TIDMNAS

RNS Number : 5022M

North Atlantic Smlr Co Inv Tst PLC

16 September 2019

North Atlantic Smaller Companies Investment Trust plc

Half-Yearly Report for the six months ended 31 July 2019

Registered in England and Wales number 1091347

objective of the company and financial highlights

The objective of the Company is to provide capital appreciation

through investment in a portfolio of smaller companies principally

based in countries bordering the North Atlantic Ocean.

31 July 31 January

2019 2019 %

(unaudited) (audited) Change

Net asset value ("NAV") per 5p Ordinary Share*:

Basic 4,120p 3,710p 11.1

Diluted 4,118p 3,708p 11.1

Basic adjusted# 4,255p 3,776p 12.7

Diluted adjusted# 4,253p 3,774p 12.7

Mid-market price of the 5p Ordinary Shares 3,100p 2,910p 6.5

Discount to diluted net asset value 24.7% 21.5%

Discount to diluted adjusted net asset value 27.1% 22.9%

Standard & Poor's 500 Composite Index 2,451.2 2,062.8 18.8

Russell 2000 Index 1,295.0 1,143.8 13.2

Ongoing charges (annualised) 1.1% 1.1%

* Includes current period.

# Adjusted to reflect Oryx International Growth Fund plc

("Oryx") under the equity method of accounting, which is how the

Company previously accounted for its share of Oryx, prior to the

adoption of IFRS 10. This is useful to the shareholder as it shows

the NAV based on valuing Oryx at NAV. See note 6.

Sterling adjusted.

chief executive's review

During the six months period under review the fully diluted net

asset value rose by 12.7% (with Oryx under the equity method of

accounting) as compared to a rise in the Sterling Adjusted Standard

& Poors Composite Index of 18.8%. The performance however

compares very favourably with UK indices where the majority of the

Company's assets are located.

Profit for the period amounted to GBP3,671,000 (31 July 2018 of

GBP2,389,000). The Directors do not intend to declare a dividend at

this time, although it is highly likely that a final dividend will

be paid in respect of the current financial year.

During the period, the Company purchased for cancellation

132,863 ordinary shares at a favourable discount to NAV which

benefits all long term shareholders.

quoted portfolio

The majority of the UK portfolio performed well with Oryx's NAV

rising 14.9% and MJ Gleeson rising 16.9%. Other stocks that

performed well include Polar Capital, Ergomed, Augean and, in

particular, Renalytix which rose over 100%.

This was, however, to some extent offset by the need to totally

write off Goals Soccer following a fraud which adversely impacted

the net asset value by just under 1%.

Principal new investments during the period were made in Stobart

Group, Ergomed and Hargreaves Services.

US quoted portfolio

Our two biggest investments Mountain Commerce and Ambac, both

reported satisfactory results during the period but the overall

portfolio remains small as a percentage of the total fund.

unquoted portfolio

No new direct investments were made during the period. GAJV and

Harwood Leeds were sold. The proceeds were invested in UK

equities.

outlook

The Company invested approximately GBP33m in equities during the

period. All the investments were made in businesses trading at a

significant discount to private market value and which it is

believed will add to the net asset value over the medium term.

Nevertheless, the Company remains conservatively invested with net

cash of approximately GBP93m.

Markets as a whole are facing considerable headwinds including a

major economic slowdown in Europe in its manufacturing industries

and the very realistic possibility of a major China/US trade war

which could also spill into Europe. MIFID 2 and a dire IPO market

is creating further problems for the UK small cap sector with

falling liquidity. However, given the Company's permanent capital

structure and substantial cash balances, it remains well placed to

benefit from the favourable opportunities which we foresee over the

medium term.

