:

1.1 Net interest income used in the calculation Six months ended

of NIM 30 June

2023 2022

(restated)

=========== ============

EUR000 EUR000

=========== ============

Net interest income as per the underlying

basis/statutory basis 358,342 145,722

=========== ============

Net interest income used in the calculation

of NIM (annualized) 722,623 293,859

=========== ============

1.2 Interest 30 June 31 March 31 December

earning assets 2023 2023 2022

=========== =========== ============

EUR000 EUR000 EUR000

=========== =========== ============

Cash and balances with central banks 9,127,429 9,247,705 9,567,258

=========== =========== ============

Loans and advances to banks 431,812 415,832 204,811

=========== =========== ============

Loans and advances to customers 10,007,819 10,013,108 9,953,252

=========== =========== ============

Prepayments, accrued income and other

assets - Deferred consideration receivable

('DPP') (Note 20) 320,655 315,755 311,523

=========== =========== ============

Investments

=========== =========== ============

Debt securities (Note 15) 3,178,127 2,746,790 2,499,894

=========== =========== ============

Total interest earning assets 23,065,842 22,739,190 22,536,738

=========== =========== ============

1.3 Quarterly average interest earning

assets (EUR000)

=========== =========== ============

* as at 30 June 2023 22,780,590

=========== =========== ============

* as at 30 June 2022 22,235,482

=========== =========== ============

1.4 Net interest margin (NIM) Six months ended

30 June

2023 2022

(restated)

=========== ============

Net interest income (annualised) (as per table

1.1 above) (EUR000) 722,623 293,859

=========== ------------

Quarterly average interest earning assets

(as per table 1.3 above) (EUR000) 22,780,590 22,235,482

=========== ============

NIM (%) 3.17% 1.32%

=========== ============

2. Cost to income ratio

2.1 Reconciliation of the various components of total expenses

used in the cost to income ratio calculation from the underlying

basis to the statutory basis is provided below:

2.1.1 Reconciliation of Staff costs Six months ended

30 June

=========================

2023 2022

(restated)

======= ================

EUR000 EUR000

======= ================

Total Staff costs as per the underlying basis 93,043 95,173

======= ================

Reclassifications for:

======= ================

Restructuring costs - separately presented

under the underlying basis in 2022 n/a 3,130

------- ----------------

Staff costs as per the statutory basis (Note

11) 93,043 98,303

======= ================

2.1.2 Reconciliation of Other operating expenses Six months ended

30 June

2023 2022 (restated)

======= ================

EUR000 EUR000

======= ================

Other operating expenses as per the underlying

basis 68,199 69,149

======= ================

Reclassifications for:

======= ================

Operating expenses and restructuring costs

relating to the NPE sales, presented within

'Restructuring and other costs relating to

NPE sales' under the underlying basis n/a 1,389

======= ================

Advisory and other transformation costs - organic,

separately presented under the underlying basis 2,257 5,286

------- ================

Other operating expenses as per the statutory

basis (Note 11) 70,456 75,824

======= ================

Reconciliation of the various components of total income used in

the cost to income ratio calculation from the underlying basis to

the statutory basis is provided below:

2. 2 Total Income as per the underlying basis Six months ended

30 June

2023 2022 (restated)

======== ================

EUR000 EUR000

======== ================

Net interest income as per the underlying

basis/statutory basis (as per table 1.1 above) 358,342 145,722

======== ================

Net fee and commission income as per the underlying

basis/statutory basis 89,604 93,639

======== ================

Net foreign exchange gains, Net gains/(losses)

on financial instruments and Net gains on

derecognition of financial assets measured

at amortised cost as per the underlying basis

(as per table 2.3 below) 21,487 2,907

======== ================

Net insurance result (Note below) 24,561 23,724

======== ================

Net losses from revaluation and disposal of

investment properties and Net gains on disposal

of stock of properties (as per the statutory

basis) 4,694 6,870

======== ================

Other income (as per the statutory basis) 12,200 8,927

-------- ----------------

Total Income as per the underlying basis 510,888 281,789

======== ================

Net insurance result comprises the aggregate of captions 'Net

insurance finance income/(expense) and Net reinsurance finance

income/(expense)', 'Net insurance service result' and 'Net

reinsurance service result' per the statutory basis.

