false

0001144879

0001144879

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

October

31, 2024

(Date

of earliest event reported)

APPLIED

DIGITAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31968 |

|

95-4863690 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

| 3811

Turtle Creek Blvd., Suite

2100, Dallas, TX |

|

75219 |

| (Address of principal executive

offices) |

|

(Zip Code) |

214-427-1704

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

APLD |

|

Nasdaq

Global Select Market |

Item

8.01. Other Matters

On

October 31, 2024, Applied Digital Corporation (the “Company”) issued a press release announcing the upsize and pricing of

its private offering (the “Offering”) of $375 million aggregate principal amount of its 2.75% Convertible Senior Notes due

2030 (the “Convertible Notes”). The Convertible Notes will only be sold to persons reasonably believed to be qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. The Company also granted to the initial purchasers of the

Convertible Notes an option to purchase, within a 13-day period beginning on, and including, the date on which the Convertible Notes

are first issued, up to an additional $75 million aggregate principal amount of the Convertible Notes. The Offering is expected to close

on November 4, 2024, subject to satisfaction of customary closing conditions.

The

Company estimates that the net proceeds of the Offering will be approximately $361.8 million (or approximately $434.5 million if the

initial purchasers exercise in full their option to purchase additional Convertible Notes), after deducting the initial purchasers’

discounts and commissions but before estimated offering expenses payable by the Company. The Company intends to use approximately $43.1

million of the net proceeds from the sale of the Convertible Notes to pay the cost of certain capped call transactions, approximately

$52.7 million of the net proceeds from the sale of the Convertible Notes to fund the cost of entering into certain prepaid forward

transaction, approximately $31.3 million to repurchase shares of its common stock and the remainder for general corporate purposes.

A

copy of the press release announcing the pricing of the Offering is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The

information included in this Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: |

October

31, 2024 |

By:

|

/s/

Mohammad Saidal L. Mohmand |

| |

|

Name: |

Mohammad

Saidal L. Mohmand |

| |

|

Title: |

Chief

Financial Officer |

Exhibit

99.1

Applied

Digital Corporation Announces Upsize and Pricing of

$375

Million of Convertible Notes Offering

October

31, 2024

DALLAS,

Oct. 31, 2024 (GLOBE NEWSWIRE) — Applied Digital Corporation (Nasdaq: APLD) (“Applied Digital” or the “Company”),

a designer, builder, and operator of next-generation digital infrastructure designed for High-Performance Computing (HPC) applications,

today announced the upsize and pricing of its offering of $375 million aggregate principal amount of 2.75% Convertible Senior Notes due

2030 (the “Convertible Notes”). The Convertible Notes will be sold in a private offering to persons reasonably believed to

be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).

Key

Elements of the Transaction:

| | ● | $375

million 2.75% Convertible Notes offering (32.5% conversion premium) |

| | | |

| ● | Capped

call transactions entered into in connection with the pricing of Convertible Notes due 2030

with an initial cap price of $14.72 per share of common stock, which represents a 100% premium

to the closing sale price of Applied Digital’s common stock on October 30, 2024 |

| | | |

| ● | Share

Repurchase

Programs of approximately $84 million of shares of the common stock in

connection with the offering, consisting of a prepaid forward repurchase (as described below)

and concurrent share buyback |

Applied

Digital has granted the initial purchasers of the Convertible Notes an option to purchase, for settlement within a 13-day period beginning

on, and including the date on which the Convertible Notes are first issued, up to an additional $75 million aggregate principal amount

of the Convertible Notes. The offering is expected to close on November 4, 2024, subject to satisfaction of customary closing conditions.

