TIDMPMGR

02 August 2023

Premier Miton Global Renewables Trust Plc (the `Company')

Legal Entity Identifier: 2138004SR19RBRGX6T68

Premier Miton Global Renewables Trust PLC's half report and accounts for the six

months to 30 June 2023 is available

at https://www.globalrenewablestrust.com/documents/ (https://urldefense.proofpoin

t.com/v2/url?u=https

-3A__www.globalrenewablestrust.com_documents_&d=DwMFaQ&c=bZnDpUh0cTwskH9nIvyseq2t

J5dkOfcF56epRyP8Xxo&r=wQnexMsUGp0XsVLKr1B45v6qZ8Bu4EcisQIIBezJE74&m=TRPkhQfWOQskK

3-LXMIsamyMn9u7QBywtbvDuPudw6CmkQeiqEe6FL6F6NLQ2M8l&s=8TB0mc-YEt

-SQ9lFhisa7IBZZbwxZOs94cEJLQvm4g0&e=).

It has also been submitted in full unedited text to the Financial Conduct

Authority's National Storage Mechanism and is available for inspection

at data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with DTR

6.3.5(1A) of the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules.

PREMIER MITON GLOBAL RENEWABLES TRUST PLC

Half Year Report

for the six months to 30 June 2023

INVESTMENT OBJECTIVES

The investment objectives of the Premier Miton Global Renewables Trust PLC are

to achieve a high income from, and to realise long-term growth in the capital

value of its portfolio. The Company seeks to achieve these objectives by

investing principally in the equity and equity-related securities of companies

operating primarily in the renewable energy sector, as well as other sustainable

infrastructure investments.

GREEN ECONOMY - LONDON STOCK EXCHANGE

In January 2021, the Company received London Stock Exchange's Green Economy

Mark, a classification which is awarded to companies and funds that are

driving the global green economy. To qualify for the Green Economy Mark,

companies and funds must generate 50% or more of their total annual revenues

from products and services that contribute to the global green economy.

PRI - PRINCIPLES FOR RESPONSIBLE INVESTMENT

The Fund Manager integrates Governance and Social responsibility into its

investment process. Premier Miton is a signatory to the Principles for

Responsible Investment, an organisation which encourages and supports its

signatories to incorporate environmental, social, and governance factors into

their investment and ownership decisions.

FE FUNDINFO - CROWN FUND RATING - 4 STARS

The Crown Fund Rating is a global quantitative rating that is based on a

fund's historical performance relative to an appropriate benchmark. The rating

relies on three key measurements - alpha, volatility and consistent

performance, to dictate the one-to-five Crown score. The ratings are designed

to help investors distinguish funds that have superior performance in terms of

stock picking, consistency and risk control.

COMPANY HIGHLIGHTS

for the six months to 30 June 2023

Six months to Year ended

30 June 31 December

2023 2022

TOTAL RETURN PERFORMANCE

Total Assets Total Return[1] (6.2%) (7.3%)

S&P Global Clean Energy Index (GBP)[2] (11.5%) 6.6%

Ongoing charges[3] 1.68% 1.70%

Six months to Year ended

30 June 31 December

2023 2022 % change

ORDINARY SHARE RETURNS

Net Asset Value per 156.35p 178.44p (12.4%)

Ordinary Share (cum

income)[4]

Mid-market price per 132.00p 155.50p (15.1%)

Ordinary Share

Discount to Net Asset (15.6%) (12.9%)

Value

Net Asset Value Total (10.4%) (12.1%)

Return[5]

Share Price Total (12.9%) (17.7%)

Return[2]

Six months to Six months to

30 June 30 June

2023 2022 % change

RETURNS AND

DIVIDS

Revenue Return per 4.43p 3.95p 12.2%

Ordinary Share

Net Dividends 3.70p 3.50p 5.7%

declared per

Ordinary Share

HISTORIC FULL YEAR DIVIDS

31 December 31 December

Dividends paid in respect of the year to: 2022 2021 % change

Dividend 7.00p 7.00p -

Six months to Year ended

30 June 31 December

2023 2022 % change

ZERO DIVID PREFERENCE

SHARE RETURNS

Net Asset Value per Zero 113.42p 110.71p 2.4%

Dividend Preference

Share[4]