2. Cost to income ratio (continued)

2.3 Reconciliation of Net foreign exchange gains, Six months ended

Net gains/ (losses) on financial instruments 30 June

and Net gains on derecognition of financial

assets measured at amortised cost between the

statutory basis and the underlying basis

20 2 3 2022 (restated)

================= ==================

EUR000 EUR000

================= ==================

Net foreign exchange gains, Net gains/(losses)

on financial instruments and Net gains on derecognition

of financial assets measured at amortised cost

as per the underlying basis 21,487 2,907

================= ==================

Reclassifications for:

================= ==================

Net losses on loans and advances to customers

measured at fair value through profit or loss

(FVPL), disclosed within 'Loan credit losses'

per the underlying basis (Note 10) (9) (2,059)

================= ==================

Net gains on derecognition of financial assets

measured at amortised cost - loans and advances

to customers (Table 4 Section 'Reconciliations'

above) 5,902 2,515

================= ==================

Net foreign exchange gains, et gains/(losses)

on financial instruments and Net gains on derecognition

of financial assets measured at amortised cost

as per the statutory basis (see below) 27,380 3,363

================= ==================

Net foreign exchange gains, Net gains/(losses)

on financial instruments and Net gains on derecognition

of financial assets measured at amortised cost

(as per table above) are reconciled to the statutory

basis as follows:

================= ==================

Net foreign exchange gains 15,839 11,898

================= ==================

Net gains/(losses) on financial instruments

(Note 10) 5,680 (10,183)

================= ==================

Net gains on derecognition of financial assets

measured at amortised cost 5,861 1,648

----------------- ------------------

27,380 3,363

================= ==================

2. 4 Total Expenses as per the underlying basis Six months ended

30 June

2023 2022

(restated)

================= ==============

EUR000 EUR000

================= ==============

Staff costs as per the underlying basis (as

per 2.1.1 table above) 93,043 95,173

================= ==============

Special levy on deposits and other levies/contributions

as per the underlying basis/statutory basis 18,236 16,507

================= ==============

Other operating expenses as per the underlying

basis (as per table 2.1.2 above) 68,199 69,149

----------------- --------------

Total Expenses as per the underlying basis 179,478 180,829

================= ==============

Cost to income ratio

================= ==============

Total expenses (as per table 2.4 above) (EUR000) 179,478 180,829

================= ==============

Total income (as per table 2.2 above) (EUR000) 510,888 281,789

================= ==============

Total expenses/Total income (%) 35% 64%

================= ==============

3. Operating profit return on average assets

The various components used in the determination of the

operating profit return on average assets are provided below:

30 June 31 March 31 December

2023 2023 2022

(restated)

EUR000 EUR000 EUR000

========== =========== ============

Total assets used in the computation

of the operating profit return on average

assets/per the Interim Consolidated 25,706,63

Balance Sheet 7 25,386,804 25,288,541

========== =========== ============

Quarterly average total assets (EUR000)

---------- ----------- ------------

* as at 30 June 2023 25,460,661

---------- ----------- ------------

* as at 30 June 2022 (restated) 25,142,255

---------- ----------- ------------

2023 2022

(restated)

Annualised total income for the six months ended

30 June (as per table 2.2 above) (EUR000) 1,030,244 568,249

=========== ============

Annualised total expenses for the six months

ended 30 June (as per table 2.4 above) (EUR000) (361,931) (364,655)

----------- ------------

Annualised operating profit for the six months

ended 30 June (EUR000) 668,313 203,594

=========== ============

Quarterly average total assets as at 30 June

(as per table above) (EUR000) 25,460,661 25,142,255

=========== ============

Operating profit return on average assets (annualised)

(%) 2.6% 0.8%

=========== ============

4. Cost of Risk

Six months ended

30 June

2023 2022

=========== ===========

EUR000 EUR000

=========== ===========

Annualised loan credit losses (as per table

4 in section 'Reconciliation' above) 49,198 46,619

=========== ===========

Average gross loans (as defined) (as per table

1 above) 10,247,455 10,951,845

=========== ===========

Cost of Risk (CoR) % 0.48% 0.43%

=========== ===========

5. Basic earnings after tax and before non-recurring items per

share attributable to the owners of the Company

The various components used in the determination of the 'Basic

earnings after tax and before non-recurring items per share

attributable to the owners of the Company (EUR cent)' are provided

below:

2023 2022

(restated)

Profit after tax and before non-recurring items

(attributable to the owners of the Company)

per the underlying basis for the six months

ended 30 June (as per table 5.1 below) (EUR000) 222,504 52,404

======== ============

Weighted average number of shares in issue during

the period, excluding treasury shares (EUR000)

