TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

Armadale Capital Plc

('Armadale' or 'the Company')

Final Results and Notice of AGM

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

announce its final results for the year ended 31 December 2019

('Final Results' or 'Annual Report'). The Company also announces

that its Annual General Meeting ('AGM') will be held at Level 25,

108 St George's Terrace, Perth, Western Australia on 30 June 2020

at 17.00 AWST (10:00 BST). A notice of AGM, together with printed

copies of the Company's full Annual Report for the year ended 31

December 2019 will be posted to shareholders today. Copies will

also be available to view on the Company's website:

www.armadalecapitalplc.com.

Highlights

-- Targeting commercial production at flagship Mahenge Liandu Graphite

Project in Tanzania in 2021 ('Mahenge' or 'Mahenge Liandu')

-- DFS confirms project as a long-life low-cost graphite project with

c.US$358m NPV and IRR of 91%

-- High-quality graphite flake of up to 97.1% purity

-- Staged ramp-up to facilitate near term production

-- Scope for further improvement - updated mine schedule ('Mine Schedule')

has increased average annual output to 109ktpa of concentrate over life

of mine, which is a 30% increase on the DFS

-- Updated feasibility study based on updated Mine Schedule anticipated

('Feasibility Study')

-- Poised to take advantage of increasing graphite demand as the electric

vehicle market rapidly expands with strategic MoUs in place for offtake

agreements

-- Bolstered board of directors ('Board') to reflect and support Armadale's

progression to a production company

-- Further upside potential from quoted portfolio, where the Directors

believe there are opportunities for capital gains

Nick Johansen, Chairman of Armadale said: "We look to the year

ahead with much anticipation. Having long held confidence in the

significant value potential of Mahenge Liandu, the project

continues to exceed our expectations as we progress towards

production. With an extensive and incredibly pure graphite resource

there is unquestionable market demand for our product -- as

highlighted through a number of strategic MoUs we have secured for

offtake agreements, but of course the critical element to the

viability of any project is ensuring the cost effectiveness of

getting this resource out of the ground. The DFS results prove that

Mahenge Liandu has significant commercial value; with a US$358m NPV

and IRR of 91% and potential to significantly increase this through

an optimised study currently being completed, the project's

economic profile is incredibly strong. Our focus now is to finalise

ongoing discussions with potential debt finance partners and

project level development funding so that we can commence

construction, whilst further progressing our application for a full

mining licence. With defined work programmes in place to deliver on

these objectives and further advance our project, we are committed

to commencing commercial production in 2021 and realising the value

of Mahenge Liandu for the benefit of all stakeholders."

Strategic Report

Operational and Corporate Highlights for Period Ending 31

December 2019

Significant progress made in delivering key accretive milestones

in advancing the Mahenge Liandu Graphite Project in Tanzania

1. Completed Resource Upgrade incorporating high-grade near

surface mineralisation intersected in drilling.

2. Delivered revised Resource estimate which, broken down by

categories is as follows:

-- Measured: 11.5Mt @ 10.5% vs Nil previously

-- Indicated: 32.1Mt @ 9.6% vs 38.7Mt @ 9.3% previously

-- Inferred: 15.9Mt @ 9.8% vs 12.4Mt @ 9.1% previously

3. Metallurgical test-work programme completed with results

confirming that high-quality graphite flake of up to 97.1% purity

can be produced

4. Targeting commercial production 2021

5. Further off-take MOU signed and discussions underway with

other potential customers

6. Advancing workstream to secure project level funding

mandate

Post Period End -- Key Data Announced From DFS

1. US$882m pre-tax cashflow generated from initial 17 year mine life

2. Estimated pre-tax NPV of US$358m (utilising a discount rate of 10%) and

IRR of 91%

3. Staged ramp-up planned to facilitate near term production with 60,000tpa

graphite concentrate to be produced for the first four years (Stage 1)

before increasing to 90,000tpa (Stage 2)

4. Capital cost estimate for Stage 1 is US$38.6m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost

5. 1.6-year payback for Stage 1 (after tax) based on an average sales price

of US$1,179/tonne. Stage 2 expansion is expected to be funded from

cashflow

Considerable scope for further positive improvement upon

economics in near-term through delivery of optimised DFS.

