TIDMSOU

RNS Number : 5289C

Sound Energy PLC

13 June 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation ("MAR") (EU) No. 596/2014, as incorporated into UK law

by the European Union (Withdrawal) Act 2018. Upon the publication

of this announcement, this inside information is now considered to

be in the public domain.

13 June 2023

Sound Energy plc

("Sound Energy" or the "Company")

Corporate Update

and

Issue of Convertible Bonds and Issue of Warrants

Sound Energy (AIM: SOU), the transition energy company, is

pleased to provide a corporate update in relation to the entry into

exclusivity for the partial divestment of the Tendrara Exploitation

Concession and the Grand Tendrara Exploration Permit, and a

financing of up to GBP4.0 million by way of a fixed price, senior

unsecured convertible bond instrument.

Key Highlights

-- Binding 45 day period of exclusivity and non-binding term

sheet entered into with Calvalley Petroleum (Cyprus) Limited

("Calvalley") for a partial divestment of a 40% working interest in

the Tendrara Exploitation Concession and the Grand Tendrara

Exploration Permit which will see, subject to agreement of

definitive transaction documentation:

o Funding of the first US$48 million of Sound Energy and

Calvalley's Phase 2 equity funded development costs by Calvalley,

subject to final investment decision

o Funding of 100% of the TE-4 Horst well costs by Calvalley up

to a cap of US$7 million

o Funding of 40% share of Phase 1 costs, including back costs

net to Calvalley of approximately US$8 million (through to July

2023)

o Advancement to Sound Energy of additional Phase 1 and Phase 2

costs, if necessary and at the Company's election, repayable out of

future revenue

-- Up to GBP4.0 million funding through the issue of senior

unsecured convertible loan notes to provide the Company with

liquidity ahead of receipt of outstanding receivables and/or

receipt of Phase 1 back costs from Calvalley, if a partial

divestment is ultimately completed.

Partner and Potential Partial Divestment Update

The Company announced on 9 August 2022 that it had initiated a

formal farm-out process to identify a partner for the Tendrara

Production Concession and the surrounding Grand Tendrara and Anoual

exploration permits. The Company is pleased to announce that it has

now entered into exclusivity for a period of 45 days

("Exclusivity") on the basis of an otherwise non-binding term sheet

("Term Sheet") with Calvalley, an associated company of Octavia

Energy Corporation Limited ("Octavia").

Whilst the terms of the Term Sheet, outside of Exclusivity, are

non-binding and subject to, inter alia, agreement of definitive

transaction documentation between the parties, if a transaction is

concluded, the terms of the Term Sheet would provide Sound Energy,

together with the envisaged project debt financing and under

current cost estimates, with the required funds to achieve first

gas under its Phase 2 development plan whilst also funding the

costs of drilling the TE-4 Horst well, with an estimated

exploration potential of 273 Bcf gross Pmean GIIP.

TE-4 was tested in 2006 but did not flow gas to the surface.

Mechanical stimulation has proven to be a key technology to

commercially unlock the potential of the TAGI gas reservoir in the

TE-5 Horst gas accumulation and, accordingly, the Company believes

this offers potential to unlock commerciality at the TE-4 Horst,

which sits adjacent to the TE-5 Horst and could be tied-in in the

future for further development of the area.

Target name Unrisked Volume Potential Chance of

Gas Initially-in-Place (Bcf) Success

Gross (100%) basis

------------------------------------

Low Best High Mean

------- -------- -------- -------

TE-4 Horst Well 153 260 408 273 36%

------- -------- -------- ------- ----------

Calvalley was previously listed on the Toronto Stock Exchange

and was taken private in 2016. Today, Octavia and its associated

companies operate Block S-1 and Block 9 in Yemen with gross

production of approximately 6,200 bopd (3,100 bopd net). Calvalley

is backed by a consortium of private investors who draw on a strong

financial capability from many successful businesses across many

sectors in the Middle East, Africa, and Asia.

Under the Term Sheet, Calvalley would acquire a 40% working

interest in the Tendrara Exploitation Concession and the Grand

Tendrara Exploration Permit, with Sound Energy retaining a 35%

working interest and operatorship. Contingent upon the Phase 2

Final Investment Decision, Calvalley would fund the first US$48

million of Sound Energy and Calvalley's Phase 2 equity funded

development costs (a US$22.4 million net carry to the Company),

being the Company's estimate of equity funded costs to first gas

under Phase 2 after the expected amounts available under the

project debt financing. The Term Sheet also envisages Calvalley

funding the first US$7 million of exploration costs on the Grand

Tendrara Exploration Permit (a US$3.3 million net carry to the

Company), being the estimated costs of drilling the TE-4 Horst

well. In addition, Calvalley will fund its 40% working interest

share of all Phase 1 costs to a cap of US$16.4 million (net to the

40% working interest), which will include payment of its 53.33%

share of back costs payable on completion, comprising approximately

US$8 million through to July 2023.

