TIDMPNS

RNS Number : 7493X

Panther Securities PLC

27 April 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ("MAR"). With the publication of this announcement,

this information is now considered to be in the public domain.

Panther Securities P.L.C. ("the Company" or "the Group")

Final results for the year ended 31 December 2022

CHAIRMAN'S STATEMENT

I am once again pleased to present the results for the year

ended 31 December 2022 which show a profit before tax of

GBP22,902,000 compared to a profit before tax of GBP15,922,000 for

the previous year ended 31 December 2021.

Both these figures are substantially affected by the movement in

our swap liabilities amounting to a gain of GBP19,722,000 in 2022

(2021 - GBP16,754,000). This 2022 movement now turns the liability

we have carried on our balance sheet since 2008, into an asset of

GBP4,467,000. The improvement in the year being due to the market

expectation of future higher interest rates, which are expected to

be in place over the life of the instruments, as at 31 December

2022, compared to those anticipated at 31 December 2021.

If you look at our operating profit, which has the advantage

that it is not distorted by the improvement of interest rate

derivatives, then for 2022 it was GBP6,331,000 compared to

GBP7,701,000 for the previous year. The main reason for the

decrease is that we had significantly higher costs in 2022, leading

to our cost of sales being GBP1,098,000 higher. We had

significantly increased rates, repairs, legal costs and of course

light and heat. The increase included certain one-off costs that

will not be repeated next year, such as back dated rates and also

the repairs and legal fees to facilitate significant lettings of

Maldon and Trowbridge. We estimate over half of the additional cost

of sales in 2022 will be non-recurring.

Our bad debt charge was back to a normal level of GBP702,000 in

2022 compared to a much reduced GBP286,000 in 2021, as with

hindsight we overprovided in 2020 at the peak of the pandemic and

we got the benefit of the reversal of this overprovision in

2021.

Rents Receivable

Rents receivable for the year ended 31 December 2022 were

GBP13,411,000, compared to the previous year's GBP13,172,000. This

was despite not benefiting from rents of circa GBP440,000 received

in 2021 following the disposals of Wembley and West Molesey in late

2021. In 2023 we should see further increases as we get a full year

of rent on our purchases (the key ones being Chorley and

Trowbridge) and also a full year at the improved rent on

Maldon.

Disposals

The Quadrangle, Glasgow

On 2 November 2021, we contracted to sell our site/building at

The Quadrangle, Glasgow, which sits on a corner site of 94,000 sq.

ft. on the canal and is ideal for a social housing development. The

price agreed was GBP1,250,000, subject to planning. We received

GBP65,000 released to us last year (and the non-refundable deposit

taken to profit in 2021), with the balance at completion on 1

August 2022 being that recognised in the 2022 figures.

Acquisitions

In May 2022, we acquired the Lower Healey Business Park in

Chorley, Lancashire. The freehold estate comprises approximately 10

acres containing 116,000 sq. ft. of single storey factory space let

to a number of different tenants with some vacant land capable of

further development. We understand there is good tenant demand in

this area partly because the Estate adjoins the M61 and is 2.5

miles from Exit 8. This Estate is currently producing GBP432,000

per annum and cost GBP5,026,000, including purchasing costs.

In June 2022, we completed our purchase of the (previously

mentioned) substantial freehold factory and warehouse in

Trowbridge, Wiltshire. This comprised of approximately 96,000

sq.ft. of usable space standing in six acres. This property is

located on an excellent industrial estate in Trowbridge where

demand is strong. This unit was purchased vacant for GBP3,300,000

and has since been let in August to an excellent covenant at

GBP455,000 per annum exclusive and has shown a decent value

increase at our year end.

Developments

Swindon

We are almost there and just need to agree a price for extending

and varying our lease with 70 years remaining. It is slow progress

but we hope to finally get there in 2023!!! We have one planning

permission granted with a second one in progress but tied in with

the lease extension on this central Swindon site.

Barry Parade, Peckham Rye

Our original attractive scheme for this site was eventually

rejected at appeal. Whilst this application was at appeal we

submitted a similar proposal with reduced residential units but

higher commercial elements. This is still going through planning,

for which we hope to obtain a positive decision for in due course.

Currently, we are negotiating the S.106 agreement which will

include an extortionate commuted sum in lieu of us providing

affordable units (four units on a nine unit scheme). Due to the

number of units and the layout of the scheme, we are already aware

that no affordable housing providers would be interested, which is

forcing us to pay the commuted sum.

Peterborough

The former Beales store in Peterborough, was vacated by New

Start 2020 Limited, trading as Beales, in February 2023. The store

was uneconomical for them due to business rates applied to the

trading area. Our planning application for the mixed-use

development of shops/offices and 124 residential units is at the

final stages and we hope to have a planning committee date in May

following the local elections. The current older style department

store contains approximately 145,000 sq. ft. of space which is

unsuitable for current retail markets.

Post Balance Sheet Events

On 16 January 2023, the Company drew down GBP2,000,000 from its

revolving facility.

On 23 March 2023 the Company completed on the purchase of the

freehold of 192-194 Northdown Road, Cliftonville, Margate for

GBP451,000. The majority of the property is let to Boots at

GBP25,000 pa with the remaining vacant space potentially suitable

for conversion to residential. This purchase adjoins a property in

our existing ownership.

Loans

On 16 July 2021 we completed our refinance which consisted of a

GBP66,000,000 loan for a three year period as a club facility

jointly lent by HSBC and Santander. The loan has a term element of

GBP55,000,000 and a more flexible revolving element of

GBP11,000,000 which gives us the ability to pay down and redraw

over the three year term.

GBP59,750,000 was drawn at the year end and we drew another

GBP2,000,000 after the year end. We make repayments of GBP125,000

per quarter.

We will be starting refinancing discussions soon which we hope

to put in place by the end of 2023.

From 1 September 2023, following the variation made in 2021, we

will start to benefit from the drop in our fixed rate to 3.40% pa

(currently 5.06% pa) on GBP35,000,000 of our loan saving the Group

GBP581,000 p.a. in cash flow until the end-point of the instrument

(compared to pre-variation). This instrument is in place until 31

August 2038.

Our other instrument fixes our interest rate at 2.01% pa on

GBP25,000,000 until 1 December 2031.

With GBP60,000,000 of our GBP66,000,000 facility fixed at lower

than market rates for many years to come we are in an enviable

position.

Charitable Donations

In March 2022 the Group donated GBP20,000 to the Daily Mail

Ukrainian appeal. We also made regular other donations in the year

including GBP10,000 to Land Aid and other smaller contributions

being mainly adverts within Charity programs or diaries.

Political Donations

I consider most of the problems our business and many other

businesses have to deal with occur because of poorly considered

legislation and excessive taxation brought in by our

unknowledgeable political leaders.

Therefore, at this year's annual general meeting, I have

proposed a resolution for the Company to donate GBP20,000 to the

Reform Party, with a hope many other people will believe a change

of political direction may be of benefit to all businesses, and

thus also the general population.

