Princess Private Equity Holding Ltd Princess publishes November NAV (7041Y)

05 Enero 2024 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 7041Y

Princess Private Equity Holding Ltd

05 January 2024

(LSE: PEYS/PEY)

Princess Private Equity Holding Limited

Princess publishes November NAV

-- Net asset value decreased by 0.9% to EUR 14.47 per share, net

of the interim dividend of EUR 0.365 per share; total NAV at EUR 1

billion

-- The FY 2023 dividend of EUR 0.73 per share, which includes

the first interim dividend paid in June, aligns with the objective

to distribute 5% of opening NAV annually

-- Value creation contributed to NAV (+0.7%), however the gains

were outweighed by adverse currency movements (-1.3%), caused by

the strengthening of the euro against the US dollar

-- Agreed sale of Civica

At portfolio level, PCI Pharma Services ("PCI"), DiversiTech and

Pharmathen, all three companies amongst the top 20 positions, were

notable contributors to value creation during the month. The value

of PCI, a global provider of outsourced pharmaceutical services

based in the US, increased on the back of its continued robust

financial performance driven by continued organic growth across all

segments including its injectable business, Lyophilization Services

of New England.

DiversiTech, a manufacturer of components and supplies for the

US residential heating, ventilation, and air conditioning ("HVAC")

market, experienced an increase in value driven by a healthy

combination of both organic and inorganic growth, which was further

supported by the earlier acquisition of Castel Engineering

(November 2022) and Pro1 Themostats (June 2023). Moreover,

DiversiTech acquired GIA Group, an Italian manufacturer and

supplier of HVAC parts. The acquisition will greatly expand the

product range and services of DiversiTech International, a new

subsidiary business formed after DiversiTech's acquisition of

Castel Engineering.

Pharmathen, a leading developer of advanced drug delivery

technologies for complex pharmaceutical products, appreciated in

value during the month, reflecting its continued strong financial

performance driven by higher-than-expected sales and strong growth

in long-acting injectable products in the US and European market.

The acquisition of a Greek developer and manufacturer of peptide

active pharmaceutical ingredients offers valuable vertical

integration and enhances the company's development capabilities,

contributing to a positive outlook for future growth.

Finally, Partners Group, acting on behalf of its clients, has

agreed to sell Civica, a global provider of cloud software

solutions for the public sector. Partners Group acquired Civica in

2017 and has since transformed Civica into a pure software

business, pivoting away from its previous services such as IT

management. This has driven Civica's strong growth, with EBITDA

doubling since Partners Group's investment. During Partners Group's

ownership, Civica has accelerated organic topline growth, developed

a cloud offering, built out its offshore R&D operations, and

executed 24 highly complementary add-on acquisitions. The sale is

expected to complete in Q2 2024.

Further information is available in the monthly report, which

can be accessed via:

http://www.princess-privateequity.net/en/investor-relations/financial-reports/.

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests in private equity direct

investments. Princess is managed in its investment activities by

Partners Group, a global private markets investment management firm

with USD 142 billion in investment programs under management in

private markets, of which USD 74 billion in private equity.

Princess aims to provide shareholders with long-term capital growth

and an attractive dividend yield. Princess is traded on the Main

Market of the London Stock Exchange (ticker: PEY for the Euro

Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Investor relations contact: Media relations contact:

Sarah Page Jenny Blinch

Phone: +44 20 7575 2695 Phone: +41 41 784 65 26

E-mail: sarah.page@partnersgroup.com E-mail: jenny.blinch@partnersgroup.com

Registered Number: 35241 LEI: 54930038LU8RDPFFVJ57

Notes:

1. Note that references in this announcement to Princess Private

Equity Holding Limited have been abbreviated to "Princess" or

"Company". References to Partners Group AG have been abbreviated to

"Partners Group " or "Investment Manager".

2. This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess Private Equity Holdings. The distribution of

this document may be restricted by law in certain jurisdictions.

Persons into whose possession this document comes must inform

themselves about and observe any such restrictions on the

distribution of this document. In particular, this document and the

information contained therein is not for distribution or

publication, neither directly nor indirectly, in or into the United

States of America, Canada, Australia or Japan.

3. This document may have been prepared using financial

information contained in the books and records of the product

described herein as of the reporting date. This information is

believed to be accurate but has not been audited by any third

party. This document may describe past performance, which may not

be indicative of future results. No liability is accepted for any

actions taken on the basis of the information provided in this

document. Neither the contents of Princess' website nor the

contents of any website accessible from hyperlinks on Princess'

website (or any other website) is incorporated into, or forms part

of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRUSUVRSOUARAR

(END) Dow Jones Newswires

January 05, 2024 02:00 ET (07:00 GMT)

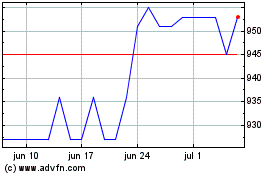

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

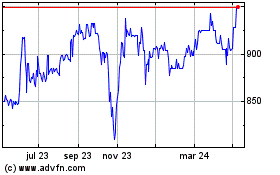

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024