Pan African Resources Plc Provisional summarised audited results for the year ended 30 June 2023

13 Septiembre 2023 - 1:00AM

UK Regulatory

TIDMPAF

Pan African Pan African Resources Funding

Resources PLC Company Limited

(Incorporated Incorporated in the Republic of

and South Africa with limited

registered in liability

England and

Wales under Registration number:

the Companies 2012/021237/06

Act 1985 with

registration Alpha code: PARI

number

3937466 on 25 (Funding Company)

February

2000)

Share code on

AIM: PAF

Share code on

JSE: PAN

ISIN:

GB0004300496

ADR ticker

code: PAFRY

(Pan African

or the

Company or

the Group)

(Key features are reported in United States dollar (US$) or South African rand

(ZAR), to the extent relevant.)

Provisional summarised audited results for the year ended 30 June 2023 - SHORT

FORM ANNOUNCEMENT

KEY FEATURES

Production

· Gold production of 175,209oz (2022: 205,688oz), in line with revised

guidance

· Increased production outlook for the 2024 financial year - guidance of

178,000oz to 190,000oz

Safety

· As previously announced, a fatal accident occurred at Evander Mines in March

2023, following 1 million fatality-free shifts at the operation prior to the

accident

· Improvement in overall safety rates compared to the previous financial year,

with a total recordable injury frequency rate of 7.96 per million man hours for

the year (2022: 8.95 per million man hours)

· Focused initiatives implemented to further enhance safety performance

Costs and cost outlook

· All-in sustaining costs (AISCAPM) for the current financial year of

US$1,327/oz, a sub-US$ inflation increase of 3.3% (US$1,284/oz for the financial

year ended 30 June

· AISC in line with revised guidance for 2023 of between US$1,325/oz to

US$1,350/oz

· AISC of US$1,152/oz (2022: US$1,145/oz) for our lower-cost operations,

comprising all operations, excluding Sheba Mine and Consort Mine, which account

for more than 81%

(2022: 87%) of annual production

· Remedial measures implemented to reduce real AISC at high-cost operations

(Sheba and Consort Mines)

· Renewable energy generation and water recycling, together with other

initiatives to increase the Group's future gold production, are expected to

contribute to a decline in future real AISC

· 2024 AISC guidance of US$1,350/oz (assuming an exchange rate of

US$/ZAR:18.50)

Financial

· Net cash generated from operating activities of US$100.1 million (2022:

US$110.0 million)

· Profit for the year of US$60.7 million (2022: US$75.0 million)

· Headline earningsAPM of US$60.4 million (2022: US$75.6 million)

· Earnings per share of US 3.19 cents per share (2022: US 3.90 cents per

share) and headline earnings per shareAPM of US 3.15 cents per share (2022: US

3.93 cents per share)

· Robust financial position at year-end, with net debtAPM of US$22.0 million

(2022: US$13.0 million)

· Liquidity remains healthy, with access to immediately available cash and

undrawn facilities of US$84.7 million (2022: US$69.4 million) at financial year

-end. Post the current financial year, the Company also closed the dedicated

Mogale Tailings Retreatment project (MTR project) senior debt facility of

US$70.3 million

Proposed dividend

· Sector-leading final dividend of ZA 18.00000 cents per share (or US 0.95592

cents per share at an exchange rate of US$/ZAR:18.83) proposed for approval at

the upcoming annual general meeting (AGM)

Growth projects

· The MTR project construction commenced in July 2023 with steady-state

production expected by December 2024

· Evander Mines' 8 Shaft 24, 25 and 26 Level underground expansion project is

on track

· Refrigeration plant at 24 Level commissioned in phases to facilitate

mining at depth

· Development to access the 25 and 26 Level mining areas has commenced

· Equipping of an existing underground ventilation shaft for rock hoisting

capacity of up to 40,000tpm is planned to be completed during the third quarter

of the 2024 financial year, improving efficiencies and eliminating the

cumbersome and labour-intensive conveyor system

Environmental, social and governance (ESG) initiatives

· Established a renewable energy roadmap to decarbonisation - construction of

Fairview Mine's solar facility commenced at Barberton Mines

· Commissioned Evander Mines' water recycling plant to reduce potable water

requirements and lower costs

Sudan exploration

· Exploration activities resumed post the reporting period, following a

detailed risk assessment of the in-country operating environment in the

exploration area

CHIEF EXECUTIVE OFFICER'S STATEMENT

Cobus Loots, Pan African's chief executive officer, commented:

"Pan African delivered a resilient financial performance for the current

financial year, with a much-improved rand gold price compensating for lower

production from our underground operations.

