false

0000749647

0000749647

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 13, 2024

Imunon,

Inc.

(Exact

name of registrant as specified in its Charter)

| Delaware |

|

001-15911 |

|

52-1256615 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 997

Lenox Drive, Suite 100, Lawrenceville, NJ |

|

08648-2311 |

| (Address of principal

executive offices) |

|

(Zip Code) |

(609)

896-9100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value

$0.01 per share |

|

IMNN |

|

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

May 13, 2024, Imunon, Inc. issued a press release reporting its financial results for the quarter ended March 31, 2024. A copy of the

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On

May 6, 2024, Imunon, Inc. announced it would hold a conference call on May 13, 2024 to discuss its financial results for the quarter

ended March 31, 2024 and provide a business update. The conference call will also be broadcast live on the internet at http://www.imunon.com.

The

information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. Such information shall not be incorporated by reference into any filing with

the Securities and Exchange Commission made by Imunon, Inc., whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

The

press release contains forward-looking statements which involve certain risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Please refer to the cautionary note in the press release regarding these

forward-looking statements.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

IMUNON

INC. |

| |

|

|

| Dated: May 13, 2024 |

By: |

/s/ Jeffrey

W. Church |

| |

|

Jeffrey W. Church |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit

99.1

IMUNON

Reports First Quarter 2024 Financial Results and Provides Business Update

Conference

Call Begins Today at 11:00 a.m. Eastern Time

LAWRENCEVILLE,

N.J. (May 13, 2024) – IMUNON, Inc. (NASDAQ: IMNN), a clinical-stage drug-development

company focused on developing DNA-mediated immuno-oncology therapies and next-generation vaccines, today reported financial results

for the three months ended March 31, 2024. The Company also provided an update on its clinical development programs with IMNN-001, a

DNA-based interleukin-12 (IL-12) immunotherapy in Phase 2 clinical development for first-line treatment of locally advanced ovarian cancer,

and on its PlaCCine modality, a proprietary mono- or multi-cistronic DNA plasmid and a synthetic DNA delivery technology for the expression

of pathogen antigens for the development of next-generation vaccines.

“Potential

key value-creating milestones are upon us. We expect that this summer will be rewarding and busy as we look to improve the treatment

paradigm in late-stage ovarian cancer and to offer an “mRNA-better” vaccine platform technology with excellent commercial

promise,” said Mr. Michael H. Tardugno, IMUNON’s Executive Chairman.

“We

remain on track to report topline results from the OVATION 2 Study with IMNN-001 in advanced ovarian cancer in mid-2024. If interim data

are confirmed, the observed progression-free survival (PFS) benefit would represent a clinically meaningful outcome. In September, we

reported interim PFS and overall survival (OS) data suggesting an approximate 30% delay in disease progression or death in the treatment

arm compared with the control arm, with the hazard ratio nearing the study objective. Preliminary OS data followed a similar trend, showing

an approximate nine month improvement in the treatment arm over the control arm. Subgroup analyses suggest patients treated with a PARP

inhibitor (PARPi) as maintenance therapy had longer PFS and OS if they were also treated with IMNN-001, compared with patients treated

with neoadjuvant chemotherapy (NACT) only,” he added.

“Our

Investigational New Drug (IND) application to the U.S. Food and Drug Administration (FDA) for our seasonal COVID-19 booster vaccine (IMNN-101)

was accepted by the Agency. The Company has begun a Phase 1 proof-of-concept study in two investigational centers. Our goal is to confirm

the safety and immunogenicity of this DNA-based vaccine as an annual booster with long-lasting protection. The first patients are expected

to be enrolled during the current quarter, and based on the results, we intend to advance discussions with potential partners for further

development. Our optimism is based, in part, on final data from non-human primate studies that showed excellent immunological response

and viral clearance. In a recent mouse study, we demonstrated that a single dose of IMNN-101, without a booster dose, produced longer

duration of IgG responses and higher T cell activation than an mRNA vaccine. We have also demonstrated continued drug stability at standard

refrigerated temperature of 4°C for more than 12 months, representing a significant advantage over commercial mRNA-based vaccines.”