C H B Mills

Chief Executive

16 September 2019

top ten investments

as at 31 July 2019

Company

Fair

Value % of

GBP'000 net assets

US Treasury Bills US Treasury Stock 82,249 14.1

Oryx International Growth Fund Limited* UK Listed 57,960 9.9

MJ Gleeson Group plc UK Listed 42,762 7.3

Polar Capital Holdings plc UK Quoted on AIM 40,040 6.8

Harwood Private Equity Fund IV LP UK Unquoted 37,338 6.4

Ten Entertainment Group plc UK Listed 36,300 6.2

EKF Diagnostics Holdings plc UK Quoted on AIM 34,104 5.8

Stobart Group Limited UK Quoted on AIM 21,812 3.7

Augean plc UK Quoted on AIM 21,275 3.6

Sherwood Holdings Limited UK Unquoted 18,181 3.1

----------------------------------------- ------------------- -------- -----------

392,021 66.9

------------------------------------------------------------- -------- -----------

* Traded price under IFRS 10, incorporated in Guernsey.

All investments are valued at fair value.

interim management report

investment objective

The objective of North Atlantic Smaller Companies Investment

Trust PLC ("the Company") is to provide capital appreciation to its

shareholders through investing in a portfolio of smaller companies

which are principally based in countries bordering the North

Atlantic Ocean.

material events

The Board do not consider that there were any material events

during the period ended 31 July 2019.

material transactions

There were no material transactions during the period.

risk profile

The principal risks and uncertainties for the remaining six

months of the year continue to be as described in the Annual Report

for the year ended 31 January 2019. The principal risks arising

from the Company's financial instruments are market price risk,

including currency risk, interest rate risk and other price risk,

liquidity risk and credit risk. The Directors review and agree

policies with the Manager, Harwood Capital LLP, for managing these

risks. The policies have remained substantially unchanged in the

six months since the year end.

The Company does not have any significant exposure to credit

risk arising from any one individual party. Credit risk is spread

across a number of counterparties, each having an immaterial effect

on the Company's cash flows, should a default happen. The Company

assesses the credit worthiness of its debtors from time to time to

ensure that they are neither past due or impaired.

To support its investment in unquoted companies, the Company may

periodically agree to guarantee all or part of the borrowings of

investee companies. Provision is made for any costs that may be

incurred when the Directors consider it likely that the guarantee

will crystallise.

The Company's exposure to market price risk comprises mainly

movements in the value of the Company's investments. It should be

noted that the prices of options tend to be more volatile than the

prices of the underlying securities. The Manager assesses the

exposure to market risk when making each investment decision and

monitors the overall level of market risk on the whole of the

investment portfolio on an ongoing basis.

The functional and presentational currency of the Company is

Sterling, and therefore, the Company's principal exposure to

foreign currency risk comprises investments priced in other

currencies, principally US Dollars.

The Company invests in equities and other investments that are

realisable.

related party

These are listed in note 10 to the half yearly condensed

financial transactions statements.

By Order of the Board

Peregrine Moncreiffe

Chairman

16 September 2019

responsibility statement

The Directors confirm to the best of their knowledge that:

-- The condensed set of financial statements contained within

this half yearly financial report have been prepared in accordance

with International Accounting Standard ("IAS") 34 'Interim

Financial Reporting' as adopted by the European Union and gives a

true and fair view of the assets, liabilities, financial position

and profit of the Company; and

-- The half yearly financial report includes a fair review of

the information required by the FCA's Disclosure and Transparency

Rule 4.2.7R being disclosure of important events that have occurred

during the first six months of the financial year, their impact on

the condensed set of financial statements and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The half yearly financial report includes a fair review of

the information required by the Disclosure and Transparency Rule

4.2.8R being disclosure of related party transactions during the

first six months of the financial year, how they have materially

affected the financial position of the Company during the period

and any changes therein.