Post Period End - Other

1. Board strengthened with the previously announced appointments of Ms Amne

Suedi as Non-Executive Director in January 2020 and Mr Matt Bull as

Non-Executive Director in April 2020

2. Two additional MOUs signed to supply high quality graphite products

produced at Mahenge Liandu

3. Focus remains upon converting existing off-take agreements from MoUs to

binding offtake agreements

4. Continuation of application for full mining licence (thus furthering

major permitting milestones)

5. Advancement of discussions with potential debt finance partners and

project level development funding for construction

6. Ongoing review of quoted portfolio, where the Directors believe there are

opportunities for capital gains

7. Continue to actively review other exciting investment opportunities

During the year under review, Armadale continued to operate as a

diversified investing company focused on natural resource projects

in Africa. To this end, its portfolio is divided into two

groups:

-- Actively managed investments where the Company has majority ownership of

the investment; and

-- Passively managed investments where the Company has a minority investment,

typically in a quoted company, and does not have management control.

Currently, the Company's key actively managed investment is the

Mahenge Liandu Graphite Project in Tanzania.

With its large, high-grade open cut resource, and having

completed a Definitive Feasibility Study that highlighted an NPV of

US$358m and IRR of 91%, the Company is on track to commence

production at the Project during the course of 2022. This is timely

given that global need for graphite is set to accelerate driven by

demand for spherical graphite from the new energy sector as well as

emerging demand for expandable graphite used in products such as

fire-proof insulation.

Notably, the strength of the market was highlighted when, post

period end, the Company signed two additional off-take MOUs. The

Company is also currently reviewing other potential markets and

customers within this space.

Additionally, the Company continued to actively review other

investment opportunities with a view to targeting investments with

similar quality and potential as Mahenge Liandu.

ACTIVELY MANAGED INVESTMENTS

Mahenge Liandu Graphite Project, Tanzania

The Company continued to deliver excellent progress at its 100%

owned Mahenge Liandu Graphite Project during 2019. where an

extensive drilling campaign during the year delivered a meaningful

upgrade in the Mineral Resource Estimate for Mahenge where the

total Mineral Resource Estimate Increased to a JORC compliant

59.5Mt @ 9.8% Total Graphitic Content ('TGC') and making it one of

the largest high-grade graphite deposits in Tanzania.

The revised resources estimate broken down by categories is as

follows:

-- Measured: 11.5Mt @ 10.5% vs Nil previously

-- Indicated: 32.1Mt @ 9.6% vs 38.7Mt @ 9.3% previously

-- Inferred: 15.9Mt @ 9.8% vs 12.4Mt @ 9.1% previously

This upgrade reflects the substantial work undertaken by our

team on the ground in Tanzania this year and is a clear step

forward the development of Mahenge away from production.

In addition, the Company successfully completed an outstanding

metallurgical test-work programme where results which confirming

high-quality graphite flake of up to 97.1% purity convincingly

demonstrated that Armadale can produce a high-quality graphite

concentrate.

Work to date has demonstrated Mahenge Liandu's potential as a

project with compelling economics and a deposit with significant

tonnage, high-grade coarse flake and near surface mineralisation

(implying a low strip ratio) contained within one contiguous ore

body.

The focus of activities for the remainder of 2019 into 2020 was

the completion of a Definitive Feasibility Study ('DFS') which,

post-period end on 31 March 2020 delivered extremely compelling

economics. The study represented one of the most significant

de-risking milestones in the Company's history to date delivering

economics such as a 91% IRR and a 1.6 year payback upon

capital.

The DFS demonstrated that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$882m over an initial 17 year mine-life and

scope for further improvement work for which is currently

progressing with an updated DFS nearing completion.

Further details of the Definitive Feasibility Study may be found

below.

Project Location & Licences

The Mahenge Project is located in the Morogoro region, Ulanga

district, Tanzania close to existing transport infrastructure. It

is 10km south of the Mahenge township and about 76km via a

well-maintained dirt road to Ifakara after which it is 400km by

sealed road from Dar-es-Salaam port. Other operators in the region

include Blackrock Mining Limited and Kibaran Resources Limited,

which have similar product purity and resource grades.

