As

filed with the Securities and Exchange Commission on October 31, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Gen

Digital Inc.

(Exact

Name of Registrant as Specified in Its Charter)

Delaware

(State

or Other Jurisdiction of Incorporation or Organization) |

|

77-0181864

(I.R.S.

Employer Identification No.) |

60

E. Rio Salado Parkway, Suite 1000

Tempe, Arizona 85281

(Address

of Principal Executive Offices) (Zip Code) |

| Gen

Digital Equity Incentive Plan |

| (Full

Title of the Plans) |

Bryan

Ko

Chief

Legal Officer and Corporate Secretary

Gen

Digital Inc.

60

E. Rio Salado Parkway, Suite 1000Tempe, Arizona 85281 |

| (Name

and Address of Agent For Service) |

| (650)

527-8000 |

| (Telephone

Number, including area code, of agent for service) |

Copies

to:

William

L. Hughes, Esq.

Justin

“JT” Ho, Esq.

Orrick,

Herrington & Sutcliffe LLP

405

Howard Street

San

Francisco, California 94105

(415)

773-5700

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

x |

|

Accelerated

filer |

¨ |

| Non-accelerated

filer |

¨ |

|

Smaller

reporting company |

¨ |

| |

|

|

Emerging

growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ¨

PART I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

information called for by Part I of Form S-8 will be delivered to employees, without charge, as specified by Rule 428

under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with the rules and

regulations of the Securities and Exchange Commission (the “Commission”), such information is not being filed

with the Commission as part of this registration statement on Form S-8 (the “Registration Statement”).

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3.

Incorporation of Documents by Reference.

The

following documents filed by Gen Digital Inc. (the “Registrant”) with the Commission pursuant to the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

| (b) | all

other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act

since the end of the fiscal year covered by the Registrant’s Annual Report referred

to in (a) above; and |

| (c) | the

description of the Registrant’s common stock contained in Exhibit 4.01 of the

Registrant’s Annual Report on Form 10-K for the fiscal year ended March 29,

2024 filed with the Commission on May 16, 2024 pursuant to Section 13(a) of

the Exchange Act, including any amendment or report filed for the purpose of updating such

description. |

All

documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the

filing of a post-effective amendment, which indicates that all securities offered hereby have been sold or which deregisters all securities

then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of the filing of

such documents, except as to specific sections of such statements as set forth therein.

Unless

expressly incorporated into this Registration Statement, a report furnished on Form 8-K prior or subsequent to the date hereof shall

not be incorporated by reference into this Registration Statement, except as to specific sections of such statements as set forth therein.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded for purposes of this Registration Statement to the extent that a statement contained in any subsequently filed document, which

also is deemed to be incorporated by reference herein, modifies or supersedes such statement.

Item 4.

Description of Securities.

Not

applicable.

Item 5.

Interests of Named Experts and Counsel.

Not

applicable.

Item 6.

Indemnification of Directors and Officers.

Section 145

of the Delaware General Corporation Law (“DGCL”) authorizes a court to award, or a corporation’s board

of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances

for liabilities (including reimbursement for expenses incurred) arising under the Securities Act.

As

permitted by Sections 102(b)(7) and 145 of the DGCL, the Registrant’s Amended and Restated Certificate of Incorporation includes

a provision that eliminates the personal liability of its directors for monetary damages for breach of fiduciary duty as a director,

except for liability:

| · | for

any breach of the director’s duty of loyalty to the Registrant or its stockholders; |

| · | for

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation

of law; |

| · | under

Section 174 of the DGCL, regarding unlawful dividends and stock purchases; and |

| · | for

any transaction from which the director derived an improper personal benefit. |

Article 7

of the Registrant’s Amended and Restated Certificate of Incorporation, as amended, limits the liability of directors to the fullest

extent permitted by Section 102(b)(7).

As

permitted by the DGCL, the Registrant’s Bylaws provide that:

| · | the

Registrant is required to indemnify its directors and officers to the fullest extent permitted

by the DGCL, subject to limited exceptions; |

| · | the

Registrant is required to advance expenses, as incurred, to its directors and officers in

connection with a legal proceeding to the fullest extent permitted by the DGCL, subject to

limited exceptions; and |

| · | the

rights conferred in the Bylaws are not exclusive. |

The

Registrant has entered into indemnity agreements with each of its current directors and officers to give such directors and officers

additional contractual assurances regarding the scope of the indemnification set forth in the Registrant’s Certificate of Incorporation

and Bylaws and to provide additional procedural protections.

The

Registrant maintains directors’ and officers’ liability insurance that includes coverage for public securities matters, subject

to the policy terms and conditions.

These

indemnification provisions and the indemnification agreements entered into between the Registrant and each of its directors and executive

officers may be sufficiently broad to permit indemnification of the Registrant’s directors and executive officers for liabilities

arising under the Securities Act.

See

also the undertakings set out in response to Item 9 hereof.