We are confident that the measures we are implementing, specifically at

Barberton Mines' underground operations, will result in higher production in the

future, with production guidance increased for the 2024 financial year. If the

current rand gold price tailwinds persist, we can look forward to another robust

financial performance from Pan African in the year ahead.

Our surface remining operations, the Elikhulu Tailings Retreatment Plant

(Elikhulu) and the Barberton Tailings Retreatment Plant, performed in line with

expectations during the past financial year, contributing significantly to the

Group's production, cash flows and profits. The consistent performance of these

low-cost and, in the case of Elikhulu, long-life assets, demonstrates their

importance in our portfolio and reinforces our decision to develop the MTR

project.

Pan African has an outstanding track record in the development and operation of

tailings retreatment operations. Full-scale construction of the MTR plant

commenced on schedule in July this year, with commissioning anticipated within

the next 18 months. The MTR project's incremental production of approximately

50,000oz per year will contribute to almost 50% of the Group's annual gold

output being sourced from low-cost, safe, surface remining operations. In

addition to being a compelling investment, large-scale tailings retreatment

operations of this nature rehabilitate and restore the environment, while also

providing much-needed employment and economic opportunities.

The development of Evander Mines' 24 Level project is progressing well, with

crews being redeployed to the 24 Level area as the 8 Shaft's pillar mining nears

completion. Improved mining flexibility, together with other initiatives being

implemented to ensure that infrastructure availability is optimised, will ensure

sustainable production from this long-life underground operation.

We are grateful that after year-end we managed to resume our gold exploration

activities in Sudan. The decision to recommence operations was only made after a

comprehensive risk assessment of the in-country operating environment in the

exploration area, and we will continue to closely monitor the political

situation.

Globally, gold producers have experienced severe cost inflation in recent

years. Despite inflationary pressures on input costs with, specifically,

reagents used in processing and electricity costs being subject to large

increases, the financial results for the year benefited from Pan African's

culture of cost control. AISC increased by only 3.3% in US$ to US$1,327/oz,

with the depreciation of the rand relative to the US$ providing an offset to the

higher rand unit costs.

We ended the financial year in a strong financial position with net debt of only

US$22.0 million, despite a substantial capital investment programme and the

payment of an attractive dividend to shareholders in the past year. The fact

that we are able to maintain this dividend in rand terms, while undertaking the

MTR project's construction, our largest capital project ever, is a testament to

the quality of our portfolio.

Excellent progress was also made with our ESG initiatives, with an increased

focus on renewable energy projects. In May 2023, construction of the Group's

second solar plant commenced at Barberton Mines. This plant, with a capacity of

8.75MW, will supply most of the daytime power requirements for the Fairview

Mine. The Group has also signed a third-party power purchase agreement for the

off-site provision of 40MW of wheeled power over a period of up to 15 years.

Along with Evander Mines' operating solar plant, these projects are expected to

reduce our carbon emissions by up to 30% (by 2030), as well as deliver

associated cost benefits, as the price of grid power continues to increase at

above-inflation rates. Evander Mines' water recycling plant is also expected to

generate attractive cost savings as underground water can now be used as process

water, reducing our reliance on municipal resources.

Reflecting on the past year, we wish to again express our condolences to the

family, friends and co-workers of our colleague, Mr Sahlukaniso, who was fatally

injured in a fall of ground accident at our Evander Mines' underground mine in

March 2023. Pan African remains steadfast in its resolve to achieve a zero-harm

working environment in the coming years.