Stacy

Lindborg, PhD appointed President and Chief Executive Officer

With

great pleasure, the Company announced the appointment of Stacy R. Lindborg, Ph.D. as President and Chief Executive Officer, effective

May 13, 2024. Dr. Lindborg has served on IMUNON’s board of directors since 2021 and was most recently Co-Chief Executive Officer

of BrainStorm Cell Therapeutics, where she remains a director.

“We

are delighted that Dr. Lindborg has agreed to deepen her ties with IMUNON as President and CEO,” said Mr. Tardugno. “We have

benefited significantly from her counsel as a director, where she has played an integral role in establishing our strategic priorities.

Stacy joins the Company at a particularly important time. We now look forward to benefiting from her expertise in a more meaningful way,

especially as our near-term data readouts will require important decisions with respect to advancing various programs and assets.”

Dr.

Lindborg, a globally recognized biostatistician, has nearly 30 years of pharmaceutical and biotech industry experience with a particular

focus on R&D, regulatory affairs, executive management and strategy development. She has worked with biologics, small molecules and

cell therapies to address a range of diseases and disorders. She has extensive experience in early-stage development, having taken molecules

from first-in-human studies into the clinic, through regulatory approval and commercial launch.

RECENT

DEVELOPMENTS

IMNN-001

Immunotherapy

Reported

Interim PFS and OS Data in OVATION 2 Study in Advanced Ovarian Cancer. In September 2023, the Company announced

interim PFS and OS data with IMNN-001 in its OVATION 2 Study. This study is evaluating the dosing, safety, efficacy and biological activity

of intraperitoneal IMNN-001 in combination with chemotherapy prior to tumor reduction surgery (known as: NACT) in patients newly diagnosed

with advanced epithelial ovarian, fallopian tube or primary peritoneal cancer. NACT is designed to shrink the tumors as much as possible

for optimal surgical removal after three cycles of chemotherapy. Following NACT, patients undergo tumor debulking surgery, followed by

three additional cycles of chemotherapy to treat any remaining tumor tissue.

The

open-label study is directional and is designed to show an approximate 33% improvement in PFS when comparing the treatment arm with the

control arm. Key secondary endpoints include OS, and the objective response rate. The final readout of this study is expected in mid-2024.

A positive readout would inform the Phase 3 study design.

| ● | Interim

data from the intent-to-treat population showed efficacy trends in PFS, demonstrating a delay

in disease progression in the treatment arm of approximately three months compared with the

control arm, with the hazard ratio nearing the study objective. Preliminary OS data followed

a similar trend, showing an approximate nine-month improvement in the treatment arm over

the control arm. |

| ● | Non-prespecified

subgroup analyses, commissioned as a result of the evolving standard of care for this population,

suggest that patients treated with a PARPi as maintenance therapy had longer PFS and OS if

they were also treated with IMNN-001, compared with patients treated with NACT only. |

| ○ | The

median PFS in the PARPi + NACT group and the PARPi + NACT + IMNN-001 group was 15.7 months

and 23.7 months, respectively. |

| ○ | The

median OS in the PARPi + NACT group was 45.6 months and has not yet been reached in the PARPi

+ NACT + IMNN-001 group. |

Began

Treatment in a Phase 1/2 Clinical Trial Evaluating IMNN-001 in Combination with Bevacizumab (Avastin®) in Advanced Ovarian Cancer.

In October 2023, the first patient was enrolled in this trial at the University of Texas MD Anderson Cancer Center. This trial is

expected to enroll 50 patients with Stage III/IV ovarian cancer. Patients undergoing frontline neoadjuvant therapy will be randomized

1:1 to receive standard chemotherapy plus bevacizumab, or standard chemotherapy plus bevacizumab and IMNN-001. The trial’s primary

endpoint is detection of minimal residual disease (MRD) by second-look laparoscopy and the secondary endpoint is PFS. This trial will

also include a wealth of translational endpoints aimed at understanding the clonal evolution and immunogenomic features of the MRD phase

of ovarian cancer that is currently undetectable by imaging or tumor markers. In February 2024, the Company announced that Memorial Sloan

Kettering Cancer Center joined MD Anderson Cancer Center in enrolling patients in this clinical trial.