I have previously proposed resolutions to donate firstly to the

Conservative party then latterly to UKIP which has substantially

transformed itself into the Reform party, after UKIP succeeded in

convincing the majority of those who bothered to vote that leaving

the European Union was the correct decision for this country. The

Reform Party has some very interesting proposals but, most

importantly, they state that they will listen to the concerns of

the majority of the public and try to reduce taxation, and

excessive regulations.

As with previously proposed political donations, I will not vote

my personal shareholdings, but leave it to the body of shareholders

to decide if we should give support to this new party even if it is

just to show that our present, so called, Conservative party's

failure to enumerate traditional Conservative policies is unwelcome

by many voters.

Dividends

We paid a delayed 6p per share interim dividend for year ended

31 December 2021 in February 2022. We also paid a 6p per share

final dividend for the year ended 31 December 2021 on 20 July 2022.

We paid an interim dividend for the year ending 31 December 2022 of

6p per share paid on 20 October 2022.

A 10p per share special dividend in relation to the year ending

31 December 2023 was paid on 10 February 2023 to recognise the

improvement in our balance sheet due to the reversing of our swap

liabilities to a reasonable asset.

The Directors recommend a payment of a final dividend for the

year ended 31 December 2022 of 6p per share, following the interim

dividend which was paid on 20 October 2022 of 6p per share. The

final dividend of 6p per share will be payable on 19 July 2023 to

shareholders on the register at the close of business on 30 June

2023 (Ex dividend on 29 June 2023).

We expect to maintain our final and interim dividends for the

2023 full year and intend to make further announcements in relation

to this in due course and of course have already paid the 10p per

share special dividend.

Finally, I repeat my thanks to our small but dedicated team of

staff, growing team of financial advisers, legal advisers, agents

and accountants for all their hard work during the past year.

Special thanks and good wishes are in order for our tenants and I

hope they are able to overcome the present troubled environment and

make a full and profitable recovery.

Andrew S Perloff

CHAIRMAN

27 April 2023

CHAIRMAN'S RAMBLINGS

Max Bygraves was a very popular much loved all round entertainer

who occasionally performed in pantomimes during the 1950s.

My older brother and I were very lucky to have been taken by our

parents to see him in "Mother Goose" at the London Palladium in

1954. As a 10 year old, these were exciting outings for me. We sat

at the very rear of the ground floor stalls where I could sit on

the up folded seat to see the stage over the people in front of

us.

I am sure you all know the story about a goose that used to lay

a golden egg each day that brought wealth to a poor village, but

their leaders became greedy and decided to cut open its stomach to

find all the other golden eggs inside. Well, of course, there were

no golden eggs and the goose died, thus no more golden eggs were

laid, and the village became poor again. Part way through the show

the villagers were looking round and about to see where "Goosey"

had laid the golden egg. This involved some actors running around

the theatre and one finding a member of the audience to whom they

would give a golden egg for them to take on stage and announce,

"I've found it". Obviously, as I was the cutest little boy in the

audience, they picked me! The egg was in a brown paper bag but I

was too shy and nervous to take the egg up on stage so my brother,

Harold, took it up and got the applause for finding it and was also

given an inflatable goose.

This is where the expression "don't kill the goose that lays the

golden egg" came into being.

It also made me think what geese this country have which lay the

golden eggs? Well, first was energy. The UK sits on 100 years of

available coal and huge offshore oil and gas reserves and recently

discovered gas under many remote areas of the country. This

offshore oil has for some years produced golden eggs, very heavily

taxed, but we have currently killed off the possible golden eggs of

fracking (which has made the USA completely energy independent).

Even though renewable energy is clearly an important energy source,

and governments should encourage renewables, but why kill off our

energy independence? How foolish can we be?

One of Max Bygraves' catch phrases, "I'm gonna tell you a

story", also reminded me that sometimes a story helps people

understand.

My Friend the Builder

One of my friends, a builder who has carried out a number of

building jobs for me very successfully over the past 35 years, the

last one being a joint development of nine award winning housing

units in the West Country near his home. This was a few years ago

and after the scheme he decided he was fed up with planning

housing/building schemes because the authorities made it as

difficult as possible.

With his share of nine house scheme profits, he purchased a

small but successful laminate furniture manufacturer also in the

West Country and all was going well with the business running

smoothly. Well aware of local/UK and world news from the media he

heard about Russian troops carrying out "manoeuvres" near the

Ukraine border, and was concerned because over 50% of his laminate

trade involved using wood/veneers from Ukraine and he knew that if

Russia attacked Ukraine there would be disruption to his

supply.

With uncanny foresight he immediately ordered and contracted for

nine months' supply of his speciality timber from his supplier (who

were delighted with the order) for quick delivery, although this

put his finances at a stretch. Well, his intuition was correct, and

we all know what happened. Supplies of raw materials shrunk

considerably, but he managed to continue his usual production all

year and even though his production never ceased, prices for this

raw material rose 50%. This allowed his customers to continue to

receive his products, cheaper than his rivals (many of whose

supplies had been rationed) for six or seven months before some

alternative supplies became available at much higher prices.

Most of you will not be too worried about a shortage of wood

veneer, but the same circumstances apply to energy, oil, and

gas.

I suspect we have quite a few thousand people in the Ministry of

Defence, watching events, and the Department of Energy scrutinising

world supplies, all paid excessively well to ponder what problems

in this big world could affect this small country badly.

Why didn't any of our bureaucrats say to our Ministers "pick up

the phone to the chief executives of our fracking, oil and gas

companies to ramp up production quickly as trouble is coming and

where necessary we will grant assistance to assist in any way we

can"? A request that coal fired power generators also be kept on

standby. If they had, it may have saved this country's inhabitants

billions of pounds of direct energy costs and also the taxpayer

millions of pounds in subsidies. Indeed, if Russia saw that the UK

and Europe were able to ramp up their own energy production to move

dependence away from Russian energy, they may have reconsidered

their aggressive invasion plans.

I then wondered, what other geese does this country have which

lay the golden eggs?

Retail High Streets

A second goose for supplying golden eggs was our retail property

industry. People love shopping and our high streets were the

magnets of world travellers who spent their cash in our country.

The anchor of most of our high streets was the department stores,

many of which started over 150 years ago. They contained a

cornucopia of goods available at competitive prices.

Our clodhopper government taxed them so excessively as to

decimate the department store sector, which in turn damaged the

other high street retailers who always benefitted from the

attractions of these huge stores in town centres. Thus many towns

and, especially Northern towns, became in need of massive

regeneration funds to "level up" the damage created by poor

taxation decisions. There are so many benefits to our country in

having successful and busy high streets but too many social

benefits to mention here. Oxford Street and Bond Street in Central

London were, for many years as long as I can remember, the focal

point of wealthy tourists anxious to purchase luxury goods. By

removing the incentive of their ability to reclaim the VAT they pay

on their purchases, many of them now travel to Paris, Milan and

Venice as they feel they receive better value. This affects the

hotel/restaurant and service industries. The bureaucrats have

killed another golden egg producer.