In terms of the outlook for the year ahead, we will continue to balance safe,

sustainable gold production, the successful delivery of our transformational

growth projects, cash returns to shareholders and all our other initiatives to

the benefit of our stakeholders. We are well positioned to exceed the production

achieved in the current financial year, with estimated production of between

178,000oz and 190,000oz forecast for the 2024 financial year."

PROPOSED DIVID FOR THE FINANCIAL YEARED 30 JUNE 2023

The board has proposed a final dividend of ZAR400.1 million for the 2023

financial year (approximately US$21.2 million), equal to ZA 18.00000 cents per

share or approximately US 0.95592 cents per share (0.75219 pence per share). A

dividend of ZA 18.00000 cents per share or approximately US 1.05820 cents per

share (or 0.86915 pence per share) was paid for the 2022 financial year. The

dividend is subject to approval by shareholders at the AGM, which is to be

convened on Thursday, 23 November 2023.

Assuming shareholders approve the final dividend, the following salient dates

would apply:

+------------------------------+---------------------------+

|Annual general meeting |Thursday, 23 November 2023 |

+------------------------------+---------------------------+

|Currency conversion date |Thursday, 23 November 2023 |

+------------------------------+---------------------------+

|Currency conversion |Friday, 24 November 2023 |

|announcement released by 11:00| |

|(SA time) | |

+------------------------------+---------------------------+

|Last date to trade on the JSE |Tuesday, 28 November 2023 |

+------------------------------+---------------------------+

|Last date to trade on the LSE |Wednesday, 29 November 2023|

+------------------------------+---------------------------+

|Ex-dividend date on the JSE |Wednesday, 29 November 2023|

+------------------------------+---------------------------+

|Ex-dividend date on the LSE |Thursday, 30 November 2023 |

+------------------------------+---------------------------+

|Record date on the JSE and LSE|Friday, 1 December 2023 |

+------------------------------+---------------------------+

|Payment date |Tuesday, 12 December 2023 |

+------------------------------+---------------------------+

The British pound (GBP) and US$ proposed final dividend was calculated based on

a total of 2,222,862,046 shares in issue and an illustrative exchange rate of

US$/ZAR:18.83 and GBP/ZAR:23.93, respectively.

No transfers between the Johannesburg and London registers, between the

commencement of trading on Wednesday, 29 November 2023 and close of business on

Friday, 1 December 2023 will be permitted.

No shares may be dematerialised or rematerialised between Wednesday, 29 November

2023 and Friday, 1December 2023, both days inclusive.

The South African dividend taxation rate is 20% per ordinary share for

shareholders who are liable to pay dividend taxation, resulting in a net

dividend of ZA 14.40000 cents per share for these shareholders. Foreign

investors may qualify for a lower dividend taxation rate, subject to completing

a dividend taxation declaration and submitting it to Computershare Investor

Services Proprietary Limited or Link Asset Services, who manage the South

African and UK registers, respectively. The Company's South African income

taxation reference number is 9154588173. The proposed dividend will be paid out

of the Company's retained earnings, without drawing on any other capital

reserves.

AUDIT OPINION

The Group's external auditor, PricewaterhouseCoopers LLP (PwC), has issued their

opinion on the consolidated annual financial statements for the year ended 30

June 2023.

The audit of the consolidated annual financial statements was conducted in

accordance with the International Standards on Auditing. PwC has expressed an

unmodified opinion on the consolidated annual financial statements. A copy of

the audited annual financial statements and the audit report is available for

inspection at the issuer's registered office. Any reference to future financial

performance included in this provisional summarised audited results announcement

has not been reviewed or reported on by the Group's external auditor.

DIRECTORS' RESPONSIBILITY

The information in this announcement has been extracted from the provisional

summarised audited results for the year ended 30 June 2023, but this short-form

announcement itself has not been reviewed by the Company's auditors. The

provisional summarised audited results have been prepared under the supervision

of the financial director, Deon Louw. This short-form announcement is the

responsibility of the directors of Pan African and is only a summary of the

information contained in the full announcement and does not contain full or

complete details.

Any investment decisions should be based on the full announcement and the

Group's detailed operational and financial summaries.