In

addition, the Registrant has entered into various merger agreements and registration rights agreements in connection with its acquisitions

of and mergers with various companies and its financing activities under which the parties to those agreements have agreed to indemnify

the Registrant and its directors, officers, employees and controlling persons against specified liabilities.

Item 7.

Exemption from Registration Claimed.

Not

applicable.

Item 8.

Exhibits.

Item

9. Undertakings.

| a. | The

undersigned Registrant hereby undertakes: |

| (1) | To

file, during any period in which offers or sales are being made, a post-effective amendment

to this Registration Statement: |

| (i) | To

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | To

reflect in the prospectus any facts or events arising after the effective date of the Registration

Statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the Registration

Statement; and |

| (iii) | To

include any material information with respect to the plan of distribution not previously

disclosed in the Registration Statement or any material change to such information in the

Registration Statement; |

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do

not apply if the information required to be included in a post-effective amendment by such paragraphs is contained in reports filed with

or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are

incorporated by reference in the Registration Statement.

| (2) | That,

for the purpose of determining any liability under the Securities Act, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

| (3) | To

remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering. |

| b. | The

undersigned Registrant hereby undertakes that, for purposes of determining any liability

under the Securities Act, each filing of the Registrant’s annual report pursuant to

Section 13(a) or Section 15(d) of the Exchange Act that is incorporated

by reference in the Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. |

| c. | Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors,

officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Commission such

indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the Registrant of expenses incurred or paid by a director, officer or

controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities

being registered hereby, the Registrant will, unless in the opinion of its counsel the matter

has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Tempe, State of Arizona, on October 31, 2024.

| |

|

Gen Digital Inc. |

| |

|

|

|

| Date: |

October 31, 2024 |

By: |

/s/

Vincent Pilette |

| |

|

Name: |

Vincent Pilette |

| |

|

Title: |

Chief Executive Officer

and Director |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that the undersigned officers and directors

of Gen Digital Inc., a Delaware corporation, do hereby constitute and appoint Vincent Pilette, Natalie Derse and Bryan Ko, and each of

them, the lawful attorneys-in-fact and agents with full power and authority to do any and all acts and things and to execute any and

all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable said

corporation to comply with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities

and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority,

the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated

below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration

Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments

or supplements thereof, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them,

shall do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on

behalf of the Registrant in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Vincent Pilette |

|

Chief

Executive Officer and Director

(Principal Executive Officer) |

|

October 31,

2024 |

| Vincent Pilette |

|

|

|

| |

|

|

|

|

| /s/ Natalie

Derse |

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer) |

|

October 31,

2024 |

| Natalie Derse |

|

|

|

| |

|

|

|

|

| /s/ Sue

Barsamian |

|

Director |

|

October 31, 2024 |

| Sue Barsamian |

|

|

|

|

| |

|

|

|

|

| /s/ Pavel

Baudis |

|

Director |

|

October 31, 2024 |

| Pavel Baudis |

|

|

|

|

| |

|

|

|

|

| /s/ Eric

K. Brandt |

|

Director |

|

October 31, 2024 |

| Eric K. Brandt |

|

|

|

|

| |

|

|

|

|

| /s/ Frank

E. Dangeard |

|

Director |

|

October 31, 2024 |

| Frank E. Dangeard |

|

|

|

|

| |

|

|

|

|

| /s/ Nora

Denzel |

|

Director |

|

October 31, 2024 |

| Nora Denzel |

|

|

|

|

| |

|

|

|

|

| /s/ Peter

Feld |

|

Director |

|

October 31, 2024 |

| Peter Feld |

|

|

|

|

| |

|

|

|

|

| /s/ Emily

Heath |

|

Director |

|

October 31, 2024 |

| Emily Heath |

|

|

|

|

| |

|

|

|

|

| /s/ Sherrese

Smith |

|

Director |

|

October 31, 2024 |

| Sherrese Smith |

|

|

|

|

| |

|

|

|

|

| /s/ Ondrej

Vlcek |

|

Director |

|

October 31, 2024 |

| Ondrej Vlcek |

|

|

|

|

Exhibit 5.1

October 31,

2024

Gen Digital

Inc.

60 E. Rio

Salado Parkway, Suite 1000

Tempe, Arizona

85281

Re: Registration

Statement on Form S-8

Ladies and

Gentlemen:

We

have acted as counsel for Gen Digital Inc., a Delaware corporation (the “Company”), in connection with the preparation

and filing with the Securities and Exchange Commission (the “Commission”) of the Company’s registration statement

on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities

Act”) relating to the registration of 30,000,000 shares of the Company’s common stock, par value $0.01 per share ("Shares"),

reserved for issuance pursuant to the Company’s Equity Incentive Plan, which is an amendment and restatement of the 2013 Equity

Incentive Plan, as amended and restated (the “Plan”). As your legal counsel, we have reviewed the actions proposed

to be taken by you in connection with the issuance and sale of the Shares to be issued under the Plan.