PlaCCine:

Developing the Prophylactic Vaccines of the Future

IND

Application Cleared by the FDA to Begin Human Testing of IMNN-101. In April 2024, the Company announced receipt

of FDA clearance to begin a Phase 1 proof-of-concept clinical trial with IMNN-101, a seasonal COVID-19 booster vaccine. Pending resolution

of limited comments from the FDA, IMUNON expects to commence patient enrollment in the second quarter of 2024.

IMNN-101

utilizes the company’s PlaCCine platform, a proprietary mono- or multi-valent DNA plasmid that regulates the expression of key

pathogen antigens and is delivered via a unique synthetic DNA delivery system. The primary objectives of the Phase 1 study are to evaluate

safety, tolerability, neutralizing antibody response and the vaccine’s durability (duration of immunogenicity) in healthy adults.

Secondary objectives include evaluating the ability of IMNN-101 to elicit binding antibodies and cellular responses and their associated

durability. Based on reported preclinical data, durability of immune protection is expected to be superior to published mRNA vaccine

data.

As

currently planned, the Phase 1 study will enroll 24 subjects evaluating three escalating doses of IMNN-101 at two U.S. clinical trial

sites. For this study, IMMN-101 has been designed to protect against the SARS-CoV-2 Omicron XBB1.5 variant, in accordance with the FDA’s

Vaccines and Related Biological Products Advisory Committee’s June 2023 announcement of the framework for updated COVID-19 doses.

Preclinical

Data for IMUNON’s PlaCCine DNA-Based Vaccine in SARS-CoV-2 Published in Peer-Reviewed Journal Vaccine. In February 2024,

the Company announced that an article titled “Strong

immunogenicity & protection in mice with PlaCCine: A COVID-19 DNA vaccine formulated with a functionalized polymer” was published

in the peer-reviewed journal Vaccine, by Elsevier.

The

article is available at https://authors.elsevier.com/sd/article/S0264-410X(24)00077-X.

The

study described in the article used IMUNON’s proprietary formulation against the spike proteins from two SARS-CoV-2 variants, both

alone and in combination. Data from the study show:

| ● | IMUNON’s

proprietary formulation of functionalized polymer protected DNA from degradation and enhanced

protein expression, while the combination with an adjuvant led to an increase in immunogenicity. |

| ● | PlaCCine

vaccines are stable for up to one year at 4°C and at least one month at 37°C. |

| ● | Vaccination

with PlaCCine resulted in the induction of spike-specific neutralizing antibodies and cytotoxic

T cells. |

| ● | In

the in vivo challenge model, the vaccine-induced immune response was capable of suppressing

viral replication. |

| ● | Multiple

inserts can be cloned into the PlaCCine backbone (a plug-and-play strategy), therefore allowing

for an immune response with broader protection. |

Corporate

Developments

Received

$1.3 Million in Non-Dilutive Funding from the Sale of New Jersey Net Operating Losses. In March 2024, the Company received $1.3 million

in net cash proceeds from the sale of approximately $1.4 million of its unused New Jersey net operating losses (NOLs). The NOL sales

cover the tax year 2022 and are administered through the New Jersey Economic Development Authority’s Technology Business Tax Certificate

Transfer (NOL) program. This non-dilutive funding further strengthened the Company’s balance sheet.

FINANCIAL

RESULTS FOR THE THREE MONTHS ENDED MARCH 31, 2024

IMUNON

reported a net loss for the first quarter of 2024 of $4.9 million, or $0.52 per share, compared with a net loss of $5.6 million, or $0.68

per share, for the first quarter of 2023. Operating expenses were $5.0 million for the first quarter of 2024, a decrease of $0.7 million

or 12% from $5.7 million for the first quarter of 2023.

Research

and development (R&D) expenses were $3.3 million for the first quarter of 2024, an increase of $0.7 million from $2.6 million for

the comparable period in 2023. Costs associated with the OVATION 2 Study were $0.3 million for both the first quarters of 2024 and 2023.

Other clinical and regulatory costs were $1.1 million for the first quarter of 2024 compared with $0.3 million for the prior-year period.