The General Property Industry

The backbone of the country's wealth is its housing market,

which was sophisticated and worked well, with saver's money

deposited in building societies and banks who recycled loans to

help new buyers and thus allowed many builders to increase

production and provided new and extra homes. Of course, local

councils saw the opportunity of squeezing money out of builders and

demanded various payments, under a variety of pretexts, to obtain

permissions. Councils were incredibly slow in decision-making and

because less homes were built, so prices increased, stamp duty was

raised so often and it is mind boggling levels to which the taxes

have reached for higher value properties, thus hindering the

liquidity of the housing market.

The parasites of Westminster have taxed and re-taxed those who

save and invest in housing for rental, such that there is now a

growing shortage of rental homes. If the excessive taxation payable

by rentiers was not quite enough, legislation under the zero carbon

mantra has been brought in to load rental properties with heavy

extra insulation costs. The simple answer is for the owner to sell

making less availability and higher costs of rentals which our

foolhardy government will have to subsidise as a major part of the

poorer renters cannot afford the higher cost. Thus, not only

another golden egg disappears but a lead balloon attached to our

social security costs.

"I'm gonna tell you another story".

Bureaucratic Sloth

When I was first an Estate Agent, I had to employ a qualified

Surveyor to assist with some of our transactions. I chose one who

was particularly helpful to us. He told me my late Father had given

him some jobs when he first started his own practice so he in turn

was very loyal and reasonable to our fledgling practice.

I never forgot the story he relayed to me many years ago. He

left university/college with a surveying degree and went to work

for a London council in their surveying department. In those days,

councils were able to grant loans to enable people to buy their own

homes.

He was given a list of properties to inspect to ascertain that

the properties were good for the loan and appropriate value.

He carefully studied his property list and worked out the best

logistical way to view them. The first day he inspected over ten

properties as he said it was not an onerous task. He also arrived

back at the council offices in good time to start completing the

report forms. He was expecting some type of praise for such speedy

and diligent work.

However, the Head Surveyor told him that he had worked too hard.

He was meant to carry out one survey in the morning and one in the

afternoon, otherwise half the department would be out of a job

within months.

He did not stay long with this council as he felt they were

wasting not only their time but his time as well, so he decided to

start his own firm and long was it successful.

Personally in recent times, having dealt with the Probate

Office, HM Revenue & Customs, The Land Registry and the

District Valuers Department, it appears this attitude is still well

established. Long-term illness in the civil service is twice that

of the private sector. Even the simplest of matters takes an

inordinate amount of time.

Whilst excessive taxation is more obvious because of its extent,

foolhardy interfering legislation is also adversely perverse in its

ramifications.

Antique Trade Interference

The ban on ivory trading to save the elephants of Africa and

India, and big game, is a case in point. Banning the sale of

antique ivory carvings or ivory worked and used maybe between

150-50 years ago will not save one elephant's life but will destroy

many thousands of peoples businesses. If the authorities donated a

tiny fraction of our overseas aid to the appropriate countries,

many more elephants would be protected. However, in their usual

gesture politics way, our legislators are bringing in legislation

to stop legal licensed hunters from anywhere bringing back their

trophies. Whilst I am very much against hunting, the conservation

authorities in the relevant jurisdiction pointed out their policies

which include limited and carefully licensed hunting has increased

the elephant population which seems to be an oxymoron but reflects

real life situations and actions of the citizens of the countries

concerned whereas those that banned hunting saw substantial falls

in the elephant population, until they reversed the bans. Virtually

all African nations who were very intent on protecting their

environment and animal diversity wrote to our legislators

explaining why they oppose the ban.

Whilst this type of interference in other nations' policies may

be good gesture politics, it is extremely condescending to African

nationals who have vast experience of what saves elephants and what

does not. (Read Dominic Lawson's article in the Sunday Times of

12th March 2023.)

I include this rant about hunting, not because I believe in

hunting, but it is symptomatic of our legislators producing

interfering and poor legislation because a small bunch of

entertainers have found a protestable subject that will get them

publicity as caring people, even though they are misconceived, but

by their protests create the exact opposite of what they wish to

achieve.

This is promoted by Michael Gove who is also involved with laws

on property including environmental laws, which will create a

massive reduction in rental availability of homes. The one

certainty is his proposals will destroy the rental market and

create large extra costs to be paid out of the social security

budget.

The freedom to enjoy one's extra money from extra work and

success is discouraged should you want a second home for leisure

and/or should you provide a rental property, to supplement your

pensions, extra tax on buying and also on your income - the result

- less rental homes - less golden eggs.

Work hard, build a big business and when you sell it, having

already paid 50% of your income for many years in tax, then paid

20% capital gains tax on a sale and as and when you die (hopefully

many years later) 40% inheritance tax. I call this grand

larceny.

You are better off moving to a non-tax paying area for your

final years, which of course many people do.

One percent of our wealthiest taxpayers pay about 30% of the tax

gathered. What would happen if half of them left our country, i.e.,

150,000 people? Who would pay that 15% tax that disappeared? Would

there be any golden eggs left!!!

Yours

Andrew S Perloff

Chairman

27 April 2023

GROUP STRATEGIC REPORT

About the Group

Panther Securities PLC ("the Company" or "the Group") is a

property investment company quoted on the AIM market (AIM). Prior

to 31 December 2013 the Company was fully listed and included in

the FTSE fledgling index. It was first fully listed as a public

company in 1934. The Group currently owns and manages over 900

individual property units within over 120 separately designated

buildings over the mainland United Kingdom. The Group specialises

in property investing and managing of good secondary retail,

industrial units and offices, and also owns and manages many

residential flats in several town centre locations.

Strategic objective

The primary objective of the Group is to maximise long-term

returns for our shareholders by stable growth in net asset value

and dividend per share, from a consistent and sustainable rental

income stream.

Progress indicators

Progress will be measured mainly through financial results, and

the Board considers the business successful if it can increase

shareholder return and asset value in the long-term, whilst keeping

acceptable levels of risk by ensuring gearing covenants are well

maintained.

Key ratios and measures

2022 2021 2020 2019

Gross profit margin (gross profit/ turnover) 57% 65% 73% 76%

Loan to value* 39% 36% 38% 36%

Interest cover (actual) * 297% 281% 259% 353%

Finance cost rate (finance costs excluding lease portion/ average borrowings

for the year) 7.0% 7.5% 7.0% 7.1%

Yield (rents investment properties/ average market value investment

properties) 8.2% 7.9% 7.8% 8.8%

Net assets value per share 637p 553p 488p 480p

Earnings/ (loss) per share - continuing 96.6p 76.4p 14.9p (23.1)p

Dividend per share** 12.0p 12.0p 12.0p 12.0p

Investment property acquisitions GBP8.9m GBP0.8m GBP5.5m GBP8.1m

Investment property disposal proceeds GBP1.2m GBP15.8m GBP0.7m GBP1.1m

* As reported to the Lenders - based on charged property rents,

borrowed funds and bank valuations as appropriate.