Mid-market price per Zero 108.50p 108.50p 0.0%

Dividend Preference

Share[2]

Discount to Net Asset Value (4.3%) (2.0%)

As at As at

30 June 31 December

2023 2022

HURDLE RATES (PER ANNUM)

Ordinary Shares

Hurdle rate to return the 30 June 2023 share price of (1.8%) (0.8%)

132.00p (December 2022: 175.50p) at 28 November

2025[6]

Zero Dividend Preference Shares

Hurdle rate to return the redemption share price for (30.3%) (27.7%)

the 2025 ZDPs of 127.6111p at 28 November 2025[7]

Six months to Year ended

30 June 31 December

2023 2022 % change*

BALANCE SHEET

Gross Assets less Current £ 44.6m £48.3m (7.6%)

Liabilities

Zero Dividend Preference (£ 16.1m) (£15.7m) 2.7%

Shares

Equity Shareholders' Funds £ 28.5m £32.5m (12.3%)

Gearing on Ordinary 56.5% 48.4%

Shares[8]

Zero Dividend Preference 2.32x 2.51x

Share Cover (non

-cumulative)[9]

1 Source: Premier Fund Managers Ltd ("PFM Ltd"). Based on opening and closing

total assets plus dividends marked "ex-dividend" within the period.

2 Source: Bloomberg.

3 Ongoing charges have been based on the Company's management fees and other

operating expenses as a percentage of gross assets less current liabilities

over the period (excluding ZDPs' accrued capital entitlement).

4 Articles of Association Basis.

5 Source: PFM Ltd. Based on opening and closing NAVs plus dividends marked "ex

-dividend".

6 Source: PFM Ltd. The Ordinary Shares Hurdle Rate is the compound rate of

growth of the total assets required each year to meet the Ordinary Share price

at 30 June 2023.

7 Source: PFM Ltd. The ZDP Shares Hurdle Rate is the compound rate that the

total assets could decline each year until the predetermined redemption date,

for ZDP shareholders still to receive the redemption entitlement.

8 Source: PFM Ltd. Based on Zero Dividend Preference Shares divided by

Ordinary Shareholders' Equity at end of each period.

9 Source PFM Ltd. Non-cumulative cover = Gross assets at period end divided by

final repayment of ZDP Shares plus management fees charged to capital.

*% change is calculated on actual figures, and may be different from that

which could be obtained by using rounded figures shown within this section.

CHAIR'S STATEMENT

for the six months to 30 June 2023

Introduction

Following a difficult 2022, it is disappointing to record a further

deterioration in the first half of 2023. The renewable energy sector, despite

performing well on a fundamental basis, with higher earnings and dividends being

the norm, lost value as inflation and interest rates continued to increase.

The macro-economic environment has proved particularly challenging for what the

market perceives to be interest rate sensitive sectors, commonly referred to as

"bond proxies". This includes utilities, property, and of relevance to Premier

Miton Global Renewables Trust ("PMGR"), renewable energy.

A widely held view is that companies with highly visible revenues in which a

large part of investment return is taken through the dividend, are comparatively

less attractive when yields on government bonds or cash increase. However, this

ignores the positive dynamics applicable to the renewable energy sector, such as

its exceptional growth, government support, and power prices which remain

relatively high despite a recent pull back.

The primary triggers for inflation are well understood, primarily the post-covid

supply shock exacerbated by overly loose monetary policy (although central

bankers may dispute the second reason). The debate has now moved on to the

question as to what extent inflation expectations have become "embedded".

Central bankers, caught behind the curve, are now playing catch up. Rates,

particularly in the UK, have reached higher levels than they might otherwise

have done had monetary tightening started earlier.

Despite this rather pessimistic macro-economic backdrop, I believe we are closer

to the end of this cycle than the beginning, and given strong fundamentals, the

renewable energy sector is well placed to rebound when interest rates peak and

potentially start to fall again.

Performance

The Company's total assets total return, measuring the performance of the

portfolio including costs, was a negative 6.2%. This was however better than the

Company's performance comparator, the S&P Global Clean Energy Index (GBP

adjusted), which returned a negative 11.5%.

