TIDMSAGA

RNS Number : 2114D

SAGA PLC

20 June 2023

20 June 2023

Saga plc

AGM Trading Update

Growth momentum continues

Saga plc (Saga or the Group), the UK's specialist in products

and services for people over 50, provides the following update on

trading covering the period from 1 February 2023 to 19 June

2023.

Euan Sutherland, Saga Group Chief Executive Officer,

commented:

"Four months into the financial year, we have continued to build

on the momentum in our Cruise and Travel operations, while making

further progress in our growth agenda through the development of

our newer businesses. Year-end underlying profit is expected to be

well ahead of the prior year.

"We have taken strong bookings for our ocean cruises with a load

factor that is ahead of the same point in the prior year, and our

River Cruise and Travel businesses are on track to return to

profitability in line with previous guidance. In Insurance, market

conditions, particularly in motor, continue to weigh on our Group

result. We have secured a valuable partnership with Bupa that will

not only improve our current private medical offering but also open

up exciting new opportunities, and we plan to launch our new pet

insurance later in the year. Meanwhile, we are also continuing with

the sale process of our Insurance Underwriting business.

"We are developing a series of new products in Saga Money and

preparing for the July launch of Saga Spaces, our new

subscription-based online platform that will offer customers social

interaction and a series of online services. At the same time, we

have continued to develop Saga Media, which is performing ahead of

expectations, and have made good progress in our data and digital

strategy".

Group highlights

-- Growth momentum continues to build in Cruise, Travel, Money and Media.

-- The sale process for the Group's Insurance Underwriting

business is ongoing, consistent with the ambition to reduce debt

and move towards a more capital-light model.

Cruise

-- The booked Ocean Cruise load factor for 2023/24 at 18 June

2023 was 79%, 7ppts ahead of the same point last year. At the same

date, the per diem was GBP338, which was 6% ahead of the same point

in 2022.

-- The full year load factor projection is in line with previous

guidance of at least 80% and we remain on-track to deliver GBP40m

EBITDA per ship (excluding overheads). Due to expected seasonality

in the late summer, this will be weighted towards the second half

of the year.

-- The launch of the 2024/25 Ocean Cruise season was the

strongest on record, already having secured a booked load factor of

34% and per diem of GBP342 at 18 June 2023.

-- The booked River Cruise load factor for 2023/24 at the same

date was 74%, with a per diem of GBP293. This equated to revenue of

GBP39m which was 37% ahead of the same point in the prior year.

Travel

-- The booked revenue for 2023/24, at 18 June 2023, was GBP150m,

37% ahead of the same point in 2022 and largely driven by an uplift

in touring.

-- Travel is on track to return to an Underlying Profit Before

Tax for the second half and full year, in line with previous

guidance.

Insurance Broking

-- In what continued to be a challenging market, total policy

sales across all products, for the four months ended 31 May 2023,

were 6% behind the prior year.

-- The growth in sales of travel insurance continued over the

same period, with policies 6%, and revenue 22%, ahead of the prior

year.

-- Private medical insurance (PMI) delivered revenue growth of

16% when compared with the prior year on a broadly stable policy

count.

-- To further enhance our PMI product, we are pleased to have

secured a new partnership with Bupa. This move will not only

improve our current proposition but also open up exciting new

opportunities for a digital health and wellbeing offer for our

customers.

-- Within motor and home insurance, for the same four-month period:

o Policy sales were 7% behind the prior year.

o Customer retention remained strong at 85%, compared with 83%

last year.

o The margin per policy was GBP56, reflecting the market-wide

inflationary environment and is expected to be around GBP55 for the

first half, before returning to around GBP60 over the medium term

in line with previous guidance.

Group liquidity

-- In the financial year to date, a further GBP15.8m of ocean

cruise ship debt was repaid and, after taking account of this,

Available Cash, at 31 May 2023 was GBP149.5m.

Wider strategic progress

-- An ambitious expansion plan is in place for Saga and we

remain on track to deliver another year of growth in revenue and

underlying profit.

-- Saga Money will launch a series of new products in the second half of the year.

-- Saga Exceptional, through Saga Media, continues to deliver

audience numbers significantly ahead of its initial business case

with more than 2.5m visits since it was launched in late

January.

-- We are planning the launch of Saga Spaces in July, a new

subscription-based online platform that will offer customers social

interaction and online services initially with a focus on health

and wellbeing and including classes, health advice and 24/7 GP

access.

-- Progress in enhancing our data capabilities continues,

including actions to improve customer consent and contactability

across the Group and the development of a more personalised

approach to marketing.

Annual General Meeting

The Annual General Meeting will be held at 11.00am today at the

offices of Numis Securities Limited, 45 Gresham Street, London EC2V

7BF.

For further information, please contact:

Saga plc

Emily Roalfe, Head of Investor Relations and Treasury Tel: 07732 093 007 Email: emily.roalfe@saga.co.uk

Headland Consultancy

Susanna Voyle Tel: 07980 894 557

Will Smith Tel: 07872 350 428

Tel: 020 3805 4822

Email: saga@headlandconsultancy.com

Notes to editors

Saga is a specialist in the provision of products and services

for people over 50. The Saga brand is one of the most recognised

and trusted brands in the UK and is known for its high level of

customer service and its high quality, award-winning products and

services including cruises and holidays, insurance, personal

finance and publishing. www.saga.co.uk

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLGDLGDBDGXC

(END) Dow Jones Newswires

June 20, 2023 02:00 ET (06:00 GMT)

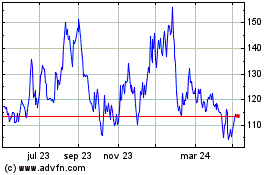

Saga (LSE:SAGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

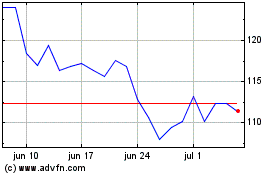

Saga (LSE:SAGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024