** Based on those declared for the year.

Business review

The overall year was a strong year for the Group with earnings

being almost a GBP1 per share. Much of this growth was driven by

the turnaround in the valuations of the financial derivatives which

improved by GBP19.7 million (2021- GBP16.8 million). Following some

variations including the premium paid in 2021 to amend the

agreement, and also due to a higher interest rate outlook, these

are now forecasted to be strong hedges going forward - adding value

to the Group and putting it in an enviable position in terms of its

fixing of its borrowing costs.

Group's turnover grew in 2022 by GBP239,000, despite the

disposals late in 2021 (of Wembley and West Molesey), pre-disposal

rents of GBP438,000 were received in 2021, which we did not benefit

from in 2022. The property investments purchased in 2022 of Chorley

and Trowbridge were only bought half way through the year, together

with Maldon (our largest rent on a single property) only being

re-let for three quarters of the year (at the higher rent of

GBP800,000), means we should benefit from circa a further

GBP500,000 additional rents in 2023 (compared to 2022).

Disappointingly the overall gross profits were held back by higher

costs, many of these items are non-recurring charges, which should

not be repeated, but the Group cannot avoid the rising costs that

are currently affecting most organisations and individuals.

The bad debt charge was higher in 2022, compared to 2021, but

actually this is back to more normal levels. 2021 showed a low

charge, as the directors with hindsight had been too cautious in

2020, with the COVID-19 pandemic still causing uncertainty, and

this overprovision was unwound in 2021.

The property values improved slightly by GBP1.4 million

following a Directors' valuation at the year-end.

The most significant impact on the income statement, already

mentioned, was the sizeable improvement of the swap liability

(derivative financial liabilities) by GBP19.7 million in 2022, in

addition to the GBP16.8 million improvement in 2021. Approximately

half of the reduction in the liability in 2021 was due to the Group

paying a premium to exit the swap and re-enter a new more

beneficial arrangement for a GBP5 million premium at an estimated

discount of GBP3.3 million (this is explained in more detail under

Financing below). The remainder of the improvement in our swap

liability position in 2021 and 2022 is in relation to the change in

market expectations of higher future interest rates (leading to a

lower liability).

The consolidated statement of cash flows in 2022, shows that

cash was depleted by GBP8.9 million in the year, but we also bought

exactly GBP8.9 million of investment properties.

In terms of the statement of financial position, the Group saw

improvement in its asset value with the net asset value per share

now being 637p (2021 - 553p per share). This improvement was less

than the GBP1 per share mentioned regarding earnings, due to the

18p of dividends paid in the year. The 18p included the payment of

a delayed 2021 interim dividend of 6p per share as well as the

usual 12p. The board delayed this dividend whilst assessing the

impact of COVID-19 and waiting for the loan renewal to be approved

by credit committee.

Through the many downward economic cycles and in particular, the

COVID-19 pandemic, the most important plank within the Group's

business plan is the balance within the portfolio between different

asset classes and the resulting diverse, resilient, income streams

these investments provide. Over the last few years, the industrial

properties and the secondary "local" retail investments have

performed the best in terms of growth in values and have shown

resilient income collection. We also benefit from having properties

with residential elements or planning potential. As explained in

the last few annual reports (and worth repeating), we have seen

that the secondary local shopping parades hold up well, especially

during the pandemic. The traders in these properties managed to

survive and some even flourish. Although lockdowns meant closures,

many of these businesses were considered essential and most

benefited from additional local footfall whilst people were not

commuting into major towns or city centres. We also saw our smaller

tenants adapt better and were more flexible in their approach, as

well as the government help being more meaningful for covering

their fixed costs.

We feel the pandemic in particular has proven that our business

model of investing in a diversified selection of property

investments rather than specialising, is the correct one and

provided adequate income for all our requirements.

It is still our view, that secondary retail properties (which is

a large part of our portfolio - over half by value) will be less

affected by the seismic change in shoppers' habits. The average

secondary retail parade has a higher proportion of businesses which

are providing non-retail offerings, even though they are shops.

This includes service providers, restaurants or take away use,

or convenience offerings, which are by their very nature less

affected than pure destination retail, or by ever changing consumer

habits. In many instances, the Web even provides additional

opportunities i.e. being able to offer take away services via Just

Eat etc. Even our more traditional high street or pure retail

positions are mainly large blocks in the centre of towns - which we

believe will benefit from longer-term regeneration plans from the

Government and local councils for town centres. As such, if and

when some retail locations become less viable, we believe we can

create value from these sites with planning permission to

eventually give them other uses or purposes. In the meantime, they

continue in the most part to be strong cash contributors providing

high returns on initial investment.

Going forward

We are experiencing rental growth, some of this being from

renting long-term vacant properties and the rest from improved

rental terms. Going forward over the next couple of years we

foresee the biggest issue being controlling the holding and

maintenance costs of our properties. In response to this, we are

bringing in further controls and phasing our work programmes.

Additionally there will be potential additional costs of

improving the energy efficiency of our buildings to keep them in

line, or even ahead of the EPC ("energy performance certificate")

regime requirements which is constantly being updated. We are

attempting to cost this for our more valuable properties to

potentially include in our refinancing request (if required).

We believe there are still many opportunities to unlock value

within our portfolio, both in terms of letting more of the vacant

properties, through repurposing and some from planning schemes to

rebuild.

The economy has entered a higher interest and high inflation

environment. We have fixed interest swaps which will protect us

from interest increases. The nature of property companies naturally

protects the business from inflation, as property investments tend

to increase in line with inflation, whilst the real value of loans

utilised effectively decreases.

There are always uncertainties and COVID-19 was an extreme

example. Uncertainties can affect property prices in the short

term, however the Board continues to believe we are protected by

our portfolio's diversity, experienced management team, ability to

adapt and by having access to funds. We have low gearing levels,

supportive lenders and cash reserves.

The Board is confident about the business going forward.

Financing

The Group refinanced its facilities in the prior year and agreed

a GBP66 million facility for a three-year term from July 2021. We

are hoping to refinance again by the end of 2023.

At the Statement of Financial Position date, the Group had

GBP4.5 million of cash funds, with GBP5.5 million available within

the loan facility.

Financial derivative

We have seen a fair value gain (of a non-cash nature) in our

long term liability on derivative financial instruments of

GBP19.722 million (2021: GBP16.754 million). Following this gain

the total derivative financial is now an asset on our Consolidated

Statement of Financial Position of GBP4.5 million (2021: GBP15.3

million liability).

In November 2021 a GBP25m swap which was at a fixed interest

rate of 4.63% came to the end of its term and has been replaced by

one at 2.01% which will show a saving in interest costs of circa

GBP654,000 per annum compared to the historic position.

In February 2021 the Company paid GBP5,000,000 to vary a

long-term swap agreement. The agreement varied was an interest rate

swap fixed at 5.06% until 31 August 2038 on a nominal value of

GBP35m and has circa 17.5 years remaining. Following the variation,

the Group's fixed rate will drop on 1 September 2023 to 3.40%

saving the Group GBP581,000 p.a. in cash flow until the end point

of the instrument.

