Intesa Sanpaolo 1Q Net Profit Rose Sharply -- Update

08 Mayo 2018 - 9:22AM

Noticias Dow Jones

(Adds earnings details, comment from CEO and 2018 outlook.)

By Pietro Lombardi

Intesa Sanpaolo SpA (ISP.MI) said Tuesday that its first-quarter

net profit rose 39% to deliver a result that Chief Executive Carlo

Messina deemed the bank's "best since 2008."

The Italian bank posted net profit of 1.25 billion euros ($1.49

billion) compared with EUR901 million in the same period last year.

The increase was helped by growing fees and commissions, higher

profits on financial assets and liabilities designated at fair

value, as well as lower provisions for bad loans.

Analysts had expected net profit of EUR890 million for the

period, according to a consensus forecast provided by FactSet.

Profits on financial assets and liabilities at fair value rose

significantly to EUR621 million from EUR226 million, with a

positive contribution of EUR264 million stemming from the fair

value measurement of its investment in Italian railway group

NTV.

Loan-loss provisions fell 31% to EUR483 million.

Fees and commissions rose 8.2% to EUR2.01 billion, underscoring

Intesa's push to make more revenue from fees and commissions than

from traditional lending activities as the latter suffer in the

current low-rate environment.

"The quality and strength of our results are based on

double-digit revenue growth, with net interest income rising for

the second consecutive quarter, and growth in commissions that

places us at the top among European banks," Mr. Messina said.

The bank expects net profit will grow in 2018 from 2017,

excluding from last year's results the EUR3.5 billion public

contribution Intesa received as part of the rescue of two regional

Italian banks that went bust.

The Italian government liquidated the regional banks' bad

assets, while Intesa bought the good ones for 1 euro. The deal

included the EUR3.5 billion public contribution to offset the

transaction's impact on Intesa's capital ratios.

"An increase in revenues, continuous cost management and a

decrease in the cost of risk are envisaged as the drivers of the

expected performance of net income," it said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 08, 2018 10:07 ET (14:07 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

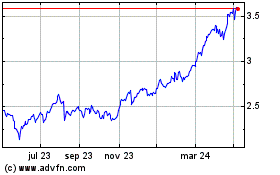

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

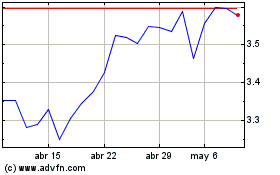

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024