TIDMWEB

RNS Number : 5223M

Webis Holdings PLC

15 September 2023

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATIONS (EU) NO. 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("MAR"), AND IS DISCLOSED IN ACCORDANCE WITH THE COMPANY'S

OBLIGATIONS UNDER ARTICLE 17 OF MAR.

Webis Holdings PLC

15 September 2023

Webis Holdings plc

("Webis" or "the Company")

Webis agrees new Convertible Loan for expansion of business

Webis Holdings plc, the global gaming group, today announces

that it has agreed to issue GBP1,150,000 of convertible loan notes

("Convertible Notes") to Galloway Limited ("Galloway"), in respect

of GBP750,000 of new funding made available to the Company by

Galloway and in satisfaction of amounts due to Galloway pursuant to

a prior loan made to the Company in 2017 which is due for

repayment.

The new funding of GBP750,000 will enable the Company to invest

further in its business-to-consumer sector ("B2C"), recognising the

growth potential of this sector. Specifically, the Company intends

to invest in a programme of further software developments of its

main website www.watchandwager.com and marketing the mobile

product. As previously reported, the Company has been very

encouraged by the operation of our platform in considering the

limited investment made to date. The platform has performed well,

and we can see the opportunity to further grow our market share in

the USA. As we improve the user experience, we will further invest

in key marketing techniques, especially player recruitment and

retention with special focus on online marketing techniques. We

will keep shareholders fully up to date with developments.

Terms of the Convertible Notes

-- The Convertible Notes comprise of GBP750,000 in respect of

new funds advanced to the Company and an existing debt of

GBP400,000 (after conversion of US$ 500,000 due and outstanding by

the Company to Galloway from US$ to GBP at the prevailing rate

published by Bloomberg of GBP0.80:$1 as at 13 September 2023).

-- The Convertible Notes shall be convertible into ordinary

shares of GBP0.01 each in the capital of the Company in the

following circumstances:

o on completion of an equity fundraising of at least GBP750,000,

at the price applicable to that equity fundraising;

o on completion of a change of control of the Company, at the

price applicable to that change of control;

o at the election of Galloway, at the higher of (i) GBP0.0156

(being the 20 day volume weighted average price of the Company's

shares on the business day immediately prior to the date of this

announcement) ("Default Price"), and (ii) the 20 day volume

weighted average price of the Company's shares on the business day

immediately prior to the date of conversion of the Convertible

Notes into Company shares; and

o if not converted earlier, on the date falling 5 years after

the date of issue of the Convertible Notes, at the Default

Price.

-- The Convertible Notes shall only be repaid in cash in a

default event or otherwise at the election of the Company.

-- The Convertible Notes shall accrue interest at the rate of

11% per annum, such interest to be repaid on repayment or

conversion of the Convertible Notes in cash or Company shares, at

the election of the Company.

-- For such time as funds remain outstanding under the

Convertible Notes, Galloway shall have the right to appoint an

additional director to the Board of Directors of the Company.

Alongside a potential future Galloway nominee, the Company

continues to actively look for a suitable independent non-executive

director to join the Board.

Related Party Transaction

Denham Eke, the Non-Executive Chairman of Webis, is a director

of Galloway Limited and a director of Burnbrae Group Limited of

which Galloway Limited is a wholly owned subsidiary. Katie Errock,

a Non-Executive Director is the Company Secretary of Burnbrae Group

Limited, which is an indirect 63.1 per cent. shareholder in Webis.

Accordingly, Galloway is a Related Party of the Company and

therefore the issue of the Convertible Notes is a Related Party

Transaction under the AIM Rules; as such, the independent Directors

(being Ed Comins and Richard Roberts - Denham Eke and Katie Errock

having recused themselves), having consulted with the Company's

Nominated Adviser, consider the terms of the Convertible Notes are

fair and reasonable in so far as Webis's shareholders are

concerned.

Ed Comins, Managing Director of Webis, stated:

"Webis is very pleased to receive further backing from our

principal shareholder. Their expression of support is important for

the Company and compares favourably with other potential forms of

funding considered. Webis stands in an excellent position in the

USA gambling market and particularly with our array of content and

licensed presence in the USA, particularly California. These are

key assets that are not readily available to new entrants into the

market, and we look forward to continued discussion regarding any

potential partnerships, mergers, opportunities, and acquisitions to

continue to build our strength."

For further information:

Webis Holdings plc Tel: 01624 639396

Denham Eke / Ed Comins

Beaumont Cornish Limited Tel: 020 7628 3396

Roland Cornish / James Biddle

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBRGDCGUBDGXS

(END) Dow Jones Newswires

September 15, 2023 02:00 ET (06:00 GMT)

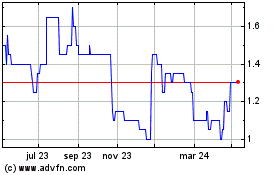

Webis (LSE:WEB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

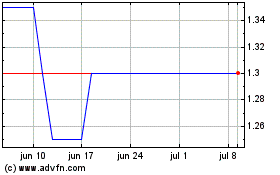

Webis (LSE:WEB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024