These financial instruments (shown in note 27) are interest rate

swaps that were entered into to remove the cash flow risk of

interest rates increasing by fixing our interest costs. We have

seen that in uncertain economic times there can be large swings in

the accounting valuations.

Small movements in the expectation of future interest rates can

have a significant impact on the fair value of these interest rate

swaps; this is partly due to their long dated nature.

Financial risk management

The Company and Group's operations expose it to a variety of

financial risks, the main two being the effects of changes in the

credit risk of tenants and interest rate movement exposure on

borrowings. The Company and Group have in place a risk management

programme that seeks to limit the adverse effects on the financial

performance of the Company and Group by monitoring and managing

levels of debt finance and the related finance costs. The Company

and Group also use interest rate swaps to protect against adverse

interest rate movements with no hedge accounting applied.

Mark-to-market valuations on our financial instruments have been

erratic due to current low market interest rates and due to their

long term nature but have improved in 2022. These large

mark-to-market movements are shown within the Income Statement.

However, the actual cash outlay effect is nil when considered

alongside the term loan, as the instruments have been used to fix

the risk of further cash outlays due to interest rate rises or can

be considered as a method of locking in returns (the difference

between rent yield and interest paid at a fixed rate).

Given the size of the Company and Group, the Directors have not

delegated the responsibility of monitoring financial risk

management to a sub-committee of the Board. The policies set by the

Board of Directors are implemented by the Company and Group's

finance department.

Credit risk

The Company and Group have implemented policies that require

appropriate credit checks on potential tenants before lettings are

agreed. In many cases a deposit is requested unless the tenant can

provide a strong personal or other guarantee. The amount of

exposure to any individual counterparty is subject to a limit,

which is reassessed annually by the Board. Exposure is reduced

significantly due to the Group having a large spread of tenants who

operate in different industries.

Price risk

The Company and Group are exposed to price risk due to normal

inflationary increases in the purchase price of the goods and

services it purchases in the UK. The exposure of the Company and

Group to inflation is considered low due to the low cost base of

the Group and natural hedge we have from owning "real" assets.

Price risk on income is protected by the rent review clauses

contained within our tenancy agreements and often secured by medium

or long-term leases.

Liquidity risk

The Company and Group actively manage liquidity by maintaining a

long-term finance facility, strong relationships with many banks

and holding cash reserves. This ensures that the Company and Group

have sufficient available funds for operations and planned

expansion or the ability to arrange such.

Interest rate risk

The Company and Group have both interest bearing assets and

interest bearing liabilities. Interest bearing assets consist of

cash balances which earn interest at fixed rate when placed on

deposit. The Company and Group have a policy of only borrowing debt

to finance the purchase of cash generating assets (or assets with

the potential to generate cash). We also use financial derivatives

(swaps) where appropriate to manage interest rate risk. The

Directors revisit the appropriateness of this policy annually.

Principal risks and uncertainties of the Group

The successful management of risk is something the Board takes

very seriously as it is essential for the Group to achieve

long-term growth in rental income, profitability and value. The

Group invests in long term assets and seeks a suitable balance

between minimising or avoiding risk and gaining from strategic

opportunities. The Group's principal risks and uncertainties are

all very much connected as market strength will affect property

values, as well as rental terms and the Group's finance, or term

loan, whose security is derived primarily from the property assets

of the business. The financial health of the Group is checked

against covenants that measure the value of the property, as a

proportion of the loan, as well as income tests. The two measures

of the Group's finances are to check if the Group can support the

interest costs (income tests) and also the ability to repay

(valuation covenants).

The Group has a successful strategy to deal with these risks,

primarily its long lasting business model and strong management.

This meant the business had little or no issues during the 2008

financial crisis, which some commentators say was the worst

financial crisis since the Great Depression of the 1930s. The

COVID-19 crisis also showed the resilience of the investments'

income streams and their good management, in particular the

disposals degearing the business made in 2018 and 2021.

Market risk

If we want to buy, sell or let properties there is a market that

governs the prices or rents achieved. A property company can get

caught out if it borrows too heavily on property at the wrong time

in the market, affecting its loan covenants. If loan covenants are

broken, the Company may have to sell properties at non-optimum

times (or worse) which could decrease shareholder value. Property

markets are very cyclical and we in effect have three strategies to

deal with or mitigate the risk, but also take advantage of this

opportunity:

1) Strong, experienced management means when the market is

strong we look to dispose of assets and when it is weak we try and

source bargains i.e. an emergent strategy also called an

entrepreneurial approach.

2) The Group has a diversified property portfolio and maintains

a spread of sectors over retail, industrial, office and

residential. The other diversification is having a spread

regionally, of the different classes of property over the UK. Often

in a cycle not all sectors or locations are affected evenly,

meaning that one or more sectors could be performing stronger,

maybe even booming, whilst others are struggling. The stronger

performing investment sectors provide the Group with opportunities

that can be used to support slower sectors through sales or

income.

3) We invest in good secondary property, which tends to be lower

value/cost, meaning we can be better diversified than is possible

with the equivalent funds invested in prime property. There are not

many property companies of our size that have over 900 individual

units and over 120 buildings/ locations. Secondary property also,

very importantly, is much higher yielding which generally means the

investment generates better interest cover and its value is less

sensitive to market changes in rent or loss of tenants.

Property risk

As mentioned above, we invest in most sectors in the market to

assist with diversification. Many commentators consider the retail

sector to be in period of severe flux, considerably affected by

changing consumer habits such as internet shopping as well as a

preference for experiences over products. Of the Group's investment

portfolio, retail makes up the largest sector being circa 60 to 65%

by income generation. However, the retail sector is affected to

lesser degrees in what we would describe as neighbourhood parades,

as opposed to traditional shopping high streets. The large part of

our retail portfolio is in these neighbourhood parades, meaning we

are less affected by consumer habits and even benefit from some of

the changes. Neighbourhood parades provide more leisure, services

and convenience retail.

For example we have undertaken a few lettings to local or

smaller store formats, to big supermarket chains, which would not

have taken place many years ago. Block policy is another key

mitigating force within our property risks. Block policy means we

tend to buy a block rather than one off properties, giving us more

scope to change or get substantial planning permission if our type

of asset is no longer lettable. The obvious example is turning

redundant regional offices into residential. In addition by having

a row of shops, we can increase or reduce the size of retail units

to meet the current requirements of retailers.

Finance risk

The final principal risk, which ties together the other

principal risks and uncertainties, is that if there are adverse

market or property risks then these will ultimately affect our

financing, making our lenders either force the Group to sell assets

at non-optimal times, or take possession of the Group's assets. The

management, business model and diversification factors described

above help mitigate against property and market risks, which as a

consequence mitigate our finance risk.