Use

of Proceeds:

The

Company estimates that the aggregate net proceeds from the offering will be approximately $361.8 million (or approximately $434.5 million

if the initial purchasers exercise in full their option to purchase additional notes), after deducting the initial purchasers’

discounts and commissions and the Company’s estimated offering expenses. The Company intends to use approximately $84 million

of the net proceeds from the offering to fund share repurchases of the Company’s common stock (the “common stock”)

in connection with the offering including (i) $52.7 million to fund the cost of entering into prepaid forward repurchase (as

described below) and (ii) $31.3 million to repurchase shares of the Company’s common stock (the “common stock”),

approximately $43.1 million of the net proceeds from the offering to pay the cost of the capped call transactions (as described below), and the remainder for general

corporate purposes. If the initial purchasers exercise their option to purchase additional notes, then the Company intends to use a portion

of the additional net proceeds to fund the cost of entering into additional capped call transactions.

Additional

Details of the Convertible Notes:

The

Convertible Notes will be senior unsecured obligations of the Company and will accrue interest at a rate of 2.75% per annum, payable

semi-annually in arrears on June 1 and December 1 of each year, beginning on June 1, 2025. The Convertible Notes will mature on June

1, 2030, unless earlier repurchased, redeemed or converted in accordance with their terms. Prior to March 1, 2030, the Convertible Notes

will be convertible only upon satisfaction of certain conditions and during certain periods, and thereafter, the Convertible Notes will

be convertible at any time until the close of business on the second scheduled trading day immediately preceding the maturity date.

The

Convertible Notes will be convertible into cash, shares of the common stock or a combination of cash and shares of the common stock,

at the Company’s election, subject to certain restrictions. The conversion rate will initially be 102.5431 shares of common stock

per $1,000 principal amount of Convertible Notes (equivalent to an initial conversion price of approximately $9.75 per share of the common

stock). The initial conversion price of the Convertible Notes represents a premium of approximately 32.5% to the $7.36 closing price

per share of the common stock on The Nasdaq Global Select Market on October 30, 2024. The conversion rate will be subject to adjustment

in certain circumstances. In addition, upon conversion in connection with certain corporate events or a notice of redemption, the Company

will increase the conversion rate.

The

Company may not redeem the Convertible Notes prior to December 1, 2027. The Company may redeem for cash all or any portion of the Convertible

Notes (subject to certain limitations), at its option, on or after December 1, 2027, if the last reported sale price of the common stock

has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30

consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately

preceding the date on which the Company provides notice of redemption to holders at a redemption price equal to 100% of the principal

amount of the Convertible Notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date.

Holders

of the Convertible Notes will have the right to require the Company to repurchase all or a portion of their Convertible Notes upon the

occurrence of a fundamental change (as defined in the indenture governing the Convertible Notes) at a cash repurchase price of 100% of

their principal amount plus accrued and unpaid interest, if any, to, but excluding the applicable repurchase date.

Share

Repurchase Program of Prepaid Forward Repurchase

and Concurrent Share Repurchases:

In

connection with the pricing of the Convertible Notes, the Company entered into share repurchase programs consisting of a prepaid forward

repurchase and a concurrent share buyback. Pursuant to the share repurchase programs, the Company will repurchase an aggregate of

approximately $84 million of shares of the common stock through (i) privately negotiated transactions effected concurrently

with the pricing of the Convertible Notes with respect to $31.3 million of shares of the common stock (with the purchase

price per share of the common stock repurchased in such transactions equal to $7.36 closing price per share of the common stock on October

30, 2024) and (ii) a privately negotiated prepaid forward stock repurchase transaction (the “prepaid forward repurchase”)

with one of the initial purchasers of the Convertible Notes (the “forward counterparty”) with respect to $52.7

million of shares of the common stock.