Location of Mahenge Liandu Prospect

The Company holds following exploration tenements for Mahenge

Liandu:

-- PL10846/2016 granted on 21/9/2016 expires 20/9/2020 area 7.34 square

kilometres

-- PL10840/2016 granted 21/9/2016 expires 20/9/2020 area 21.89 square

kilometres

Project Geology

The prospect is situated within the pan African Mozambique belt,

which is the orogenic belt resulting from activities taking place

in the Neoproterozoic time. The belt extends along the eastern

border of Africa from Ethiopia through Kenya and Tanzania. The

orogenic event resulted in a complex series of geological events

including the rifting system. The belt consists of high-grade

mid-crustal rocks with a Neoproterozoic metamorphic overprint. It

is divided into the Western Granulite and Eastern Granulite. The

deposit is situated in the Eastern Granulites. The belt has

undergone retrograde metamorphism which resulted in the present

upper amphibolite metamorphic facies in the Project area.

Systematic drilling indicated the existence of broad, shallow to

steep dipping schists overlaying granitic gneisses/gneiss. The

gneisses are underlaid by marble units. The graphitic schists form

alternating compositional layering, with quartz being the content

that differentiates these units. High grade graphite schists

(graphite schist) have a lower composition of quartz. Medium to low

grade graphite schists (quartz graphite schist) have a higher

visual quartz percentage. The marble unit likely forms the base of

the sequence (there has not been drilling done beyond the marble

unit).

The drilling results have been very consistent with the

structural measurements taken during the mapping programme which

suggested gentle to steep dipping to the south and south-southwest.

The mineralisation remains open in all directions.

Definitive Feasibility Study

Post-period end a Definitive Feasibility Study was completed for

Mahenge Liandu, which included the completion of a mine

optimisation study, infill drilling and the resource upgrade.

Highlights of the Definitive Feasibility Study were as

follows

-- DFS confirms Mahenge in the board's view as a large, long life, low cost

graphite deposit with a focus on high quality graphite concentrate for

the rapidly emerging EV market

-- US$882m pre-tax cashflow generated from initial 17 year mine life

utilises just 25% of the resource, which remains open in multiple

directions offering significant further upside

-- Estimated pre-tax NPV of US$358m (utilising a discount rate of 10%) and

IRR of 91% with scope for further positive improvement upon economics in

near-term through delivery of optimised DFS

-- Staged ramp-up planned to facilitate near term production with 60,000tpa

graphite concentrate to be produced for the first four years (Stage 1)

before increasing to 90,000tpa (Stage 2)

-- Capital cost estimate for Stage 1 is US$38.6m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, a slight

increase on the scoping study allowing for the staged ramp up

-- 1.6 year payback for Stage 1 (after tax) based on an average sales price

of US$1,179/t

-- Stage 2 expansion is expected to be funded from cashflow

-- The outlook for the graphite market remains strong with the ongoing

development of the EV market

-- Scope for improvement of DFS economics through delivery of further

detailed modelling of higher-grade zones to increase the head grade in

the mine schedule - work is underway

-- Application for Mining Licence is planned to commence in Q3 2020

-- Projected timeline to first production is expected to be approximately

10-12 months from the start of construction

-- DFS delivery has confirmed the commercial potential of Mahenge and will

support ongoing discussions for offtake agreements, debt package finance

for construction and project level development funding

The Definitive Feasibility Study for the Mahenge Graphite

Project delivered extremely compelling economics. This study

represents one of the most significant de-risking milestones in the

Company's history to date. The Feasibility Study demonstrated

economics such as a 91% IRR and a 1.6 year payback upon capital.

The DFS showed that Armadale can be a significant low-cost supplier

to the graphite industry with the potential to generate pre-tax

cashflows of US$882m over an initial 17 year mine-life and scope

for further improvement

Environmental and Social Studies

During August 2018, the Company announced the completion of

field work for Environmental and Social baseline surveys and the

Company has finalised the Environmental Social Impact Assessment

('ESIA') and Relocation Action Plan ('RAP') for submission to the

National Environment Management Council ('NEMC').

To help increase local engagement in the Project area, the

Company has appointed a community liaison officer who will aid

understanding of the impact and benefits of mining in the region.

Further information in respect of this work of will be provided as

progress is made.

Product Marketing and Offtake Partners

In February 2019, the Company announced an MOU with the Matrass

Group, a China based graphite mining and processing company, for

high quality graphite products produced at Mahenge Liandu. This

includes a proposed offtake of 30,000tpa of graphite concentrate

for an initial five-year term at a price to be agreed based on the

Chinese benchmark for the quality of the graphite produced.

In September 2019, the Company announced an MOU with CoolRU

Information Technology, a China based technology company, for high

quality graphite products produced at Mahenge Liandu. This includes

a proposed offtake of 5,000tpa of graphite concentrate for an

initial five-year term at a price to be agreed based on the Chinese

benchmark for the quality of the graphite produced.