The main mitigating factor is to maintain conservative levels of

borrowing, or headroom to absorb downward movements in either

valuation or income cover. The other key mitigating factor is to

maintain strong, honest and open relationships with our lenders and

good relationships with their key competitors. This means that if

issues arise, there will be enough goodwill for the Group to stay

in control and for the issues to resolve themselves and

hopefully

remedy the situation. As a Group we also hold uncharged

properties and cash resources, which can be used to rectify any

breaches of covenants.

Other non-financial risks

The Directors consider that the following are potentially

material non-financial risks:

Risk Impact Action taken to mitigate

Reputation Ability to raise capital/ Act honourably, invest

deal flow reduced well and be prudent.

Regulatory changes Transactional and holding Seek high returns to cover

costs increase additional costs.

Lobby Government -"Ramblings".

Use advisers when necessary.

People related Loss of key employees/ Maintain market level remuneration

issues low morale/ inadequate packages, flexible working

skills and training. Strong succession

planning and recruitment.

Suitable working environment.

Computer failure Loss of data, debtor External IT consultants,

history backups, offsite copies.

Latest virus and internet

software.

Asset management Wrong asset mix, asset Draw on wealth of experience

illiquidity, hold cash to ensure balance between

income producing and development

opportunities. Continued

spread of tenancies and

geographical location.

Prepare business for the

economic cycles.

Where possible cover with

Acts of God (e.g. Weather incidents, insurance. Ensure the Group

COVID 19) fire, terrorism, pandemics carry enough reserves and

resources to cover any

incidents.

----------------------------- -------------------------------------

Section 172(1) statement

This is a reporting requirement and relates to companies defined

as large by the Companies Act 2006, this includes public companies

as otherwise the Group would not be considered large.

Each individual Director must act in the way he considers, in

good faith, would be the most likely to promote the success of the

company for benefit of its members as a whole, and in doing so the

Directors have had regard to the matters set out in section 172(1)

(a) to (f) when performing their duty under section 172.

The matters set out are:

((a) the likely consequences of any decision in the long

term;

The longer term decisions are made at Board level ensuring a

wealth of experience and a breadth of skills. The value creation in

the business is mainly generated by buying the investments at the

right time in the financial cycles, whilst reducing risk by

choosing assets that have alternative or back up values to the

current use, as well as initial values. It is also key that long

term decisions are made in respect of ensuring that property assets

are maintained, where economically viable. Other areas to ensure

decisions are in tune with long term consideration are making sure

the best possible financing of the Group to match the requirements

of the long-term nature of property ownership. The Board and

management makes long term decisions such as keeping a vigilant

review of the changing nature of property usage and tries where

possible to diversify its income streams. Caerphilly and Gateshead

were relatively more recent purchases which are good examples of

long term decision making, i.e. choosing offices and a leisure led

retail scheme - as such giving

some protection against changing consumer habits in more general

retail arena.

(b) the interests of the company's employees;

The Company makes investment in and the development of talent of

its employees, including paying for professional development,

providing in house updates and encouraging knowledge sharing. The

Group has a strong track record of promoting from within the

business and in 2020 two surveyors were promoted to Joint Head of

Property. In 2021 the Finance Director was promoted to Chief

Executive. The Group undertakes team building activities to

encourage cohesion and working together.

(c) the need to foster the company's business relationships with

suppliers, customers and others;

Being in the secondary property industry the business is used to

dealing with many types of businesses as tenants from large

multi-national businesses to small sole traders - keeping good

sound relationships with both is key. We also use many small

operators and suppliers and we ensure prompt payment, paying within

30 days in most instances to again foster good working relations.

We installed a purchase order system in 2018 and in 2019 replaced

this with a new system, which has since been refined to streamline

and speed up payments supporting small suppliers.

(d) the impact of the company's operations on the community and

the environment;

The Group's investments by their very nature often have a

significant impact on local communities, providing services and

convenience businesses, or places for local enterprise or

employment. By owning a parade of shops, we can ensure where

possible that these are viable locations by encouraging a variety

of offerings. The Group maintains and upkeeps its investment

properties to a viable level which benefits the local communities

they provide accommodation for, or seeks improvements in planning

permission which can enhance local areas. The Group also ensures it

recycles much of its head office paper and is moving towards less

paper communication; from 2019 to date our invoices have been

emailed as standard to our tenants and we also encourage the

receipt of electronic invoices. In 2021 we had a renewed push to

move our last few tenants away from cheque payments. We also ensure

we upgrade our units to the required EPC levels which by its very

nature reduces the longer term environmental impact of the use of

these units.

(e) the desirability of the company maintaining a reputation for

high standards of business conduct;

The Group maintains an appropriate level of Corporate Governance

that is documented within its own section within these Financial

Statements and on the Company's website. With a relatively small

management team it is easier to monitor and assess the culture and

encourage the appropriate standards. The Board strives to delegate

and empower its management teams to ensure the high standards are

maintained at all levels within the business.

(f) the need to act fairly as between members of the

company.

The Group has excellent communication with its members, actively

encouraging participation and discussion at its AGMs and also

circulating letters of our announcements to ensure older members or

those not accessing the financial news can keep up to date with

relevant information. Our Chairman is unpaid, his benefit or income

from the Company is received via dividends pro-rata the same as all

members including minority shareholders.

The Group Strategic Report set out on the above pages, also

includes the Chairman's Statement shown earlier in these accounts

and was approved and authorised for issue by the Board and signed

on its behalf by:

S. J. Peters

Company Secretary

Unicorn House

Station Close

Potters Bar

Hertfordshire EN6 1TL 27 April 2023

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2022

Notes 31 December 31 December

2022 2021

GBP'000 GBP'000

Revenue 13,411 13,172

Cost of sales (5,749) (4,651)

Gross profit 7,662 8,521

Other income 1,009 958

Administrative expenses (1,638) (1,492)

Bad debt expense (702) (286)

---------------- ----------------

Operating profit 6,331 7,701

Profit on disposal of investment properties 461 701

Movement in fair value of investment

properties 4 1,384 961

---------------- ----------------

8,176 9,363

Finance costs - interest (3,265) (2,322)

Finance costs - swap interest (1,481) (2,806)

Finance costs - swap variation - (5,000)

Investment income 28 29

Loss on the disposal of investments (278) (96)

Fair value gain on derivative financial

liabilities 5 19,722 16,754

---------------- ----------------

Profit before income tax 22,902 15,922

Income tax expense (5,917) (2,411)

Profit for the year 16,985 13,511

================ ================

Continuing operations attributable

to:

Equity holders of the parent 16,985 13,511

Profit for the year 16,985 13,511

================ ================

Earnings per share

Basic and diluted - continuing operations 3 96.6p 76.4p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2022

Notes 31 December 31 December

2022 2021

GBP'000 GBP'000

Profit for the year 16,985 13,511

----------- -----------

Items that will not be reclassified

subsequently to profit or loss

Movement in fair value of investments

taken to equity (59) 55

Deferred tax relating to movement in

fair value of

investments taken to equity 15 (14)

Realised fair value on disposal of investments

previously taken to equity 309 148

Realised deferred tax relating to disposal

of investments previously taken to equity (77) (37)