Renewable and clean energy was a distinct market laggard, with the major western

market indices recording gains over the first half of the year. The US stock

market performed well, although performance was concentrated in the well-known

large capitalisation technology companies. Europe also performed well, but the

UK market, while being in positive territory, was a little way behind Europe.

Given PMGR's geared capital structure, movements in gross assets are amplified

in the net assets. The NAV total return was negative 10.4%.

In common with many other investment trusts, particularly those focussed on

infrastructure, the discount at which PMGR's shares trade in comparison to their

NAV, widened during the period, from 12.9% at December 2022, to 15.6% at June

2023.

Despite depressed capital values, income generation has been strong, reflecting

a good operating environment and the generally strong earnings performance of

the portfolio companies.

Review of the six months

Renewable energy companies currently face a variety of headwinds and tailwinds.

European power prices have pulled back from recent highs but remain elevated in

comparison to "pre-Ukraine" levels. Gas prices, a key determinant of electricity

prices, have fallen back on weak demand from Asia and a combination of mild

weather and low demand in Europe. Europe has made good progress in securing ship

-borne liquified natural gas ("LNG") to replace piped Russian gas, but this

major market change will inevitably lead to structurally higher costs in future.

European governments, while increasing renewable installation targets, have

persisted with additional taxes, increasing sector complexity and risk. The US,

through the "inflation reduction act", appears to be on a very different track

with huge tax incentives available to the renewable energy sector to encourage

further investment.

Higher financing costs, coupled with equipment suppliers seeking to restore

profitability through higher prices for items such as wind turbines, have

increased the costs of new build renewable projects. As such, markets have

become concerned that returns on new renewable projects might be under pressure.

However, current levels of power pricing and strong demand for renewable power,

indicate that returns on well-designed projects should remain attractive.

As noted above, the most significant market driver over the half was the

increase in central bank interest rates. This has been most pronounced in the

UK, where the Bank of England raised its base rate from 3.50% at December 2022

to 5.00% by June 2023. Of more relevance to renewable sector valuations are long

dated bond yields, with UK 10-year gilt yields increasing from 3.67% at the

close of 2022, to 4.39% by the end of June. By contrast, the US Treasury's

increase in the Fed Funds rate, from 4.50% to 5.25%, was not reflected in 10

-year US treasury yields which were relatively flat over the half, from 3.87% at

the end of 2022 to 3.84% at June 2023.

It is worth remembering that interest rates have been increased in order to

bring down inflation. European renewable companies in particular often have a

high degree of indexation built into their revenues, therefore benefitting from

inflation. However, this did not stop the sector being sold down on the back of

higher rates.

Earnings and Dividends

Earnings and dividend growth reported by the majority of portfolio holdings was

very strong, with many companies reporting exceptionally good results on the

back of high power prices, coupled with continued growth in assets. Dividend

receipts were consequently higher, with net revenue earnings per ordinary share

increasing by 12.2% to 4.43p.

Given the healthy income picture, in April the Board declared an increased first

interim dividend, of 1.85p per share, paid at the end of June. The Board has now

declared a second interim dividend of 1.85p per share, to be paid on 29

September 2023 and will be marked ex-dividend on 31 August 2023. These dividends

represent an increase of 5.7% as compared to the dividends paid in respect of

the first half of 2022.

Outlook

The war in Ukraine shows little sign of ending in the near future. Commodities,

and in particular energy, remain volatile as a result. Further, it could be

argued that mild weather and an effective voluntary rationing programme, has

allowed a degree of complacency to creep into European energy markets. Continued

conflict, a return to demand growth in Asia, and a cold 2023/24 winter could see

another sharp spike in gas and electricity prices.

The earnings and asset performances of PMGR's portfolio holdings have most

certainly not been reflected in share prices over the past twelve months. Over

the longer term I believe this anomaly will be likely to correct when markets

again focus on fundamental value and business performance. Until then,

investors' patience may continue to be tested.

Gillian Nott OBE

Chair

1 August 2023

INVESTMENT MANAGER'S REPORT

for the six months to 30 June 2023

Market review

While the first half of 2023 proved to be successful in terms of underlying

performance measured by company earnings and dividends paid, share prices rather

frustratingly took their direction from macroeconomic issues, mainly falling in

price.