The half yearly financial report was approved by the Board on 16

September 2019 and the above responsibility statement was signed on

its behalf by:

Peregrine Moncreiffe

Chairman

16 September 2019

condensed statement of comprehensive income (unaudited)

Six months ended Six months ended

31 July 31 July

2019 2018

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Income 6,880 - 6,880 5,273 - 5,273

Net gains on investments at fair

value - 53,377 53,377 - 44,404 44,404

Currency exchange gains - 188 188 - 129 129

------------------------------------ --------- ----------------- -------- --------- ----------------- --------

total income 6,880 53,565 60,445 5,273 44,533 49,806

Expenses

Investment management fee (note 10) (2,705) - (2,705) (2,546) - (2,546)

Other expenses (504) - (504) (338) - (338)

------------------------------------ --------- ----------------- -------- --------- ----------------- --------

return before taxation 3,671 53,565 57,236 2,389 44,533 46,922

Taxation - - - - - -

------------------------------------ --------- ----------------- -------- --------- ----------------- --------

return for the period 3,671 53,565 57,236 2,389 44,533 46,922

------------------------------------ --------- ----------------- -------- --------- ----------------- --------

earnings per ordinary share (note 5)

Basic 400.2p 325.3p

Diluted 400.1p 324.9p

The total column of the statement is the Statement of

Comprehensive Income of the Company prepared in accordance with

International Financial Reporting Standards ("IFRS"). As adopted by

the EU. The supplementary revenue and capital columns are presented

for information purposes as recommended by the Statement of

Recommended Practice ("SORP") issued by the Association of

Investment Companies ("AIC").

All items in the above Statement derive from continuing

operations. No operations were acquired or discontinued in the

period.

The accompanying notes are an integral part of these financial

statements.

Year ended

31 January

2019

Revenue Capital Total

GBP'000 GBP'000 GBP'000

11,645 - 11,645 Income

- 31,095 31,095 Net gains on investments at fair value

- 271 271 Currency exchange gains

-------------- ------------------ ------------------ --------------------------------------------------

11,645 31,366 43,011 total income

Expenses

(5,091) (1,788) (6,879) Investment management fee (note 10)

(714) - (714) Other expenses

-------------- ------------------ ------------------ --------------------------------------------------

5,840 29,578 35,418 return before taxation

- - - Taxation

-------------- ------------------ ------------------ --------------------------------------------------

5,840 29,578 35,418 return for the period

-------------- ------------------ ------------------ --------------------------------------------------

earnings per ordinary share (note 5)

246.2p Basic

245.8p Diluted

condensed statement of changes in equity (unaudited)

Share Share

Share options premium Capital

capital reserve account reserve

GBP'000 GBP'000 GBP'000 GBP'000

six months ended 31 July 2019

31 January 2019 716 24 1,301 524,316

Total comprehensive income for the period - - - 53,565

Shares purchased for cancellation (7) - - (3,927)

------------------------------------------- -------- -------- -------- ---------

31 July 2019 709 24 1,301 573,954

------------------------------------------- -------- -------- -------- ---------

six months ended 31 July 2018

31 January 2018 721 55 1,301 498,123

Total comprehensive income for the period - - - 44,533

------------------------------------------- -------- -------- -------- ---------

31 July 2018 721 55 1,301 542,656

------------------------------------------- -------- -------- -------- ---------

year ended 31 January 2019

31 January 2018 721 55 1,301 498,123

Total comprehensive income for the year - - - 29,578

Shares purchased for cancellation (5) - - (2,920)

Share option discharge - (31) - (465)

------------------------------------------- -------- -------- -------- ---------

31 January 2019 716 24 1,301 524,316

------------------------------------------- -------- -------- -------- ---------

The accompanying notes are an integral part of these financial

statements.

Capital

redemption Revenue

reserve reserve Total

GBP'000 GBP'000 GBP'000

six months ended 31 July 2019

154 4,914 531,425 31 January 2019

- 3,671 57,236 Total comprehensive income for the period

7 - (3,927) Shares purchased for cancellation

-------------- ------------- ----------------- ------------------------------------------

161 8,585 584,734 31 July 2019

-------------- ------------- ----------------- ------------------------------------------

six months ended 31 July 2018

149 (926) 499,423 31 January 2018

- 2,389 46,922 Total comprehensive income for the period

-------------- ------------- ----------------- ------------------------------------------

