Mobico Group PLC Mobico Secures EUR500m Debt Financing (7072N)

26 Septiembre 2023 - 5:49AM

UK Regulatory

TIDMMCG

RNS Number : 7072N

Mobico Group PLC

26 September 2023

26 September 2023

MOBICO GROUP PLC

Mobico Secures EUR500m Debt Financing

Mobico Group PLC ("Mobico" or the "Company"), a leading

international shared mobility provider, announces that it has

successfully priced and issued EUR500m eight-year notes under its

GBP1.5bn Euro Medium Term Note Programme (the "Bonds"). The Bonds

have a fixed coupon of 4.875%, have been rated Baa2 and BBB by

Moody's and Fitch respectively, and will mature on 26 September

2031.

The Bonds will be listed on the Main Market of the London Stock

Exchange.

Today's issuance marks Mobico's inaugural benchmark

EUR-denominated bonds and is consistent with the Company's

objective of diversifying its sources of funding. The proceeds from

the issue of the Bonds will primarily be used to refinance the

Group's existing debt, including its GBP400m 2.5% bonds which are

due to mature on 11 November 2023.

James Stamp, Group Chief Financial Officer of Mobico, said: "We

are pleased by the support we received from investors in this debt

issue. The issue strengthens our debt maturity profile, diversifies

our sources of funding and provides us with a stronger platform

from which to deliver future growth."

Enquiries

Mobico Group PLC

John Dean, Investor Relations Director 0121 803 2580

Headland

Mobico@headlandconsultancy.com

Stephen Malthouse 07734 956201

Matt Denham 07551 825496

About the Group

Mobico Group is a leading, international shared mobility

provider with bus, coach and rail services in the UK, North

America, continental Europe, North Africa and the Middle East.

Notes

Legal Entity Identifier : 213800A8IQEMY8PA5X34

Classification : 3.1 (with reference to DTR 6 Annex 1R)

DISCLAIMER - INTENDED ADDRESSEES

Please note that the Bonds have not been registered under the

U.S. Securities Act of 1933 and may not be offered or sold in the

United States absent registration or an applicable exemption from

registration. This announcement shall not constitute an offer to

sell or the solicitation of an offer to buy the Bonds described

herein, nor shall there be any sale of these Bonds in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODUNSRROWUKUAR

(END) Dow Jones Newswires

September 26, 2023 06:49 ET (10:49 GMT)

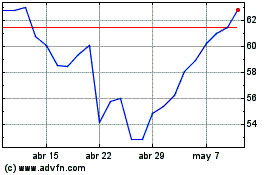

Mobico (LSE:MCG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

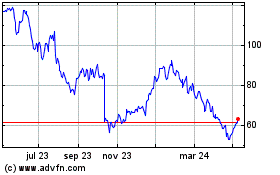

Mobico (LSE:MCG)

Gráfica de Acción Histórica

De May 2023 a May 2024