It is some consolation that the Trust's income levels increased as a result of

the strong underlying performances, and this has enabled the Board to declare an

increased dividend.

Over 2021 and 2022, PMGR's portfolio has had a higher exposure to Europe and the

UK and less in North America. There were a few reasons for this. Firstly,

European and UK renewable energy assets tend to have a higher degree of

inflation linkage within revenues than those in the US, where renewable power is

usually sold on pre-determined fixed prices. Moving into a more inflationary

environment, European and UK companies should therefore offer more protection

against inflation.

Secondly, we expected UK and European electricity prices would move higher, to

the benefit of renewable generators. This was due to the structural shift in the

gas market, replacing piped Russian gas with higher priced LNG, increased carbon

prices, and the increasingly unreliable and ageing French nuclear power

stations.

On a basic level, these decisions have turned out to be largely correct. Many of

the UK and European investments have reported very strong financial results,

with increased dividends on the back of higher power prices and inflation linked

revenues. North American holdings, although benefiting from improved sentiment

generated by the Inflation Reduction Act, have under-performed Europe in terms

of financial results.

What has come as a disappointment, however, is that the market has appeared to

largely ignore reported financial results and higher dividends, focussing

instead on movements in short term interest rates.

European Governments and the EU have not helped matters by imposing windfall

taxes onto renewable generators, while at the same time calling for increased

levels of investment. This has soured investor sentiment, created asymmetric

financial risks and is a disincentive to future investment.

Portfolio review

The portfolio was almost universally weak, with only a few positive performances

to offset falling share prices. Despite this, most companies made good

operational progress, business plans tended to be expanded rather than reduced,

and dividends, with just one exception, were either held or increased.

Given weak share prices, the sector is vulnerable to corporate activity, and one

holding received a takeover offer at a substantial premium to its share price.

Both geographic and sector allocations were relatively settled, and portfolio

trading activity was lower than previous years. The UK and Europe remain the

largest allocations, at around 33% each, with Global (companies operating on a

global basis) just over 20%. The holding in North American companies remains

relatively modest at approximately 8% and we remain of the view that US

renewables offer lower value than European counterparts.

Emerging markets continue to be held at a low weighting in the portfolio, with

China and Latin America each at approximately 2%.

As in prior years, we categorise core renewable generation companies into two

groups. Firstly, the investment companies, often referred to as yield companies

or "yieldcos", which usually acquire built, or construction ready, assets paying

out the majority of cash-flow to investors, and raising capital through new

equity. Secondly, integrated development companies, which develop projects from

first inception, retaining some assets and raising capital through a combination

of retained earnings and project sales. Together, these form approximately 70%

of the portfolio.

Yieldcos & Funds

As noted above, the renewable energy yield companies performed poorly in the

period. Of the UK focussed names held, Greencoat UK Wind, NextEnergy Solar, and

Foresight Solar, saw their shares fall by 5.2%, 15.0%, and 17.1% respectively

over the half year. Reported NAVs per share have been robust, with March 2023

reported NAVs being 11.4%, 0.7% and 6.1% ahead of March 2022 respectively.

Essentially, increased interest rates (used as a "discount rate" to calculate

the NAV) have been offset by higher power price and inflation assumptions. In

addition, the companies have generated cash flows well in excess of dividends

paid to shareholders.

The three UK listed European focussed yieldcos held also showed a similar

dynamic, with Octopus Renewable Infrastructure, Aquila European Renewables, and

Greencoat Renewables seeing share price declines of 7.9%, 3.0% and 11.4%

respectively. March 2023 NAVs were 3.6%, 6.4%, and 3.1% higher than 12 months

earlier, again demonstrating that higher interest rates have been more than

offset by other factors.

As a result of the opposing movements in share prices (down) and NAVs (up),

these companies are now trading at meaningful discounts to their published asset

values, while also offering high dividend yields well covered by cash flows.