(Note 14) 446,058 446,058

======== ============

Basic earnings after tax and before non-recurring

items per share attributable to the owners of

the Company (EUR cent) 49.88 11.75

======== ============

The reconciliation between the 'Profit after tax and before

non-recurring items (attributable to the owners of the Company)'

per the underlying basis to the 'Profit after tax (attributable to

the owners of the Company)' per the statutory basis is provided in

the table below:

5.1 Reconciliation of Profit after tax-attributable to the owners of the Company

Six months ended

30 June

2023 2022

(restated)

======== ============

EUR000 EUR000

======== ============

Profit after tax and before non-recurring items

(attributable to the owners of the Company)

per the underlying basis 222,504 52,404

======== ============

Reclassifications for:

======== ============

Loan credit losses relating to NPE sales, disclosed

under non-recurring items within 'Provisions/net

loss relating to NPE sales' under the underlying

basis (as per table 4 in section 'Reconciliations'

above) - (385)

======== ============

Operating expenses and restructuring costs relating

to the NPE sales, presented within 'Restructuring

and other costs relating to NPE sales' under

the underlying basis (as per table 2.1.2 above) - (1,389)

======== ============

Advisory and other transformation costs - organic,

separately presented under the underlying basis

(as per table 2.1.2 above) (2,257) (5,286)

======== ============

Restructuring costs - voluntary exit plan, and

other termination benefits, separately presented

under the underlying basis (as per table 2.1.1

above) - (3,130)

======== ============

Profit after tax (attributable to the owners

of the Company) per the statutory basis 220,247 42,214

======== ============

6. Return on tangible equity (ROTE)

The various components used in the determination of 'Return on

tangible equity (ROTE)' are provided below:

2023 2022

(restated)

Annualised profit after tax (attributable to

the owners of the Company) for the six months

ended 30 June (as per table 5.1 above) (EUR000) 444,145 85,128

========== ============

Quarterly average tangible shareholder's equity

as at 30 June (as per table 6.2 below) (EUR000) 1,846,802 1,751,868

========== ============

ROTE (%) 24.0% 4.9%

========== ============

6.1 Tangible shareholder's equity 30 June 31 March 31 December

2023 2023 2022

(restated)

EUR000 EUR000 EUR000

========== ========== ============

Equity attributable to the owners

of the Company (as per the statutory

basis) 1,984,459 1,899,202 1,806,266

========== ========== ============

Less: Intangible assets (as per the

statutory basis) (47,546) (49,430) (52,546)

========== ========== ============

Total tangible shareholder's equity 1,936,913 1,849,772 1,753,720

========== ========== ============

6.2 Quarterly average tangible shareholder's

equity (EUR000)

========== ========== ============

* as at 30 June 2023 1,846,802

========== ========== ============

* as at 30 June 2022 (restated) 1,751,868

========== ========== ============

7. Leverage ratio

2023 2022

(restated)

Total assets as at 30 June 2023/31 December

2022 (EUR000) 25,706,637 25,288,541

=========== ============

Tangible total equity (including Other equity

instruments) as at 30 June 2023/31 December

2022 (as per table 7.1 below) (EUR000) 2,172,430 1,973,720

=========== ============

Leverage ratio 8.5% 7.8%

=========== ============

7.1 Tangible total equity 30 June 31 December

2023 2022

(restated)

EUR000 EUR000

========== ============

Equity attributable to the owners of the Company

(as per the statutory basis) 1,984,459 1,806,266

========== ============

Other equity instruments 235,517 220,000

========== ============

Less: Intangible assets (as per the statutory

basis) (47,546) (52,546)

========== ============

Total tangible equity 2,172,430 1,973,720

========== ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFEETTIAIIV

(END) Dow Jones Newswires

August 09, 2023 02:03 ET (06:03 GMT)

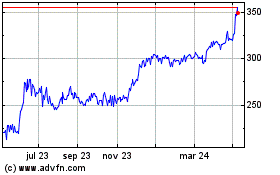

Bank Of Cyprus Holdings ... (LSE:BOCH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

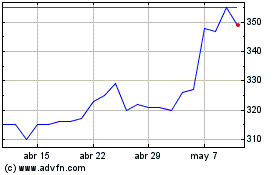

Bank Of Cyprus Holdings ... (LSE:BOCH)

Gráfica de Acción Histórica

De May 2023 a May 2024