Acquisition and Disposal

06 Agosto 2001 - 2:56AM

UK Regulatory

RNS Number:0535I

Innogy Holdings PLC

6 August 2001

INNOGY HOLDINGS PLC

Innogy Press Release

PROPOSED ACQUISITION OF THE ENERGY SUPPLY BUSINESS

OF NORTHERN ELECTRIC AND SALE OF

YORKSHIRE ELECTRICITY DISTRIBUTION BUSINESS

Innogy Holdings plc ("Innogy") is pleased to announce an innovative

transaction with Northern Electric plc ("Northern Electric"), to swap its

interest in Yorkshire electricity distribution business and associated debt

for Northern Electric's energy supply business ("Northern Electric's Supply

Business"). This move simultaneously reinforces Innogy's position as a

leading energy supplier in the UK and enables it to release capital from its

regulated electricity distribution interest.

HIGHLIGHTS:

* Innogy to sell Yorkshire electricity distribution business for # 1,004 million

Innogy is selling its 94.75% interest in the Yorkshire electricity

distribution business to Northern Electric for the amount that was attributed

to that business in its recent acquisition of Yorkshire Power Group Limited

("Yorkshire"). The transaction places an enterprise value of #1,004 million on

that business. Northern Electric is also assuming #742 million in net debt.

* Innogy to acquire Northern Electric's Supply Business at #275 per customer

Northern Electric's Supply Business comprises approximately 1.57 million

customers and will take Innogy's total customer base to approximately seven

million, reinforcing Innogy's position as a leading player in the UK energy

supply markets. Innogy has agreed to pay #257 million for Northern Electric's

Supply Business including a power purchase agreement, implying a cost per

customer of approximately #275.

Commenting on the transaction Ross Sayers, Innogy's Executive Chairman, said

"This innovative transaction takes us to seven million customers. It

establishes Innogy as the number one electricity supplier to households and

businesses in the UK and the number two supplier in gas, by volume. We will

capitalise on the opportunities and economies of scale that this transaction

brings. Selling Yorkshire's regulated asset based distribution business and

reinvesting in supply is consistent with our strategy to become a leading

customer focused integrated energy company."

Brian Count, Innogy's CEO Designate said

"By combining the Northern Electric Supply Business with the existing supply

businesses of Innogy we expect to deliver synergy savings of at least #25

million per annum by 2004. This together with the targeted savings from the

integration of the Yorkshire supply business is expected to bring the total

operational savings of Innogy's supply operations to at least #60 million per

annum within four years. Our focus is now on delivery of the cost savings and

further development of the npower brand. Together we believe that these will

create real value for our shareholders."

TRANSACTION DETAILS:

Under the proposed terms of the transaction, Northern Electric has agreed to

acquire 94.75% of Yorkshire which consists of Yorkshire's regulated

electricity distribution operations and Yorkshire's external connections and

contracting business(1). This places an enterprise valuation for 100% of that

business at #1,004 million.

Northern Electric will also assume net debt of #742 million, comprising all of

Yorkshire's current debt securities with the exception of the $350 million

6.154% 2003 Yorkshire Power Finance Limited and the #150 million 8.625% 2005

Yorkshire Electricity Group plc securities which will be redeemed prior to

completion.

Innogy is acquiring the Northern Electric Supply Business for a consideration

of #257 million. Innogy will not be assuming any net debt. The Northern

Electric Supply Business includes:

* 1.11 million electricity and 0.46 million gas domestic and SME

customers;

* Northern Electric's industrial and commercial contracts and trading

operations; and

* Northern Electric's metering services business.

In addition, Innogy is to assume Northern Electric's power purchase agreement

with Teesside Power Limited ("Teesside") under which Teesside agreed to supply

power to Northern Electric until 2008.

The resultant net payment is #5 million in cash to Innogy. This will be

adjusted for net working capital at completion, together with an adjustment

for the presence of the minority interest in Yorkshire referred to below. The

parties to the transaction have agreed to an effective economic closing date

as at 30 June 2001.

Xcel Energy Inc. ("Xcel") holds a 5.25% interest in Yorkshire. Xcel has, for

a limited period, minority shareholder pre-emption rights.

The transaction is subject to a number of conditions, including European

Commission approval of Northern Electric's acquisition of Yorkshire, and is

expected to complete within 3 months. There is a break fee of up to #20

million.

The transaction will not be subject to Innogy shareholder approval.

FINANCIAL INFORMATION:

Northern Electric's supply business recorded sales of #1,135 million for the

12 month financial period ended 31 December 2000. Profits before tax,

non-recurring items and discontinued activities were #16 million. As at 31

December 2000, Northern Electric's supply business had net assets of #192

million.