The portfolio's holdings in North American yieldcos also lost value, with

Clearway Energy's shares falling by 9.8%. Likewise, Atlantica Sustainable

Infrastructure fell by 9.5%. UK listed US Solar Fund fell by 18.5%. The latter

two have undertaken strategic reviews in the half year, and while Atlantica's is

still in progress, US Solar Fund's Board has concluded that the current market

backdrop is not conducive to a sale of the company or its assets. It will

however commence a share buyback programme.

PORTFOLIO SECTOR ALLOCATION

30 June 2023 31 December 2022

Yieldcos & funds 38.1% 38.9%

Renewable energy developers 32.7% 29.9%

Renewable focused utilities 8.3% 9.5%

Energy storage 6.9% 9.0%

Biomass generation and production 6.0% 6.8%

Renewable technology and service 3.3% 2.2%

Electricity networks 2.6% 2.3%

Renewable financing and energy efficiency 1.3% 0.0%

Waste to energy 0.9% 1.3%

Numbers may not sum to 100% due to rounding

Source: PFM Ltd

Renewable Energy Developers

The portfolio contains a larger number of investments in renewable development

companies than yieldcos, although the average investment size is smaller.

Concentrating on the larger holdings, the position in RWE's shares fell by 6.5%

despite reporting excellent results for both 2022 and the first quarter of 2023.

Spanish solar developer, Grenergy Renovables was one of the few gainers in the

portfolio, its shares improving by 1.7%. Grenergy sold one of its development

projects at a good price and sentiment was also improved following a bid for

peer company OPD Energy, also owned, but with a smaller weighting. As a result

of the bid, OPD's shares gained 49.0% over the six months. The bid was pre

-accepted by its major shareholders and illustrates the discrepancy between

private and public market valuations in the renewable energy sector.

Also listed in Spain, global developer Acciona Energias saw its shares fall by

15.3% despite exceptional 2022 financial results, with net earnings more than

doubling from 2021. Norway listed Bonheur recorded a share price fall of 9.4%,

with a fourfold increase in 2022 net earnings over 2021 doing little to help the

stock. Aside from renewable energy, Bonheur also owns offshore wind turbine

installation vessels, a market which looks to become increasingly under

-supplied, plus the Fred Olsen Cruise line business. Both these divisions should

see improved earnings in coming years.

Northland Power is a global renewable developer, with a particular focus on

offshore wind. 2022 results increased sharply on higher power prices received by

their three North Sea offshore wind farms, and 2023 should see the completion of

new onshore wind assets in the US, plus a large solar farm in Mexico. Beyond

that, Northland is developing sizable offshore wind projects in the Baltic Sea

off Poland, and off Taiwan. These are expected to commence commercial operation

over 2026 and 2027. Northland's shares fell by 25.6% over the half year.

PMGR has held the shares of Estonia-listed Baltic developer Enefit Green since

its listing in October 2021, and one of Enefit's wind farms is featured on the

cover of this report. It has been a successful investment to date, showing a

good gain over book cost, and aims to more than double operating capacity by the

end of 2025. Its shares managed to hold steady over the first half of the year.

PORTFOLIO GEOGRAPHIC ALLOCATION

June 2023 December 2022

United Kingdom 33.70% 36.26%

Europe (excluding UK) 32.74% 30.72%

Global 21.35% 18.86%

North America 7.69% 9.16%

Latin America 2.39% 1.90%

China 2.13% 3.11%

Source: PFM Ltd

Other sectors

Biomass producer and generator Drax Group reported very strong earnings momentum

in 2022 (adjusted net earnings up almost fourfold compared to 2021), and this

momentum should continue into 2023 and 2024, benefitting from forward power

sales already locked in at attractive prices. The UK Government is yet to decide

on possible offtake contracts for a carbon capture plant investment at the Drax

Power station site, however the company has now shared investment plans for

biomass power generation with carbon capture in the US, the returns on which

look both very attractive while also being less politically contentious. Drax's

shares fell 17.5% in the first half of the year.