R&D costs associated with the development of IMNN-001 to support the OVATION 2 Study, as well as development of the PlaCCine DNA

vaccine technology platform, were $1.6 million for the first quarter of 2024, compared with $1.4 million for the same period last year.

CMC costs were $0.3 million for the first quarter of 2024, compared with $0.6 million for 2023 due to the development of in-house pilot

manufacturing capabilities for DNA plasmids and nanoparticle delivery systems.

General

and administrative expenses were $1.7 million for the first quarter of 2024, compared with $3.1 million for the comparable prior-year

period. This decrease was primarily attributable to lower non-cash stock compensation expense ($0.3 million), lower legal costs ($0.5

million), lower employee-related costs ($0.2 million), lower consulting fees ($0.2 million) and lower insurance costs ($0.1 million).

Other

non-operating income was $81,921 for the first quarter of 2024, compared with $93,085 for the comparable prior-year period. Investment

income decreased $0.2 million due to lower balances of short-term investments in the current quarter. Interest expense decreased $0.2

million due to the repayment of the Company’s loan facility with Silicon Valley Bank in the second quarter of 2023.

Net

cash used for operating activities was $5.9 million for the first quarter of 2024, compared with $4.0 million for the comparable prior-year

period. This increase was primarily due to the final payment of CRO costs associated with the Phase III OPTIMA Study.

The

Company ended the first quarter of 2024 with $9.8 million

in cash, investments and accrued interest receivable. The Company believes it has sufficient capital

resources to fund its operations to the end of 2024.

Conference

Call and Webcast

The

Company is hosting a conference call at 11:00 a.m. Eastern time today to provide a business update, discuss first quarter 2024 financial

results and answer questions. To participate in the call, please dial 833-816-1132 (Toll-Free/North America) or 412-317-0711 (International/Toll)

and ask for the IMUNON First Quarter 2024 Earnings Call. A live webcast of the call will be available here.

The

call will be archived for replay until May 27, 2024. The replay can be accessed at 877-344-7529 (U.S. Toll-Free), 855-669-9658 (Canada

Toll-Free) or 412-317-0088 (International Toll), using the replay access code 9343581. A webcast of the call will be available here

for 90 days.

About

IMUNON

IMUNON

is a clinical-stage biotechnology company focused on advancing a portfolio of innovative treatments that harness the body’s natural

mechanisms to generate safe, effective and durable responses across a broad array of human diseases, constituting a differentiating approach

from conventional therapies. IMUNON is developing its non-viral DNA technology across its modalities. The first modality, TheraPlas®,

is developed for the coding of proteins and cytokines in the treatment of solid tumors where an immunological approach is deemed promising.

The second modality, PlaCCine®, is developed for the coding of viral antigens that can elicit a strong immunological response.

This technology may represent a promising platform for the development of vaccines in infectious diseases.

The

Company’s lead clinical program, IMNN-001, is a DNA-based immunotherapy for the localized treatment of advanced ovarian cancer

currently in Phase 2 development. IMNN-001 works by instructing the body to produce safe and durable levels of powerful cancer-fighting

molecules, such as interleukin-12 and interferon gamma, at the tumor site. Additionally, the Company is entering a first-in-human study

of its COVID-19 booster vaccine (IMNN-101). We will continue to leverage these modalities and to advance the technological frontier of

plasmid DNA to better serve patients with difficult-to-treat conditions. For more information on IMUNON, visit www.imunon.com.

Forward-Looking

Statements

IMUNON

wishes to inform readers that forward-looking statements in this news release are made pursuant to the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that such forward-looking statements involve risks and

uncertainties including, without limitation, unforeseen changes in the course of research and development activities and in clinical

trials; the uncertainties of and difficulties in analyzing interim clinical data; the significant expense, time and risk of failure of

conducting clinical trials; the need for IMUNON to evaluate its future development plans; possible acquisitions or licenses of other

technologies, assets or businesses; possible actions by customers, suppliers, competitors or regulatory authorities; and other risks

detailed from time to time in IMUNON’s filings with the Securities and Exchange Commission. IMUNON assumes no obligation to update

or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

Contacts:

| IMUNON |

LHA

Investor Relations |

| Jeffrey

W. Church |

Kim

Sutton Golodetz |

| Executive

Vice President, CFO |

212-838-3777 |

| and

Corporate Secretary |

Kgolodetz@lhai.com |

| 609-482-2455 |

|

| jchurch@imunon.com |

|

(Tables

to Follow)

IMUNON,

Inc.

