Petroneft Resources PLC Final Results (6711C)

22 Junio 2021 - 2:00AM

UK Regulatory

TIDMPTR

RNS Number : 6711C

Petroneft Resources PLC

22 June 2021

PetroNeft Resources plc

22(nd) June 2021

PetroNeft Resources plc ('PetroNeft' or 'the Company')

2020 Final Results

Click here to view 2020 Final Results

PetroNeft (AIM: PTR) an oil & gas exploration and production

company, operating in the Tomsk Oblast, Russian Federation, and 90%

owner and operator of Licences 67 and 50% owner and operator of

Licence 61 is pleased to report its final results for the year

ended 31(st) December 2020.

Highlights

-- New leadership, combined with strong local support, continues

to demonstrate significant technical, operational and financial

progress in 2020.

-- Despite external adverse factors including closing down

production in April 2020 due to oil price, gross 2020 production

averaged 1,562 bopd down only 3.2% year on year (1,614 bopd

2019).

-- Operating costs per barrel reduced by 10.3% (cost of sales

excluding depreciation and Mineral Extraction Tax) at US$12.39 per

barrel (2019: US$13.82 per barrel).

-- Loss for the year US$4.54M (2020) reduced from US$6.04M

(2019) despite 32.7% fall in realized oil price per barrel.

-- Due to the COVID-19 pandemic, the Company intends to publish

later the notice for the Annual General Meeting in order to

increase the chances of shareholders to be able to physically

attend.

2021 Update

-- Gross production currently 2,289 bopd.

-- Improved oil prices have translated into higher netbacks in 2021 to date.

-- Closing of successful acquisition of additional 40% interest

in Licence 67 (PTR working interest 90% post acquisition) ahead of

rapid transition from an Exploration to a producing asset Q1

2021.

-- Significant strengthening of the Company' Capital Structure

as evidenced by the following key indicators.

o Successful Convertible Debt raise at substantial premium to

market price of US2.9M and later retiring US2.86M Convertible Debt

through conversion.

o Increased equity holding in Licence 67 to 90% from 50%, funded

through equity issue combined with a US$1.7M loan advanced by the

seller Sarum Energy Limited.

o The strong operational performance, combined with the

improving oil price, has significantly improved the finances of the

Company which has enabled the Company to fund construction of the

all-season road and re-entry of the Ledovoye L-2a well without the

need to call down agreed financing arrangements with

Alexandrovskoye Refinery. This $1M facility remains in place,

should we decide to utilize.

David Sturt, Chief Executive Officer of PetroNeft Resources plc,

commented

"In 2019 we laid the crucial foundations for the survival and

future growth of the company which enabled us to meet the enormous

challenges caused by the 2020 combination of the Covid pandemic and

the precipitous fall in the price of oil.

Following continued operational improvements, the latent

potential that are the oil fields in both licenses 61 and 67 are

now starting to see the true extent of the opportunity available to

PetroNeft. By continuing to improve our understanding of the

company's assets we are continually identifying low risk growth

opportunities whilst also maintaining our focus on operational

efficiencies. The Company is ideally placed to extract the

significant value proposition that PetroNeft Resources

represents.

Moving into 2021, there is renewed global optimism in our

sector. Due to the steps taken in 2019 and 2020 combined with the

dedication of our staff and support of our stakeholders we are well

placed to continue to develop the company and the true value of the

assets."

For further information, contact:

+44 7903 869

David Sturt, CEO, PetroNeft Resources plc 608

John Frain/Ciara O'Mongain, Davy (NOMAD and Joint +353 1 679

Broker) 6363

+353 1 498

Joe Heron / Douglas Keating, Murray Consultants 0300

The information contained in this announcement has been reviewed

and verified by Mr. David Sturt, Chief Executive Officer and

Executive Director of PetroNeft, for the purposes of the Guidance

Note for Mining and Oil & Gas Companies issued by the London

Stock Exchange in June 2009. Mr. Sturt holds a B.Sc. Degree in

Earth Sciences from Kingston University and an MSc. in Exploration

Geophysics from The University of Leeds. He is a member of the

Petroleum Exploration Society Great Britain and has over 35 years'

experience in oil and gas exploration and development.

Glossary

bopd Barrels of oil per day

M Million

-----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKBBPABKKNAB

(END) Dow Jones Newswires

June 22, 2021 03:00 ET (07:00 GMT)

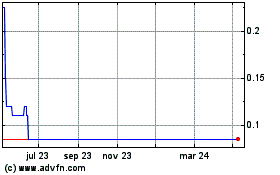

Petroneft Resources (LSE:PTR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Petroneft Resources (LSE:PTR)

Gráfica de Acción Histórica

De May 2023 a May 2024