Ever higher levels of intermittent renewable energy production mean a greater

requirement for energy storage assets to match power supply with demand. For

instance, pumped hydro storage assets, of the sort owned within the portfolio by

SSE and Drax Group, have seen very good results in recent years and both

companies aim to expand these assets. However, battery storage is quicker and

cheaper to build, and can also provide frequency regulation services which hydro

is not technically able to do. However, the three battery storage funds held,

Harmony Energy, Gore Street Energy and Gresham House Energy Storage, all lost

value in the half year, with their shares falling by 15.0%, 15.5% and 10.3%

respectively. All three now trade on material discounts to NAV.

The Renewable focussed utilities segment was, by some margin, the best

performing section of the portfolio. The Trust holds SSE in the UK, Iberdrola in

Spain, and Algonquin Power & Utilities in North America. Their shares increased

by 7.5%, 9.3% and 23.5% respectively. SSE out-performed market assumptions for

its March 2023 results, while also announcing an almost 50% increase in its

investment plan to 2027 together with faster predicted earnings growth.

Algonquin saw a recovery in its share price following the poor performance seen

in the latter part of 2022.

Income

Strong underlying earnings have manifested in higher dividends received by the

Trust. Notable increases include Drax Group, which increased its full year

dividend by 11.7%, Acciona Energias increased by 150.0%, Bonheur's payment

increased by 16.3%, and Enefit Green by 37.7%. Dividends paid by the UK listed

yieldcos sector tend to have high correlation to inflation, and 2023 should see

good dividend increases based on targets announced during the first half.

The only company to cut its dividend was waste to energy company China

Everbright, where lower construction revenues meant lower earnings. Its 2022

full year dividend was reduced by 29.4% compared to 2021. However, the other

Chinese position, China Suntien Green Energy, managed to increase its dividend

by 15.6%.

Total income received during the half year was £1.15m, an increase of 5.9%.

Currency

The portfolio was largely hedged against adverse movements in the Euro and Hong

Kong Dollar during the half year, and currency hedging profits of £0.6m were

recorded. Given sterling's recent strength against the Euro, the Euro hedge has

now been removed although the currency situation remains under review.

Portfolio activity

Investment activity levels were relatively modest over the half year, with

purchases of £4.7m and sales also of £4.7m.

Outlook

European power prices have now fallen back to more normal levels although remain

substantially higher than levels seen historically. I believe that higher power

pricing is a structural shift, brought about by changes in the gas market,

carbon pricing, and a higher cost of capital for energy companies.

Given share price movements, it is evident that this is not necessarily a view

held by financial markets, and this creates potential opportunities for

renewable energy investors.

Further, the climate agenda is only increasing in importance, and governments

have acted to increase targets for renewable energy production, not least the

EU's RePower EU programme, the UK Government's ambitions for offshore wind, and

the US Government's targets contained within the Inflation Reduction Act.

Macroeconomic headwinds remain for the time being, but leading indicators give

hope that inflation pressures are now easing, including deflationary trends in

China and sharply falling money supply in the West. We hope, therefore, for an

improved performance in the second half.

James Smith

Premier Fund Managers Limited

1 August 2023

INVESTMENT PORTFOLIO

at 30 June 2023

Company Activity Country Value£000 % of Ranking

Ranking

totalinvestments June

December

2023

2022

Greencoat UK Yieldcos & United 2,900 6.6 1

2

Wind funds Kingdom

RWE Renewable Europe 2,736 6.2 2

4

energy (ex.

developers UK)

NextEnergy Yieldcos & United 2,617 6.0 3

3

Solar Fund funds Kingdom

Drax Group Biomass United 2,610 5.9 4

1

generation Kingdom

and

production

Octopus Yieldcos & Europe 2,498 5.7 5

5

Renewable funds (ex.

Infrastructure UK)

Aquila Yieldcos & Europe 2,291 5.2 6

6

European funds (ex.

Renewables UK)

Atlantica Yieldcos & Global 2,026 4.6 7

7

Sustainable funds

Infrastructure

Grenergy Renewable Global 1,815 4.1 8

11

Renovables energy

developers

Clearway Yieldcos & North 1,783 4.1 9

10

Energy `A' funds America

SSE Renewable United 1,657 3.8 10

15

focused Kingdom

utilities

Foresight Yieldcos & United 1,566 3.6 11

12

Solar Fund funds Kingdom

Bonheur Renewable Europe 1,527 3.5 12

16

energy (ex.

developers UK)

Harmony Energy Energy United 1,508 3.4 13

9

Income storage Kingdom

Trust (incl.