Condensed

Consolidated Statements of Operations

(in

thousands except per share amounts)

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

Licensing revenue | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 3,294 | | |

| 2,620 | |

| General and administrative | |

| 1,717 | | |

| 3,064 | |

| Total operating expenses | |

| 5,011 | | |

| 5,684 | |

| | |

| | | |

| | |

| Loss from operations | |

| (5,011 | ) | |

| (5,684 | ) |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| Interest expense on loan facility | |

| - | | |

| (160 | ) |

| Investment and other income | |

| 82 | | |

| 253 | |

| Total other income (expense), net | |

| 82 | | |

| 93 | |

| | |

| | | |

| | |

| Net loss | |

$ | (4,929 | ) | |

$ | (5,591 | ) |

| | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | |

| Basic and diluted | |

$ | (0.52 | ) | |

$ | (0.68 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding | |

| | | |

| | |

| Basic and diluted | |

| 9,400 | | |

| 8,281 | |

IMUNON, Inc.

Selected Balance Sheet Information

(in thousands)

| | |

March 31, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,347 | | |

$ | 5,839 | |

| Investment securities and interest receivable on investment securities | |

| 7,462 | | |

| 9,857 | |

| Advances, deposits on clinical programs and other current assets | |

| 2,285 | | |

| 2,545 | |

| Total current assets | |

| 12,094 | | |

| 18,241 | |

| | |

| | | |

| | |

| Property and equipment | |

| 694 | | |

| 752 | |

| | |

| | | |

| | |

| Other assets | |

| | | |

| | |

| Deferred tax asset | |

| - | | |

| 1,280 | |

| Operating lease right-of-use assets, deposits, and other assets | |

| 1,537 | | |

| 1,645 | |

| Total other assets | |

| 1,537 | | |

| 2,925 | |

Total assets | |

$ | 14,325 | | |

$ | 21,918 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 4,316 | | |

$ | 6,906 | |

| Operating lease liability – current portion | |

| 501 | | |

| 485 | |

| Total current liabilities | |

| 4,817 | | |

| 7,391 | |

| | |

| | | |

| | |

| Operating lease liability – noncurrent portion | |

| 1,008 | | |

| 1,139 | |

| Total liabilities | |

| 5,825 | | |

| 8,530 | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock | |

| 94 | | |

| 94 | |

| Additional paid-in capital | |

| 401,470 | | |

| 401,501 | |

| Accumulated other comprehensive gain (loss) | |

| 133 | | |

| 61 | |

| Accumulated deficit | |

| (393,112 | ) | |

| (388,183 | ) |

| | |

| 8,585 | | |

| 13,473 | |

| Less: Treasury stock | |

| (85 | ) | |

| (85 | ) |

| Total stockholders’ equity | |

| 8,500 | | |

| 13,388 | |

Total liabilities and stockholders’ equity | |

$ | 14,325 | | |

$ | 21,918 | |

#

# #

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

001-15911

|

| Entity Registrant Name |

Imunon,

Inc.

|

| Entity Central Index Key |

0000749647

|

| Entity Tax Identification Number |

52-1256615

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

997

Lenox Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Lawrenceville

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08648-2311

|

| City Area Code |

(609)

|

| Local Phone Number |

896-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value

$0.01 per share

|

| Trading Symbol |

IMNN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

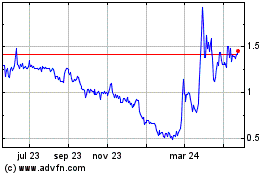

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

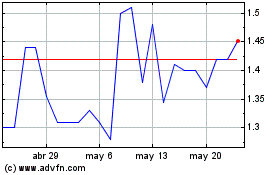

De Abr 2024 a May 2024

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

De May 2023 a May 2024