149 1,463 546,345 31 July 2018

-------------- ------------- ----------------- ------------------------------------------

year ended 31 January 2019

149 (926) 499,423 31 January 2018

- 5,840 35,418 Total comprehensive income for the year

5 - (2,920) Shares purchased for cancellation

- - (496) Share option discharge

-------------- ------------- ----------------- ------------------------------------------

154 4,914 531,425 31 January 2019

-------------- ------------- ----------------- ------------------------------------------

condensed balance sheet (unaudited)

As at As at As at

31 July 31 July 31 January

2019 2018 2019

GBP'000 GBP'000 GBP'000

non current assets

Investments at fair value through profit or loss 569,914 526,415 500,696

------------------------------------------------------------ --------- --------- -----------

569,914 526,415 500,696

current assets

Trade and other receivables 2,961 11,279 19,623

Cash and cash equivalents 12,865 11,066 30,669

------------------------------------------------------------ --------- --------- -----------

15,826 22,345 50,292

------------------------------------------------------------ --------- --------- -----------

total assets 585,740 548,760 550,988

------------------------------------------------------------ --------- --------- -----------

current liabilities

Trade and other payables (1,006) (2,415) (19,563)

------------------------------------------------------------ --------- --------- -----------

total liabilities (1,006) (2,415) (19,563)

------------------------------------------------------------ --------- --------- -----------

total assets less current liabilities 584,734 546,345 531,425

------------------------------------------------------------ --------- --------- -----------

net assets 584,734 546,345 531,425

------------------------------------------------------------ --------- --------- -----------

represented by:

Share capital 709 721 716

Share options reserve 24 55 24

Share premium account 1,301 1,301 1,301

Capital reserve 573,954 542,656 524,316

Capital redemption reserve 161 149 154

Revenue reserve 8,585 1,463 4,914

------------------------------------------------------------ --------- --------- -----------

total equity attributable to equity holders of the company 584,734 546,345 531,425

------------------------------------------------------------ --------- --------- -----------

net asset value per ordinary share (note 6):

Basic 4,120p 3,787p 3,710p

Diluted 4,118p 3,782p 3,708p

The accompanying notes are an integral part of these financial

statements.

condensed cash flow statement (unaudited)

Six months Six months

ended ended Year ended

31 July 31 July 31 January

2019 2018 2019

GBP'000 GBP'000 GBP'000

cash flows from operating activities

Investment income received 5,502 4,036 9,002

Deposit interest received 13 5 15

Other income - - -

Investment Manager's fees and performance fees paid (4,463) (3,654) (7,686)

Share based payment - discharge of options - - (496)

Other cash payments (987) (847) (826)

------------------------------------------------------ ----------- ----------- -------------

cash generated/(expended) from operations (note 8) 65 (460) 9

Taxation paid - - -

------------------------------------------------------ ----------- ----------- -------------

net cash inflow/(outflow) from operating activities 65 (460) 9

cash flows from investing activities

Purchases of investments (185,307) (195,357) (358,127)

Sales of investments 171,297 196,188 380,966

------------------------------------------------------ ----------- ----------- -------------

net cash (outflow)/inflow from investing activities (14,010) 831 22,839

------------------------------------------------------ ----------- ----------- -------------

cash flows from financing activities

Repurchase of Ordinary Shares for cancellation (3,927) - (2,920)

------------------------------------------------------ ----------- ----------- -------------

net cash outflow from financing activities (3,927) - (2,920)

------------------------------------------------------ ----------- ----------- -------------

(decrease)/increase in cash and cash

equivalents for the period (17,872) 371 19,928

cash and cash equivalents at the start of the period 30,669 10,653 10,653

Revaluation of foreign currency balances 68 42 88

------------------------------------------------------ ----------- ----------- -------------

cash and cash equivalents at the end of

the period 12,865 11,066 30,669

------------------------------------------------------ ----------- ----------- -------------

The accompanying notes are an integral part of these financial

statements.

notes to the financial statements (unaudited)

1. a) basis of accounting

North Atlantic Smaller Companies Investment Trust plc ("NASCIT")

is a company incorporated and registered in England and Wales. The

principal activity of the Company is that of an investment trust

company within the meaning of Sections 1158/1159 of the Corporation

Tax Act 2010.