`C'

Shares)

Corp. Acciona Renewable Europe 1,313 3.0 14

14

Energias energy (ex.

Renovables developers UK)

National Grid Electricity Global 1,144 2.6 15

18

networks

Northland Renewable Global 1,032 2.3 16

17

Power energy

developers

Opdenergy Renewable Global 1,029 2.3 17

30

energy

developers

Iberdrola Renewable Global 1,025 2.3 18

8

focused

utilities

Algonquin Renewable North 974 2.2 19

19

Power and focused America

Utilities utilities

Enefit Green Renewable Europe 822 1.9 20

27

energy (ex.

developers UK)

Gore Street Energy United 797 1.8 21

22

Energy storage Kingdom

Storage Fund

Cloudberry Renewable Europe 751 1.7 22

29

Clean Energy energy (ex.

developers UK)

Gresham House Energy United 715 1.6 23

13

Energy storage Kingdom

Storage Fund

Eneti Renewable Global 713 1.6 24

32

technology

and service

Cadeler Renewable Europe 593 1.3 25

38

technology (ex.

and service UK)

China Suntien Renewable China 562 1.3 26

20

Green energy

Energy developers

Greencoat Yieldcos & Europe 513 1.2 27

24

Renewables funds (ex.

UK)

US Solar Fund Yieldcos & North 508 1.2 28

26

funds America

7C Solarparken Renewable Europe 505 1.1 29

25

energy (ex.

developers UK)

Omega Energia Renewable Latin 455 1.0 30

31

energy America

developers

MPC Energy Renewable Latin 442 1.0 31

28

Solutions energy America

developers

SDCL Energy Renewable Global 371 0.8 32

-

Efficiency financing

Income Trust and energy

efficiency

China Waste to China 371 0.8 33

23

Everbright energy

Environment

GreenVolt Renewable Europe 288 0.7 34

40

energy (ex.

developers UK)

Solaria Renewable Europe 241 0.5 35

39

Energía y energy (ex.

Medio developers UK)

Ambiente

Atrato Onsite Renewable United 224 0.5 36

33

Energy energy Kingdom

developers

Boralex Renewable Global 214 0.5 37

37

energy

developers

GCP Renewable United 195 0.4 38

-

Infrastructure financing Kingdom

and energy

efficiency

Fusion Fuel Renewable Europe 155 0.4 39

34

Green technology (ex.

(incl. and service UK)

warrants)

Polaris Renewable Latin 150 0.4 40

-

Renewable energy America

Energy developers

Innergex Renewable North 109 0.3 41

41

Renewable energy America

developers

Clearvise Renewable Europe 102 0.3 42

45

energy (ex.

developers UK)

Alternus Renewable Europe 34 0.2 43

-

Energy energy (ex.

developers UK)

43,881 99.9

PMGR ZDP United 50 0.1

Securities subsidiary Kingdom

2025

PLC

Total 43,931 100.0

investments

INTERIM MANAGEMENT REPORT

Premier Miton Global Renewables Trust PLC is required to make the following

disclosures in its Half Year Report:

PRINCIPAL RISKS AND UNCERTAINTIES

The Board believes that the principal risks and uncertainties faced by the

Company continue to fall into the following categories:

· Structure of the Company and gearing

· Repayment of ZDP Shares

· Dividend levels

· Currency risk

· Liquidity risk

· Market price risk

· Discount volatility

· Operational risk

· Accounting, legal and regulatory risk

· Political intervention

· Industry regulation

· Geopolitical risk

· Climate risk

Information on each of these, save for Repayment of ZDP Shares, is given in the

Strategic Report in the Annual Report for the year ended 31 December 2022.

Attention is further drawn to the new 2025 ZDP Shares' liability falling due on

28 November 2025, the repayment of which stands in preference to the

entitlements of Ordinary Shares. A fall in value of the Company's portfolio

around that time could have a material adverse effect on the value of the

Ordinary Shares.

