TIDMPHI

RNS Number : 4129Q

Pacific Horizon Investment Tst PLC

17 October 2023

Pacific Horizon Investment Trust PLC ('PHI')

Legal Entity Identifier: VLGEI9B8R0REWKB0LN95

Regulated Information Classification: Annual Financial and Audit

Reports

Annual Report and Financial Statements

Further to the preliminary statement of audited annual results

announced to the Stock Exchange on 6 October 2023, Pacific Horizon

Investment Trust PLC ("the Company") announces that the Company's

Annual Report and Financial Statements for the year ended 31 July

2023, including the Notice of Annual General Meeting, has today

been posted to shareholders and submitted electronically to the

National Storage Mechanism where it will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

It is also available on the Company page of the Baillie Gifford

website at: pacifichorizon.co.uk (as is the preliminary statement

of audited annual results announced by the Company on 6 October

2023).

Statement of Directors' Responsibilities in respect of the

Annual Report and the Financial Statements

Each of the Directors, whose names and functions are listed

within the Directors and Managers section of the Annual Report and

Financial Statements, confirm that, to the best of their

knowledge:

3/4 the Financial Statements, which have been prepared in

accordance with applicable law and United Kingdom Accounting

Standards (United Kingdom Generally Accepted Accounting Practice)

including FRS 102 'The Financial Reporting Standard applicable in

the UK and Republic of Ireland' give a true and fair view of the

assets, liabilities, financial position and net return of the

Company;

3/4 the Annual Report and Financial Statements taken as a whole,

is fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's performance,

business model and strategy; and

3/4 the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that it faces (as also set out below).

Principal and Emerging Risks relating to the Company

As explained on page 71 of the Annual Report and Financial

Statements there is a process for identifying, evaluating and

managing the risks faced by the Company on a regular basis. The

Directors have carried out a robust assessment of the principal and

emerging risks facing the Company, including those that would

threaten its business model, future performance, regulatory

compliance, solvency or liquidity. There have been no material

changes to the principal risks during the year. A description of

these risks and how they are being managed or mitigated is set out

below.

The Board considers the heightened macroeconomic and

geopolitical concerns to be factors which exacerbate existing

risks, rather than being new emerging risks, within the context of

an investment trust. Their impact is considered within the relevant

risks .

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Financial Risk: The Company's The Board has, in particular, This risk is increasing

assets consist mainly of considered the impact due to increased

listed securities (93.6% of heightened market market volatility

of the investment portfolio) volatility during recent as a result of heightened

and its principal and emerging months due to macroeconomic macroeconomic and

financial risks are therefore factors such as higher geopolitical concerns.

market related and include inflation and interest

market risk (comprising currency rates and geopolitical

risk, interest rate risk concerns. In order

and other price risk), liquidity to oversee this risk,

risk and credit risk. An the Board considers

explanation of those risks at each meeting various

and how they are managed metrics including regional

is contained in note 18 to and industrial sector

the Financial Statements weightings, top and

on pages 104 to 111. bottom stock contributors

to performance along

with sales and purchases

of investments. Individual

investments are discussed

with the portfolio

manager together with

general views on the

various investment

markets and sectors.

A strategy session

is held annually.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Investment strategy risk: To mitigate this risk, This risk is increasing

Pursuit of an investment the Board regularly as the market's

strategy to fulfil the Company's reviews and monitors appetite for growth

objective which the market the Company's objective stocks, typically

perceives to be unattractive and investment policy held by the Company,

or inappropriate, or the and strategy, the investment has decreased during

ineffective implementation portfolio and its performance, the recent period

of an attractive or appropriate the level of discount/premium of heightened macroeconomic

strategy, may lead to reduced to net asset value and geopolitical

returns for shareholders at which the shares concern.

and, as a result, a decreased trade and movements

demand for the Company's in the share register

shares. This may lead to and raises any matters

the Company's shares trading of concern with the

at a widening discount to Managers.

their net asset value.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Political and associated Political developments This risk is increasing

economic financial risk: are closely monitored due to the ongoing

The Board is of the view and considered by the Russia-Ukraine military

that political change in Board, for example conflict and tensions

areas in which the Company in respect of tensions between China and

invests or may invest may between the USA and the US.

have financial consequences China regarding tariffs

for the Company. and unrest in Hong

Kong and repercussions

from the Russian invasion

of Ukraine. It monitors

portfolio diversification

by investee companies'

primary location, to

mitigate against the

negative impact of

military action or

trade barriers. The

Board believes that

the Company's portfolio,

which predominantly

comprises companies

listed on the stock

markets of the Asia

Pacific region (excluding

Japan) and the Indian

Sub-continent, partially

helps to mitigate such

political risks.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Discount risk: The discount/premium To manage this risk, The Company's discount

at which the Company's shares the Board monitors widened during the

trade relative to its net the level of discount/premium year.

asset value can change. The at which the shares

risk of a widening discount trade and the Company

is that it may undermine has authority to buy

investor confidence in the back its existing shares,

Company. when deemed by the

Board to be in the

best interests of the

Company and its shareholders.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Regulatory risk: Failure To mitigate this risk, All control procedures

to comply with applicable Baillie Gifford's Business are working effectively.

legal and regulatory requirements Risk, Internal Audit There have been

such as the tax rules for and Compliance Departments no material regulatory

investment trust companies, provide regular reports changes that have

the FCA Listing Rules and to the Audit Committee impacted the Company

the Companies Act could lead on Baillie Gifford's during the year.

to suspension of the Company's monitoring programmes.