In October 2019, the Company announced an MOU with Datong

Resources ("Datong"), China, for high quality graphite products

produced at Mahenge Liandu. This includes a proposed offtake of

25,000tpa of graphite concentrate for an initial five-year term at

a price to be agreed based on the Chinese benchmark for the quality

of the graphite produced.

Offtakes under MOU total 60,000 tpa representing over 122% of

average target annual production. Work to progress these MOU to a

binding agreement is underway as are discussions with other

potential offtake partners.

The graphite market continues to strengthen with several

Tanzanian based graphite projects securing binding offtakes and

construction financing packages over recent months. The rapid

expansion of the electric vehicle market is expected to continue to

drive this growth.

Project Level Financing

The Company is engaged in discussions to secure a project level

funding mandate. Further details in respect of this element will be

provided as material developments occur.

Mining Lease Application

Reflecting the progress of work to date, the Company expects to

submit its application for a mining licence in August 2020.

Front End Engineering Design

Following completion of the DFS, the Company commenced some work

for the Front-End Engineering Design ('FEED') programme. The FEED

process is a detailed technical project planning phase undertaken

prior to the commencement of construction and used as a basis to

secure project construction bids.

Project Construction

Subject to a successful and timely completion of the

aforementioned preparatory work, suitable project level financing

and receipt of relevant regulatory permits and licences, the

Company expects to commence the construction phase in Q2 2021.

Production

Based on current estimates and assuming a construction phase of

10 months the first production would be achieved from the Mahenge

Liandu Project around Q1 2022.

PASSIVELY MANAGED INVESTMENTS

Mine Restoration Investments Limited ('MRI'), South Africa

The shares in MRI are being carried at Nil market value (2018:

Nil) as MRI shares were suspended from trading on the Johannesburg

Stock Exchange. The MRI shares continued to be suspended throughout

the year.

Quoted Portfolio

The Company has a small portfolio of quoted investments,

principally in resource companies where the Directors believe there

are opportunities for capital gain. The Company continues to keep

its portfolio under review. The Company's strategy with its quoted

portfolio is to gain exposure in projects that have the potential

to create short to medium term returns for the Company as well as

diversify the Company's exposure to a broader range of commodities

while being able to enter and exit the position with minimal cost

and time.

SUSTAINABLE DEVELOPMENT

The Company is committed to sustainable development and

conducting its business ethically. Given that the Company invests

in the mining industry, one of Armadale's key focuses is on

maintaining a high level of health and safety, environmentally

responsibility, and support for the communities close to its

investments.

CORPORATE INFORMATION

Principal risks and uncertainties

There are known risks associated with the mineral industry,

especially in Africa. The Board regularly reviews the risks to

which the Group is exposed and endeavours to minimise them as far

as possible. The following summary, which is not exhaustive,

outlines some of the risks and uncertainties currently facing the

Group:

-- The Group is exposed to graphite. Graphite is a relatively new commodity

whose market is being driven by demand in renewable energy. It is thus

vulnerable to global energy policies.

-- The impact of Brexit on companies operating in the UK is still being

monitored. Thus far Brexit has not impacted the Group's ability to raise

funds.

-- The exploration for and development of mineral resources involves

technical risks, infrastructure risks and logistical challenges, which

even a combination of careful evaluation and knowledge may not eliminate.

-- There can be no assurance that the Group's project will be fully

developed in accordance with current plans.

-- Future development work and subsequent financial returns arising may be

adversely affected by factors outside the control of the Group.

-- The availability and access to future funding within the global economic

environment.

-- The Group operates in multiple national jurisdictions and is therefore

vulnerable to changes in government policies which are outside its

control. The mining regulation changes in Tanzania are still being

evaluated, however they seem to have minimal impact on investment in

graphite mining. The Group continues to monitor the implementation of the

changes to evaluate and mitigate sovereign risks.

-- The impact of COVID-19 pandemic on the project is so far minimal as the

Company's site activities were substantially completed in 2019. However,

the financial impact on the Company is continuing to be evaluated and

strategies implemented to reduce cash outflow.

-- The Group is exposed to gold as the holder of a royalty on gold

production from its previously held gold project. The Group's potential

future royalty stream will be affected by fluctuations in the prevailing

market price of gold and to variations of the US dollar in which gold

sales will be denominated.