The condensed financial statements of the Company have been

prepared in accordance with International Accounting Standard (IAS)

34 - "Interim Financial Reporting" as adopted by the EU. The

accounting policies and methods of computation followed in these

half-yearly condensed financial statements are consistent with the

most recent annual financial statements for the year ended 31

January 2019 included in the Annual Report.

The financial statements have also been prepared in accordance

with the AIC SORP for the financial statements of investment trust

companies and venture capital trusts, except to any extent where it

is not consistent with the requirements of IFRS.

The financial information contained in this Half-Yearly Report

does not constitute statutory accounts as defined in the Companies

Act 2006. The financial information for the periods ended 31 July

2019 and 31 July 2018 have not been audited or reviewed by the

Company's Auditor. The figure and financial information for the

year ended 31 January 2019 are an extract from the latest published

audited financial statements, which have been filed with the

Registrar of Companies. The report of the Auditor on those

financial statements was unqualified and did not contain a

statement under either Section 498(2) or 498(3) of the Companies

Act 2006.

b) functional currency

The functional currency of the Company is Pounds Sterling

because this is the primary economic currency in which the Company

operates. The financial statements are presented in Pounds Sterling

rounded to the nearest thousand, except where otherwise

indicated.

c) significant accounting policies

The accounting policies applied are consistent with those of the

Annual Financial Report for the year ended 31 January 2019. Since

the year end no new standards have been adopted.

d) segmental reporting

The Directors are of the opinion that the Company is engaged in

a single segment of business, being investment business. The

Company invests in smaller companies principally based in countries

bordering the North Atlantic Ocean.

e) going concern

The financial statements have been prepared on a going concern

basis and on the basis that approval as an investment trust company

will continue to be met.

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has the resources to continue in operational existence for the

foreseeable future (being a period of at least 12 months from the

date these financial statements were approved). Furthermore, the

Directors are not aware of any material uncertainties that may cast

significant doubt upon the Company's ability to continue as a going

concern, having taken into account the liquidity of the Company's

investment portfolio and the Company's financial position in

respect of its cash flows, borrowing facilities and investment

commitments (of which there are none of significance). Therefore,

the financial statements have been prepared on the going concern

basis.

2. investment management and performance fees

A Performance Fee is only payable if the investment portfolio,

including Oryx at the adjusted price, outperforms the Sterling

adjusted Standard & Poor's 500 Composite Index at the end of

each financial year and is limited to a maximum payment of 0.5% of

Shareholders' Funds, and is allocated 100% to capital.

An amount would be included in these financial statements for

the Performance Fee that could be payable based on investment

performance to 31 July 2019. At that date, no Performance Fee,

inclusive of VAT, has been accrued for in the accounts (31 July

2018: GBPnil; 31 January 2019: GBP1,788,000).

3. taxation

The Company has an effective tax rate of 0%. The estimated

effective tax rate is 0% as investment gains are exempt from tax

owing to the Company's status as an Investment Trust and there is

expected to be an excess of management expenses over taxable income

and thus there is no charge for corporation tax.

During the half year to 31 July 2019, the Company recognised a

total charge of GBPnil (half year to 31 July 2018: GBPnil, year

ended 31 January 2019: GBPnil), representing irrecoverable

withholding tax paid on overseas investment income.