In the event Phase 1 costs exceed US$41 million gross (being

US$16.4 million net to the 40% working interest), Calvalley would

advance the Company up to US$11.65 million and Calvalley will be

entitled to receive revenues equivalent to 0.9% above its 40%

working interest share of revenue for every US$1 million of

advancement drawn down by the Company (at its sole election) for a

period of five years from first production from Phase 1. Likewise,

in the event the Phase 2 pre-production costs exceed the current

estimate, Calvalley would advance Sound Energy up to US$10 million

and Calvalley will be entitled to receive revenues equivalent to

0.9% above its 40% working interest share of revenue for every US$1

million of advancement drawn down by Sound Energy (at its sole

election) for a period of two years from first production from

Phase 2.

During the due diligence period Calvalley will complete its

confirmatory due diligence and the parties will seek to agree

binding transaction documentation.

The Company cautions that there can be no assurance that binding

transaction documentation will be entered into in respect of a

partial divestment with Calvalley, or any other party, and further

announcements will be made, as appropriate, in due course.

Issue of Convertible Notes and Warrants

The Company is also pleased to announce that it has raised up to

GBP4.0 million by way of a senior unsecured convertible bond

instrument (the "Convertible Notes") with an institutional investor

(the "Investor"). The proceeds of the Convertible Notes will, if

fully drawn, provide funds for the Company to continue to execute

its Phase 1 development of the Tendrara Production Concession and

bridge group working capital liquidity ahead of receipt of a

receivable as disclosed in the year end results and / or receipt of

Phase 1 back costs from Calvalley if a partial divestment is

ultimately completed .

The first tranche of the Convertible Notes comprises GBP2.5

million with a fixed conversion price of 2.25 pence per ordinary

share, a premium of approximately 28% to the closing price of 1.76

pence per ordinary share on 12(th) June 2023.

The second tranche of the Convertible Notes comprises a further

GBP1.5 million, which can be drawn at Sound Energy's election on 13

December 2023 (being six months from the first tranche draw down)

and can be drawn sooner if mutually agreed by the Company and the

Investor. The second tranche can be drawn subject to the Company's

closing mid-price of its ordinary shares on the business day

immediately preceding the proposed issue date being at least 1.32

pence per ordinary share. The second tranche conversion price will

be fixed at the time of draw down at a 25% premium to the five-day

volume weighted average price ("VWAP") from the business day

immediately preceding the second tranche drawdown date.

The term of the Convertible Notes is five years from draw down

date, with interest of 15% per annum, payable bi-annually in cash

or capitalised to the principal, at the Company's election.

Subject to the draw down in full of both tranches of the

Convertible Notes, the Company is now funded for its near-term

working capital requirements until year end 2023.

Other key terms of the Convertible Notes:

-- Issue price and redemption price on maturity: 100% of par value

-- Early redemption/change of control: callable in cash by the

Company at any time after draw down or in the event of a change of

control of the Company at 110% of par value together with all

unpaid interest. If the Convertible Notes are redeemed by the

Company, the maximum amount of future interest payable by the

Company in respect of any early redemption occurring on or prior to

the second anniversary of the relevant issue date will be 15% of

the Convertible Notes, and in respect of any early redemption

occurring after the second anniversary of the relevant issue date

will be 10% of the Convertible Notes. The Investor shall have two

trading days to elect to convert some or all of outstanding amounts

or accept the early redemption. In the event of default,

Convertible Notes will be redeemable immediately at 120% of par

value of outstanding Convertible Notes plus accrued interest.

-- Conversion: convertible into Sound Energy ordinary shares at

each tranche's fixed conversion price in whole or in part. Upon

conversion, interest shall be rolled up and paid as if the

Convertible Notes were held to the redemption date (being five

years from draw down), with such interest convertible at the lower

of the applicable fixed conversion price and the average of the

five daily VWAP calculations selected by the Investor out of the 15

trading days prior to the conversion date.

