XP Power Ltd Trading Update

02 Octubre 2023 - 1:00AM

UK Regulatory

TIDMXPP

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF

THE MARKET ABUSE REGULATION (EU) NO 596/2014 (AS IT FORMS PART OF RETAINED EU

LAW AS DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018).

FOR IMMEDIATE RELEASE.

2 October 2023

XP Power Limited

(`XP Power' or `the Group' or the `Company')

Trading Update

XP Power, one of the world's leading developers and manufacturers of critical

power control components to the electronics industry, is today issuing a trading

update.

Trading

Trading over the third quarter has been below our expectations as weaker end

-market demand resulted in some customers deferring shipments into 2024. The

economic uncertainty in China has also led to a reduction in demand in that

market. These conditions are likely to continue for the remainder of the year,

leaving the outlook below our prior expectation, with operating profit for the

year ended 31 December 2023 now expected to be broadly similar to last year.

We expect Q3 revenue to be c.£75 million, down around 2% year-on-year on a

constant currency basis against a strong comparative. The Group continues to

deliver double digit operating margins. In light of current trading conditions,

we are implementing a wide range of actions to reduce costs, conserve cash and

maximise headroom in the Group's borrowing facilities.

The Group's current order book is c.£225 million, with an expected book to bill

of c.0.6x in Q3. While we have yet to see a recovery in orders from the

Semiconductor Manufacturing Equipment sector, our customers' outlook for 2024

and 2025 is encouraging, although the timing of the overall economic recovery

remains uncertain.

Financial Position and Dividend

Net debt is currently around £163 million, including c.£6 million of foreign

exchange impact since the end of the first half (£148 million at H1 2023). We

now expect net debt to rise further by the year-end, reflecting a combination of

the higher than planned capital expenditure on the Californian site relocation

which will take place in late December, lower than expected revenue and

profitability and a less than expected working capital reduction. In order to

conserve cash, we have temporarily suspended the build for the new Malaysian

plant, which will restart when the market outlook becomes clearer.

The Group continues to be in compliance with its banking covenants but is now

expecting net debt / Adjusted EBITDA to be close to or above current covenant

limits in the near-term. The Group is initiating dialogue with its lenders to

seek covenant and liquidity flexibility through the year-end and into 2024. We

are also exploring other near-term options to strengthen the balance sheet, to

bring leverage back to within our target 1-2x net debt/Adjusted EBITDA range,

restoring the flexibility necessary to allow the Group to take full advantage of

the strong organic growth opportunities across the business.

The second quarter dividend will be paid on 12 October 2023 to all eligible

shareholders, as previously announced. In light of the current circumstances,

the Board intends that no further dividends will be paid in respect of the 2023

financial year. The Group recognises the importance of dividends to shareholders

and will recommence paying dividends as soon as appropriate.

Outlook

We are disappointed by the change in current trading conditions and 2023

outlook, which is largely being driven by weaker market demand leading to

customer shipment deferrals. This will impact the current full year outlook and

we are taking appropriate mitigating actions to reduce costs and conserve cash.

Notwithstanding these short-term challenges, the Board believes XP's clear

strategy leaves the Group well positioned to grow ahead of its end markets,

drive further market share gains, improve profitability and deliver strong cash

generation.

Full year trading update

The Group is scheduled to release its Q4 and full year trading update on

Thursday 11 January 2024.

Enquiries:

XP Power

Gavin Griggs, Chief Executive Officer +44 (0)118 984 5515

Matt Webb, Chief Financial Officer +44 (0)118 984 5515

Citigate Dewe Rogerson

Kevin Smith/Lucy Gibbs +44 (0)207 638 9571

Note to editors

XP Power designs and manufactures power controllers, the essential hardware

component in every piece of electrical equipment that converts power from the

electricity grid into the right form for equipment to function. Power

controllers are critical for optimal delivery in challenging environments but

are a small part of the overall customer product cost.

XP Power typically designs power control solutions into the end products of

major blue-chip OEMs, with a focus on the Industrial Technology (circa 41% of

sales), Healthcare (circa 20% sales) and Semiconductor Manufacturing Equipment

(circa 39% of sales) sectors. Once designed into a programme, XP Power has a

revenue annuity over the life cycle of the customer's product which is typically

five to seven years depending on the industry sector. XP Power has invested in

research and development and its own manufacturing facilities in China, North

America, and Vietnam, to develop a range of tailored products based on its own

intellectual property that provide its customers with significantly improved

functionality and efficiency.

Headquartered in Singapore and listed on the Main Market of the London Stock

Exchange since 2000, XP Power is a constituent of the FTSE All Share Index. XP

Power serves a global blue-chip customer base from over 30 locations in Europe,

North America, and Asia.

For further information, please visit www.xppowerplc.com

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

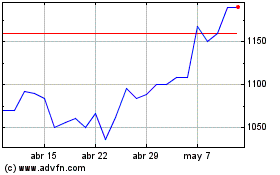

Xp Power (LSE:XPP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Xp Power (LSE:XPP)

Gráfica de Acción Histórica

De May 2023 a May 2024