TIDMPRIM

RNS Number : 0568V

Primorus Investments PLC

18 July 2018

Primorus Investments plc

("Primorus" or the "Company")

Portland Extended Flow Test ("EWT"): Well Clean-Up Phase

Complete, Dry Oil Flows to Surface,

Horse Hill-1 Oil Discovery, PEDL137, Weald Basin, UK

Highlights:

-- Initial Portland well "clean-up" phase completed successfully

-- Light sweet crude oil (36 API) and associated solution gas

flowed sustainably via pump and natural flow to surface over a

4-day period to date. Oil contains no metered water content (i.e.

"dry oil")

-- Metered daily oil rates to date equal to or exceed 2016

values. Highest observed hourly rate equivalent to an implied daily

rate of 352 barrels of oil per day ("bopd"). Corresponding metered

solution gas volumes are up to an implied rate of 30,000 cu ft per

day.

-- Flow has not yet been optimised for maximum sustainable flow rates

-- First tanker containing 214 barrels of dry oil exported to BP's Hamble oil terminal

-- Initial analysis indicates well productivity unaffected by 2 year shut-in period since 2016

-- Following a planned 24-hour shut in (i.e. pressure build-up

test) the first of three planned Portland test sequences will

commence

Primorus (London AIM: PRIM) is pleased to announce that it has

been informed by its investee company, Horse Hill Developments Ltd

("HHDL"), the operator of the Horse Hill-1 ("HH-1") Kimmeridge and

Portland oil discovery that the initial well "clean-up" phase of

the Portland extended well test ("EWT") programme has been

completed according to plan. Over the past four days, the well has

delivered a sustained dry oil and solution gas flow to surface via

pump and natural flow.

The Company holds a 3.25% beneficial interest in licence PEDL137

containing the HH-1 oil discovery.

Observed metered Portland flow rates to date are broadly

equivalent to, or exceed, those recorded during the short duration

2016 test. The highest recorded hourly metered rate to date,

equates to an implied daily rate of 352 bopd and was achieved using

a 20/64" choke, a notably more restricted setting than the 64/64"

choke used in 2016. Corresponding solution gas flows have been

measured up to an implied rate of 30,000 cubic feet per day. Note

that, to date, flow has not yet been optimised for maximum

sustainable production rates, this will follow in the subsequent

test sequences.

Several periods of sustained natural flow (i.e. flow to surface

without pumping) have also been observed over the past few days,

with the most productive period producing an implied daily dry oil

rate of 228 bopd over a two-hour period.

Initial reservoir parameter analysis indicates that the Portland

is performing very well compared to the productivity measured in

2016 prior to temporarily shutting in and suspending the well.

To date a total of 463 barrels of light sweet 36 API crude have

been recovered to surface during the clean-up period, together with

all 141 barrels of completion and kill fluids (i.e. saline water)

used to suspend the well after the 2016 well test.

Forward EWT Plans

The well will now be shut in for a planned 24-hour pressure

build-up test. Operations will then include further flow parameter

optimisation, followed by the first of three planned flow sequences

designed to assess whether the Portland oil pool contains a

commercially viable volume of oil. The first test sequence will

likely include an optimised maximum rate test, prior to choking

back the well to provide the steady state flow conditions necessary

to determine the Portland oil pool's connected oil volume. Note

that in order to collect the required data during these steady

state flow periods, rates will likely be below any future optimised

production rates.

Testing of each of the Kimmeridge Limestone 4 ("KL4") and KL3

oil pools will follow completion of the Portland test sequence.

Alastair Clayton, Executive Director of Primorus, commented:

"with the clean-up phase now complete, the operator can now get on

with the business of determining the actual flow parameters. We

are, at this very early stage, also pleased to note the strong oil

and gas flows to surface at the well in advance of the shut-in and

commencement of the flow testing programme itself."

Extended Well Test ("EWT") Overview

As the 2016 short flow test campaign established commercially

viable initial flow rates for each of the Portland, KL4 and KL3

zones, the 2018 EWT's prime goal is to confirm that the wellbore is

connected to a commercially viable oil volume within one or more of

the three zones.

The long-term reservoir performance data is also expected to

provide the necessary data to enable, for the first time, Petroleum

Resources Management System compliant Kimmeridge and Portland

reserve figures to be estimated at Horse Hill.

Each test sequence will include a short, optimised rate test,

together with a sequence of "choked back" (i.e. reduced)

steady-state flow periods necessary to obtain the data required to

determine the connected oil volume within each zone. A series of

associated long pressure build up tests are also planned. Oil

produced from the EWT will be sold on the "spot" oil market and any

revenues will be utilised to offset overall testing costs.

Qualified Person's Statement

Stephen Sanderson, Executive Chairman and Chief Executive of UK

Oil & Gas Investments plc, who has over 35 years of relevant

experience in the oil industry, has approved the information

contained in this announcement. Mr Sanderson is a Fellow of the

Geological Society of London and is an active member of the

American Association of Petroleum Geologists.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

The directors of Primorus accept responsibility for this

announcement.

For further information, please contact:

+44 (0) 20 7440

Primorus Investments plc: 0640

Alastair Clayton

+44 (0) 20 7213

Nominated Adviser: 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

+44 (0) 20 3621

Broker: 4120

Turner Pope Investments Limited

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFMGMNZRZGRZM

(END) Dow Jones Newswires

July 18, 2018 09:00 ET (13:00 GMT)

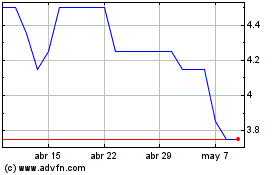

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024