AVAILABILITY OF THE ANNUAL FINANCIAL STATEMENTS AND PROVISIONAL SUMMARISED

AUDITED RESULTS

The annual financial statements (together with PwC's audit opinion thereon) have

been released on SENS and are available for viewing via the JSE Limited (JSE)

link at https://senspdf.jse.co.za/documents/2023/jse/isse/pan/FYE2023.pdf

and via the Company's website at https://www.panafricanresources.com/wp

-content/uploads/Pan-African-Resources-integrated-annual-report-2023.pdf.

The provisional summarised audited results for the year ended 30 June 2023 can

be viewed via the Company's website at https://www.panafricanresources.com/wp

-content/uploads/Pan-African-Resources-year-end-results-SENS-announcement

-2023.pdf

Copies of the full announcement may also be requested by emailing

ExecPA@paf.co.za

The Company has a dual primary listing on the JSE in South Africa and the

Alternative Investments Market (AIM) of the London Stock Exchange (LSE) as well

as a sponsored Level 1 ADR programme in the USA through the Bank of New York

Mellon and a secondary listing on the A2X Market.

For further information on Pan African, please visit the Company's website at

www.panafricanresources.com

Rosebank

13 September 2023

+-----------------------------------------------+---------------------------+

|Corporate information |

+-----------------------------------------------+---------------------------+

|Corporate office |Registered office |

| | |

|The Firs Building |2nd Floor |

| | |

|2nd Floor, Office 204 |107 Cheapside |

| | |

|Corner Cradock and Biermann Avenues |London |

| | |

|Rosebank, Johannesburg |EC2V 6DN |

| | |

|South Africa |United Kingdom |

| | |

|Office: + 27 (0) 11 243 2900 |Office: + 44 (0) 20 7796 |

| |8644 |

|info@paf.co.za | |

| |info@paf.co.za |

+-----------------------------------------------+---------------------------+

|Chief executive officer |Financial director and debt|

| |officer |

|Cobus Loots | |

| |Deon Louw |

|Office: + 27 (0) 11 243 2900 | |

| |Office: + 27 (0) 11 243 |

| |2900 |

+-----------------------------------------------+---------------------------+

|Head investor relations |Website: |

| |www.panafricanresources.com|

|Hethen Hira | |

|Tel: + 27 (0) 11 243 2900 | |

|Email: hhira@paf.co.za | |

+-----------------------------------------------+---------------------------+

|Company secretary |Nominated adviser and joint|

| |broker |

|Jane Kirton | |

| |Ross Allister/David McKeown|

|St James's Corporate Services Limited | |

| |Peel Hunt LLP |

|Office: + 44 (0) 20 7796 8644 | |

| |Office: +44 (0) 20 7418 |

| |8900 |

+-----------------------------------------------+---------------------------+

|JSE sponsor |Joint broker |

| | |

|Ciska Kloppers |Thomas Rider/Nick Macann |

| | |

|Questco Corporate Advisory Proprietary Limited |BMO Capital Markets Limited|

| | |

|Office: + 27 (0) 11 011 |Office: +44 (0) 20 7236 |

|9200 (https://www.google.co.za/search?q=questco|1010 |

|&rlz=1C1EJFC_enZA816ZA818&oq=q | |

|uestco&aqs=chrome..69i57j0l5.1 | |

|159j0j4&sourceid=chrome&ie=UTF-8) | |

+-----------------------------------------------+---------------------------+

| |Joint broker |

| | |

| |Matthew Armitt/Jennifer Lee|

| | |

| |Joh. Berenberg, Gossler & |

| |Co KG |

| | |

| |Office: +44 (0) 20 3207 |

| |7800 |

+-----------------------------------------------+---------------------------+

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

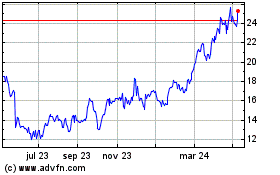

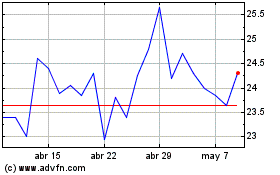

Pan African Resources (LSE:PAF)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pan African Resources (LSE:PAF)

Gráfica de Acción Histórica

De May 2023 a May 2024