In

connection with this opinion, we have examined and relied upon originals or copies, certified or otherwise identified to our satisfaction,

of (i) the Amended and Restated Certificate of Incorporation of the Company, as amended and restated through the date hereof, (ii) the

Bylaws of the Company, as amended and restated through the date hereof, (iii) the Registration Statement, (iv) the Plan, and

(v) such corporate records, agreements, documents and other instruments, and such certificates or comparable documents of public

officials and of officers and representatives of the Company, and have made such inquiries of such officers and representatives, as we

have deemed relevant and necessary or appropriate as a basis for the opinion set forth below.

In

our examination, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all

documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic,

certified or photostatic copies, and the authenticity of the originals of such copies. In making our examination of documents executed

or to be executed, we have assumed that the parties thereto, other than the Company, had or will have the power, corporate or other,

to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or

other, and the execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties.

As to any facts material to the opinions expressed herein that we did not independently establish or verify, we have relied upon statements

and representations of officers and other representatives of the Company and others and of public officials.

Based

on the foregoing and subject to the limitations, qualifications and assumptions set forth herein, we are of the opinion that the Shares

to be issued pursuant to the terms of the Plan have been duly authorized and, when issued, delivered and paid for in accordance with

the terms of the Plan, will be validly issued, fully paid and non-assessable.

The

opinion expressed herein is limited to the General Corporation Law of the State of Delaware, and we express no opinion as to the effect

on the matters covered by this letter of the laws of any other jurisdictions.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not hereby admit

that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations of the Commission promulgated thereunder.

Very truly

yours,

/s/ ORRICK,

HERRINGTON & SUTCLIFFE LLP

ORRICK, HERRINGTON &

SUTCLIFFE LLP

Exhibit 23.1

|

|

| |

KPMG LLP

Mission Towers I

Suite 600

3975 Freedom Circle Drive

Santa Clara, CA 95054 |

Consent of Independent

Registered Public Accounting Firm

We consent to the use of our report dated May 15, 2024, with

respect to the consolidated financial statements of Gen Digital Inc., and the effectiveness of internal control over financial reporting,

incorporated herein by reference.

Santa Clara, California

October 31, 2024

| |

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. |

S-8

S-8

EX-FILING FEES

0000849399

Gen Digital Inc.

Fees to be Paid

0000849399

2024-10-28

2024-10-28

0000849399

1

2024-10-28

2024-10-28

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

Gen Digital Inc.

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock, par value $0.01 per share, Equity Incentive Plan

|

Other

|

30,000,000

|

$

27.05

|

$

811,500,000.00

|

0.0001531

|

$

124,240.65

|

|

Total Offering Amounts:

|

|

$

811,500,000.00

|

|

$

124,240.65

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

124,240.65

|

|

1

|

(1) Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement on Form S-8 shall also cover any additional shares of Gen Digital Inc.'s (the "Registrant") common stock, $0.01 par value per share ("Common Stock"), that become issuable under the Equity Incentive Plan, as amended and restated (the "Plan"), in respect of the shares identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration, which results in an increase in the number of the Registrant's outstanding shares of Common Stock.

(2) Represents 30,000,000 additional shares of Common Stock that were reserved for future issuance under the Plan.

(3) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rules 457(c) and (h) of the Securities Act, based on $27.05 per share, which is the average of the high and low prices of Common Stock as reported on the Nasdaq Global Select Market on October 28, 2024.

|

|

|

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Oct. 28, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, par value $0.01 per share, Equity Incentive Plan

|

| Amount Registered | shares |

30,000,000

|

| Proposed Maximum Offering Price per Unit |

27.05

|

| Maximum Aggregate Offering Price |

$ 811,500,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 124,240.65

|

| Offering Note |

(1) Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement on Form S-8 shall also cover any additional shares of Gen Digital Inc.'s (the "Registrant") common stock, $0.01 par value per share ("Common Stock"), that become issuable under the Equity Incentive Plan, as amended and restated (the "Plan"), in respect of the shares identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration, which results in an increase in the number of the Registrant's outstanding shares of Common Stock.

(2) Represents 30,000,000 additional shares of Common Stock that were reserved for future issuance under the Plan.

(3) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rules 457(c) and (h) of the Securities Act, based on $27.05 per share, which is the average of the high and low prices of Common Stock as reported on the Nasdaq Global Select Market on October 28, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

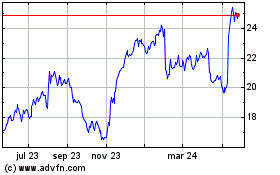

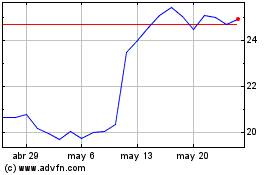

Gen Digital (NASDAQ:GEN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Gen Digital (NASDAQ:GEN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024