4. dividends

A final dividend for the year ended 31 January 2019 of 30p per

Ordinary Share has been declared by the Board, with an Ex date of

31 October 2019 and a payment date of 21 November 2019.

5. earnings per ordinary share

Revenue Capital

Net Per Net Per

return Ordinary Share return Ordinary Share

GBP'000 Shares pence GBP'000 Shares pence

six months ended 31 July 2019

Basic return per Share 3,671 14,300,663 25.7 53,565 14,300,663 374.5

Share options* - 5,067 - 5,067

-------- ----------- -------- -----------

Diluted return per Share 3,671 14,305,703 25.7 53,565 14,305,703 374.4

-------- ----------- -------- -----------

six months ended 31 July 2018

Basic return per Share 2,389 14,425,620 16.6 44,533 14,425,620 308.7

Share options* - 14,885 - 14,885

-------- ----------- -------- -----------

Diluted return per Share 2,389 14,440,505 16.5 44,533 14,440,505 308.4

-------- ----------- -------- -----------

year ended 31 January 2019

Basic return per Share 5,840 14,388,359 40.6 29,578 14,388,359 205.6

Share options* - 20,895 - 20,895

-------- ----------- -------- -----------

Diluted return per Share 5,840 14,409,254 40.5 29,578 14,409,254 205.3

-------- ----------- -------- -----------

Basic return per Ordinary Share has been calculated using the

weighted average number of Ordinary Shares in issue during the

period.

* Excess of total number of potential shares on Option

Conversion over the number that could be issued at the average

market price, as calculated in accordance with IAS 33: Earnings per

share.

Total

Net Per

return Ordinary Share

GBP'000 Shares pence

six months ended 31 July 2019

57,236 14,300,663 400.2 Basic return per Share

- 5,067 Share options*

-------- ------------

57,236 14,305,703 400.1 Diluted return per Share

-------- ------------

six months ended 31 July 2018

46,922 14,425,620 325.3 Basic return per Share

- 14,885 Share options*

-------- ------------

46,922 14,440,505 324.9 Diluted return per Share

-------- ------------

year ended 31 January 2019

35,418 14,388,359 246.2 Basic return per Share

- 20,895 Share options*

-------- ------------

35,418 14,409,254 245.8 Diluted return per Share

-------- ------------

Basic return per Ordinary Share has been calculated using the

weighted average number of Ordinary Shares in issue during the

period.

* Excess of total number of potential shares on Option

Conversion over the number that could be issued at the average

market price, as calculated in accordance with IAS 33: Earnings per

share.

6. net asset value per ordinary share

The basic net asset value per Ordinary Share is based on net

assets of GBP584,734,000 (31 July 2018: GBP546,345,000; 31 January

2019: GBP531,425,000) and on 14,192,757 Ordinary Shares (31 July

2018: 14,425,620; 31 January 2019: 14,325,620) being the number of

Ordinary Shares in issue at the period end.

The diluted net asset value per Ordinary Share is calculated on

the assumption that all 10,000 (31 July 2018: 30,000; 31 January

2019: 10,000) Share Options in-the-money were exercised at the

prevailing exercise prices, giving a total of 14,202,757 issued

Ordinary Shares (31 July 2018: 14,455,620; 31 January 2019:

14,335,620).

During the period, 132,863 Ordinary shares were bought back for

cancellation, at a total cost to the Company of GBP3,900,000.

adjustment for Oryx

The Company has also reported an adjusted net asset value per

share using equity accounting, in accordance with its previous

method of valuing its investment in Oryx. The Company has chosen to

report this net asset value per share to show the difference

derived if equity accounting were to be used. Equity accounting

permits the use of net asset value pricing for listed assets which

in the case of Oryx is higher than its fair value.

The values of Oryx, as at each period end, are as follows:

31 July 2019 31 July 2018 31 January 2019

GBP'000 GBP'000 GBP'000

Oryx at Fair value (traded price) 57,960 59,940 57,776

Oryx value using Equity Accounting 77,059 67,968 67,270

Increase in net assets using Equity Accounting 19,099 8,028 9,494

31 July 2019 31 July 2018 31 January 2019

Net asset value per Share

- Basic 4,120p 3,787p 3,710p

- Diluted 4,118p 3,782p 3,708p

Net asset value per Share adjusted

- Basic 4,255p 3,843p 3,776p

- Diluted 4,253p 3,838p 3,774p

7. share based remuneration

As at 31 July 2019, there were a total of 10,000 (31 July 2018:

30,000; 31 January 2019: 10,000) options in issue with an estimated

fair value of GBP24,000 under the 2011 options scheme.