Some of the mitigation strategies the Group applies in its

present stage of development include, among others:

-- Proactive management to reducing fixed costs.

-- Rationalisation of all capital expenditures.

-- Maintaining strong relationships with government (employing local staff

and partial government ownership), which improves the Group's position as

a preferred small mining partner.

-- Engagement with local communities to ensure our activities provide value

to the communities where we operate.

-- Alternative and continued funding activities with a number of options to

secure future funding to continue as a going concern.

-- To address the financial impact of COVID-19, the Company recently reduced

Directors and office holders fees by 50% for an initial period of 3

months from April 2020. This will be reviewed again in June 2020.

The Directors regularly monitor such risks and will take actions

as appropriate to mitigate them. The Group manages its risks by

seeking to ensure that it complies with the terms of its

agreements, and through the application of appropriate policies and

procedures, and via the recruitment and retention of a team of

skilled and experienced professionals.

Key Performance Indicators

The Group's current key performance indicators ('KPIs') are the

performance of its underlying investments, measured in terms of the

development of the specific projects they relate to, the increase

in capital value since investment and the earnings generated for

the Group from the investment. The Directors consider that it is

still too early in the investment cycle of any of the investments

held, for meaningful KPIs to be given.

Success is also measured through the identification and

investment in suitable additional opportunities that fit the

Group's investment objectives.

Section 172 Statement

Section 172(1): A director of a company must act in the way he

considers, in good faith, would be most likely to promote the

success of the company for the benefit of its members as a whole,

and in doing so have regard (amongst other matters) to --

Section 172(1) (b) the interests of the company's employees,

Company's Comment: While the company is largely staffed by

contractor employees (rather than direct employees of the Company),

the directors consider that continuing active work on the Mahenge

Liandu Graphite Project to be in the best interest of such staff to

utilise their skills and develop their local communities. The board

seeks regular feedback from its key stakeholders (including staff

and advisers) to ensure that the corporate culture of the Company

remains highly ethical in terms of our Company's values and

behaviours.

Section 172(1) (c) the need to foster the company's business

relationships with suppliers, customers and others,

Company's Comment: The directors ensure that suppliers are

available and meeting commitments and there is good communication

with staff as a key requirement for high levels of engagement. This

is done by periodic and ad-hoc briefings and discussions.

Reasons to engage shareholders are to meet regulatory

requirements and understand shareholder sentiments on the business,

its prospects and performance of management.

This is done by regulatory news releases, keeping the investor

relations section of the website up to date, annual and half-year

reports and presentations and AGM.

Section 172(1) (d) the impact of the company's operations on the

community and the environment,

Company's Comment: The Company's activities impact communities

in the places where we operate and elsewhere. The Company engages

communities with employment / business development arrangements

within guidelines. Through preparation and compliance with

environmental and social management plans, which include the

regulatory requirements for the Company on its Mahenge Liandu

Graphite Project, the directors ensure that wherever possible its

activities have a positive impact on the community and avoid

adverse environmental impacts.

The Company has engaged the services of a local contact person

in Liandu who provides information to the community about our

intended project activities and is responsible for managing local

affairs and feedback to the Company. In the year ending 31 December

2019 the Company contributed funds to the local primary school for

food and other needs.

Section 172(1) (e) the desirability of the company maintaining a

reputation for high standards of business conduct, and

Company's Comment: The directors consider standards of business

conduct in all dealings of the Company. The members of the board

have a collective responsibility and obligation to promote the

interests of the Company and are collectively responsible for

defining standards of business conduct which includes corporate

governance arrangements. The board provides strategic leadership

for the Company and operates within the scope of our corporate

governance framework and sets the strategic goals for the

Company.

Section 172(1) (f) the need to act fairly as between members of

the company.

Company's Comment: The board takes feedback from a wide range of

shareholders (large and small) and endeavours at every opportunity

to pro-actively engage with all shareholders (via regular news

reporting-RNS) and engage with any specific shareholders in

response to particular queries they may have from time to time. The

board considers that its key decisions during the year have

impacted equally on all members of the Company.

Board

Post period end, in January 2020, Ms Amne Suedi was appointed to

the Board as a Non-executive Director.

Ms Suedi is a highly experienced legal professional who

specialises in Africa based investment and business law. Ms Suedi

is the founder and CEO of Shikana Law Group, a law firm in Kenya,

Zanzibar and Tanzania and headquartered in Dar es Salaam, which

provides legal and investment advice to foreign investors operating

in Africa. Previously Ms Suedi acted as a legal adviser to Pictet

Asset Management in Switzerland and the World Trade

Organisation.

