TIDMWHR

RNS Number : 1596F

Warehouse REIT PLC

05 March 2020

5 March 2020

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART DIRECTLY OR INDIRECTLY, BY ANY MEANS OR MEDIA TO US PERSONS OR

IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH

THE PUBLICATION, DISTRIBUTION OR RELEASE OF THIS ANNOUNCEMENT WOULD

BE UNLAWFUL.

This announcement is an advertisement and does not constitute a

prospectus. Investors must subscribe for or purchase any shares

referred to in this announcement only on the basis of information

contained in a prospectus expected to be published later today by

Warehouse REIT plc (the "Prospectus") in its final form and not in

reliance on this announcement. A copy of the Prospectus will,

following publication, be available for inspection from the

Company's registered office and on its website (

www.warehousereit.co.uk). This announcement does not constitute,

and may not be construed as, an offer to sell or an invitation or

recommendation to purchase, sell or subscribe for any securities or

investments of any description, or a recommendation regarding the

issue or the provision of investment advice by any party.

Terms not otherwise defined in this announcement have the

meanings that will be given to them in the Prospectus.

Warehouse REIT plc

(the "Company" or "Warehouse REIT")

Publication of Prospectus

Further to the announcement made earlier today in connection

with the Proposed Placing, Open Offer, Offer for Subscription and

Intermediaries Offer, Warehouse REIT is pleased to announce that

the Prospectus has now been approved by the FCA.

A copy of the Prospectus will be submitted to the National

Storage Mechanism and will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM and on the Company's website at

www.warehousereit.co.uk. Hard copies of the Prospectus will also be

available from the Company's registered office at Beaufort House,

51 New North Road, Exeter, EX4 4EP.

Enquiries:

Warehouse REIT plc (via FTI Consulting)

+44 (0) 1244 470

Tilstone Partners Limited 090

Andrew Bird, Peter Greenslade, Paul Makin

Peel Hunt (Nominated Adviser, Sole Broker +44 (0) 20 7418

and Bookrunner) 8900

Corporate: Capel Irwin, Carl Gough, Harry

Nicholas

Intermediaries: Sohail Akbar

FTI Consulting (Financial PR & IR Adviser +44 (0) 20 3727

to the Company) 1000

Dido Laurimore, Ellie Sweeney, Richard Gotla

G10 Capital Limited (part of the IQEQ Group), +44 (0) 20 3696

AIFM 1302

Maria Glew, Gerhard Grueter

Important notice

Disclaimer

The information in this announcement is for background purposes

only and does not purport to be full or complete. No reliance may

be placed for any purpose on the information contained in this

announcement or its accuracy or completeness.

This announcement is an advertisement and not a prospectus and

investors should not purchase any shares referred to in this

announcement except on the basis of information in the

Prospectus.

This announcement has been issued by and is the sole

responsibility of the Company.

The material in this announcement is for informational purposes

only and does not constitute an offer of securities for sale or a

solicitation of any offer to buy securities in the United States,

Australia, Canada, Japan, New Zealand, the Republic of South Africa

or any other jurisdiction in which such an offer or solicitation is

unlawful. The securities referred to herein have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the Securities Act), or with any securities regulatory

authority of any state or other jurisdiction of the United States,

and may not be offered or sold within the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and any

applicable securities laws of any state or other jurisdiction of

the United States. No public offering of securities will be made in

the United States. The securities have not been approved or

disapproved by the United States Securities Exchange Commission,

the securities commission of any state of the United States, or any

other regulatory authority of the United States.

In relation to each Member State of the EEA and the UK (each a

"Relevant State"), no New Ordinary Shares have been offered or will

be offered pursuant to the Issue to the public in that Relevant

State prior to the publication of a prospectus in relation to the

New Ordinary Shares which has been approved by the competent

authority in that Relevant State, or, where appropriate, approved

in another Relevant State and notified to the competent authority

in that Relevant State, all in accordance with the Prospectus

Regulation, except that it may make an offer to the public in that

Relevant State of any New Ordinary Shares any time under the

following exemptions under the Prospectus Regulation:

-- to any legal entity which is a "qualified investor" as defined in the Prospectus Regulation;

-- to fewer than 150 natural or legal persons (other than

Qualified Investors as defined in the Prospectus Regulation);

or

-- in any other circumstances falling within Article 1(4) of the

Prospectus Regulation, provided that no such offer of New Ordinary

Shares shall result in a requirement for the publication of a

prospectus pursuant to Article 3 of the Prospectus Regulation or

supplemental prospectus pursuant to Article 23 of the Prospectus

Regulation.

For the purposes of this provision, the expression an "offer to

the public" in relation to any offer of New Ordinary Shares in any

Relevant State means a communication in any form and by any means

of sufficient information on the terms of the offer and any New

Ordinary Shares to be offered so as to enable an investor to decide

to purchase or subscribe for the New Ordinary Shares.