8. reconciliation of total return before taxation to cash

(expended)/generated from operations

Six months Six months

ended ended Year ended

31 July 31 July 31 January

2019 2018 2019

GBP'000 GBP'000 GBP'000

Total return before taxation 57,236 46,922 35,418

Gains on investments (53,565) (44,533) (31,366)

Interest reinvested (1,050) - (3,500)

Share option discharge - - (496)

Net return from Subsidiary (7) (7) (7)

(Increase)/decrease in debtors and accrued income (365) (805) 847

Decrease in creditors and accruals (2,184) (2,037) (887)

--------------------------------------------------- ----------- ----------- -----------

Cash generated/(expended) from operations 65 (460) 9

--------------------------------------------------- ----------- ----------- -----------

9. investments

financial assets at fair value through profit or loss

This requires the Company to classify fair value measurements

using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. The fair value hierarchy

consists of the following three levels:

-- Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

-- Level 2 - Inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from

prices).

-- Level 3 - Inputs for the asset or liability that are not

based on observable market data (unobservable inputs).

The level in the fair value hierarchy within which the fair

value measurement is categorised in its entirety is determined on

the basis of the lowest level input that is significant to the fair

value measurement in its entirety.

For this purpose, the significance of an input is assessed

against the fair value measurement in its entirety. If a fair value

measurement uses observable inputs that require significant

adjustment based on unobservable inputs, that measurement is a

Level 3 measurement. Assessing the significance of a particular

input to the fair value measurement in its entirety requires

judgement, considering factors specific to the asset or

liability.

The determination of what constitutes 'observable' requires

significant judgement by the Company. The Company considers

observable data from investments actively traded in organised

financial markets, fair value is generally determined by reference

to Stock Exchange quoted market bid prices at the close of business

on the Balance Sheet date, without adjustment for transaction costs

necessary to realise the asset.

The table below sets out fair value measurements as at the

period end, by the level in the fair value hierarchy into which the

fair value measurement is categorised.

six months ended 31 July 2019

Total Level 1 Level 2 Level 3

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 447,339 372,822 - 74,517

Fixed interest investments 122,575 82,249 - 40,326

---------------------------- -------- --------- -------- --------

Total 569,914 455,071 - 114,843

---------------------------- -------- --------- -------- --------

six months ended 31 July 2018

Total Level 1 Level 2 Level 3

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 397,117 334,188 - 62,929

Fixed interest investments 129,298 87,089 - 42,209

---------------------------- -------- --------- -------- --------

Total 526,415 421,277 - 105,138

---------------------------- -------- --------- -------- --------

year ended 31 January 2019

Total Level 1 Level 2 Level 3

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 364,801 297,472 - 67,329

Fixed interest investments 135,895 90,893 - 45,002

---------------------------- --------- --------- -------- --------

Total 500,696 388,365 - 112,331

---------------------------- --------- --------- -------- --------

reconciliation of level 3 movement - financial assets at 31 July

2019

Fixed interest

Equity

Total investments investments

GBP'000 GBP'000 GBP'000

Opening balance at 31 January 2019 112,331 67,329 45,002

Purchases 10,724 - 10,724

Sales (19,579) (2,953) (16,626)

Total gains included in gains on

investments in the statement of

comprehensive income:

- on assets sold 2,045 1,656 389

- on assets held at the end of the

period 9,322 8,485 837

------------------------------------ --------- ------------ ---------------

Closing balance 114,843 74,517 40,326

------------------------------------ --------- ------------ ---------------

unquoted at directors' estimate of fair value

Unquoted investments are valued in accordance with the

International Private Equity and Venture Capital Valuation ("IPEV")

Guidelines. Their valuation incorporates all factors that market

participants would consider in setting a price. The primary

valuation techniques employed to value the unquoted investments are

earnings multiples, recent transactions and the net asset basis.

Valuations in local currency are translated into Sterling at the

exchange rate ruling on the Balance Sheet date.