In April 2020, Mr. Matt Bull was appointed to the Board as a

Non-executive Director.

Mr. Bull has served as Technical Director of the Company since

2016 and has led the development of the Mahenge Liandu Graphite

Project in Tanzania during that time. Mr. Bull is an experienced

geologist responsible for managing numerous exploration projects in

remote locations in Australia and Sub-Saharan Africa including the

running of multi-rig drilling programs with large support

teams.

Financial Results

For the year ended 31 December 20198 the Group did not earn any

revenues as its business related solely to the making of

investments in non-revenue producing resource projects and

companies.

The Group made a loss after tax of GBP0.273 million (2018:

GBP0.648 million) for the year ended 31 December 2019.

Expenditure on the Mahenge Liandu project during the year

amounted to GBP593,000, which was capitalised as additional

exploration and evaluation assets. The disposal of the Mpokoto

project was finalised in January and accumulated foreign exchange

gains, arising on annual restatement of the project's net assets,

of GBP240,000 were released to revenue reserves. A strategic

investment of GBP59,000 was made in shares of Forum Energy Metals

Corp, a company incorporated in Canada and listed on the Toronto

Stock Exchange. By 31 December 2019, the value of this investment

had risen to GBP105,000.

Funds raised during the year amounted in total to GBP1.3 million

of which GBP0.9 million came from placings of shares and GBP0.4

million from an issue of convertible loan notes. Other share issues

during the year were in respect of loan note conversions and the

discharge of certain consultants' invoices. A new loan facility of

GBP0.3 million was put in place but no drawdown was made during the

year. Since the year end, a further GBP0.7 million has been raised

from a placing of shares and from warrant and option exercises and

GBP230,000 of the loan notes issued in 2019 have been converted

into ordinary shares. The balance of the new loan facility, GBP0.25

million, remains available for drawdown.

At 31 December 2019, the Group had cash of GBP96,000 (2018:

GBP44,000) and debt of GBP867,000 (2018: GBP677,000).

Outlook

Looking to the future, with its clear development path to

production, the Directors believe that Mahenge Liandu represents an

exciting opportunity for the Group. As identified in the going

concern note to the Directors' Report, the Company's ability to

achieve its strategy with respect to the project is dependent on

the further fundraising. Furthermore, other notable investment

opportunities are under review, which the board believe could

replicate this success and deliver significant value to

shareholders.

Nicholas Johansen

Director

4 June 2020

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2019

2019 2018

GBP GBP

Administrative expenses (468,948) (392,945)

Share based payment charges (22,550) -

Change in fair value of derivative (45,467) -

Change in fair value of investments 46,145

Operating loss (490,820) (392,945)

Finance costs (21,241) (17,459)

Loss before taxation (512,061) (410,404)

Taxation - -

Loss for the year from continuing operations (512,061) (410,404)

Profit/(Loss) from discontinued operations, net of tax 239,513 (237,616)

Loss after taxation (272,548) (648,020)

Other comprehensive income

Items that may be reclassified to profit or loss:

Reclassification of foreign exchange gain (239,513)

Exchange differences on translating foreign entities (93,571) 83,407

Total comprehensive (loss) / income attributable to the

equity holders of the parent company (605,632) (564,613)

Loss per share attributable to the equity holders of the

parent company Pence Pence

Basic and diluted total loss per share (0.07) (0.23)

Basic and diluted loss per share from continuing

operations (0.14) (0.14)

Consolidated Statement of Financial Position

At 31 December 2019

2019 2018

GBP GBP

Assets

Non-current assets

Exploration and evaluation assets 3,705,210 3,192,999

Investments 105,755 973

3,810,965 3,193,972

Current assets

Trade and other receivables 159,495 53,486

Cash and cash equivalents 95,641 44,310

255,136 97,796

Non-current assets classified as held for sale - 128,011

255,136 225,807

Total assets 4,066,101 3,419,779

Equity and liabilities

Equity

Share capital 3,139,135 3,038,605

Share premium 21,037,478 20,569,844

Shares to be issued 286,000 286,000

Share option and warrant reserve 661,676 94,884

Foreign exchange reserve 88,168 421,252

Retained earnings (22,400,310) (22,129,940)