RELATED PARTY TRANSACTIONS

The Directors are recognised as a related party under the Listing Rules and

during the six months to 30 June 2023 fees paid to Directors of the Company

totalled £39,860 (six months ended 30 June 2022: £37,700 and year to 31 December

2022: £75,375).

GOING CONCERN

The Directors believe that, having considered the Company's investment

objectives (shown on page 1), risk management policies and procedures, nature of

portfolio and income and expense projections, the Company has adequate

resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for a period of at

least 12 months from the date these financial statements were approved. For

these reasons, they consider that the use of the going concern basis is

appropriate. The risks that the Directors considered most likely to adversely

affect the Company's available resources over this period were a significant

fall in the valuation or a reduction in the liquidity of the Company's

investment portfolio.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors are responsible for preparing the Half Year Report, in accordance

with applicable law and regulations. The Directors confirm that, to the best of

their knowledge:

· The condensed set of Financial Statements within the Half Year Report has been

prepared in accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and applicable law; and

· The Interim Management Report includes a fair review of the information

required by 4.2.7R (indication of important events during the first six months

of the year) and 4.2.8R (disclosure of related party transactions and changes

therein) of the FCA's Disclosure and Transparency Rules.

For and on behalf of the Board

Gillian Nott OBE

Chair

1 August 2023

DIRECTORS AND ADVISERS

Directors

Gillian Nott OBE - Chair

Melville Trimble - Chair of the Audit Committee

Victoria Muir - Chair of the Remuneration Committee

Alternative Investment Fund Manager ("AIFM")

Premier Portfolio Managers Limited

Eastgate Court

High Street

Guildford

Surrey GU1 3DE

Telephone: 01483 306 090

www.premiermiton.com

Authorised and regulated by the Financial Conduct Authority ("FCA")

Investment Manager

Premier Fund Managers Limited

Eastgate Court

High Street

Guildford

Surrey GU1 3DE

Telephone: 01483 306 090

www.premiermiton.com

Authorised and regulated by the

Financial Conduct Authority

Secretary and Registered Office

Link Company Matters Limited

6th Floor

65 Gresham Street

London EC2V 7NQ

Registrar

Link Group

The Registry

Central Square

29 Wellington Street

Leeds LS1 4DL

Telephone: 0371 664 0300*

Overseas: +44 (0) 371 664 0300*

E-mail: shareholderenquiries@linkgroup.co.uk

www.signalshares.com

Depositary

Northern Trust Investor Services Limited

50 Bank Street

Canary Wharf

London E14 5NT

Authorised by the Prudential Regulation Authority ("PRA") and regulated by the

FCA and PRA

Custodian

The Northern Trust Company

50 Bank Street

Canary Wharf

London E14 5NT

Auditor

KPMG LLP

15 Canada Square

London E14 5GL

(resigned 3 July 2023)

Haysmacintyre LLP

10 Queen Street Place

London EC4R 1AG

(appointed 13 July 2023)

Tax Advisor

Crowe U.K. LLP

55 Ludgate Hill

London EC4M 7JW

Stockbroker

finnCap Capital Markets

One Bartholomew Close

London EC1A 7BL

Telephone: 0207 220 0500

Ordinary Shares

SEDOL: 3353790GB

LSE: PMGR

Zero Dividend Preference Shares

SEDOL: BNG43G3GB

LSE: PMGZ

Global Intermediary Identification Number

GIIN: W6S9MG.00000.LE.826

*Calls are charged at the standard geographic rate and will vary by provider.

Calls outside the United Kingdom will be charged at the applicable international

rate. The Registrar is open between 09:00 - 17:30 Monday to Friday excluding

public holidays in England and Wales.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

August 02, 2023 02:01 ET (06:01 GMT)

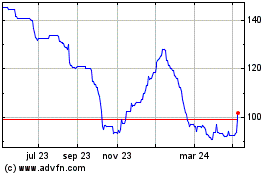

Premier Miton Global Ren... (LSE:PMGR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

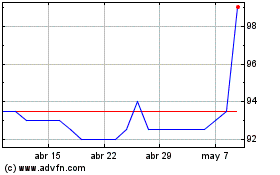

Premier Miton Global Ren... (LSE:PMGR)

Gráfica de Acción Histórica

De May 2023 a May 2024