Any purchase of Ordinary Shares in the proposed Issue should be

made solely on the basis of the information contained in the final

Prospectus to be issued by the Company in connection with the Issue

and Admission. No reliance may or should be placed by any person

for any purposes whatsoever on the information contained in this

announcement or on its completeness, accuracy or fairness. The

information contained in this announcement is given at the date of

its publication (unless otherwise marked) and is subject to

updating, revision and amendment when the definitive Prospectus is

published. In particular, the proposals referred to herein are

tentative and are subject to verification, material updating,

revision and amendment.

The timetable for the Issue, including the date of Admission,

may be influenced by a range of circumstances such as market

conditions. There is no guarantee that the Issue and the Admission

will occur and you should not base your financial decisions on the

Company's intentions in relation to the Issue and Admission at this

stage. Acquiring Ordinary Shares to which this announcement relates

may expose an investor to a significant risk of losing all of the

amount invested. Persons considering making such an investment

should consult an authorised person specialising in advising on

such investments. This announcement does not constitute a

recommendation concerning the Issue. The value of Ordinary Shares

can decrease as well as increase. Potential investors should

consult a professional advisor as to the suitability of the Issue

for the person concerned. Past performance or information in this

announcement or any of the documents relating to the Issue cannot

be relied upon as a guide to future performance.

G10 is authorised and regulated by the Financial Conduct

Authority. TPL is an appointed representative of G10 which is

authorised and regulated by the FCA. Each of G10 and Peel Hunt is

authorised and regulated in the United Kingdom by the FCA and is

acting exclusively for the Company and no-one else in connection

with the Issue and Admission. They will not regard any other person

as their respective clients in relation to the Issue and Admission

and will not be responsible to anyone other than the Company for

providing the protections afforded to their respective clients, nor

for providing advice in relation to the Issue and Admission, the

contents of this announcement or any transaction, arrangement or

other matter referred to herein.

In connection with the Issue and Admission, Peel Hunt and any of

its respective affiliates, acting as investors for their own

accounts, may purchase Ordinary Shares and in that capacity may

retain, purchase, sell, offer to sell or otherwise deal for their

own accounts in such Ordinary Shares and other securities of the

Company or related investments in connection with the Issue and the

Admission or otherwise. Accordingly, references in the Prospectus,

once published, to the Ordinary Shares being issued, offered,

subscribed, acquired, placed or otherwise dealt in should be read

as including any issue or offer to, or subscription, acquisition,

placing or dealing by Peel Hunt and any of their affiliates acting

as investors for their own accounts. Peel Hunt does not intend to

disclose the extent of any such investment or transactions

otherwise than in accordance with any legal or regulatory

obligations to do so.

Peel Hunt, which is authorised and regulated by the FCA in the

United Kingdom, is acting as nominated adviser and broker for the

Company in connection with the Issue and no one else and will not

be responsible to anyone other than the Company for providing the

protections afforded to clients of Peel Hunt nor for providing

advice in relation to the Issue and/or any other matter referred to

in this Announcement.

None of the Company, TPL, G10 or Peel Hunt nor any of their

respective affiliates or agents accepts any responsibility or

liability whatsoever for, or makes any representation or warranty,

express or implied, as to this announcement, including the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to the Company, whether written,

oral or in a visual or electronic form, and howsoever transmitted

or made available or for any loss howsoever arising from any use of

the announcement or its contents or otherwise arising in connection

therewith. The Company, TPL, G10 and Peel Hunt and their respective

affiliates accordingly disclaim all and any liability whether

arising in tort, contract or otherwise which they might otherwise

have in respect of this announcement or its contents or otherwise

arising in connection therewith.

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

Each of the Company, TPL, G10 and Peel Hunt and their respective

affiliates expressly disclaim any responsibility, obligation or

undertaking to update, review or revise any forward-looking

statement contained in this announcement whether as a result of new

information, future developments or otherwise.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) MiFID II; (b) Articles 9 and 10 of Commission

Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c)

local implementing measures (together, the "Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the New Ordinary Shares have

been subject to a product approval process, which has determined

that the New Ordinary Shares are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, it should be noted

that: (i) the price of the New Ordinary Shares may decline and

investors could lose all or part of their investment; (ii) New

Ordinary Shares offer no guaranteed income and no capital

protection; and (iii) an investment in New Ordinary Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result

therefrom.

The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Issue. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, Peel Hunt will

only procure investors who meet the criteria of professional

clients and eligible counterparties. For the avoidance of doubt,

the Target Market Assessment does not constitute: (a) an assessment

of suitability or appropriateness for the purposes of MiFID II; or

(b) a recommendation to any investor or group of investors to

invest in, or purchase, or take any other action whatsoever with

respect to New Ordinary Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and for

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PDIFELFBBXLLBBF

(END) Dow Jones Newswires

March 05, 2020 06:22 ET (11:22 GMT)

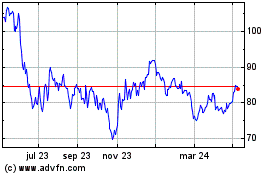

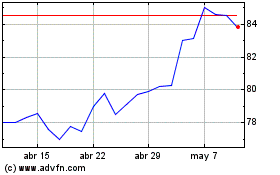

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024