Total equity 2,812,147 2,280,645

Current liabilities

Trade and other payables 267,566 333,653

Loans 866,854 677,470

Derivative liability 119,534 -

1,253,954 1,011,123

Liabilities directly associated with non-current

assets classified as held for sale - 128,011

Total Liabilities 1,253,954 1,139,134

Total equity and liabilities 4,066,101 3,419,779

Approved by the Board and authorised for issue on 4 June

2020

Signed on behalf of the Board

ES Mahede N Johansen

Director Director

Company Statement of Financial Position

At 31 December 2019

2019 2018

GBP GBP

Assets

Non-current assets

Investments 1,705,755 1,600,973

Other receivables 2,078,657 1,394,461

3,784,412 2,995,434

Current assets

Trade and other receivables 77,097 13,439

Cash and cash equivalents 88,466 4,240

165,563 17,679

Total assets 3,949,975 3,013,113

Equity and liabilities

Equity

Share capital 3,139,135 3,038,605

Share premium 21,037,478 20,569,844

Shares to be issued 286,000 286,000

Share option and warrant reserve 661,676 94,884

Retained earnings (22,245,747) (21,753,522)

Total equity 2,878,542 2,235,811

Current liabilities

Trade and other payables 85,045 99,832

Loans 866,854 677,470

Derivative liability 119,534

Total liabilities 1,071,433 777,302

Total equity and liabilities 3,949,975 3,013,113

The Company has taken advantage of the exemption conferred by

section 408 of Companies Act 2006 from presenting its own statement

of comprehensive income. A loss after taxation of GBP490,403 (2018:

GBP605,270) has been included in the financial statements of the

parent company.

Approved by the Board and authorised for issue on 4 June

2020

Signed on behalf of the Board

ES Mahede N Johansen

Director Director

Company Registration No. 5541602

Consolidated Statement of Changes in Equity

For the year ended 31 December 2019

Share

Option

Shares and Foreign

Share Share to be Warrant Exchange Retained

Capital Premium issued Reserve Reserve Earnings Total

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2018 2,980,211 19,720,193 286,000 94,884 337,845 (21,481,920) 1,937,213

Loss for the

year - - - - - (648,020) (648,020)

Other

comprehensive

loss - - - - 83,407 83,407

Total

comprehensive

loss for the

year - - - - 83,407 (648,020) (564,613)

Issue of

shares 58,394 905,106 - - - - 963,500

Expenses of

issue - (55,455) - - - - (55,455)

Total other

movements 58,394 849,651 - - - - 908,045

At 31 December

2018 3,038,605 20,569,844 286,000 94,884 421,252 (22,129,940) 2,280,645

Loss for the

year - - - - - (272,548) (272,548)

Other

comprehensive

loss - - - - (333,030) (333,030)

Total

comprehensive

loss for the

year - - - - (333,030) (272,548) (605,578)

Issue of

shares and

warrants 100,530 658,308 - 546,420 - - 1,305,258

Expenses of

issue (190,674) (190,674)

Transfer on

exercise of

warrants - - - (2,178) - 2,178 -

Share based

payment

charges - - - 22,550 - - 22,550

Total other

movements 100,530 467,634 - 568,970 - - 1,137,134

At 31 December

2019 3,139,135 21,037,478 286,000 661,676 88,168 (22,400,310) 2,812,147

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital amount subscribed for share capital at

nominal value

Share premium amount subscribed for share capital in

excess of nominal value, net of allowable

expenses

Shares to be issued share capital to be issued in connection

with historical acquisition

Share option and warrant reserve cumulative charge recognised under IFRS 2 in

respect of share-based payment awards

Foreign exchange reserve gains/losses arising on re-translating the

net assets of overseas operations into

sterling

Retained earnings cumulative net gains and losses recognised

in the statement of comprehensive income

Company Statement of Changes in Equity

For the year ended 31 December 2019

Share

Option

Shares and

Share Share to be Warrant Retained

Capital Premium issued Reserve Earnings Total

GBP GBP GBP GBP GBP GBP

At 31 December

2017 2,980,211 19,720,193 286,000 94,884 (20,953,744) 2,127,5446

IFRS9

adjustment to

intercompany

debt - - - - (194,508) (194,508)

At 1 January

2018 2,980,211 19,720,193 286,000 94,884 (21,148,252) 1,933,036

Loss for the

year (605,270) (605,270)

Total

comprehensive

loss for the

year (605,270) (605,270)

