TIDMMERC

RNS Number : 6528X

Mercia Asset Management PLC

20 December 2019

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, THE REPUBLIC OF

IRELAND, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

20 December 2019

Mercia Asset Management PLC

("Mercia" or the "Company")

Result of General Meeting

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused specialist asset manager, is pleased to announce

that, further to the announcements made on 3 December 2019, at the

General Meeting held earlier today at 10.00 a.m. (UK time), all

resolutions were duly passed. Accordingly, it is expected that

Admission will become effective and dealings in the Placing Shares

will commence at 8.00 a.m. on 23 December 2019, with admission of

the Initial Consideration Shares expected to become effective by no

later than 8.00 a.m. on 30 December 2019.

Issue of Equity, Admissions and Total Voting Rights

A total of 136,800,000 New Ordinary Shares are being issued and

allotted pursuant to the Placing and Acquisition, comprising of

120,000,000 Placing Shares and 16,800,000 Initial Consideration

Shares. The Placing Shares and the Initial Consideration Shares are

being credited as fully paid and will be identical to and rank pari

passu in all respects with the existing Ordinary Shares.

Following Admission of the Placing Shares, the issued share

capital of the Company will consist of 423,309,707 Ordinary Shares,

with one voting right each. Following the admission of the Initial

Consideration Shares, the issued share capital of the Company will

increase to 440,109,707 Ordinary Shares. The Company does not hold

any Ordinary Shares in treasury.

The above figures may be used by shareholders in the Company,

following completion of the Placing and/or the Acquisition (as

appropriate), as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

The definitions referenced in this announcement remain the same

as those from the announcement published at 7:01 a.m. (UK) on 3

December 2019, unless otherwise stated.

Commenting on the result of the General Meeting, Ian Metcalfe,

Non-executive Chair of Mercia Asset Management PLC, said:

"On behalf of the Board, I am pleased that shareholders have

voted overwhelmingly in favour of all resolutions proposed at

Mercia's General Meeting held earlier today, with over 96% of all

votes cast in favour of each of the four resolutions. As a company,

we greatly value the support of and engagement with all of our

shareholders, and we remain thoroughly committed to growing

shareholder value. The proceeds of the Placing will enable Mercia

to cement its position as a proactive specialist asset manager,

focused on high-growth regional SMEs, via the acquisition of the

NVM VCT business, which will now proceed as planned. The Placing

also enables the Group to evergreen its balance sheet, with future

direct investments funded from periodic portfolio cash

realisations.

The NVM VCT business is highly complementary to Mercia's

existing venture capital activities and the Board is delighted to

be acquiring the significant fund management contracts and

welcoming a high-quality investment team into the enlarged

Group.

I am confident that Mercia is well positioned to deliver

significant shareholder value in the near to medium-term and look

forward to that journey, alongside all of our shareholders, in the

years ahead."

For further information, please contact:

Mercia Asset Management PLC +44 (0)330 223 1430

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial

Officer

www.mercia.co.uk

Canaccord Genuity Limited (NOMAD,

Joint Bookrunner and Joint Broker) +44 (0)20 7523 8000

Simon Bridges, David Tyrrell, Richard

Andrews

N+1 Singer (Joint Bookrunner and

Joint Broker)

Harry Gooden, Peter Steel, James

Moat +44 (0)20 7496 3000

Buchanan Communications +44 (0)20 7466 5000

Chris Lane, Vicky Hayns, Stephanie

Watson

www.buchanan.uk.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital; the Group's

'Complete Capital Solution'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK regional footprint through its eight

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia has c.GBP500million of assets under management and, since

its IPO in December 2014, has invested over GBP90million across its

direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the epic

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMBGBDDRDDBGCG

(END) Dow Jones Newswires

December 20, 2019 05:29 ET (10:29 GMT)

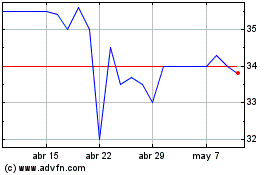

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

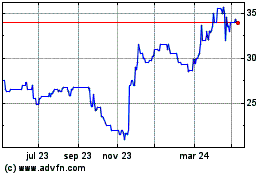

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024