Included within the Statement of Comprehensive Income as at 31

July 2019, is a gain of GBP9,322,000 relative to the movement in

the fair value of the unquoted investments valued using IPEV

valuation techniques.

the valuation techniques applied are based on the following

assumptions:

Unquoted investments are usually valued by reference to the

valuation multiples of similar listed companies or from

transactions of similar businesses. Where appropriate discounts are

then applied to those comparable multiples to reflect differences

in size and liquidity. These enterprise values are then adjusted

for net debt to arrive at an equity valuation. Where companies are

in compliance with the loan note terms these loans are generally

held at par plus accrued interest (where applicable) unless the

enterprise value suggests that the debt cannot be recovered.

10. related party transactions

There have been no changes to the related party arrangements or

transactions as reported in the Statutory Annual Financial Report

for the year ended 31 January 2019.

The Manager, Harwood Capital LLP, is regarded as a related party

of the Company. The amounts payable to the Manager and Growth

Financial Services Limited in respect of investment management for

the six months to 31 July 2019 are as follows:

Six months Six months

ended ended Year ended

31 July 31 July 31 January

2019 2018 2019

GBP'000 GBP'000 GBP'000

Annual fee 2,705 2,546 5,091

Performance fee - - 1,743

Irrecoverable VAT thereon - - 45

--------------------------- ----------- ----------- -----------

2,705 2,546 6,879

--------------------------- ----------- ----------- -----------

Fees paid to Directors, for the six months ended 31 July 2019

amounted to GBP65,000 (six months ended 31 July 2018: GBP65,000;

year ended 31 January 2019: GBP130,000).

Shareholders should also note any payments made under share

based remuneration as disclosed in note 7 to these financial

statements.

shareholder information

financial calendar

Announcement of results and annual report May

Annual General Meeting June

Half Yearly figures announced September

Half Yearly Report posted September

share price

The Company's mid-market share price is quoted daily in the

Financial Times appearing under "Investment Companies".

It also appears on:

SEAQ Ordinary Shares: NAS

Trustnet: www.trustnet.com

net asset value

The latest net asset value of the Company can be found on the

Harwood Capital LLP website:

www.harwoodcapital.co.uk

share dealing

Investors wishing to purchase more Ordinary Shares or dispose of

all or part of their holding may do so through a stockbroker. Many

banks also offer this service.

The Company's registrars are Link Asset Services. In the event

of any queries regarding your holding of shares, please contact the

registrars on: 0871 664 0300, or by email on

enquiries@linkgroup.co.uk

Changes of name or address must be notified to the registrars in

writing at:

Link Asset Services

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

Directors

Peregrine Moncreiffe (Chairman)

Christopher Mills (Chief Executive)

Lord Howard of Rising

G Walter Loewenbaum

Sir Charles Wake

Manager

Harwood Capital LLP

(Authorised and regulated by the Financial Conduct

Authority)

6 Stratton Street

Mayfair

London W1J 8LD

Telephone: 020 7640 3200

Financial Adviser and Stockbroker

Winterflood Investment Trusts

The Atrium Building

Cannon Bridge

25 Dowgate Hill

London EC4R 2GA

Registered Office

6 Stratton Street

Mayfair

London W1J 8LD

Telephone: 020 7640 3200

Registrars

Link Asset Services

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

Auditors

KPMG LLP

15 Canada Square

London E14 5GL

Company Secretary

Derringtons Limited

Hyde Park House

5 Manfred Road

London SW15 2RS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EQLFFKKFFBBL

(END) Dow Jones Newswires

September 16, 2019 11:17 ET (15:17 GMT)

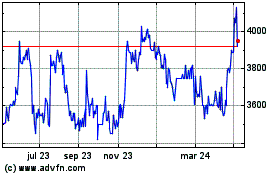

North Atlantic Smaller C... (LSE:NAS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

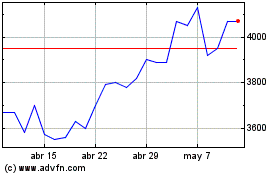

North Atlantic Smaller C... (LSE:NAS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024