Issue of

shares 58,394 905,106 - - - 963,500

Expenses of

issue - (55,455) - - - (55,455)

Share based

payment

charges - - - - - -

Transfer on

conversion of

loan notes - - - - - -

Total other

movements 58,394 849,651 - - - 908,045

At 31 December

2018 3,038,605 20,569,844 286,000 94,884 (21,753,522) 2,235,811

Loss for the

year - - - - (494,403) (494,403)

Total

comprehensive

loss for the

year - - - - (494,403) (494,403)

Issue of

shares and

warrants 100,530 658,308 - 546,420 - 1,305,258

Expenses of

share issue - (190,674) - - - (190,674)

Transfer on

exercise of

warrants - - - (2,178) 2,178 -

Share based

payment

charges - - - 22,550 - 22,550

Total other

movements 100,530 467,634 - 566,792 2,178 1,137,134

At 31 December

2019 3,139,135 21,037,478 286,000 661,676 (22,245,747) 2,878,542

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital amount subscribed for share capital at

nominal value

Share premium amount subscribed for share capital in

excess of nominal value, net of allowable

expenses

Shares to be issued share capital to be issued in connection

with historical acquisition

Share option and warrant reserve cumulative charge recognised under IFRS 2 in

respect of share-based payment awards

Retained earnings cumulative net gains and losses recognised

in the statement of comprehensive income

Consolidated Statement of Cash Flows

For the year ended 31 December 2019

2019 2018

GBP GBP

Cash flows from operating activities

Loss before taxation (272,548) (648,020)

Adjustment for:

Release of exchange gains on overseas operation (239,513) -

Impairment charge - 194,401

Share based payment charge 22,550 -

Change in fair value of derivative 45,467 -

Change in fair value of investments (46,145)

Finance costs 21,241 17,459

(468,948) (436,160)

Changes in working capital

Receivables (44,103) 1,077

Payables (14,868) 98,048

Net cash used in operating activities (527,919) (337,035)

Cash flows from investing activities

Expenditure on exploration and evaluation assets (479,238) (224,095)

Purchase of listed investments (58,637) -

Sale of listed investments - 5,732

Net cash used in investing activities (537,875) (218,363)

Cash flows from financing activities

Proceeds from share placement 968,696 560,000

Issue costs (46,500) (25,455)

Issue of loan notes 400,000 -

Loan repayment (235,071) -

Proceeds from loan 30,000 -

Net cash from financing activities 1,117,125 534,545

Net increase/(decrease) in cash and cash equivalents 51,331 (20,853)

Cash and cash equivalents at 1 January 44,310 65,163

Cash and cash equivalents at 31 December 95,641 44,310

Company Statement of Cash Flows

For the year ended 31 December 2019

2019 2018

GBP GBP

Cash flows from operating activities

Loss before taxation (494,403) (605,270)

Adjustment for:

Share based payment charge 22,550 -

Impairment charge 168,920 404,808

Change in fair value of derivative 45,467 -

Change in fair value of investments (46,145)

Finance costs 21,241 12,708

(282,370) (187,754))

Changes in working capital

Receivables (63,658) 30,311

Payables 9,663 33,203

Net cash used in operating activities (336,365) (124,240)

Cash flows from investing activities

Advances to subsidiaries (637,897) (422,606)

Purchase of listed investments (58,637) -

Sale of listed investments - 5,732

Net cash used in investing activities (696,534) (416,874)

Cash flows from financing activities

Proceeds from share placement 968,696 560,000

Issue costs (46,500) (25,455)

Issue of loan notes 400,000 -

Loan repayment (235,071) -

Proceeds from loan (Note 16) 30,000 -

Net cash from financing activities 1,117,125 534,545

Net increase/(decrease) in cash and cash equivalents 84,226 (6,569)

Cash and cash equivalents at 1 January 4,240 10,809

Cash and cash equivalents at 31 December 88,466 4,240

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**S**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and Broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Press Relations: St Brides Partners Ltd

Charlotte Page / Beth Melluish +44 (0) 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200603005976/en/

CONTACT:

Armadale Capital Plc

SOURCE: Armadale Capital Plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

June 04, 2020 02:37 ET (06:37 GMT)

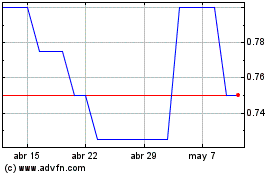

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024