Other comprehensive income for the year,

net of tax 188 152

Total comprehensive income for the

year 17,173 13,663

=========== ===========

Attributable to:

Equity holders of the parent 17,173 13,663

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Company number 00293147

As at 31 December 2022

Notes 31 December 31 December

2022 2021

ASSETS GBP'000 GBP'000

Non-current assets

Plant and equipment 64 -

Investment properties 4 176,937 167,384

Derivative financial asset 4,467 -

Deferred tax asset - 2,252

Right of use asset 258 298

Investments 256 292

181,982 170,226

----------- -----------

Current assets

Asset held for sale 191 -

Stock properties 350 350

Investments 29 29

Trade and other receivables 3,178 2,996

Cash and cash equivalents (restricted) 4 5,009

Cash and cash equivalents 4,454 8,343

8,206 16,727

----------- -----------

Total assets 190,188 186,953

=========== ===========

EQUITY AND LIABILITIES

Capital and reserves

Share capital 4,437 4,437

Share premium account 5,491 5,491

Treasury shares (772) (213)

Capital redemption reserve 604 604

Retained earnings 101,467 87,464

Total equity 111,227 97,783

Non-current liabilities

Borrowings 6 58,807 55,513

Derivative financial liability 5 - 15,255

Deferred tax liabilities 3,371 -

Leases 8,249 8,353

----------- -----------

70,427 79,121

----------- -----------

Current liabilities

Trade and other payables 7,869 9,018

Borrowings 6 500 560

Current tax payable 165 471

----------- -----------

8,534 10,049

----------- -----------

Total liabilities 78,961 89,170

----------- -----------

Total equity and liabilities 190,188 186,953

=========== ===========

The accounts were approved by the Board of Directors and

authorised for issue on 27 April 2023. They were signed on its

behalf by:

A.S. Perloff, Chairman

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022

Share Share Treasury Capital Retained Total

capital premium shares redemption earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 4,437 5,491 (213) 604 75,923 86,242

Total comprehensive

Income - - - - 13,663 13,663

Dividends - - - - (2,122) (2,122)

Balance at 1

January 2022 4,437 5,491 (213) 604 87,464 97,783

Total comprehensive

income - - - - 17,173 17,173

Dividends - - - - (3,170) (3,170)

Treasury share

purchase - - (559) - - (559)

-------- -------- --------- ----------- ---------- ----------

Balance at 31

December 2022 4,437 5,491 (772) 604 101,467 111,227

======== ======== ========= =========== ========== ==========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2022

31 December 31 December

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Operating profit 6,331 7,701

Add: Depreciation 45 -

Rent paid treated as interest (687) (687)

Profit before working capital change 5,689 7,014

(Increase)/ decrease in receivables (182) 929

Decrease in payables (1,149) (48)

----------- -----------

Cash generated from operations 4,358 7,895

Interest paid (3,766) (4,295)

Income tax paid (662) (620)

----------- -----------

Net cash (used in)/ generated from

operating activities (70) 2,980

----------- -----------

Cash flows from investing activities

Purchase of investment properties (8,947) (832)

Purchase of investments** (66) (6)

Purchase of plant and equipment (300) -

Proceeds from sale of investment property 1,176 15,841

Proceeds from sale of investments** 74 435

Dividend income received 21 21

Interest income received 7 8

----------- -----------

Net cash (used in)/ generated from

investing activities (8,035) 15,467

----------- -----------

Cash flows from financing activities

Draw down of loan 8,500 6,000

Repayments of loans (5,060) (12,057)

Loan amortisation repayments (500) (250)

Purchase of own shares (559) -

Swap variation - (5,000)

Loan arrangement fees and associated

set up costs - (884)

Dividends paid (3,170) (2,122)

----------- -----------

Net cash used in from financing activities (789) (14,313)

----------- -----------

Net (decrease)/ increase in cash and

cash equivalents (8,894) 4,134

Cash and cash equivalents at the beginning

of year* 13,352 9,218

----------- -----------

Cash and cash equivalents at the end

of year* 4,458 13,352

=========== ===========

* Of this balance GBP4,000 (2021: GBP5,009,000) is restricted by

the Group's lenders i.e. it can only be used for purchase of

investment property.

** Shares in listed and/or unlisted companies.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2022

1. General information

While the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (IFRSs), this announcement does not

itself contain sufficient information to comply with IFRSs. The

Group will publish full financial statements that comply with IFRSs

which will shortly be available on its website and are to be posted

to shareholders shortly.

The financial information set out in the announcement does not

constitute the Company's statutory accounts for the years ended 31

December 2022 or 2021. The financial information for the year ended

31 December 2021 is derived from the statutory accounts for that

year, which were prepared under IFRSs, and which have been

delivered to the Registrar of Companies. The auditor's report on

those accounts was unqualified but did include a reference to

matters to an emphasis of matter on the impact of COVID-19 which

the auditors drew attention to without qualifying their report and

did not contain a statement under either Section 498(2) or Section

498(3) of the Companies Act 2006 and did not include references to

any matters to which the auditors drew attention by way of

emphasis.

The financial information for the year ended 31 December 2022 is

derived from the audited statutory accounts for the year ended 31

December 2022 on which the auditors have given an unqualified

report, that did not contain a statement under section 498(2) or

498(3) of the Companies Act 2006. The statutory accounts will be

delivered to the Registrar of Companies following the Company's

annual general meeting.

The accounting policies adopted in the preparation of this

preliminary announcement are consistent with those set out in the

latest Group Annual financial statements.

Going Concern

The Directors have prepared detailed financial forecasts to

December 2024 assuming a significant downward trend in its income

base, increasing costs and higher interest rates. The forecasted

worst case scenario demonstrated the Group is a going concern even

if the business was subjected to a long downward spiral in its

business activities. In summary the Group has enough financial

resources to survive to beyond December 2024.

The Group is strongly capitalised, has high liquidity together

with a number of long term contracts with its customers many of

which are household names. The Group has a diverse spread of

tenants across most industries and owns investment properties based

in many locations across the country.

The Group's main loans were renewed in July 2021 for a new three

year term. It is considered that the facility will be renewed prior

to its expiry in July 2024 since the Group has a strong track

record of obtaining long term finance and expects this to continue

in the future as it has supportive lenders. The Group seeks to

maintain excellent relations with its lenders. The loan is made

jointly by two lenders and also as mentioned has a low level of

gearing which both gives the Group's finance situation more

resilience.

The lenders covenants as at 31 December 2022 have been reviewed

and significant movements would be required before a covenant was

breached such as a 30% decrease in the secured portfolio valuation

(a circa GBP46m reduction) or a 49% decrease in its actual income

cover being a circa GBP5.7m reduction in income. The Group also

currently has cash reserves (and available facility) and other

uncharged assets (including circa GBP10m of investment

property).

The Directors believe the Group is very well placed to manage

its business risks successfully and have a good expectation that

both the Company and the Group have adequate resources to continue

their operations for the foreseeable future. For these reasons they

continue to adopt the going concern basis in preparing the

financial statements.