-- Other conversion terms: any conversion notice must be for

minimum of GBP250,000. No more than 20% of the initial principal of

the Convertible Notes may be converted in any given calendar month.

If the Company's five-day VWAP exceeds 3.00 pence per ordinary

share in any given month, the conversion limit will be increased

for the relevant month to 50% of each draw down amount. If the

Company's five-day VWAP exceeds 3.50 pence per ordinary share in

any given month, the conversion limit will be removed for the

relevant month.

-- Second tranche draw down condition: the Company must maintain

available share issuance authority headroom and disapplication of

pre-emption rights to cover 150% of any draw down amount divided by

the VWAP on the day immediately preceding a draw down.

-- Warrants: 33,333,333 warrants to subscribe for new ordinary

shares in the Company at an exercise price of 2.25 pence per

ordinary share with a term of three years. If the second tranche is

drawn down, additional warrants over such number of new ordinary

shares as represents 30% of the par value of tranche 2 Convertible

Notes drawn down, with an exercise price at the conversion price of

the tranche 2 Convertible Notes and a term of three years.

Commenting, Graham Lyon (Executive Chairman) said:

"We are very pleased to have entered into exclusivity and a term

sheet with Calvalley, who have operations in the Middle East and

are supported by a very large conglomerate. The envisaged

arrangement would fund the further development of Tendrara

Concession and the drilling of a well on the nearby TE-4 Horst. The

companies will now work towards signing definitive transaction

documentation which upon completion will enable the parties

together to jointly progress to the Final Investment Decision.

I am also pleased that we have raised financing for the Company

using a fixed price convertible debt facility, convertible at a

premium to the prevailing share price, which provides the Company

with additional resources with which to continue to execute its

Phase 1 development and to progress the Phase 2 development."

Fee Shares and Warrant Issuance

In connection with the issue of the Convertible Notes, the

Company has agreed to issue 11,404,221 new ordinary shares in lieu

of cash fees ("Fee Shares") to the Investor and Gneiss Energy

Limited ("Gneiss"), the Company's financial adviser, at an

effective issue price of 1.76 pence per new ordinary share (the

"Fee Shares") and warrants over a total of 40,476,190 new ordinary

shares in total to the Investor and Gneiss, exercisable at 2.25

pence per ordinary share for a period of three years.

Admission and Total Voting Rights

Application has been made for admission of the Fee Shares to

trading on AIM, and it is expected that admission will occur on or

around 19(th) June 2023 ("Admission"). The Fee Shares will rank

pari passu with the Company's existing ordinary shares.

On Admission, the total issued share capital of the Company will

consist of 1,860,106,895 ordinary shares. The Company does not hold

any ordinary shares in treasury. Therefore, the total number of

voting rights in the Company is 1,860,106,895 and this figure may

be used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

For further information visit www.soundenergyplc.com follow on

twitter @soundenergyplc

or contact:

Flagstaff Strategic and Investor sound@flagstaffcomms.com

Communications Tel: +44 (0)20 129 1474

Tim Thompson

Mark Edwards

Alison Allfrey

Sound Energy chairman@soundenergyplc.com

Graham Lyon, Executive Chairman

Cenkos Securities - Nominated Adviser Tel: +44 (0)20 7397 8900

Ben Jeynes

Peter Lynch

SP Angel Corporate Finance LLP - Tel: +44 (0)7789 865 095

Broker

Richard Hail

Gneiss Energy Limited - Financial Tel: +44 (0)20 3983 9263

Adviser

Jon Fitzpatrick

Paul Weidman

Doug Rycroft

The information contained in this announcement has been reviewed

by Sound Energy's Vice President, Geoscience, Dr John Argent, who

is a Chartered Geologist, a Fellow of the Geological Society of

London and a Member of the Petroleum Exploration Society of Great

Britain, with 25 years of experience in petroleum geology and

management and who is the qualified person as defined in the

guidance note for mining, oil and gas companies issued by the

London Stock Exchange in respect of AIM companies.

Gas Initially-in-Place (GIIP) is the total quantity of gaseous

petroleum that is estimated to exist originally in naturally

occurring reservoirs, as of a given date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFEERSIVLIV

(END) Dow Jones Newswires

June 13, 2023 02:00 ET (06:00 GMT)

Sound Energy (LSE:SOU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

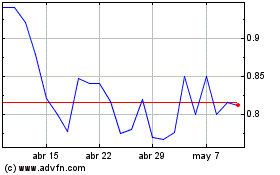

Sound Energy (LSE:SOU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024