The

initial aggregate number of shares of the common stock underlying the prepaid forward repurchase is approximately 7.2 million

shares. In the event that the Company pays any cash dividends on its common stock, the forward counterparty will pay an equivalent

amount to the Company. The prepaid forward repurchase is generally intended to facilitate privately negotiated derivative transactions,

including swaps, between the forward counterparty or its affiliates and investors in the Convertible Notes, relating to shares of the

common stock by which investors in the Convertible Notes will establish short positions relating to shares of the common stock and otherwise

hedge their investments in the Convertible Notes. As a result, the prepaid forward repurchase is expected to allow the investors

to establish short positions that generally correspond to (but may be greater than) commercially reasonable initial hedges of their investment

in the Convertible Notes. In the event of such greater initial hedges, investors may offset such greater portion by purchasing shares

of the common stock on the day the Company prices the Convertible Notes. Facilitating investors’ hedge positions by entering into

the prepaid forward repurchase, particularly if investors purchase shares of common stock on the pricing date, could increase

(or reduce the size of any decrease in) the market price of shares of the common stock and effectively raise the conversion price of

the Convertible Notes. In connection with establishing its initial hedges of the prepaid forward repurchase, the forward counterparty

or its affiliates generally expect to, but are not required to, enter into one or more derivative transactions with respect to shares

of the common stock with the investors of the Convertible Notes concurrently with or after the pricing of the Convertible Notes.

The

Company’s entry into the prepaid forward repurchase with the forward counterparty and the entry by the forward counterparty

into derivative transactions in respect of the common stock with the investors of the Convertible Notes could have the effect of increasing

(or reducing the size of any decrease in) the market price of the common stock concurrently with, or shortly after, the pricing of the

Convertible Notes and effectively raising the conversion price of the Convertible Notes.

Neither

the Company nor the forward counterparty will control how investors of the Convertible Notes may use such derivative transactions. In

addition, such investors may enter into other transactions relating to the common stock or the Convertible Notes in connection with or

in addition to such derivative transactions, including the purchase or sale of shares of the common stock. As a result, the existence

of the prepaid forward repurchase, such derivative transactions and any related market activity could cause more purchases or

sales of the common stock over the terms of the prepaid forward repurchase than there otherwise would have been had the Company

not entered into the prepaid forward repurchase. Such purchases or sales could potentially increase (or reduce the size of any

decrease in) or decrease (or reduce the size of any increase in) the market price of the common stock and/or the price of the Convertible

Notes.

In

addition, the forward counterparty or its affiliates may modify their hedge positions by entering into or unwinding one or more derivative

transactions with respect to shares of the common stock and/or purchasing or selling shares of the common stock or other securities of

the Company’s in secondary market transactions at any time following the pricing of the Convertible Notes and prior to the maturity

of the Convertible Notes. These activities could also cause or avoid an increase or a decrease in the market price of the common stock

or the Convertible Notes, which could affect the ability to convert the Convertible Notes and, to the extent the activity occurs following

conversion or during any observation period related to a conversion of Convertible Notes, it could affect the amount and value of the

consideration that noteholders will receive upon conversion of the Convertible Notes.

Capped

Call Transactions:

In

connection with the pricing of the Convertible Notes, the Company entered into privately negotiated capped call transactions with certain

financial institutions (the “option counterparties”). The cap price of the capped call transactions is initially $14.72

per share of common stock, which represents a premium of 100% over the last reported sale price of the common stock of $7.36 per share

on The Nasdaq Global Select Market on October 30, 2024, and is subject to certain adjustments under the terms of the capped

call transactions. If the initial purchasers of the Convertible Notes exercise their option to purchase additional Convertible Notes,

the Company expects to use a portion of the net proceeds from the sale of the additional Convertible Notes to enter into additional capped

call transactions with the option counterparties.

The

capped call transactions are generally expected to reduce potential dilution to the common stock upon conversion of any Convertible Notes

and/or offset any cash payments the Company is required to make in excess of the principal amount of converted Convertible Notes, as

the case may be, with such reduction and/or offset subject to a cap.