2. Dividends

Amounts recognised as distributions to equity holders in the

period:

2022 2021

GBP'000 GBP'000

Interim dividend for the year ended

31 December 2021 of 6p per share

(2020: 6p per share) 1,062 1,061

Final dividend for the year ended

31 December 2021 of 6p per share

(2020: 6p per share) 1,054 1,061

Interim dividend for the year ended

31 December 2022 of 6p per share 1,054 -

3,170 2,122

========= =========

The Directors recommend a payment of a final dividend for the

year ended 31 December 2022 of 6p per share, following the interim

dividend which was paid on 20 October 2022 of 6p per share. The

final dividend of 6p per share will be payable on 19 July 2023 to

shareholders on the register at the close of business on 30 June

2023 (Ex dividend on 29 June 2023).

The full ordinary dividend for the year ended 31 December 2022

is anticipated to be 12p per share, subject to shareholder

approval, being the 6p interim per share paid and the recommended

final dividend of 6p per share.

A 10p per share special dividend in relation to the year ended

31 December 2023 was paid on 10 February 2023.

3. Earnings per ordinary share (basic and diluted)

The calculation of profit per ordinary share is based on the

profit, being a profit of GBP16,985,000 (2021 - GBP13,511,000)

and on 17,577,699 ordinary shares being the weighted average

number of ordinary shares in issue during the year excluding

treasury shares (2021 - 17,683,469). There are no potential

ordinary shares in existence. The Company holds 275,000 (2021

- 63,460) ordinary shares in treasury.

4. Investment properties

Investment

properties

GBP'000

Fair value

At 1 January 2021 180,975

Additions 537

Disposals (15,140)

Fair value adjustment on investment properties held

on leases 51

Revaluation increase 961

At 1 January 2022 167,384

Additions 8,947

Disposals (715)

Fair value adjustment on investment properties held

on leases (63)

Revaluation increase 1,384

At 31 December 2022 176,937

==============

Carrying amount

At 31 December 2022 176,937

==============

At 31 December 2021 167,384

==============

5. Derivative financial instruments

The main risks arising from the Group's financial instruments

are those related to interest rate movements. Whilst there are no

formal procedures for managing exposure to interest rate

fluctuations, the Board continually reviews the situation and makes

decisions accordingly. Hence, the Company will, as far as possible,

enter into fixed interest rate swap arrangements. The purpose of

such transactions is to manage the cash flow risks associated with

a rise in interest rates but does expose it to fair value risk.

2022 2021

Bank loans GBP'000 GBP'000

Interest is charged as to: Rate Rate

Fixed/ Hedged

HSBC Bank plc* 35,000 7.76% 35,000 7.76%

HSBC Bank plc** 25,000 4.71% 25,000 4.71%

Unamortised loan arrangement fees (443) (737)

Floating element

HSBC Bank plc (250) (3,250)

Shawbrook Bank Ltd - 60

------- --------

59,307 56,073

======= ========

Bank loans totalling GBP60,000,000 (2021 - GBP60,000,000) are

fixed using interest rate swaps removing the Group's exposure to

fair value interest rate risk. Other borrowings are arranged at

floating rates, thus exposing the Group to cash flow interest rate

risk.

Financial instruments for Group and Company

The derivative financial assets and liabilities are designated

as held for trading.

Hedged Average Duration 2022 2021

amount rate of contract Fair value Fair value

remaining

GBP'000 'years' GBP'000 GBP'000

Derivative Financial

Asset/ (Liability)

Interest rate swap* 35,000 5.06% 15.69 1,236 (12,833)

Interest rate swap** 25,000 2.01% 8.92 3,231 (2,422)

4,467 (15,255)

============ ============

Net fair value gain on derivative financial

assets 19,722 16,754

============ ============

* Fixed rate came into effect in September 2008, following a

variation made in 2021, in September 2023 the rate drops to 3.4%

for the remaining term. ** This arrangement commenced in December

2021 but was entered into as a future fixing in April 2018.

The rates shown includes a 2.7% margin (2021 - 2.7%). Neither

contracts include break options in the term but are repayable on a

cessation of lending.

6. Bank loans

2022 2021

GBP'000 GBP'000

Bank loans due within one year 500 560

(within current liabilities)

Bank loans due after more than one

year 58,807 55,513

(within non-current liabilities)

Total bank loans 59,307 56,073

======== ========

2022 2022 2022 2021

Analysis of debt maturity GBP'000 GBP'000 GBP'000 GBP'000

Interest* Capital Total Total

Bank loans repayable

On demand or within one

year 3,626 500 4,126 2,319

In the second year 2,097 58,807 60,904 2,241

In the third year to the

fifth year - - - 55,877

5,723 59,307 65,030 60,437

========== ======== ======== ========

*based on the 3 month SONIA floating rate charged in March 23 -

3.44%.

On 16 July 2021 the Group last renewed its loan facility by

entering into a 3 year term loan with HSBC and Santander for

GBP66,000,000.

A Shawbrook bank loan of GBP60,000 at 31 December 2021 was

repaid in 2022.

The bank loans are secured by first fixed charges on the

properties held within the Group and floating asset over all the

assets of the Company. The lenders have also taken fixed security

over the shares held in the Group undertakings.

The estimate of interest payable is based on current interest

rates and as such, is subject to change.

The Directors estimate the fair value of the Group's borrowings,

by discounting their future cash flows at the market rate (in

relation to the prevailing market rate for a debt instrument with

similar terms). The fair value of bank loans is not considered to

be materially different to the book value. Bank loans are financial

liabilities.

7. Events after the reporting date

On 16 January 2023 the Company drew down GBP2,000,000 from its

revolving facility.

On 23 March 2023 the Company completed on the purchase of the

freehold of 192-194 Northdown Road, Cliftonville, Margate for

GBP451,000. The majority of the property is let to Boots at

GBP25,000 pa with the remaining vacant space potentially suitable

for conversion to residential. This purchase adjoins a property in

our existing ownership.

8. Copies of the full set of Report and Accounts

Copies of the Company's report and accounts for the year ended

31 December 2022, which will be posted to shareholders shortly,

will be available from the Company's registered office at Unicorn

House, Station Close, Potters Bar, Hertfordshire, EN6 1TL and will

be available for download on the Group's website www.pantherplc.com

.

+44 (0) 1707 667

Panther Securities PLC 300

Andrew Perloff, Chairman

Simon Peters, CEO & Finance Director

Allenby Capital Limited +44 (0) 20 3328 5656

(Nominated Adviser and Joint Broker)

Alex Brearley

Piers Shimwell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZZGZDFNRGFZM

(END) Dow Jones Newswires

April 27, 2023 09:34 ET (13:34 GMT)

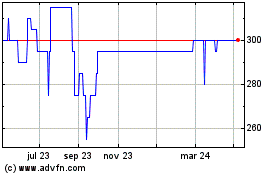

Panther Securities (LSE:PNS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panther Securities (LSE:PNS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024