Yorkshire's electricity distribution business recorded turnover of #287

million for the 12 month financial period ended 31 December 2000. Profits

before tax, non-recurring items and discontinued activities were #28 million.

As at 31 December 2000, Yorkshire's distribution business had net assets of

# 504 million.

The integration of the Northern Electric Supply Business into the existing

supply businesses of Innogy is expected to deliver synergy savings of at least

#25 million per annum by 2004. This combined with the targeted savings from

the integration of the Yorkshire supply business is expected to bring the

total operational savings of Innogy's supply operations to at least #60

million per annum over four years.

Innogy's pro forma consolidated net debt will be reduced by circa #700 million

as a result of the transaction.

ANALYSTS' AND PRESS BRIEFINGS:

There will be a presentation to analysts at 9.30 a.m. and a press conference

at 11.30 a.m. today at the City Presentation Centre, 4 Chiswell Street,

Finsbury Square, London EC1Y 4UP.

Should you be unable to attend the analyst presentation in person, there will

be a webcast on-line at (www.innogy.com) with the presentation at 9.30 a.m.

The webcast will consist of streaming audio and a synchronized slide

presentation. This will be available for replay following the event. There

will also be a dial in facility as follows:

Dial in = +44 (0) 20 8515 2310

From the US Dial in = 001 416 646 3096

Quote the Company name and Chairperson's name - Innogy, Brian Count

To accompany the dial in facility, a copy of the presentation slides will

be available on Innogy's website (www.innogy.com) and there will be a replay

facility for the briefing, available until close of business on 14 August

2001, which can be accessed as follows:

From the UK / US Dial in = +44 (0) 20 8797 2499, Access code = 117824#

All other enquires should be made to the following:

--------------------------------------------------------------------------------

Innogy

Steve Cronin Investor Relations +44 20 7406 1910

Alison Cole Media +44 1793 89 3852

Rollo Head +44 20 7251 3801

--------------------------------------------------------------------------------

CSFB

Mark Seligman +44 20 7888 6061

Alisdair Gayne +44 20 7888 0893

Matthew Wallace +44 20 7888 5231

--------------------------------------------------------------------------------

If you require a hard copy of the presentation, please e-mail Wai-yee Choy on

wai-yee.choy@innogy.com

--------------------------------------------------------------------------------

This announcement contains certain statements that are neither reported

financial results nor other historic information. These statements are

forward looking statements within the meaning of the safe-harbour provisions

of the U.S. federal securities laws. Because these forward-looking

statements are subject to risks and uncertainties, actual future results may

differ materially from those expressed in or implied by the statements. Many

of these risks and uncertainties relate to factors that are beyond the

companies' ability to control or estimate precisely, such as future market

conditions, currency fluctuations, the behaviour of other market participants,

the actions of governmental regulators and other risk factors detailed in

Innogy's and Yorkshire's reports filed with the SEC. Readers are cautioned

not to place undue reliance on these forward-looking statements, which speak

only as of the date of this document. The companies do not undertake any

obligation to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of this

announcement.

Nothing in this press release should be construed as a profit forecast or be

interpreted to mean that the earnings of Innogy for the current or future

years will necessarily match or exceed the historical or published earnings of

Innogy or Northern Electric's Supply Business.

Credit Suisse First Boston (Europe) Limited ("CSFB"), which is regulated by

The Securities and Futures Authority Limited, has approved the contents of

this document solely for the purposes of Section 57 of the Financial Services

Act 1986.

CSFB is acting for Innogy and no-one else in connection with this transaction

and will not be responsible to anyone other than Innogy for providing the

protections afforded to customers of CSFB nor for giving advice in relation to

this transaction.

This announcement does not constitute an offer to purchase shares or

securities.

--------------------------------------------------------------------------------

- ENDS -

--------------------------------------------------------------------------------

------------------------------------------------------------------------------

(1) The Utilities Act, which is anticipated to come into force on 1 October

2001, will fully separate electricity supply and distribution businesses.

Certain transitional agency arrangements have been put in place by Yorkshire,

Innogy and Northern Electric in relation to the Yorkshire and Northern

Electric supply businesses to effect the transaction. These arrangements will

cease upon the Utilities Act coming into force.

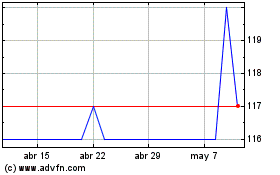

Nthn.elec.prf (LSE:NTEA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Nthn.elec.prf (LSE:NTEA)

Gráfica de Acción Histórica

De May 2023 a May 2024