In

connection with establishing their initial hedges of the capped call transactions, the Company expects the option counterparties or their

respective affiliates to purchase shares of the common stock and/or enter into various derivative transactions with respect to the common

stock concurrently with or shortly after the pricing of the Convertible Notes. This activity could increase (or reduce the size of any

decrease in) the market price of the common stock or the Convertible Notes at that time. In addition, the option counterparties or their

respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to the common stock

and/or purchasing or selling shares of the common stock or other securities of the Company in secondary market transactions following

the pricing of the Convertible Notes and prior to the maturity of the Convertible Notes (and are likely to do so on each exercise date

for the capped call transactions or following any termination of any portion of the capped call transactions in connection with any repurchase,

redemption or early conversion of the Convertible Notes). This activity could also cause or avoid an increase or decrease in the market

price of the common stock or the Convertible Notes, which could affect holders of the Convertible Notes’ ability to convert the

Convertible Notes and, to the extent the activity occurs following conversion of the Convertible Notes or during any observation period

related to a conversion of the Convertible Notes, it could affect the amount and value of the consideration that holders of the Convertible

Notes will receive upon conversion of such Convertible Notes.

The

Convertible Notes and any shares of common stock issuable upon conversion of the Convertible Notes, if any, have not been registered

under the Securities Act, securities laws of any other jurisdiction, and the Convertibles Notes and such shares of common stock may not

be offered or sold in the United States absent registration or an applicable exemption from registration under the Securities Act and

any applicable state securities laws. The Convertible Notes will be offered only to persons reasonably believed to be qualified institutional

buyers under Rule 144A under the Securities Act.

This

press release shall not constitute an offer to sell, or a solicitation of an offer to buy the Convertible Notes, nor shall there be any

sale of the Convertible Notes or common stock in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such state or jurisdiction.

About

Applied Digital

Applied

Digital (Nasdaq: APLD) develops, builds and operates next-generation data centers and cloud infrastructure. Different by design, the

company’s purpose-built facilities are engineered to unleash the power of accelerated compute and deliver secure, scalable and

sustainable digital hosting, along with turnkey CSaaS and GPU-as-a-Service solutions. Backed by deep hyperscale expertise and a robust

pipeline of available power, Applied Digital accommodates AI Factories and beyond to support the world’s most exacting AI/ML, blockchain

and high-performance computing (HPC) workloads.

Forward-Looking

Statements

This

release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 regarding,

among other things, statements regarding the anticipated terms of the notes being offered, the completion, timing and size of the proposed

offering, the intended use of the proceeds, the share repurchases and the anticipated terms of, and the effects of entering into, the

capped call transactions and prepaid forward repurchase described above. These statements use words, and variations of words,

such as “continue,” “build,” “future,” “increase,” “drive,” “believe,”

“look,” “ahead,” “confident,” “deliver,” “outlook,” “expect,”

“intend,” “hope,” “remain,” “project” and “predict.” You are cautioned not

to rely on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently

subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results

could vary materially from the Company’s expectations and projections. These risks, uncertainties, and other factors include: decline

in demand for our products and services; the volatility of the crypto asset industry; the inability to comply with developments and changes

in regulation; cash flow and access to capital; and maintenance of third-party relationships. The Company may not consummate the proposed

offering described in this press release and, if the proposed offering is consummated, cannot provide any assurances regarding the final

terms of the offering or the notes or its ability to effectively apply the net proceeds as described above. Information in this release

is as of the dates and time periods indicated herein, and the Company does not undertake to update any of the information contained in

these materials, except as required by law.

Investor

Relations Contacts

Matt

Glover and Ralf Esper

Gateway Group, Inc.

(949) 574-3860

APLD@gateway-grp.com

Media

Contact

Buffy

Harakidas, EVP and Jo Albers

JSA

(Jaymie Scotto & Associates)

jsa_applied@jsa.net

(856)

264-7827

Source:

Applied Digital Corporation

Released

October 31, 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

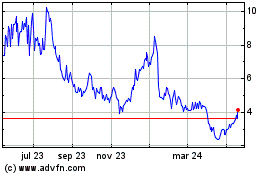

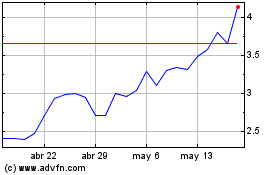

Applied Digital (NASDAQ:APLD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Applied Digital (NASDAQ:APLD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024