Stock Exchange listing, financial Major regulatory change

penalties, a qualified audit could impose disproportionate

report or the Company being compliance burdens

subject to tax on capital on the Company. In

gains. such circumstances

representation is made

to ensure that the

special circumstances

of investment trusts

are recognised. Shareholder

documents and announcements,

including the Company's

published Interim and

Annual Report and Financial

Statements, are subject

to stringent review

processes and procedures

are in place to ensure

adherence to the Transparency

Directive and the Market

Abuse Directive with

reference to inside

information.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Custody and depositary risk: To mitigate this risk, All control procedures

Safe custody of the Company's the Audit Committee are working effectively.

assets may be compromised receives six-monthly

through control failures reports from the Depositary

by the Depositary, including confirming safe custody

breaches of cyber security. of the Company's assets

held by the Custodian.

Cash and portfolio

holdings are independently

reconciled to the Custodian's

records by the Managers

who also agree uncertificated

private portfolio holdings

to confirmations from

investee companies.

The Custodian's assured

internal controls reports

are reviewed by Baillie

Gifford's Business

Risk Department and

a summary of the key

points is reported

to the Audit Committee

and any concerns investigated.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Operational risk: Failure To mitigate this risk, All control procedures

of Baillie Gifford's systems Baillie Gifford has are working effectively.

or those of other third party a comprehensive business

service providers could lead continuity plan which

to an inability to provide facilitates continued

accurate reporting and monitoring operation of the business

or a misappropriation of in the event of a service

assets. disruption. The Audit

Committee reviews Baillie

Gifford's Report on

Internal Controls and

reports by other key

third party providers

are reviewed by Baillie

Gifford on behalf of

the Board and a summary

of the key points is

reported to the Audit

Committee and any concerns

investigated. The other

key third party service

providers have not

experienced significant

operational difficulties

affecting their respective

services to the Company.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Leverage risk: The Company To mitigate this risk, The Company's revolving

may borrow money for investment all borrowings require loan facility remains

purposes. If the investments the prior approval undrawn.

fall in value, any borrowings of the Board and leverage

will magnify the impact of levels are discussed

this loss. If borrowing facilities by the Board and Managers

are not renewed, the Company at every meeting. Covenant

may have to sell investments levels are monitored

to repay borrowings. The regularly. The majority

Company can also make use of the Company's investments

of derivative contracts. are in quoted securities

that are readily realisable.

Further information

on leverage can be

found on page 118 and

the Glossary of Terms

and Alternative Performance

Measures on pages 123

and 124 of the Annual

Report and Financial

Statements.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Climate and governance risk: This is mitigated by The Investment Manager

Perceived problems on environmental, the Managers' strong continues to employ

social and governance ('ESG') ESG stewardship and strong ESG stewardship

matters in an investee company engagement policies and engagement policies.

could lead to that company's which are available

shares being less attractive to view on the Managers'

to investors, adversely affecting website, bailliegifford.com,

its share price, in addition and which have been

to potential valuation issues reviewed and endorsed

arising from any direct impact by the Company, and

of the failure to address which have been fully

the ESG weakness on the operations integrated into the

or management of the investee investment process.

company (for example in the Due diligence includes

event of an industrial accident assessment of the risks

or spillage). Repeated failure inherent in climate

by the Managers to identify change (see page 55

ESG weaknesses in investee of the Annual Report

companies could lead to the and Financial Statements).

Company's own shares being

less attractive to investors,

adversely affecting its own

share price.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Cyber security risk: A cyber To mitigate this risk, All control procedures

attack on Baillie Gifford's the Audit Committee are working effectively.

network or that of a third reviews Reports on

party service provider could Internal Controls published

impact the confidentiality, by Baillie Gifford

integrity or availability and other third party

of data and systems. service providers.

Cyber security due

diligence is performed

by Baillie Gifford

on third party service

providers which includes

a review of crisis

management and business

continuity frameworks.

--------------------------------------- -------------------------------- -----------------------------

What is the risk? How is it managed? Current assessment

of risk

--------------------------------------- -------------------------------- -----------------------------

Emerging risk: As explained This is mitigated by No change in emerging

on page 71 of the Annual the Managers' close risks.

Report and Financial Statements, links to the investee

the Board has regular discussions companies and their

on principal risks and uncertainties, ability to ask questions

including any risks which on contingency plans.

are not an immediate threat The Managers believe

but could arise in the longer the impact of such

term. The Board considers events may be to slow

that the key emerging risks growth rather than

arise from the interconnectedness to invalidate the investment

of global economies and the rationale over the

related exposure of the investment long term.

portfolio to external and

emerging threats such as

escalating geopolitical tensions,

cyber security risks including

developing AI and quantum

computing capabilities, and

new coronavirus variants

or similar public health

threats.

--------------------------------------- -------------------------------- -----------------------------

Increasing risk Decreasing risk No change

Baillie Gifford & Co Limited

Company Secretaries

17 October 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSGPGCGUUPWGGM

(END) Dow Jones Newswires

October 17, 2023 07:15 ET (11:15 GMT)

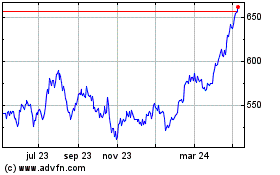

Pacific Horizon Investment (LSE:PHI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

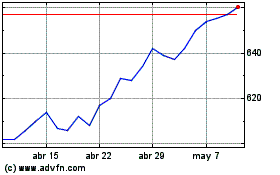

Pacific Horizon Investment (LSE:PHI)

Gráfica de Acción Histórica

De May 2023 a May 2024